Finance

What Does PPD Mean In Banking

Published: October 13, 2023

Discover the meaning of PPD in banking and its implications for finance. Learn how PPD influences financial transactions and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of banking! If you have ever come across the acronym “PPD” while navigating through your financial transactions, you may have wondered what it stands for and how it relates to the banking industry. In this article, we will uncover the meaning of PPD in banking and explore its significance in facilitating seamless financial operations.

PPD, which stands for “Prearranged Payment and Deposit,” is a term used in the banking sector to refer to a specific type of electronic transaction. It plays a crucial role in streamlining and expediting various financial processes, making it an essential component of modern banking practices.

In essence, PPD allows individuals, businesses, and financial institutions to establish preauthorized payments for regular transactions, such as recurring bill payments or direct deposits. By authorizing these prearranged payments, customers can automate their financial activities, saving time and effort in the process.

Now that we have a basic understanding of what PPD means, let’s delve deeper into its involvement in the banking industry and explore the benefits it brings to both customers and financial institutions.

Definition of PPD

PPD, short for Prearranged Payment and Deposit, refers to a type of electronic transaction in the banking industry. It enables individuals and businesses to authorize and automate various financial activities, such as recurring payments and direct deposits.

At its core, PPD allows customers to establish preauthorized instructions with their banks, ensuring that specific payments or deposits are regularly processed without the need for manual intervention. This simplifies financial management and provides a convenient and efficient way to handle routine transactions.

PPD transactions are typically initiated by the payer, who submits the necessary information and consents to the bank to execute the payment or deposit. Once the authorization is in place, funds are electronically transferred from the payer’s account to the payee’s account on a scheduled basis, as specified by the prearranged agreement.

It is important to note that PPD transactions are different from other types of electronic fund transfers, such as ACH (Automated Clearing House) transactions. While ACH encompasses a broader range of transactions, PPD is specifically designed for preauthorized payments and deposits.

One common example of a PPD transaction is setting up automatic bill payments. By authorizing their banks to deduct funds from their accounts on specified dates, individuals can ensure that their bills are paid on time without the hassle of manual payments or the risk of late fees. Similarly, businesses can use PPD to receive regular direct deposits from their clients or customers.

In summary, PPD is a mechanism that allows individuals and businesses to establish preauthorized instructions with their banks for regular payments and deposits. By automating these financial activities, PPD streamlines processes, saves time, and enhances convenience for all parties involved.

PPD in the Banking Industry

PPD plays a crucial role in the banking industry by offering a convenient and efficient way for customers to manage their finances. It serves as a foundation for numerous financial processes and transactions, simplifying operations for both individuals and businesses.

One of the primary applications of PPD in the banking industry is automating bill payments. Customers can set up preauthorized payments for recurring bills, such as mortgage payments, utility bills, or subscription fees. By doing so, they eliminate the need for manual payments and reduce the risk of missing due dates, resulting in greater convenience and peace of mind.

Moreover, PPD enables businesses to efficiently collect recurring payments from their customers. For instance, a gym membership or a streaming service can be linked to a customer’s bank account through PPD, ensuring that monthly fees are automatically deducted without the need for manual invoicing or payment processing.

PPD also facilitates the automation of direct deposits for businesses. Employers can use PPD to deposit employee salaries directly into their bank accounts, saving time and reducing administrative overhead associated with handling paper checks.

In addition to its role in payment automation, PPD is instrumental in facilitating various financial transactions, such as loan repayments, investment contributions, and charitable donations. By establishing preauthorized instructions through PPD, individuals and businesses can ensure that these transactions are consistently executed on time and without errors.

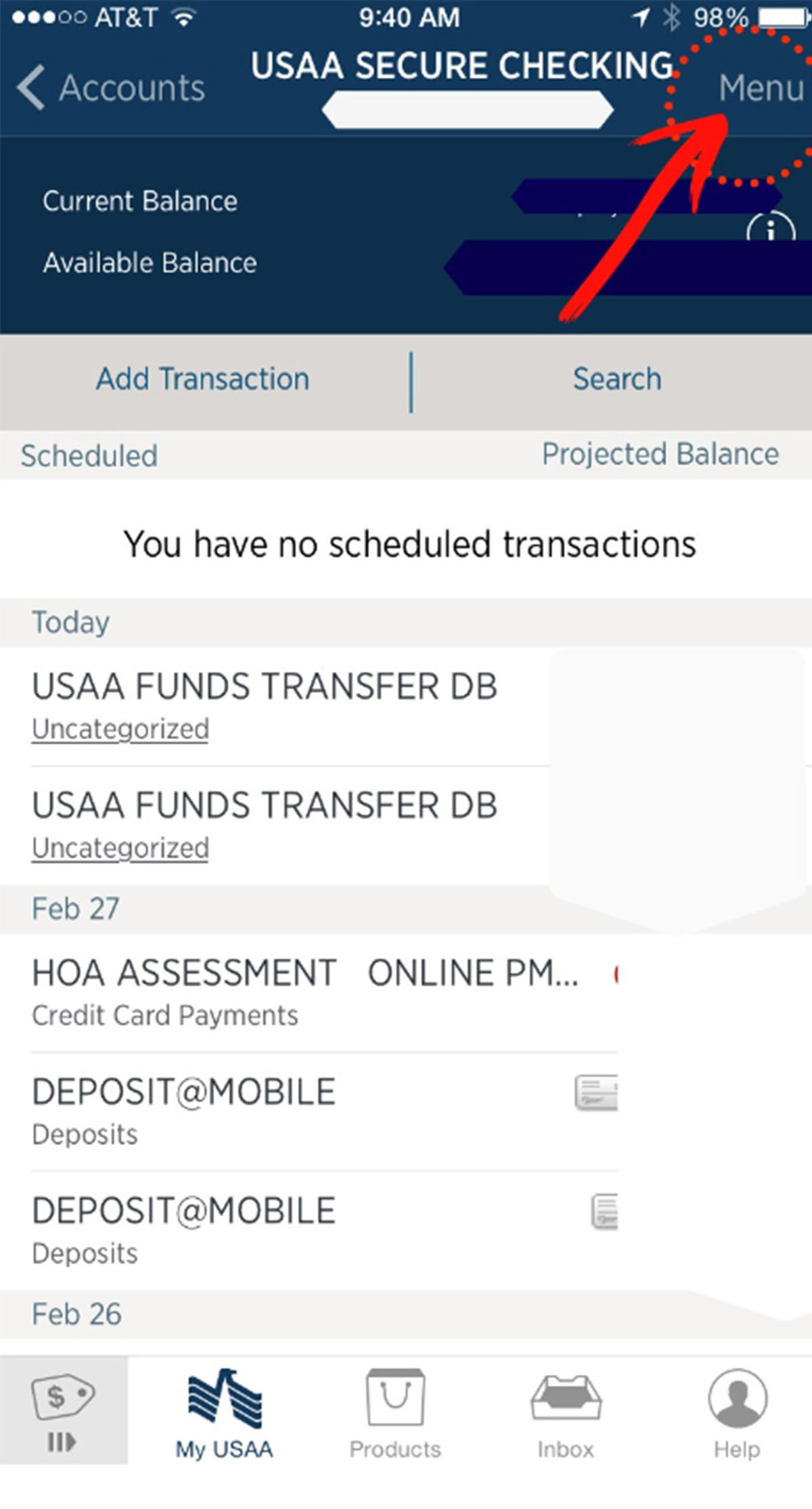

Furthermore, PPD enhances the efficiency and accuracy of financial record-keeping. With automated payments and deposits, customers can easily track their transaction history and reconcile their accounts using bank statements or online banking platforms.

Overall, PPD revolutionizes the way banking transactions are conducted. It brings convenience, efficiency, and accuracy to both customers and financial institutions by automating payments, streamlining processes, and eliminating manual intervention. As the banking industry continues to evolve, PPD will undoubtedly remain a critical component in providing seamless financial services.

Use of PPD in Banking Transactions

PPD is widely used in various banking transactions, providing convenience and efficiency for customers and financial institutions alike. Let’s explore some common applications of PPD in the realm of banking.

One of the primary uses of PPD is in the realm of bill payments. Individuals can set up preauthorized payments for recurring bills, such as rent, mortgage payments, subscriptions, and utility bills. This eliminates the need to manually initiate payments each time a bill is due, ensuring timely payments and reducing the risk of late fees or service disruptions.

Businesses also make extensive use of PPD for collecting payments from their customers. By obtaining authorization from their clients, businesses can establish preauthorized payments for services rendered or recurring fees. This simplifies the payment process for customers and improves cash flow for businesses, leading to enhanced operational efficiency and customer satisfaction.

PPD is also used for direct deposit, particularly in payroll transactions. Employers can set up PPD instructions with their employees to deposit their salaries directly into their bank accounts. This eliminates the need for paper checks, reduces administrative costs, and ensures that employees receive their wages on time.

Another area where PPD is utilized is loan repayments. Borrowers can authorize their banks or financial institutions to automatically deduct loan payments from their accounts on scheduled dates. This feature ensures that loan repayments are made on time, reducing the risk of missed payments or late fees.

Additionally, PPD is commonly used in investment contributions. Individuals can set up preauthorized payments to contribute funds regularly to their investment portfolios or retirement accounts, ensuring consistent contributions and taking advantage of dollar-cost averaging strategies.

Charitable organizations also leverage PPD for donations. Donors can authorize their banks to make regular contributions to their chosen charities, simplifying the donation process and allowing individuals to support causes they care about effortlessly.

Overall, PPD is a versatile tool used in a variety of banking transactions. It enables individuals and businesses to automate their financial activities, ensuring timely payments, improved cash flow, and greater convenience. As technology continues to advance, the use of PPD in banking transactions is likely to expand, further enhancing the efficiency and effectiveness of financial operations.

Benefits of PPD in Banking

PPD, or Prearranged Payment and Deposit, offers numerous benefits to both customers and financial institutions in the domain of banking. Let’s explore some of the key advantages of utilizing PPD for financial transactions.

1. Convenience and Time-Saving: PPD enables customers to automate their financial activities, such as bill payments and direct deposits. By eliminating the need for manual intervention, PPD saves time and effort, allowing individuals and businesses to focus on other important aspects of their lives or operations.

2. Timely Payments and Reduced Late Fees: With PPD, customers can ensure that their recurring bills, such as rent, mortgage payments, or subscriptions, are paid on time. This helps avoid late fees and service interruptions, contributing to better financial management and peace of mind.

3. Enhanced Cash Flow: For businesses, using PPD to collect payments improves cash flow predictability and efficiency. Regular automatic deposits of funds mean businesses can better manage their accounts receivable and meet their financial obligations more effectively.

4. Risk Reduction: PPD reduces the risk associated with manual payments, such as lost checks or unauthorized access to sensitive information. By eliminating the need to handle physical checks or disclose payment details repeatedly, PPD enhances security and mitigates potential fraud.

5. Efficient Payroll Processing: For employers, PPD simplifies payroll processing. Direct deposit through PPD eliminates the need to issue paper checks, reducing administrative costs and ensuring accurate and timely wage payments to employees.

6. Consistent Contributions: PPD facilitates regular contributions to investment accounts, retirement funds, or charitable organizations. This ensures a disciplined approach to saving and investing, taking advantage of compounding returns and fulfilling philanthropic goals more effectively.

7. Seamless Reconciliation and Record-Keeping: With PPD, customers can easily track and reconcile their financial transactions. Bank statements and online banking platforms provide detailed records of PPD activity, simplifying financial record-keeping and making it easier to manage personal or business finances.

Overall, the benefits of PPD in banking extend to improved convenience, time savings, accurate payments, enhanced cash flow, risk reduction, efficient payroll processing, consistent contributions, and streamlined financial management. By leveraging PPD, individuals and businesses can optimize their financial processes and pave the way for smooth and efficient banking operations.

Challenges and Risks Associated with PPD in Banking

While Prearranged Payment and Deposit (PPD) offers numerous benefits, it is important to acknowledge the challenges and risks that can arise in utilizing this payment method in the banking industry. Let’s explore some of the potential challenges and risks associated with PPD.

1. Authorization and Consent: One challenge with PPD is ensuring proper authorization and consent from customers. Financial institutions must implement robust procedures to verify the identity of individuals setting up PPD instructions and to ensure that they fully understand the terms and conditions of the preauthorized transactions.

2. Overdraft and Insufficient Funds: If customers do not maintain sufficient funds in their accounts to cover PPD transactions, overdraft fees or rejected payments can occur. Financial institutions need to effectively communicate with customers about the importance of keeping their accounts adequately funded to avoid potential issues.

3. Payment Disputes: Occasionally, disputes can arise concerning the timing, amount, or validity of PPD transactions. Clear communication channels and proper documentation are crucial for resolving payment disputes promptly and accurately.

4. Privacy and Security: PPD involves the exchange of sensitive personal and financial information. Financial institutions must employ robust security measures to protect customer data from unauthorized access or breaches, thereby minimizing the risk of identity theft or fraud.

5. Technical Glitches and System Failures: Technology is not without its challenges. System failures or glitches could lead to delays or failed PPD transactions, causing inconvenience for customers and potential disruptions in cash flow for businesses and financial institutions. Regular system maintenance, backup plans, and effective customer communication can mitigate these risks.

6. Challenges for Small Businesses: Small businesses may face additional challenges with implementing PPD due to limited resources and technical expertise. Financial institutions and payment processors should provide accessible and cost-effective solutions specifically designed for small businesses to encourage their adoption of PPD.

7. Regulatory Compliance: PPD is subject to various regulatory guidelines and requirements to ensure consumer protection and financial stability. Financial institutions need to stay updated with these regulations to maintain compliance and avoid potential penalties or legal issues.

It is crucial for financial institutions and customers to be aware of these challenges and risks associated with PPD. Proactive measures, including robust cybersecurity, clear communication, and effective dispute resolution mechanisms, are essential to mitigate these risks and ensure the smooth implementation and operation of PPD in the banking industry.

Regulatory Guidelines for PPD in Banking

Prearranged Payment and Deposit (PPD) transactions in the banking industry are subject to regulatory guidelines to ensure consumer protection, privacy, and financial stability. These guidelines aim to establish a framework that governs the use and implementation of PPD. Let’s explore some of the key regulatory guidelines for PPD in banking.

1. Electronic Funds Transfer Act (EFTA): The EFTA, enacted in the United States, provides the legal foundation for consumer protections in electronic funds transfers, including PPD. It requires financial institutions to disclose important terms and conditions related to PPD transactions, such as fees, error resolution procedures, and liability limits.

2. National Automated Clearing House Association (NACHA) Rules: NACHA, the organization that governs the Automated Clearing House (ACH) network in the United States, sets guidelines for the use of PPD transactions. These rules establish requirements and best practices for financial institutions and businesses to ensure the secure and efficient processing of PPD payments.

3. Know Your Customer (KYC) Regulations: KYC regulations require financial institutions to verify the identity of customers and understand their financial activities to prevent money laundering, fraud, and other illicit activities. Financial institutions must comply with KYC requirements when onboarding customers for PPD transactions.

4. Payment Card Industry Data Security Standard (PCI-DSS): For financial institutions and businesses that process PPD transactions involving payment cards, compliance with the PCI-DSS is mandatory. This standard ensures the secure handling of cardholder data, protecting against data breaches and fraud.

5. General Data Protection Regulation (GDPR): In the European Union (EU), the GDPR regulates the collection, storage, and processing of personal data, including PPD transaction data. Financial institutions operating in the EU must comply with GDPR requirements to protect customer privacy and data security.

6. Consumer Consent Requirements: Financial institutions must obtain proper consent from customers before initiating PPD transactions. Consent should be informed and obtained in a clear, transparent manner, ensuring that customers understand the terms and conditions of the preauthorized payments or deposits.

7. Data Retention and Security: Regulations may require financial institutions to maintain proper data retention policies and security measures to protect customer information and transaction data. These measures ensure the confidentiality, integrity, and availability of PPD transaction data.

It is crucial for financial institutions to stay abreast of these regulatory guidelines, ensuring compliance and adopting best practices in implementing and managing PPD transactions. By adhering to these guidelines, financial institutions can promote consumer trust and confidence in PPD, while maintaining the integrity and security of the banking system.

Conclusion

Prearranged Payment and Deposit (PPD) has become an integral part of the banking industry, revolutionizing the way individuals and businesses manage their financial transactions. It offers convenience, efficiency, and automation, allowing for seamless operations and improved financial management.

In this article, we explored the meaning of PPD and its significance in banking. We discussed how PPD is used for automating bill payments, facilitating direct deposits, streamlining loan repayments, enabling consistent contributions to investments and charitable organizations, and enhancing payroll processing.

Moreover, we highlighted the benefits of PPD, including convenience, time savings, improved cash flow, risk reduction, efficient record-keeping, and secure transactions. PPD brings numerous advantages to both customers and financial institutions, enhancing financial processes and customer satisfaction.

However, it is important to acknowledge the challenges and risks associated with PPD, such as authorization issues, overdrafts, payment disputes, privacy concerns, technical glitches, and regulatory compliance. Financial institutions need to address these challenges proactively to ensure a smooth and secure PPD experience for all parties involved.

To ensure consumer protection, various regulatory guidelines govern the use of PPD in banking. Compliance with regulations such as the EFTA, NACHA rules, KYC requirements, PCI-DSS, GDPR, and consent guidelines is crucial for financial institutions to safeguard customer data and maintain the integrity of PPD transactions.

In conclusion, PPD has transformed the banking landscape by offering convenient and efficient ways to automate financial transactions. Through PPD, customers can easily manage their bill payments, direct deposits, loan repayments, and investment contributions, while businesses enjoy streamlined payment collection and improved cash flow. However, it is essential for financial institutions to navigate the challenges and risks associated with PPD and adhere to regulatory guidelines to ensure secure and compliant transaction processing. With proper implementation and compliance, PPD will continue to play a vital role in shaping the future of banking, providing enhanced convenience and efficiency to individuals and businesses alike.