Finance

How Often Does JPM Pay Dividends?

Published: January 3, 2024

Stay updated on JPM dividends. Discover the frequency of dividend payments by JPMorgan Chase, a leading finance company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to an in-depth look at JPMorgan Chase & Co.’s dividend payment policy. JPMorgan Chase is one of the largest and most well-known banks in the world, with a rich history dating back over 200 years. As investors, one of the key considerations when evaluating a potential investment in a company is its dividend policy. Investors are often looking for regular income streams and the potential for future dividend growth.

JPMorgan Chase has a strong reputation for rewarding its shareholders through regular dividend payments. The company sets its dividend policy based on a variety of factors, including its financial performance, capital levels, regulatory requirements, and market conditions. By understanding the frequency and process of JPMorgan Chase’s dividend payments, investors can make more informed decisions about investing in the company.

In this article, we’ll explore how often JPMorgan Chase pays dividends, the dividend payment process, and the factors that influence dividend payments. We’ll also take a look at the historical dividend payments made by JPMorgan Chase. Whether you’re a current shareholder, considering an investment, or simply curious about the company’s dividend policy, this article will provide valuable insights.

JPM Dividend Policy

JPMorgan Chase has a well-established dividend policy that aims to provide shareholders with a consistent and attractive return on their investment. The company’s board of directors is responsible for determining the dividend amount and frequency, taking into consideration several factors.

First and foremost, JPMorgan Chase focuses on maintaining a strong and stable financial position. The board considers the bank’s profitability, capital levels, and overall financial health when deciding on dividend payments. This ensures that the company can sustain its dividend payments even during challenging economic conditions.

Another important factor that influences JPMorgan Chase’s dividend policy is the regulatory environment. As a financial institution, JPMorgan Chase operates under strict regulations established by various regulatory bodies. The board of directors takes into account these regulations, including the Federal Reserve’s stress tests, when determining the dividend amount and frequency.

Furthermore, the board considers market conditions and the competitive landscape within the banking industry. JPMorgan Chase aims to remain competitive by offering a dividend yield that is attractive to investors compared to its peers. This helps to attract and retain shareholders, supporting the long-term growth and stability of the company.

It is important to note that JPMorgan Chase’s dividend policy is subject to change based on evolving business and economic conditions. The board of directors regularly assesses the company’s financial performance, capital needs, and market conditions to ensure that the dividend policy remains appropriate and sustainable.

Overall, JPMorgan Chase’s dividend policy is built on a foundation of strong financials, regulatory compliance, and competitive positioning. The company strives to provide its shareholders with a reliable and attractive return on their investment, reflecting its commitment to maximizing shareholder value.

Frequency of JPM Dividend Payments

JPMorgan Chase is committed to providing its shareholders with regular dividend payments. Historically, the company has followed a quarterly dividend payment schedule, with dividends typically paid in the months of January, April, July, and October.

Quarterly dividend payments are a common practice for many publicly traded companies. This frequency allows shareholders to receive a steady income stream throughout the year, providing financial stability and potentially attracting more investors.

While quarterly dividends are the norm, it’s important to note that the frequency of dividend payments can be subject to change. External factors such as market conditions, changes in financial performance, or shifting regulatory requirements may prompt adjustments to the dividend payment schedule.

In addition to regular quarterly dividends, JPMorgan Chase may also choose to distribute a special dividend from time to time. Special dividends are typically one-time payments that are in addition to the regular dividend payments. These special dividends are generally paid when the company has excess cash on hand or experiences exceptional financial results.

Furthermore, JPMorgan Chase offers a Dividend Reinvestment Plan (DRIP), which gives shareholders the option to reinvest their dividends by purchasing additional shares of the company’s stock. This program provides an opportunity for investors to compound their investment over time and potentially increase their holdings in JPMorgan Chase.

Overall, JPMorgan Chase follows a quarterly dividend payment schedule, providing shareholders with regular income. The company’s commitment to consistent dividend payments demonstrates its dedication to rewarding shareholders and creating long-term value for investors.

Dividend Payment Process at JPM

The dividend payment process at JPMorgan Chase is a well-structured and efficient system designed to ensure timely and accurate distribution of dividends to shareholders. Let’s take a closer look at the steps involved in the dividend payment process.

1. Declaration Date: The dividend payment process begins with the announcement of a dividend. The company’s board of directors declares the dividend, specifying the amount to be paid per share and the record date. The declaration date typically occurs several weeks before the record date.

2. Ex-Dividend Date: After the dividend is declared, the ex-dividend date is set. The ex-dividend date is the date on which a stock no longer carries the right to receive the upcoming dividend payment. Investors who purchase the stock after the ex-dividend date will not be eligible for the current dividend.

3. Record Date: The record date is the date on which JPMorgan Chase determines the shareholders who are eligible to receive the dividend. Investors who own the company’s stock on or before the record date will be entitled to the dividend payment.

4. Payment Date: The payment date is when the actual distribution of dividends occurs. This is the date on which JPMorgan Chase transfers the dividend payments electronically or mails physical checks to eligible shareholders. The payment date is typically a few weeks after the record date.

5. Tax Withholding: JPMorgan Chase is required to withhold taxes on dividend payments in compliance with applicable tax laws. The specific tax rate varies depending on the jurisdiction and the individual’s tax status. Shareholders will receive a statement outlining the amount of tax withheld.

6. Direct Deposit or Check: JPMorgan Chase offers shareholders the option of receiving dividend payments through direct deposit into their bank accounts or as physical checks. Shareholders can choose their preferred method of receiving the dividend payment.

It is worth noting that JPMorgan Chase values clear and transparent communication with its shareholders. The company provides regular updates on dividend-related information, including declaration dates, ex-dividend dates, record dates, and payment dates through financial reports, press releases, and its investor relations website.

Overall, JPMorgan Chase has a well-defined dividend payment process designed to ensure efficient and accurate distribution of dividends to its shareholders.

Factors Influencing JPM Dividend Payments

Several factors influence JPMorgan Chase’s dividend payments. The company’s dividend policy is carefully considered and takes into account a variety of internal and external factors. Let’s explore the key factors that influence JPMorgan Chase’s dividend payments.

1. Financial Performance: JPMorgan Chase’s dividend payments are closely tied to its financial performance. The company’s profitability, earnings growth, and cash flow generation play a significant role in determining the dividend amount. A strong financial performance provides the company with the necessary resources to distribute dividends to its shareholders.

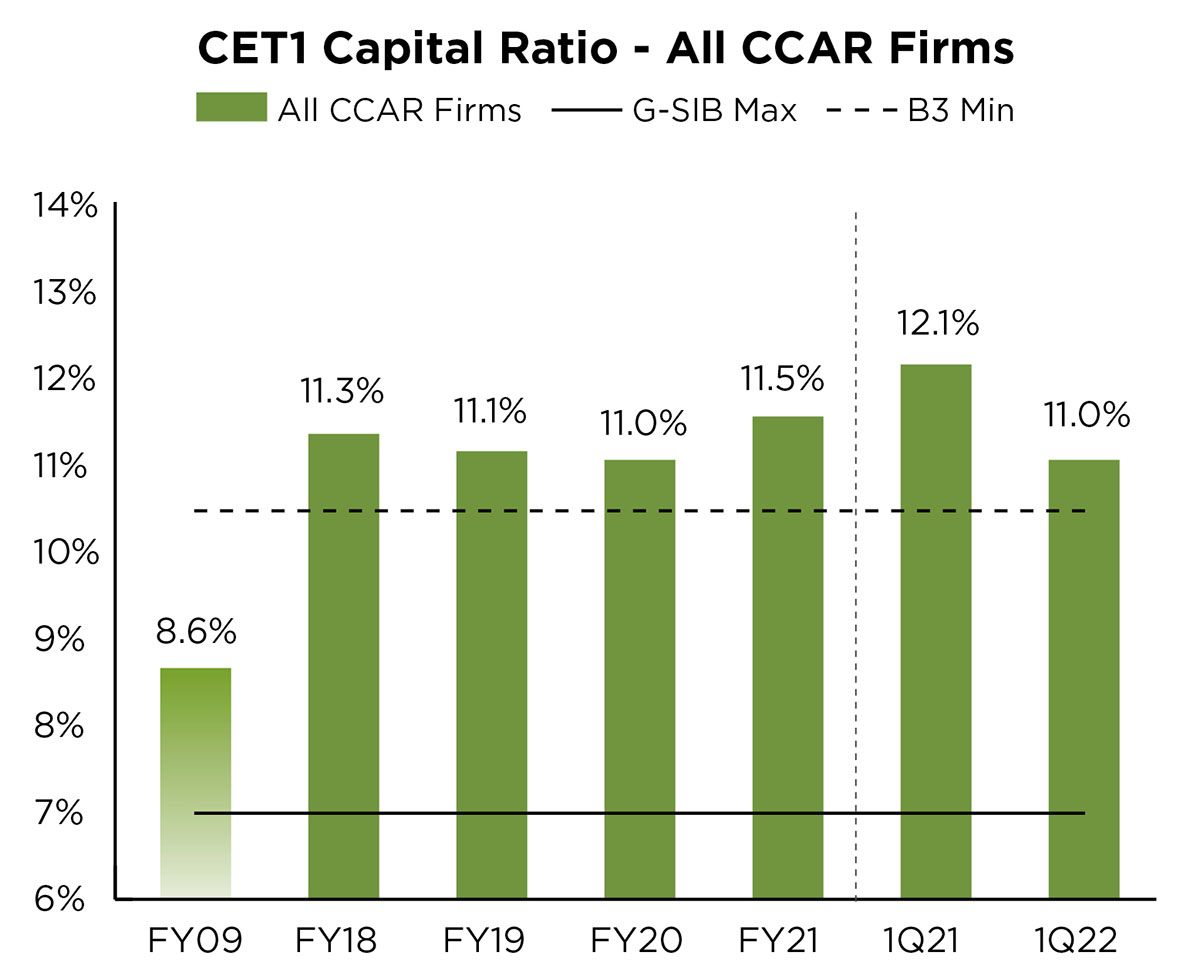

2. Capital Levels: Maintaining adequate capital levels is crucial for a financial institution like JPMorgan Chase. The company needs to meet regulatory requirements and have sufficient capital to support its business operations. The board of directors takes into account the bank’s capital position when determining dividend payments to ensure the company remains well-capitalized.

3. Regulatory Environment: As a global financial institution, JPMorgan Chase operates in a highly regulated industry. The company’s dividend payments are influenced by regulatory considerations, including stress tests conducted by regulatory authorities. The results of these tests assess the bank’s ability to withstand various economic scenarios and may impact dividend decisions.

4. Market Conditions: JPMorgan Chase operates in a dynamic market environment, and market conditions can impact the company’s dividend policy. Factors such as interest rates, economic stability, and industry trends are taken into consideration when determining dividend payments. The company aims to strike a balance between providing attractive returns to shareholders while maintaining financial flexibility to navigate changing market conditions.

5. Business Strategy: JPMorgan Chase’s long-term business strategy also influences its dividend payments. The company evaluates its growth prospects, investment opportunities, and capital allocation priorities when determining the dividend amount. Balancing shareholder returns with reinvestment in the business is essential for sustained growth and value creation.

6. Shareholder Expectations: JPMorgan Chase considers the expectations and preferences of its shareholders when setting dividend payments. The company aims to provide a competitive dividend yield to attract and retain investors. It also maintains open lines of communication with shareholders to understand their income needs and investment objectives.

It is important to note that the above factors are not exhaustive, and other considerations may come into play when determining JPMorgan Chase’s dividend payments. The company strives to maintain a prudent and sustainable approach to dividend distribution while aligning shareholder interests with business performance and market conditions.

Historical Dividend Payments by JPM

JPMorgan Chase has a long history of providing consistent and reliable dividend payments to its shareholders. Let’s take a look at the historical dividend payments made by the company over the years.

Since the financial crisis in 2008, JPMorgan Chase has significantly increased its dividend payouts. In 2010, the company began a streak of annual dividend increases, reflecting its improved financial strength and profitability. This streak continued until 2020, when the COVID-19 pandemic led to a pause in dividend growth for many financial institutions, including JPMorgan Chase.

Prior to the crisis, JPMorgan Chase had a track record of steadily increasing its dividend payments. From 2005 to 2007, the company consistently raised its dividends, showcasing its commitment to rewarding shareholders. However, the global financial crisis prompted a temporary reduction in dividend payments as the company focused on bolstering its capital reserves.

Following the crisis, JPMorgan Chase steadily rebuilt its dividend payments. In 2011, the company increased its dividend for the first time since the crisis, reinstating its commitment to returning capital to shareholders. Over the years, the dividend payments have continued to grow, reflecting the company’s strong financial performance and capital position.

In recent years, JPMorgan Chase has become known for its attractive dividend yields. The company’s dividend payments have consistently been on par with or higher than industry peers, making it an appealing investment choice for income-focused investors.

It is important to note that while JPMorgan Chase has a track record of regular dividend payments, there can be no guarantee of future dividend performance. The company’s dividend policy is influenced by various factors, including financial performance, regulatory requirements, and market conditions.

As of the most recent dividend announcement, JPMorgan Chase continues to demonstrate its commitment to returning capital to shareholders. The company aims to balance dividend payments with its goal of maintaining a strong financial position and supporting future growth initiatives.

Investors interested in tracking JPMorgan Chase’s historical dividend payments can refer to the company’s financial reports, investor relations materials, and reputable financial websites that provide dividend history and analysis.

In summary, JPMorgan Chase has a positive track record of consistent and growing dividend payments, highlighting its commitment to shareholder value and rewarding long-term investors.

Conclusion

In conclusion, JPMorgan Chase has a well-established dividend payment policy designed to provide shareholders with consistent and attractive returns on their investment. The company’s dividend policy takes into account various factors, including its financial performance, capital levels, regulatory requirements, and market conditions.

JPMorgan Chase pays dividends on a quarterly basis, typically in the months of January, April, July, and October. This regular dividend schedule provides shareholders with a predictable income stream and reflects the company’s commitment to delivering long-term value.

The dividend payment process at JPMorgan Chase is carefully structured and efficient, ensuring that dividends are distributed to eligible shareholders in a timely manner. The company offers shareholders the option to receive dividend payments through direct deposit or as physical checks.

The decision-making process behind JPMorgan Chase’s dividend payments is influenced by various internal and external factors. These factors include financial performance, capital levels, regulatory requirements, market conditions, business strategy, and shareholder expectations.

Historically, JPMorgan Chase has demonstrated a commitment to consistent and growing dividend payments. The company has a track record of increasing dividends and providing competitive dividend yields, making it an attractive choice for income-focused investors.

It is important to note that dividend payments are subject to change based on evolving business and economic conditions. Investors should regularly review the company’s financial reports, investor relations materials, and dividend announcements for the latest information on dividend payments.

Overall, JPMorgan Chase’s dividend policy reflects its dedication to maximizing shareholder value while maintaining a strong financial position and supporting future growth initiatives. Whether you’re a current shareholder or considering an investment, understanding JPMorgan Chase’s dividend policy provides valuable insights for making informed investment decisions.