Finance

How Long Does Repo Stay On Your Credit

Published: January 11, 2024

Discover how long a repo can stay on your credit report and its impact on your finances. Find out how to minimize the negative effects of repossession.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, it’s essential to understand the implications of certain actions on your credit. One such action is having a vehicle repossessed, commonly referred to as a repo. If you find yourself in a situation where you can no longer make your car payments, the lender may take possession of the vehicle to recoup their losses.

While a repo may seem like a temporary setback, it can have long-lasting effects on your credit score. Your credit score plays a crucial role in determining your financial stability, affecting your ability to secure loans, get favorable interest rates, and even rent an apartment. Understanding how a repo impacts your credit and how long it stays on your credit report is essential for taking the necessary steps to rebuild your credit.

In this comprehensive guide, we will delve into the world of repossession, discussing its effects on your credit and the length of time it remains on your credit report. We will also explore the factors that influence the duration of a repo on your credit and provide actionable steps to improve your credit score after experiencing a repo.

Whether you are currently facing the possibility of a repo or simply want to understand its consequences, this article will equip you with the knowledge you need to make informed financial decisions and regain control of your creditworthiness.

What is a Repo?

A repossession, commonly known as a repo, occurs when a lender takes possession of a vehicle due to the borrower’s failure to make timely payments. This typically happens when the borrower defaults on the loan or falls behind on payments. The lender has the legal right to repossess the vehicle as a means of recovering their investment.

When you purchase a car through financing, the lender holds a lien on the vehicle. This means that the lender has a legal claim to the car until the loan is fully paid off. If you fail to fulfill your repayment obligations, the lender can exercise their right to repossess the vehicle. They may hire a repossession agency to locate and take the car back.

Repos can occur for a variety of reasons. It could be due to financial hardship, loss of income, unexpected expenses, or simply poor financial management. Regardless of the reason, repossession can have significant consequences on your creditworthiness and financial future.

Repos are not limited to cars; they can also occur with other types of collateral, such as boats, motorcycles, or recreational vehicles. However, when we refer to a repo in this article, we will be primarily focusing on vehicle repossession.

Now that we have a basic understanding of what a repo is, let’s explore how repos can affect your credit and why it is crucial to be aware of their implications.

How Repos Affect Your Credit

When it comes to your credit, repossession can have a significant impact. Once a repossession occurs, it will be reported to the credit bureaus and reflected on your credit report. This negative entry can stay on your credit report for several years, potentially causing damage to your creditworthiness and overall financial health.

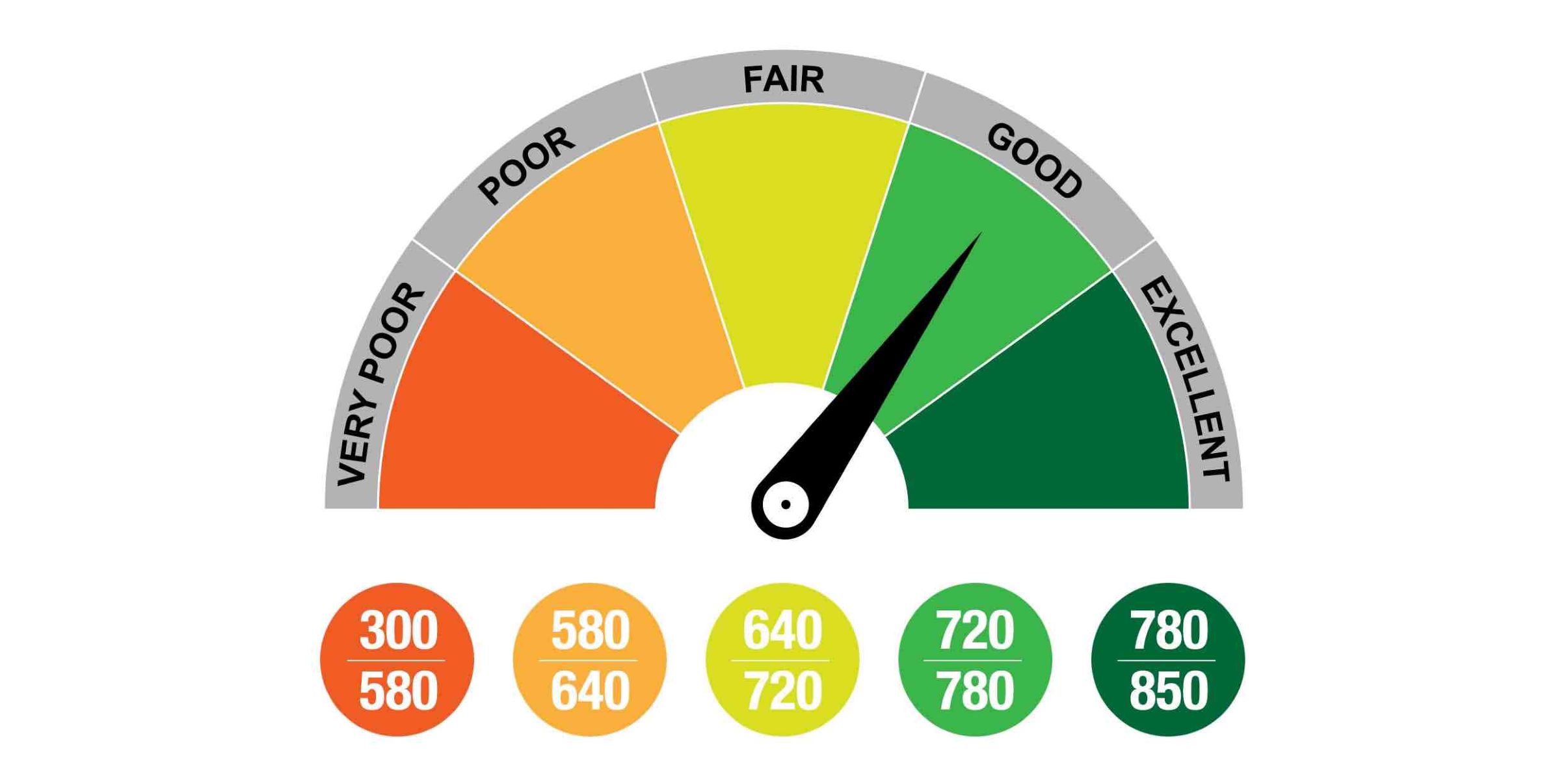

First and foremost, a repo will lower your credit score. The exact impact on your score will vary depending on your overall credit history and the specific scoring model used by each credit bureau. However, it’s safe to say that a repo will have a negative impact and lower your score by a significant amount.

A repossession can also make it difficult to obtain new credit. Lenders may view a repossession as a sign of financial instability and may be hesitant to approve you for future loans or credit cards. If you do manage to get approved, you may face higher interest rates and less favorable terms, making it more challenging to recover financially.

In addition to the impact on your credit score and ability to obtain credit, repossession can also affect other areas of your financial life. For example, it can make it harder to rent an apartment or qualify for certain jobs that require a good credit history. It can also lead to increased insurance premiums as insurers may see you as a higher risk.

It’s important to keep in mind that a repo can have a long-lasting impact. The negative entry will remain on your credit report for a certain period, which we will explore in the next section. However, even after it falls off your report, the repossession may still be taken into consideration by future lenders or creditors when assessing your creditworthiness.

Now that we understand how repossession can affect your credit, let’s delve into the question that is on many people’s minds: how long does a repo stay on your credit report?

How Long Does a Repo Stay on Your Credit?

The length of time that a repo stays on your credit report depends on several factors. Generally, a repossession can remain on your credit report for up to seven years from the date it occurred. This is the standard reporting period for most negative entries on your credit report.

However, it’s essential to note that the impact of a repo on your credit score may lessen over time as the negative entry ages. Credit scoring models typically weigh recent negative information more heavily than older negative information. This means that as the repo gets older, its impact on your credit score may gradually diminish.

If you’re wondering whether there’s a way to remove a repo from your credit report before the seven-year mark, it’s not an easy task. The information reported by credit bureaus must be accurate and verifiable. In most cases, a repossession will stay on your credit report for the full duration of the reporting period, unless there is an error or inaccuracy in the reporting.

It’s important to keep in mind that even if the repo stays on your credit report for seven years, its impact on your ability to obtain credit or secure favorable terms may lessen over time, especially if you take proactive steps to rebuild your credit and demonstrate responsible financial behavior.

Next, let’s discuss the factors that can influence the length of time a repo stays on your credit report.

Factors That Influence the Length of Time a Repo Stays on Your Credit

While a repossession generally stays on your credit report for up to seven years, there are several factors that can influence the duration of its impact. These factors can determine how long a repo remains visible to future lenders and creditors:

- State laws: State laws regulate the reporting of repossession information to credit bureaus. Some states have shorter reporting periods than the standard seven years. It’s important to be aware of the laws in your state to understand how long the repo may be visible on your credit report.

- Type of loan: The type of loan you had for the repossessed vehicle can also impact how long the repo stays on your credit report. For example, if it was an installment loan, the repo may stay on your report for seven years from the date of the first missed payment. If it was a lease or a contract purchase, the repo may remain on your report for seven years from the date of repossession.

- Credit bureau practices: Credit bureaus have their own policies and practices when it comes to reporting and removing negative entries. While the standard reporting period is seven years, there may be variations in how long a repo appears on your report depending on the credit bureau.

- Other negative entries: If you have other negative entries on your credit report, such as late payments or collections, the repo may be grouped with them and fall off your report at the same time as those other negative entries. This can impact the overall length of time the repo stays on your credit report.

It’s important to note that while these factors can influence the duration of a repo on your credit report, they do not guarantee early removal. In most cases, the repo will remain on your credit report for the full seven-year period, regardless of these factors.

Understanding these factors can give you a sense of how long the repo may impact your creditworthiness. However, it’s crucial to focus on taking steps to rebuild your credit and demonstrate responsible financial behavior to improve your credit score over time.

Now that we’ve explored the duration of a repo on your credit report, let’s discuss the impact of a repo on your credit score.

Impact of a Repo on Your Credit Score

A repossession can have a significant negative impact on your credit score. The exact decrease in your score will vary depending on various factors, including your previous credit history and the scoring model used by the credit bureau. However, it’s safe to say that a repo will lower your credit score by a considerable amount.

When a repo is reported to the credit bureaus, it signals to potential lenders and creditors that you have not fulfilled your financial obligations and may be a higher credit risk. This negative information can stay on your credit report for up to seven years, making it more challenging for you to secure new credit and favorable terms in the future.

A repo can lower your credit score by several factors:

- Payment history: Your payment history plays a significant role in determining your credit score. With a repo on your record, it indicates that you have missed payments or defaulted on your loan, which will lower your score.

- Amount owed: The amount you owe on your debts, or your credit utilization ratio, is another crucial factor in your credit score. If a repossession occurs, it typically means that you have a significant outstanding balance that has not been paid, which can negatively impact your credit score.

- Credit mix: Credit scoring models also take into account the types of credit accounts you have. If a vehicle repo is the only negative entry on your credit report, it may have a lesser impact on your score compared to if you also have multiple delinquent accounts.

- New credit applications: If you apply for new credit after a repossession, lenders may view your application less favorably, as they can see the repo on your credit report. This can result in higher interest rates, less favorable terms, or even outright denials of credit.

It’s important to remember that while a repo can significantly lower your credit score, it is not the end of your financial journey. With time and responsible financial behavior, you can improve your credit score and repair the damage caused by the repo.

In the next section, we will discuss steps you can take to improve your credit after experiencing a repo.

Steps to Improve Your Credit After a Repo

Recovering your credit after a repo will take time and effort, but it is certainly possible. Here are some steps you can take to improve your credit score and demonstrate responsible financial behavior:

- Review your credit report: Start by obtaining a copy of your credit report from all three major credit bureaus – Equifax, Experian, and TransUnion. Carefully review the report for any errors or inaccuracies related to the repossession. If you find any discrepancies, file a dispute with the credit bureau to have them corrected or removed.

- Pay your bills on time: Your payment history is a crucial factor in your credit score. Make a commitment to pay all of your bills on time going forward. Set up reminders or automatic payments to ensure you don’t miss any due dates.

- Reduce your credit utilization: Aim to keep your credit card balances low and reduce your overall credit utilization. This can help improve your credit score over time. Focus on paying off existing debts and avoid taking on new debt whenever possible.

- Build a positive credit history: Establish a positive credit history by opening new accounts and using them responsibly. Consider applying for a secured credit card or becoming an authorized user on someone else’s credit card. Make small, regular purchases and always pay your bills in full and on time.

- Patiently wait for time to pass: Over time, the impact of the repo on your credit score will diminish. Focus on improving your credit habits and letting positive information replace the negative entry in your credit report. Although it may take several years, your credit score will gradually recover with consistent responsible financial behavior.

- Seek professional help if needed: If you’re overwhelmed or unsure about how to proceed, consider reaching out to a certified credit counselor or a reputable credit repair agency. They can provide guidance and assistance in formulating a plan to rebuild your credit.

Remember that rebuilding your credit is a marathon, not a sprint. It will take time, patience, and disciplined financial habits to regain a healthy credit score. Be vigilant and avoid falling into the same credit pitfalls that led to the repossession in the first place.

Now that you have a clear understanding of the steps you can take to improve your credit, let’s conclude our discussion.

Conclusion

A repossession can have a significant impact on your credit, affecting your credit score, ability to obtain new credit, and overall financial well-being. Understanding how a repo affects your credit, how long it stays on your credit report, and the factors that influence its duration is crucial for taking steps to improve your creditworthiness.

While a repo typically remains on your credit report for up to seven years, its impact may lessen over time as the negative entry ages. State laws, the type of loan, credit bureau practices, and other negative entries on your credit report can influence the duration of the repo on your credit.

It’s important to remember that a repo is not the end of your financial journey. You can take steps to improve your credit after a repo by reviewing your credit report for errors, paying your bills on time, reducing your credit utilization, establishing a positive credit history, and seeking professional help if needed.

Rebuilding your credit will take time and discipline, but with consistent responsible financial behavior and patience, you can recover and regain control of your creditworthiness. Focus on implementing good credit habits, continue to monitor your credit report, and stay committed to improving your financial situation.

Remember, a repo is just one part of your financial history. Over time, its impact can fade as you demonstrate positive financial behavior. Be proactive, stay informed, and take the necessary steps to rebuild your credit and secure a stronger financial future.