Home>Finance>Money Supply Definition: Types And How It Affects The Economy

Finance

Money Supply Definition: Types And How It Affects The Economy

Published: December 26, 2023

Learn the definition and types of money supply in finance, and discover how it impacts the economy. Gain insights into the crucial role money supply plays in shaping economic conditions and policies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to our Finance Category: Money Supply Definition – Types and How It Affects the Economy

Money supply is a crucial concept in economics that plays a vital role in determining the overall health and stability of an economy. In this blog post, we will explore the definition of money supply, its different types, and how it impacts the economy.

Key Takeaways:

- Money supply refers to the total amount of money available in an economy at a given time.

- The three main types of money supply are M1, M2, and M3, each representing different levels of liquidity and inclusiveness of financial assets.

So, what exactly is money supply? Put simply, money supply is the total amount of money in circulation within an economy. It includes physical currency, such as banknotes and coins, as well as deposits in bank accounts that can be readily accessed for payments.

Now, let’s take a closer look at the three main types of money supply:

1. M1:

M1 is considered the narrowest measure of money supply, consisting of physical currency (like notes and coins) in circulation, demand deposits, traveler’s checks, and other checkable deposits. It represents the most liquid form of money, readily available for transactions and purchases.

2. M2:

M2 is a broader measure of money supply compared to M1. In addition to everything included in M1, it also incorporates less liquid and easily accessible financial assets, such as savings accounts, time deposits, and retail money market funds. M2 provides a more comprehensive picture of the money available in an economy.

3. M3:

M3 represents the broadest measure of money supply. It encompasses everything in M2 while also accounting for larger and less accessible financial assets, including institutional money market funds, Eurodollars, and repurchase agreements. M3 gives a more comprehensive view of the overall money supply within an economy.

Now that we understand the different types of money supply let’s discuss how it affects the economy.

Money supply affects the economy in various ways:

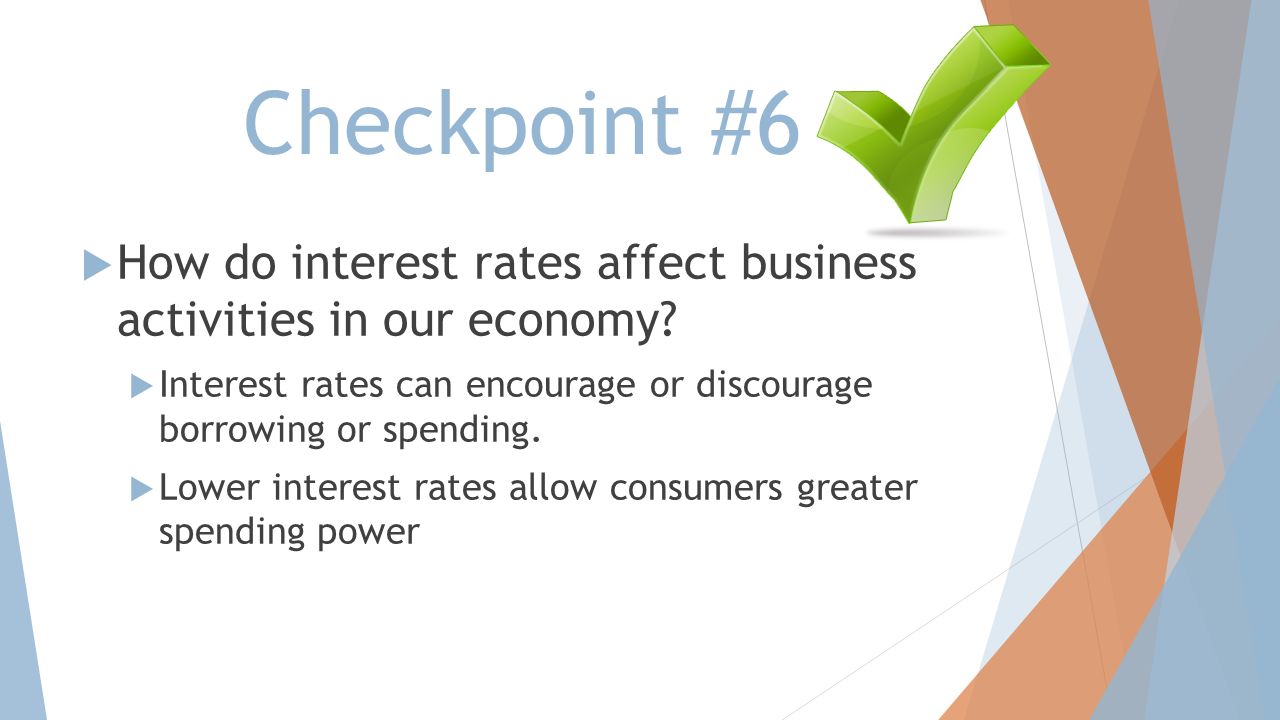

- Interest Rates: An increase in money supply can lead to lower interest rates, making borrowing more affordable and stimulating economic activity. Conversely, a decrease in money supply may result in higher interest rates, which can deter borrowing and spending.

- Inflation: The level of money supply has a direct impact on inflation. When there is excessive money supply, it can lead to higher prices of goods and services, resulting in inflation. Conversely, a decrease in money supply can help control inflation.

- Investment and Consumption: Money supply influences investment and consumption patterns in the economy. Adequate money supply encourages individuals and businesses to invest and spend, driving economic growth. Insufficient money supply may dampen investment and consumption, leading to slower economic activity.

In conclusion, understanding money supply and its different types is essential for comprehending the overall functioning of an economy. It has a significant impact on interest rates, inflation, and investment/consumption patterns. By closely monitoring and managing money supply, policymakers can strive to maintain a healthy and stable economy.

We hope this blog post has helped demystify the concept of money supply and shed light on its crucial role in the economy. Stay tuned for more informative articles on various finance topics!