Finance

Regulation AA Definition

Published: January 17, 2024

Discover the definition of Regulation AA in finance and learn how it impacts the industry. Stay informed about the latest regulations and their effects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Regulation AA: Definition and Its Importance in Finance

Welcome to our FINANCE category! In today’s blog post, we will be diving into the world of Regulation AA and taking a closer look at its definition and importance within the realm of finance. So, whether you are a finance student, professional, or simply curious about this topic, this article is for you.

What is Regulation AA?

Regulation AA, also known as the Unfair or Deceptive Acts or Practices (UDAP), is a set of rules and regulations implemented by the Consumer Financial Protection Bureau (CFPB). Its primary objective is to protect consumers from unfair, deceptive, or abusive practices carried out by financial institutions. These regulations ensure that financial institutions treat consumers fairly and provide them with transparent and understandable information about the products and services they offer.

Regulation AA applies to a wide range of financial institutions, including banks, credit card companies, mortgage lenders, payday lenders, debt collectors, and more. By adhering to these rules, financial institutions help maintain the overall integrity and stability of the financial industry while safeguarding consumers’ rights and interests.

Key Takeaways:

- Regulation AA, or the Unfair or Deceptive Acts or Practices (UDAP), is a set of rules implemented by the Consumer Financial Protection Bureau (CFPB).

- Its main purpose is to protect consumers from unfair, deceptive, or abusive practices from financial institutions.

Why is Regulation AA Important in Finance?

Regulation AA plays a crucial role in the financial industry for several reasons. Let’s explore the importance of these regulations:

1. Consumer Protection

At its core, Regulation AA aims to safeguard consumers’ interests and protect them from deceptive and unfair practices. By enforcing these rules, financial institutions must provide accurate and clear information about their products or services, ensuring that consumers can make informed decisions. This level of transparency fosters trust between consumers and financial institutions, ultimately helping to maintain a fair and healthy financial market.

2. Fairness and Equality

Regulation AA promotes fairness and equality within the financial sector. It requires financial institutions to treat all consumers equally, without discrimination based on factors such as race, gender, age, or income level. This ensures that individuals have equal access to financial products and services, supporting a more inclusive and equitable financial system.

3. Preserving Market Stability

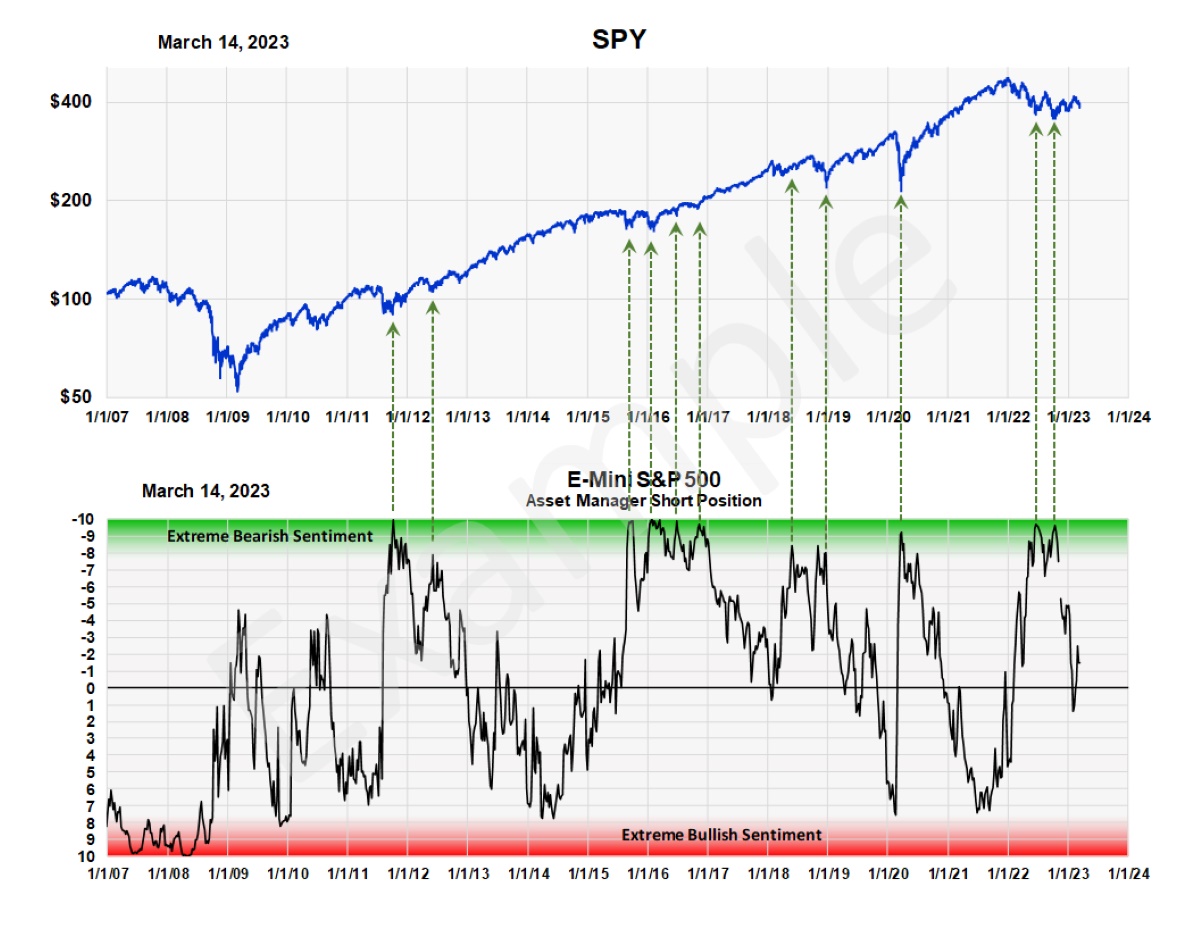

By setting standards for responsible lending and prohibiting deceptive practices, Regulation AA contributes to the stability of the financial market. It helps prevent the abusive practices that led to the 2008 financial crisis, protecting both consumers and the overall economy from potential harm caused by unethical financial behavior.

4. Compliance and Reputation Management

Financial institutions that comply with Regulation AA not only fulfill their legal obligations but also enhance their reputation in the eyes of consumers. By operating within the guidelines of fair and transparent practices, these institutions demonstrate their commitment to consumer protection. This, in turn, helps build trust among consumers, leading to stronger customer relationships and a positive brand reputation.

In Conclusion

Regulation AA plays a vital role in ensuring the fair treatment of consumers in the financial industry. It establishes guidelines that financial institutions must follow to protect consumers’ rights, promote market stability, and maintain a level playing field for all individuals. By understanding Regulation AA and its implications, both consumers and financial professionals can navigate the financial landscape with confidence and trust.