Home>Finance>What Is One Mistake That Could Reduce Your Credit Score?

Finance

What Is One Mistake That Could Reduce Your Credit Score?

Published: October 22, 2023

Discover the crucial mistake that could significantly impact your credit score. Educate yourself on finance practices to prevent any undesirable consequences.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having a good credit score is crucial for financial stability. Your credit score determines your ability to secure loans, credit cards, or even rent an apartment. It reflects your creditworthiness and is used by lenders to make decisions about your financial reliability. While many factors contribute to your credit score, there is one mistake that can have a significant impact – late or missed payments.

Late or missed payments are one of the most common and damaging mistakes that can negatively affect your credit score. When you fail to make payments on time, it sends a signal to lenders that you may be unreliable in managing your financial obligations. This can result in a lower credit score and make it more difficult for you to secure favorable loan terms or receive credit approvals in the future.

In the next section, we will explore the consequences of late or missed payments in more detail and discuss ways to avoid this common mistake that could reduce your credit score.

Late or Missed Payments

Late or missed payments can have a significant impact on your credit score. When you fail to make payments on time for your loans, credit cards, or other financial obligations, it not only incurs late fees and interest charges but also reflects negatively on your credit history.

Your payment history makes up a significant portion of your credit score, typically around 35%. Therefore, consistently paying your bills on time is vital for maintaining a good credit score. Even one missed or late payment can cause your score to drop, and the more consistently it happens, the more significant the impact on your creditworthiness.

Once a payment is 30 days late, it may be reported to the credit bureaus, resulting in a negative mark on your credit report. This late payment can stay on your report for up to seven years, impacting your creditworthiness and potentially causing lenders to view you as a higher risk borrower.

To avoid late or missed payments, it’s essential to stay organized and create a system to ensure you pay your bills on time. Here are a few tips to help you stay on track:

- Set up automatic payments: Consider setting up automatic payments for your recurring bills, such as utilities, rent, and car loans. This ensures that payments are made on time without requiring manual intervention.

- Create reminders: Set up reminders on your phone or calendar a few days before the due date of your bills. This will serve as a reminder to make the payment and avoid any penalties.

- Establish a budget: By creating a budget and keeping track of your expenses, you can ensure that you have enough funds to cover your bills on time each month.

- Communicate with lenders: If you are facing financial difficulties and anticipate difficulty in making a payment, it’s essential to communicate with your lenders. They may be willing to work with you to establish a payment plan or provide temporary relief.

By following these tips and making timely payments a priority, you can avoid the mistake of late or missed payments and maintain a healthy credit score.

High Credit Card Utilization

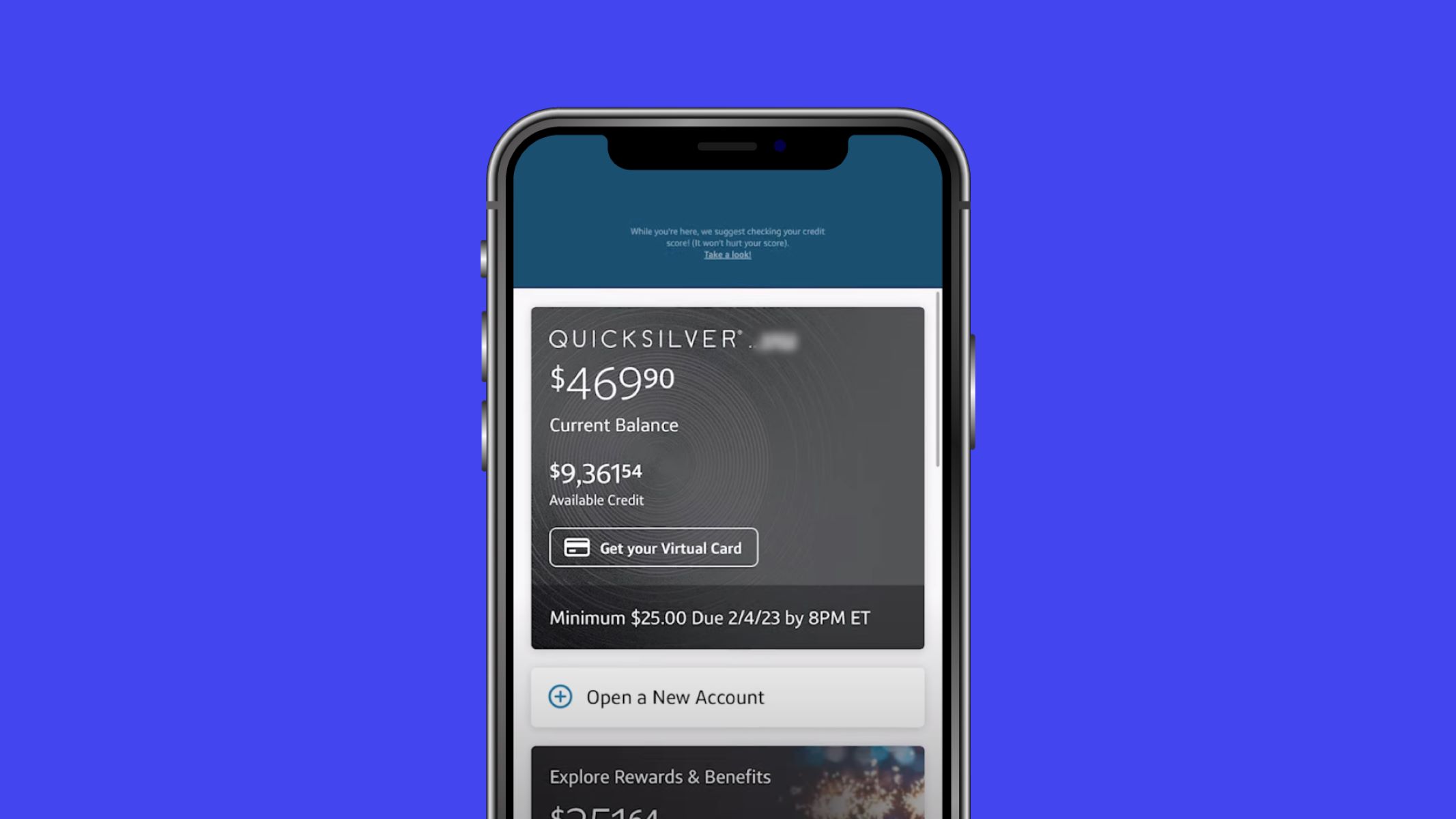

Credit card utilization refers to the ratio of your credit card balances to your credit card limits. It is an essential factor that affects your credit score. High credit card utilization can have a negative impact on your credit score and potentially reduce it.

When you have high credit card utilization, it indicates that you are utilizing a significant portion of your available credit, which can signal financial instability or a higher risk of defaulting on payments. Lenders prefer to see a lower credit utilization ratio, typically below 30%, as it demonstrates responsible credit management.

If you consistently max out your credit cards or have a high balance relative to your credit limit, it can lower your credit score. This is why it’s important to manage your credit card utilization wisely. Here are some strategies to keep your credit card utilization in check:

- Pay off balances in full: Try to pay off your credit card balances in full each month to avoid carrying over a high balance. This not only helps maintain a low credit utilization ratio but also saves you from paying unnecessary interest charges.

- Spread out your spending: Instead of making large purchases on a single credit card, consider spreading out your spending across multiple cards. This can help lower the utilization rate on each card and reduce the impact on your credit score.

- Request a credit limit increase: Another way to improve your credit utilization ratio is by requesting a credit limit increase. This will increase your available credit, reducing the percentage of utilization.

- Keep old credit cards open: Closing old credit card accounts can reduce your overall available credit and increase your credit utilization ratio. If you have no outstanding balance or annual fees, it may be beneficial to keep these accounts open.

- Monitor your credit card balances: Regularly monitor your credit card balances to ensure they are within a reasonable range. Be mindful of your credit limits and strive to keep your balances as low as possible.

By managing your credit card utilization responsibly, you can avoid the mistake of high credit card utilization and protect your credit score.

Closing Old Credit Accounts

When it comes to managing your credit, the decision to close an old credit account is not one to be taken lightly. Closing old credit accounts can have a negative impact on your credit score and potentially reduce it.

One important factor that contributes to your credit score is the length of your credit history. A longer credit history demonstrates your experience in managing credit and provides more data for lenders to evaluate your creditworthiness. Closing old credit accounts can shorten your credit history and potentially lower your credit score.

Closing an old credit account can also affect your credit utilization ratio. As mentioned earlier, credit utilization plays a significant role in determining your credit score. By closing an old credit account, you reduce your overall available credit, which can increase your credit utilization ratio if you have outstanding balances on other cards.

Additionally, closing an old credit account means losing the potential benefits associated with that account. For example, if the account has a long history of on-time payments, closing it may remove that positive payment history from your credit report, ultimately impacting your credit score.

However, there are situations where closing an old credit account may be necessary or beneficial. For instance, if the account carries high annual fees or if you have trouble managing multiple credit cards responsibly, closing an account may be a prudent decision.

If you decide to close an old credit account, here are some steps to minimize the impact on your credit score:

- Pay off any outstanding balances: Before closing an account, make sure to pay off any remaining balances. This will help avoid negative marks on your credit report and ensure a better financial standing.

- Consider opening a new credit account: To mitigate the potential negative impact of closing an old account, you can consider opening a new credit account. This will help maintain or increase your total available credit and offset any negative effects caused by the closure.

- Monitor your credit score: Keep a close eye on your credit score after closing an old credit account to assess the impact it may have. It’s always a good idea to monitor your credit regularly and take steps to address any negative changes that may occur.

Remember, it’s crucial to weigh the pros and cons before closing an old credit account. If done thoughtfully and strategically, you can minimize any potential negative impact on your credit score.

Applying for Multiple New Credit Cards

Applying for new credit cards can be tempting, especially when attractive offers and rewards are involved. However, applying for multiple new credit cards within a short period of time can have a negative impact on your credit score.

Every time you apply for a new credit card, the credit card company will conduct a hard inquiry on your credit report. These hard inquiries can stay on your credit report for up to two years and are visible to other lenders when they evaluate your creditworthiness.

Having too many hard inquiries on your credit report within a short timeframe can indicate to lenders that you may be desperate for credit or potentially riskier as a borrower. This can result in a decreased credit score and may make it more challenging for you to secure new credit or loans in the future.

It’s important to note that not all credit inquiries have the same impact on your credit score. For example, if you’re shopping around for the best mortgage rates or auto loans, multiple inquiries within a short timeframe are typically treated as a single inquiry to minimize the impact on your credit score. However, this is not the case for credit card applications.

If you’re considering applying for a new credit card, here are a few things to consider:

- Understand the terms and benefits: Before applying for any credit card, take the time to understand the terms, fees, and rewards associated with the card. Make sure it aligns with your financial goals and needs.

- Space out your applications: Avoid applying for multiple credit cards at once. Instead, space out your applications over time to minimize the number of hard inquiries on your credit report.

- Be selective with your applications: Only apply for credit cards that you genuinely need or have a high chance of being approved for. Avoid submitting applications for cards that you are unlikely to qualify for, as the inquiry can still impact your credit score.

- Monitor your credit report: Regularly review your credit report to ensure accuracy and identify any unauthorized credit inquiries. If you notice any inaccuracies or suspicious activity, take immediate steps to dispute or address them.

By being mindful of how applying for multiple new credit cards can affect your credit score, you can make informed decisions and protect your creditworthiness in the long run.

Defaulting on Loans

Defaulting on a loan occurs when you fail to make payments as agreed upon in the loan agreement. It is a serious financial misstep that can have severe consequences, including a significant negative impact on your credit score.

Defaulting on a loan can occur with various types of loans, such as personal loans, auto loans, student loans, or mortgages. When you default on a loan, it indicates to lenders that you are unable or unwilling to fulfill your financial obligations. As a result, your creditworthiness is compromised, and your credit score can take a significant hit.

Defaulting on a loan can have the following negative effects on your credit:

- Decreased credit score: Defaulting on a loan can cause a substantial drop in your credit score. This can make it more challenging to secure future loans or credit cards, and if you are approved, you may face higher interest rates due to the increased perceived risk.

- Collection efforts: When you default on a loan, the lender may engage in collection efforts to recoup the outstanding amount. This can involve relentless phone calls, letters, and even legal action, which can be both stressful and damaging to your financial well-being.

- Public records and judgments: In severe cases, the lender may sue you for the outstanding amount, resulting in a judgment against you. This judgment can be recorded as a public record on your credit report, further damaging your creditworthiness.

- Difficulty obtaining future credit: Defaulting on a loan can stay on your credit report for up to seven years, making it difficult to obtain future credit. Lenders are less likely to extend credit to someone with a history of defaulting, as it indicates a higher risk of non-payment.

To avoid defaulting on loans, it’s crucial to carefully manage your finances and stay on top of your loan payments. If you find yourself struggling to make payments, consider the following options:

- Contact your lender: If you anticipate difficulty in making a loan payment, it’s important to communicate with your lender as soon as possible. They may be willing to work with you to modify the payment terms, temporarily lower payments, or provide forbearance.

- Explore debt consolidation or refinancing: Depending on your situation, consolidating your debts or refinancing may be an option to make your monthly payments more manageable.

- Seek professional advice: If you’re overwhelmed by your debt and struggling to stay afloat, it may be beneficial to seek advice from a financial counselor or debt relief agency. They can provide guidance and help you develop a plan to address your financial challenges.

By taking proactive steps and seeking assistance when needed, you can avoid defaulting on loans and protect your credit score.

Maxing Out Credit Limits

Maxing out your credit limits refers to utilizing the entire available credit on your credit cards or other lines of credit. It is a risky financial behavior that can have a detrimental effect on your credit score and overall financial health.

When you max out your credit limits, it indicates to lenders that you are relying heavily on credit and may be living beyond your means. This can be perceived as a financial instability and a potential risk for lenders when evaluating your creditworthiness.

Maxing out your credit limits can have several negative consequences:

- High credit utilization ratio: One of the key factors that determine your credit score is your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. When you max out your credit limits, it can significantly increase your credit utilization ratio, which can quickly lower your credit score.

- Difficulty securing additional credit: Maxing out your credit limits can make it challenging to obtain additional credit or loans. Lenders may view you as a high-risk borrower and be reluctant to extend further credit to you.

- Increased interest charges: Maxing out your credit limits often results in carrying high balances on your accounts. This means you’ll be subject to hefty interest charges, which can make it harder to pay off your debts and may put you in a debt cycle.

- Financial stress: Having maxed-out credit limits can put you under significant financial stress. You may find it difficult to meet your monthly financial obligations, leading to missed payments, late fees, and the potential for collection efforts.

To avoid maxing out your credit limits and protect your financial well-being, consider the following strategies:

- Monitor your spending: Keep a close eye on your credit card balances and overall spending habits. Recognize and address any patterns of overspending or reliance on credit.

- Create a budget: Establish a realistic budget that allows you to live within your means and allocate funds towards paying down your debts.

- Pay more than the minimum: Whenever possible, pay more than the minimum payment due on your credit cards. This will help you pay down your balances faster and reduce the risk of maxing out your limits.

- Reduce unnecessary expenses: Identify areas where you can cut back on expenses to free up more funds for debt repayment. Consider prioritizing needs over wants and finding ways to save money.

- Consider debt consolidation: If you have multiple credit card balances, consider consolidating your debts into a single loan with a lower interest rate. This can help streamline your payments and make it easier to manage your debt.

By being mindful of your credit limits, managing your spending, and actively working towards reducing your debt, you can avoid the pitfall of maxing out your credit limits and maintain a healthier financial standing.

Co-signing on a Loan for Someone with Poor Credit

Co-signing on a loan for someone with poor credit is a generous act that comes with significant financial risks. While it might seem like a way to help someone in need, it’s important to understand the potential consequences before agreeing to become a co-signer.

When you co-sign a loan, you are essentially taking on the responsibility for the loan alongside the primary borrower. This means that if the primary borrower fails to make payments or defaults on the loan, you become legally obligated to repay the debt. The lender can pursue you for the outstanding balance, and your credit score can be negatively affected.

Co-signing on a loan for someone with poor credit can have several negative implications:

- Financial liability: As a co-signer, you become equally responsible for the loan. If the primary borrower cannot meet the payment obligations, you will be held accountable for repaying the debt, including any late fees or collection costs.

- Impact on credit score: The loan you co-sign for will appear on your credit report, and any missed payments or defaults can harm your credit score. This can make it difficult for you to secure new credit or loans in the future.

- Strained relationships: Money matters can strain relationships, even with the best of intentions. If the primary borrower fails to make payments or defaults on the loan, it can create tension and damage your personal relationship.

- Limited borrowing capacity: Co-signing on a loan can impact your own borrowing capacity. Lenders may view you as a higher risk borrower since you are already responsible for another loan, making it harder for you to secure credit when you need it.

Before co-signing on a loan, carefully evaluate the following factors:

- The borrower’s financial situation: Understand the reasons behind the borrower’s poor credit and assess their ability to repay the loan. Consider their income, job stability, and overall financial responsibility.

- Your own financial situation: Evaluate whether you can truly afford to take on the loan if the borrower defaults. Assess your own creditworthiness and financial obligations before committing to be a co-signer.

- Alternative options: Explore other ways to help the person in need without putting your own financial well-being at risk. This could include providing guidance in budgeting, helping them find resources for credit repair, or assisting them in exploring other loan options.

While co-signing on a loan can be a noble gesture, it’s essential to consider the potential financial consequences and the impact on your own credit and financial stability. It’s important to make an informed decision and weigh the risks and benefits before agreeing to be a co-signer.

Failing to Monitor Credit Reports

Monitoring your credit reports is a crucial aspect of maintaining good financial health. However, many individuals make the mistake of neglecting this important task, which can have serious consequences. Failing to regularly review your credit reports can leave you vulnerable to identity theft, errors, and unrecognized accounts that can harm your credit score and financial well-being.

There are several reasons why monitoring your credit reports is important:

- Identity theft: In today’s digital age, identity theft is a significant concern. By monitoring your credit reports, you can detect any unauthorized accounts or suspicious activities that may indicate someone is using your identity fraudulently.

- Inaccurate information: Credit reports may contain errors, such as incorrect account information or late payments that were actually made on time. Monitoring your reports allows you to identify these errors and take steps to rectify them, preventing potential damage to your credit score.

- Unrecognized accounts: Sometimes, fraudulent or mistaken accounts may appear on your credit report. By regularly reviewing your reports, you can quickly identify any accounts that you do not recognize and take action to address them promptly.

- Changes in credit utilization: Monitoring your credit reports helps you keep track of your credit utilization ratio. By monitoring this ratio, you can work to keep your credit card balances in check and maintain a healthy credit score.

To effectively monitor your credit reports, consider the following actions:

- Review your reports regularly: Check your credit reports from all three major credit bureaus at least once a year. You can access these reports for free through AnnualCreditReport.com. Consider spreading out your requests, obtaining a report from one bureau every four months, to ensure consistent monitoring throughout the year.

- Look for errors or discrepancies: When reviewing your reports, pay close attention to any errors, inaccurate information, or unrecognized accounts. If you identify any issues, promptly dispute them with the credit bureaus to have them corrected.

- Utilize credit monitoring services: Consider enrolling in credit monitoring services, which can provide regular updates and alerts about changes to your credit reports. These services can help you stay vigilant and address any potential issues promptly.

- Protect your personal information: Take steps to safeguard your personal information, such as using strong passwords, keeping your social security number secure, and being cautious about sharing sensitive details online or with unknown entities.

By proactively monitoring your credit reports, you can identify and address any issues that may arise, protecting your credit score and ensuring your financial well-being.

Conclusion

Maintaining a good credit score is essential for financial stability, and avoiding certain mistakes can help protect and improve your creditworthiness. By understanding the potential pitfalls and taking proactive steps to avoid them, you can safeguard your credit score and maintain healthy financial habits.

Late or missed payments can have a significant impact on your credit score. Stay organized, set up automatic payments, and communicate with lenders if you anticipate difficulty in making a payment.

High credit card utilization can also lower your credit score. Aim to keep your credit card balances below 30% of your credit limits, pay off balances in full each month, and consider requesting a credit limit increase.

Closing old credit accounts can shorten your credit history and increase your credit utilization ratio. Before closing an account, evaluate the potential impact and consider keeping the account open if it has a positive payment history and low fees.

Applying for multiple new credit cards within a short period can harm your credit score. Be selective with your applications, space them out over time, and monitor your credit report for any unauthorized inquiries.

Defaulting on loans can have severe consequences, including a drop in your credit score and collection efforts. Communicate with your lender if you anticipate difficulties, explore debt consolidation options, and seek professional advice if needed.

Maxing out credit limits can signal financial instability. Monitor your spending, pay more than the minimum payment, and reduce unnecessary expenses to avoid relying heavily on credit.

Co-signing on a loan for someone with poor credit can put your financial stability at risk. Carefully evaluate the borrower’s situation and your own financial capacity before committing to such an arrangement.

Finally, failing to monitor your credit reports can leave you vulnerable to identity theft, errors, and unrecognized accounts. Set a regular schedule to review your credit reports, check for inaccuracies, and promptly address any issues that arise.

By avoiding these common mistakes and adopting responsible financial habits, you can protect and improve your credit score, providing a solid foundation for your financial future.