Finance

Asset Turnover Ratio Definition

Published: October 9, 2023

Learn the definition of asset turnover ratio in finance and understand how it measures a company's efficiency in utilizing its assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Asset Turnover Ratio: An Essential Metric for Financial Analysis

When it comes to managing your finances and planning for the future, understanding key financial ratios is crucial. One such metric that can provide valuable insights into the efficiency of a company’s operations is the Asset Turnover Ratio. In this blog post, we will dive deeper into the definition of the Asset Turnover Ratio and its significance, helping you gain a better understanding of how this metric can impact your financial decisions.

Key Takeaways:

- The Asset Turnover Ratio measures a company’s ability to generate revenue using its assets.

- A higher Asset Turnover Ratio indicates better efficiency in utilizing assets to generate revenue.

What is the Asset Turnover Ratio?

The Asset Turnover Ratio is a financial metric used to evaluate how effectively a company is using its assets to generate revenue. It measures the amount of sales a company generates for each dollar invested in assets. By analyzing this ratio, investors and analysts can gain insights into a company’s operational efficiency, indicating how well it can generate revenue from its investment in assets.

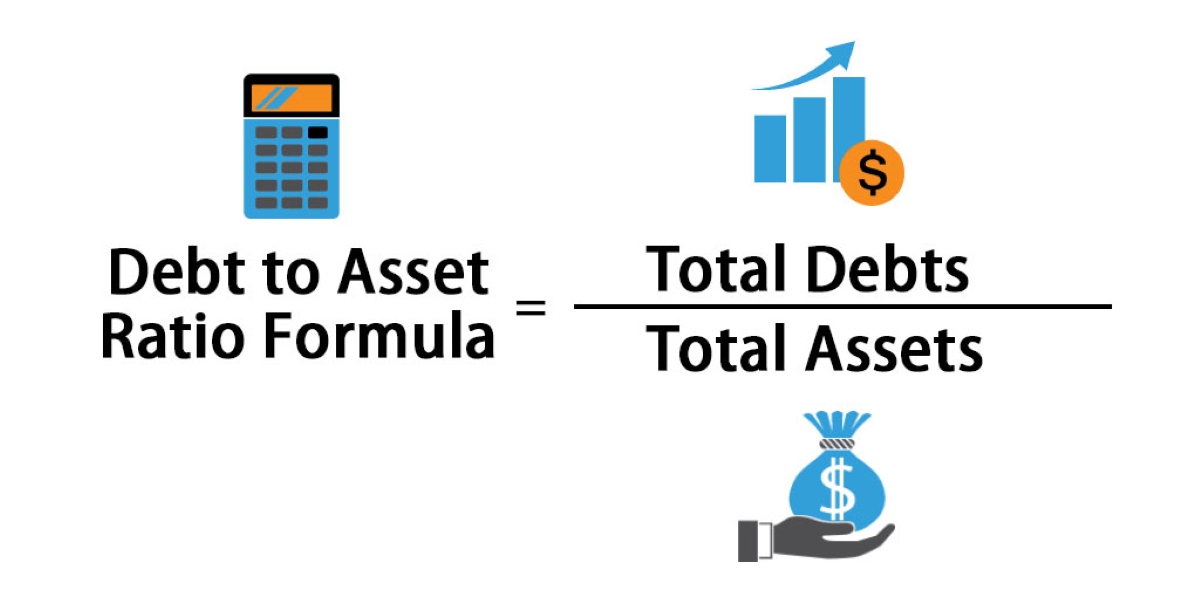

This ratio is calculated by dividing a company’s net sales by its average total assets. It shows the company’s ability to generate sales in relation to its investment in assets. The higher the ratio, the more efficiently the company is utilizing its assets to generate revenue.

Significance of the Asset Turnover Ratio

The Asset Turnover Ratio is a critical metric for financial analysis as it provides valuable insights into a company’s operational efficiency and its ability to generate revenue. Understanding the significance of this ratio can help investors and analysts make informed decisions when evaluating a company’s financial health and potential for growth. Here are two key benefits of analyzing the Asset Turnover Ratio:

- Evaluating Efficiency: The Asset Turnover Ratio helps assess how efficiently a company is utilizing its assets to generate revenue. A high ratio suggests that the company is generating a significant amount of sales with relatively lower investments in assets, indicating efficiency in operations. Conversely, a low ratio may indicate inefficiency in asset utilization, revealing potential areas for improvement or operational inefficiencies to address.

- Comparative Analysis: The Asset Turnover Ratio allows for comparisons between companies operating within the same industry or sector. By analyzing the ratio across different companies, investors can identify companies that are better positioned to generate revenue from their assets. This comparative analysis helps investors gain insights into a company’s competitive advantages or weaknesses and make informed investment decisions.

Overall, the Asset Turnover Ratio is a powerful tool for investors, analysts, and financial managers to evaluate operational efficiency and make informed decisions. By understanding how effectively a company is using its assets to generate revenue, individuals can gain insights into a company’s financial health and its ability to grow and create value.

So, next time you’re evaluating a company’s financial statements, don’t forget to calculate and analyze the Asset Turnover Ratio. It could provide valuable insights that may have a significant impact on your financial decisions.