Home>Finance>How To Calculate Debt To Asset Ratio From Balance Sheet

Finance

How To Calculate Debt To Asset Ratio From Balance Sheet

Modified: December 30, 2023

Learn how to calculate debt to asset ratio from a balance sheet in finance. Master this financial metric to assess a company's solvency and financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is the Debt to Asset Ratio?

- Why is the Debt to Asset Ratio important?

- Components of the Debt to Asset Ratio

- How to Calculate the Debt to Asset Ratio

- Step 1: Gather the balance sheet information

- Step 2: Calculate the total debt

- Step 3: Calculate the total assets

- Step 4: Calculate the Debt to Asset Ratio

- Interpretation of the Debt to Asset Ratio

- Limitations of the Debt to Asset Ratio

- Conclusion

Introduction

Welcome to the world of finance, where numbers and ratios play a crucial role in evaluating the financial health and performance of companies. One such important ratio is the debt to asset ratio. Understanding this ratio is essential for investors, lenders, and financial analysts to assess a company’s solvency and risk profile.

The debt to asset ratio measures the proportion of a company’s total debt to its total assets. It provides insights into the company’s ability to repay its debts and its overall financial stability. By analyzing this ratio, stakeholders can gauge the extent to which a company relies on debt financing to fund its operations and investments.

In this article, we will delve into the concept of the debt to asset ratio, its significance, and how to calculate it from a company’s balance sheet. Additionally, we will explore the interpretation of the ratio and its limitations.

Whether you are an investor looking to make informed decisions or a finance enthusiast seeking to expand your knowledge, understanding the debt to asset ratio will prove to be invaluable in navigating the world of finance. So, let’s dive in and unlock the secrets behind this fundamental ratio.

What is the Debt to Asset Ratio?

The debt to asset ratio is a financial metric that measures the percentage of a company’s total debt in relation to its total assets. It reflects the extent to which a company uses debt as a source of financing its operations and investments.

Essentially, the ratio indicates the level of financial leverage or debt burden on a company. A high debt to asset ratio suggests that a significant portion of the company’s assets is financed by debt, indicating a higher risk of insolvency if the company becomes unable to meet its debt obligations. On the other hand, a low debt to asset ratio indicates a lower reliance on debt financing and a potentially stronger financial position.

The debt to asset ratio is an important tool for investors, lenders, and financial analysts as it provides crucial insights into a company’s solvency and financial stability. It helps these stakeholders assess the risks associated with investing in or lending to the company.

Understanding the debt to asset ratio is particularly important when comparing companies within the same industry. It allows for a more accurate comparison of their financial health and risk profiles. Companies in different industries may have varying debt to asset ratio benchmarks due to industry-specific factors and financing practices.

Overall, the debt to asset ratio serves as a key indicator of a company’s financial risk and can significantly impact its ability to attract investors, secure loans, and navigate through challenging economic conditions. By comprehending this vital ratio, investors and financial professionals can make more informed decisions and mitigate potential risks.

Why is the Debt to Asset Ratio important?

The debt to asset ratio is an important financial metric that holds significant value for investors, lenders, and financial analysts. Here are several reasons why the debt to asset ratio is important:

- Indication of Financial Health: The debt to asset ratio provides insight into a company’s financial health and risk profile. It helps stakeholders assess the level of leverage or debt burden on the company and its ability to repay its debts. A higher ratio indicates a higher level of financial risk, while a lower ratio suggests a stronger financial position.

- Assessment of Solvency: By analyzing the debt to asset ratio, investors and lenders can evaluate a company’s solvency. A high ratio may indicate a higher probability of insolvency if the company is unable to generate sufficient cash flow to service its debt obligations. Conversely, a low ratio implies a lower risk of default and a greater ability to meet financial obligations.

- Comparative Analysis: The debt to asset ratio enables meaningful comparisons between companies within the same industry. It helps identify companies that are more or less reliant on debt financing. This comparative analysis allows investors and financial professionals to evaluate the financial position and risk profiles of potential investment opportunities.

- Investment Decision-making: The debt to asset ratio plays a crucial role in investment decision-making. Investors often seek companies with a reasonable level of debt that can generate a satisfactory return on investment. Analyzing the debt to asset ratio helps assess the risk and potential returns associated with investing in a particular company.

- Impact on Creditworthiness: Lenders consider the debt to asset ratio when assessing a company’s creditworthiness. A higher ratio may indicate a higher risk of default, potentially making it more difficult for companies to secure loans at favorable terms. Conversely, a lower ratio suggests a lower credit risk, increasing the likelihood of obtaining loans on favorable terms.

Overall, the debt to asset ratio is a vital financial metric that provides crucial insights into a company’s financial health, risk profile, and creditworthiness. It aids in decision-making, risk assessment, and comparative analysis, enabling stakeholders to make informed choices and mitigate potential risks in the dynamic world of finance.

Components of the Debt to Asset Ratio

The debt to asset ratio is a composite financial metric that consists of two key components: total debt and total assets. Understanding these components is fundamental to calculating and interpreting the ratio. Let’s take a closer look at each component:

- Total Debt: The total debt represents the sum of all liabilities owed by a company. It includes both short-term and long-term debts, such as bank loans, bonds, mortgages, and other forms of borrowing. The total debt reflects the financial obligations of the company and its reliance on debt financing to support its operations and investments.

- Total Assets: Total assets encompass all the resources owned by a company that have economic value. It includes both current assets, such as cash, accounts receivable, inventory, and property, plant, and equipment, and long-term assets, such as investments, land, and buildings. Total assets represent the financial strength and value of a company’s resources and form the foundation for generating future revenues and profits.

The debt to asset ratio compares the total debt to the total assets of a company, providing a numerical representation of the relationship between debt and assets. It is expressed as a percentage.

Mathematically, the debt to asset ratio is calculated by dividing the total debt by the total assets and multiplying the result by 100. The formula can be represented as:

Debt to Asset Ratio = (Total Debt / Total Assets) * 100

By examining the components of the debt to asset ratio, stakeholders gain a deeper understanding of a company’s debt structure and the value of its assets. This knowledge helps in assessing the financial stability, risk profile, and reliance on debt financing for a more comprehensive evaluation of the company’s financial health.

How to Calculate the Debt to Asset Ratio

Calculating the debt to asset ratio involves a simple but crucial formula that compares a company’s total debt to its total assets. Follow these steps to calculate the debt to asset ratio:

- Step 1: Gather the balance sheet information: Obtain the company’s balance sheet, which provides a snapshot of its financial position at a specific point in time. The balance sheet includes information on the company’s assets and liabilities.

- Step 2: Calculate the total debt: Identify the company’s total debt by summing up all its liabilities. This includes both short-term and long-term debt obligations, such as loans, bonds, and mortgages.

- Step 3: Calculate the total assets: Determine the company’s total assets by summing up all its current and long-term assets. This includes cash, accounts receivable, inventory, property, plant, and equipment, among others.

- Step 4: Calculate the Debt to Asset Ratio: Divide the total debt by the total assets and multiply the result by 100 to express it as a percentage. The formula can be represented as: (Total Debt / Total Assets) * 100.

For example, if a company has total debt of $500,000 and total assets of $1,000,000, the calculation would be as follows:

Debt to Asset Ratio = (500,000 / 1,000,000) * 100 = 50%

In this example, the debt to asset ratio is 50%, indicating that 50% of the company’s total assets are financed by debt.

By calculating the debt to asset ratio, stakeholders gain insights into the company’s debt structure, financial leverage, and risk profile. This allows for a more comprehensive assessment of the company’s financial health and aids in making informed decisions regarding investments, loans, and business partnerships.

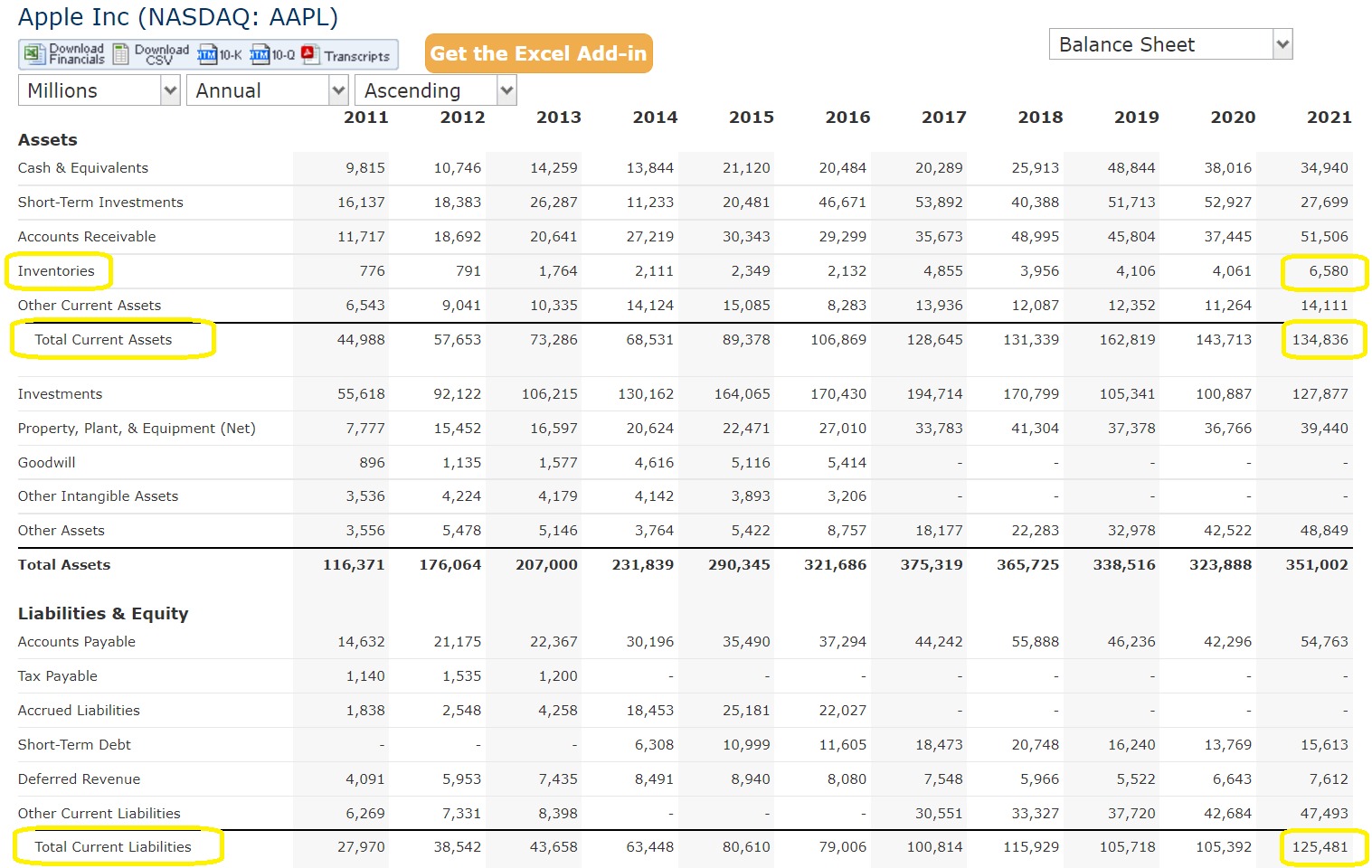

Step 1: Gather the balance sheet information

The first step in calculating the debt to asset ratio is to gather the necessary balance sheet information from the company. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time.

When preparing to calculate the debt to asset ratio, you need access to the most recent balance sheet of the company. This information is typically found in the company’s annual or quarterly financial reports.

The balance sheet is divided into two main sections: assets and liabilities. The assets section includes current assets, such as cash, accounts receivable, inventory, and short-term investments, as well as long-term assets, such as property, plant, and equipment. The liabilities section includes both short-term and long-term liabilities, such as accounts payable, loans, mortgages, and bonds.

To gather the necessary balance sheet information, follow these steps:

- Identify the reporting period: Determine the date of the balance sheet you are using for your analysis. It is crucial to ensure you are working with the most recent and relevant information available.

- Locate the balance sheet: Access the company’s financial reports, such as annual reports, 10-K filings, or quarterly reports, to find the balance sheet for the desired reporting period. These reports are typically available on the company’s website or through financial databases.

- Review the structure of the balance sheet: Familiarize yourself with the layout and sections of the balance sheet. This will help you locate the specific line items for assets and liabilities that are needed to calculate the debt to asset ratio.

- Record the relevant values: Identify and record the values of the total debt and total assets from the balance sheet. Add any short-term and long-term debt values to calculate the total debt. Similarly, sum up the current and long-term asset values to determine the total assets.

Gathering the balance sheet information is a crucial initial step in calculating the debt to asset ratio accurately. By ensuring that you have access to the correct and up-to-date information from the balance sheet, you can proceed to the next steps of the calculation process with confidence.

Step 2: Calculate the total debt

Once you have gathered the balance sheet information, the next step in calculating the debt to asset ratio is to determine the total debt of the company. Total debt represents the sum of all the liabilities owed by the company.

The balance sheet provides a breakdown of the company’s liabilities into short-term and long-term obligations. Short-term liabilities usually include accounts payable, accrued expenses, and short-term borrowings. Long-term liabilities encompass items such as long-term loans, mortgage obligations, and bonds payable.

To calculate the total debt, follow these steps:

- Review the liabilities section of the balance sheet: Locate the section of the balance sheet that lists the company’s liabilities. This section typically appears below the assets section.

- Identify the short-term liabilities: Within the liabilities section, identify and note down the values of the short-term liabilities. These include accounts payable, accrued expenses, and any other short-term borrowings.

- Identify the long-term liabilities: Next, identify and note down the values of the long-term liabilities. These may include long-term loans, mortgage obligations, bonds payable, and any other long-term borrowings.

- Calculate the total debt: Add the values of the short-term liabilities and long-term liabilities together. The sum will give you the total debt of the company.

By accurately calculating the total debt, you can proceed to the next step of calculating the debt to asset ratio. It is important to include all relevant liabilities to ensure an accurate representation of the company’s debt burden and financial obligations.

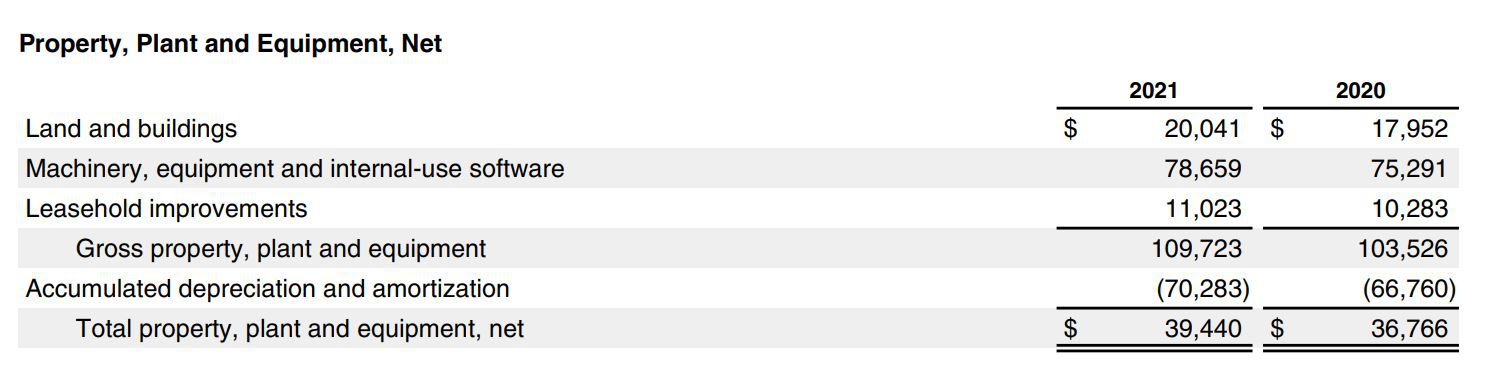

Step 3: Calculate the total assets

After determining the total debt in the previous step, the next crucial step in calculating the debt to asset ratio is to calculate the total assets of the company. Total assets represent the sum of all the resources owned by the company that have economic value.

The balance sheet provides a breakdown of the company’s assets into current assets and long-term assets. Current assets include items such as cash, accounts receivable, inventory, and short-term investments. Long-term assets include property, plant, and equipment, as well as long-term investments.

To calculate the total assets, follow these steps:

- Review the assets section of the balance sheet: Locate the section of the balance sheet that lists the company’s assets. This section is typically positioned above the liabilities section.

- Identify the current assets: Within the assets section, identify and note down the values of the current assets. These may include cash, accounts receivable, inventory, short-term investments, and any other current assets listed.

- Identify the long-term assets: Next, identify and note down the values of the long-term assets. These might include property, plant, and equipment, long-term investments, and any other long-term assets mentioned on the balance sheet.

- Calculate the total assets: Add up the values of the current assets and long-term assets. The summation will provide you with the total assets of the company.

Accurately calculating the total assets is crucial to obtaining an accurate debt to asset ratio. By including all relevant assets, you can effectively evaluate the financial health and risk profile of the company.

Step 4: Calculate the Debt to Asset Ratio

After gathering the balance sheet information, determining the total debt, and calculating the total assets, the final step in calculating the debt to asset ratio is to compute the actual ratio. The debt to asset ratio compares a company’s total debt to its total assets, expressing it as a percentage.

To calculate the debt to asset ratio, follow these steps:

- Divide the total debt by the total assets: Take the value of the total debt that you calculated in Step 2 and divide it by the total assets that you calculated in Step 3.

- Multiply the result by 100: Multiply the quotient obtained in the previous step by 100. This will convert the fraction into a percentage representation.

The formula for calculating the debt to asset ratio can be summarized as follows:

Debt to Asset Ratio = (Total Debt / Total Assets) * 100

For example, if a company has a total debt of $500,000 and total assets of $1,000,000, the calculation would be as follows:

Debt to Asset Ratio = (500,000 / 1,000,000) * 100 = 50%

In this example, the debt to asset ratio is 50%, implying that 50% of the company’s total assets are financed by debt.

The debt to asset ratio provides a numerical representation of the company’s leverage and risk profile. A higher ratio indicates a greater reliance on debt financing, which can increase the company’s financial risk, while a lower ratio suggests a more conservative financial structure.

By calculating the debt to asset ratio, stakeholders gain valuable insights into a company’s financial health, risk profile, and its ability to meet its debt obligations. This metric aids in decision-making, risk assessment, and comparative analysis, allowing investors, lenders, and financial analysts to make informed judgments about the company’s financial position.

Interpretation of the Debt to Asset Ratio

The debt to asset ratio is a significant financial metric that provides insights into a company’s financial structure and risk profile. Interpreting this ratio correctly is essential for investors, lenders, and financial analysts. Here are some key points to consider when interpreting the debt to asset ratio:

- High Ratio: A high debt to asset ratio indicates that a significant portion of the company’s assets is financed by debt. This suggests a higher risk of insolvency if the company becomes unable to meet its debt obligations. A ratio above 50% could be seen as worrisome, as it implies a heavy reliance on debt financing.

- Low Ratio: A low debt to asset ratio signifies a lower reliance on debt financing and a potentially stronger financial position. It indicates that a larger portion of the company’s assets is funded by equity or internally generated funds. A ratio below 30% is generally considered favorable, suggesting a conservative financial structure.

- Industry Comparison: It is important to compare the debt to asset ratio with industry benchmarks since different industries have varying levels of debt tolerance and financing practices. A ratio that is considered high in one industry may be typical in another. Comparing the company’s ratio to industry peers allows for a more accurate assessment of its financial health and risk profile.

- Trend Analysis: Analyzing the debt to asset ratio over time can provide valuable insights into a company’s financial performance and risk management. A rising ratio may indicate increasing financial risk, whereas a declining ratio suggests improved financial stability. It is important to consider the reasons behind any significant changes in the ratio and their implications for the company’s future prospects.

- Contextual Analysis: The debt to asset ratio should not be viewed in isolation. It is essential to consider other financial ratios, such as profitability ratios and liquidity ratios, as well as qualitative factors, such as industry dynamics, company strategy, and market conditions. A comprehensive analysis incorporating multiple factors provides a more accurate assessment of the company’s overall financial position.

It is crucial to interpret the debt to asset ratio within the specific context of the company and the industry it operates in. While a high ratio may indicate higher risk, it does not necessarily imply poor financial health, especially if the company generates consistently strong cash flows and has a proven ability to service its debt obligations.

Ultimately, the interpretation of the debt to asset ratio should be done with prudence, taking into account the company’s unique circumstances and the broader market environment. It is a valuable tool for assessing financial risk, but it should be considered alongside other financial and non-financial factors to gain a holistic perspective on the company’s financial position and outlook.

Limitations of the Debt to Asset Ratio

While the debt to asset ratio is a useful metric for assessing a company’s financial health and risk profile, it has certain limitations that should be considered when interpreting the ratio. Understanding these limitations is crucial for investors, lenders, and financial analysts. Here are some key limitations of the debt to asset ratio:

- Ignored Off-Balance Sheet Items: The debt to asset ratio only considers liabilities that are reported on the balance sheet. It does not account for off-balance sheet items such as operating leases, contingent liabilities, or unfunded pension obligations. These items can have a significant impact on a company’s financial health and risk profile, but they are not captured in the debt to asset ratio calculation.

- Different Accounting Practices: Companies may use different accounting practices, leading to variations in how they report their assets and liabilities. This can make it challenging to compare the debt to asset ratios of companies within the same industry or across different industries. It is important to consider the accounting policies and methods employed by each company when analyzing the ratio.

- Industry Variations: Debt to asset ratio benchmarks can differ across industries due to varying financing practices and capital structures. Comparing the ratio of companies in different industries may not provide an accurate assessment of their relative financial health. It is crucial to benchmark the ratio against industry-specific norms to gain meaningful insights.

- Size and Growth Considerations: The debt to asset ratio may be influenced by the size and growth stage of the company. Larger companies often have access to more debt financing options and may have higher debt levels compared to smaller companies. Similarly, rapidly growing companies may require additional debt to fund expansion and may have higher debt to asset ratios than more established companies.

- Timing of Ratios: The debt to asset ratio provides a snapshot of a company’s financial position at a specific point in time. It does not capture the dynamics of changing financial conditions or short-term fluctuations in debt or asset values. Therefore, it is important to analyze the ratio in conjunction with other financial metrics and consider its trend over time for a more accurate assessment.

Despite its limitations, the debt to asset ratio remains a valuable tool for assessing a company’s financial leverage and risk profile. However, it should be used in conjunction with other financial ratios, qualitative analysis, and a thorough understanding of the company’s unique circumstances to gain a comprehensive understanding of its financial health.

Conclusion

The debt to asset ratio is a fundamental financial metric that provides insights into a company’s financial health, risk profile, and leverage. By comparing a company’s total debt to its total assets, this ratio offers valuable information for investors, lenders, and financial analysts who seek to evaluate the company’s ability to meet its debt obligations and assess its overall financial stability.

Throughout this article, we have explored the importance of the debt to asset ratio in analyzing a company’s solvency, assessing its reliance on debt financing, and making informed investment or lending decisions. We discussed the components of the ratio, including total debt and total assets, and provided a step-by-step guide on how to calculate the ratio from a company’s balance sheet.

Furthermore, we highlighted the significance of interpreting the debt to asset ratio in the context of the company’s industry, considering trends over time, and analyzing it alongside other financial and non-financial factors. We also acknowledged the limitations of the ratio, such as the exclusion of off-balance sheet items and variations in accounting practices.

By leveraging the debt to asset ratio, stakeholders can gain valuable insights into a company’s financial structure, risk profile, and potential for sustainable growth. It serves as a crucial tool for making informed investment decisions, assessing creditworthiness, and identifying potential risks and opportunities within the dynamic landscape of finance.

However, it is important to remember that the debt to asset ratio is just one piece of the financial puzzle. It should be used alongside other financial ratios, qualitative analysis, and a comprehensive understanding of the company’s unique circumstances to obtain a holistic view of its financial health.

In conclusion, the debt to asset ratio provides a valuable lens through which to evaluate a company’s financial position and risk profile. Embracing the insights gained from this ratio empowers stakeholders to make informed decisions, manage risks effectively, and navigate the complex realm of finance with confidence.