Finance

Conduit Issuer Definition

Published: October 31, 2023

Discover the definition of conduit issuer in the world of finance. Explore the role and significance of a conduit issuer in financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Conduit Issuer Definition: A Guide to Finance

When it comes to navigating the vast world of finance, there are countless terms and concepts to understand. One such term is the conduit issuer definition. In this blog post, we will dive into the definition of a conduit issuer and explore its significance in the finance industry.

Key Takeaways:

- A conduit issuer is a financial entity that specializes in issuing securities on behalf of other organizations.

- These securities are typically used to facilitate fundraising or financing projects.

Now, let’s delve deeper into the world of conduit issuers and understand what they are and how they function.

What is a Conduit Issuer?

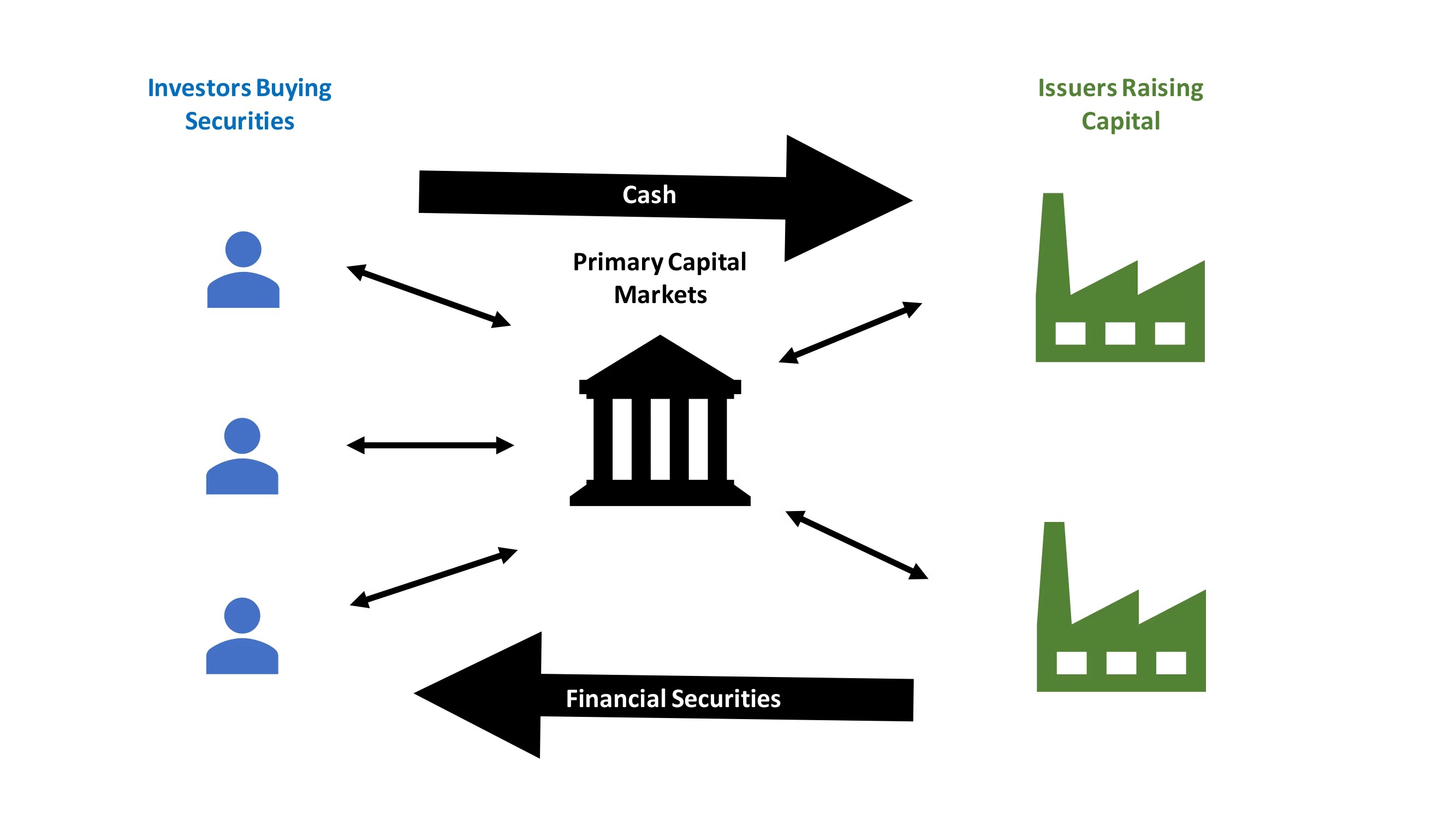

At its core, a conduit issuer is a financial entity that acts as an intermediary to help other organizations raise capital. It achieves this by issuing securities on their behalf. Think of a conduit issuer as a bridge that connects investors with organizations seeking funding.

Conduit issuers are commonly utilized in complex financial transactions, such as securitization, where assets or receivables are transformed into tradable securities. These securities are then sold to investors, enabling organizations to access much-needed capital without directly assuming the associated risks.

In simpler terms, a conduit issuer handles the issuance and sales process, allowing organizations to raise funds efficiently and effectively.

How Do Conduit Issuers Work?

Let’s break down the process step-by-step to gain a better understanding of how conduit issuers operate:

- Selection: An organization looking to raise capital will approach a conduit issuer to facilitate the process.

- Formation: The conduit issuer will establish a legal structure, often in the form of a special purpose vehicle (SPV), to issue the securities.

- Underwriting: The conduit issuer collaborates with investment banks or other financial institutions to underwrite the securities, determining their value and marketability.

- Offering: Once the securities are priced and ready for sale, the conduit issuer will initiate an offering to potential investors.

- Investment: Investors purchase the securities, providing the organization with the desired capital.

- Management: The conduit issuer manages the ongoing administrative and regulatory aspects of the issued securities.

This streamlined process allows organizations to access funding while minimizing the complexities and risks associated with directly issuing securities.

Why are Conduit Issuers Important?

Conduit issuers play a crucial role in the world of finance for several reasons:

- Efficient Fundraising: By utilizing a conduit issuer, organizations can streamline their fundraising efforts, accessing capital more quickly and with reduced administrative burden.

- Greater Access to Investors: Conduit issuers have established relationships with a wide network of investors, increasing the chances of successful fundraising.

- Risk Mitigation: Conduit issuers assume the legal and regulatory responsibilities associated with issuing securities, reducing the risk exposure for organizations.

- Financial Innovation: The use of conduit issuers enables financial innovation, allowing organizations to access funding through complex structures and transactions.

Overall, conduit issuers provide a valuable service to organizations, facilitating efficient fundraising and expanding access to capital markets.

In Conclusion

Understanding the role of conduit issuers is essential for anyone involved in the finance industry. These intermediaries help bridge the gap between organizations seeking capital and investors looking for investment opportunities. By streamlining the fundraising process and reducing risks, conduit issuers play a crucial role in facilitating financial transactions.

If you’re looking to raise capital or invest in securities, it’s worth exploring the options offered by conduit issuers, as they can provide valuable opportunities for both organizations and investors alike.