Finance

What Are Net Credit Sales

Published: January 11, 2024

Learn about net credit sales in finance and how they impact businesses. Understand the concept, calculation, and importance to make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Net credit sales is a vital concept in the world of finance and business. It refers to the total sales made on credit, after subtracting any sales returns and allowances, as well as sales discounts. In simple terms, it represents the revenue generated from sales transactions that are not immediately paid for in cash.

In today’s business landscape, credit sales have become a common practice. They allow customers to purchase products and services upfront, with the promise of making payment at a later date. This provides convenience for customers and helps businesses increase sales volume. However, it also introduces a level of risk, as there is always the possibility of customers defaulting on their payment obligations. Net credit sales play a crucial role in assessing the financial health of a company and managing credit risk.

Understanding net credit sales is essential for both businesses and individuals involved in finance or accounting. It helps companies evaluate their revenue streams, analyze customer payment behavior, and make informed decisions regarding credit policies and collection strategies.

In this article, we will delve deeper into the concept of net credit sales, exploring its definition, importance, calculation methods, and factors that affect it. Additionally, we will discuss effective strategies for managing net credit sales to mitigate risk and improve cash flow.

Definition of Net Credit Sales

Net credit sales refer to the total sales revenue generated from transactions where customers are allowed to pay at a later date, typically on credit terms. These credit terms can vary, but common examples include 30, 60, or 90 days credit. Net credit sales are an important metric for businesses as they represent the portion of sales revenue that is not immediately received in cash. Instead, they create accounts receivable, which are amounts owed to the business by its customers.

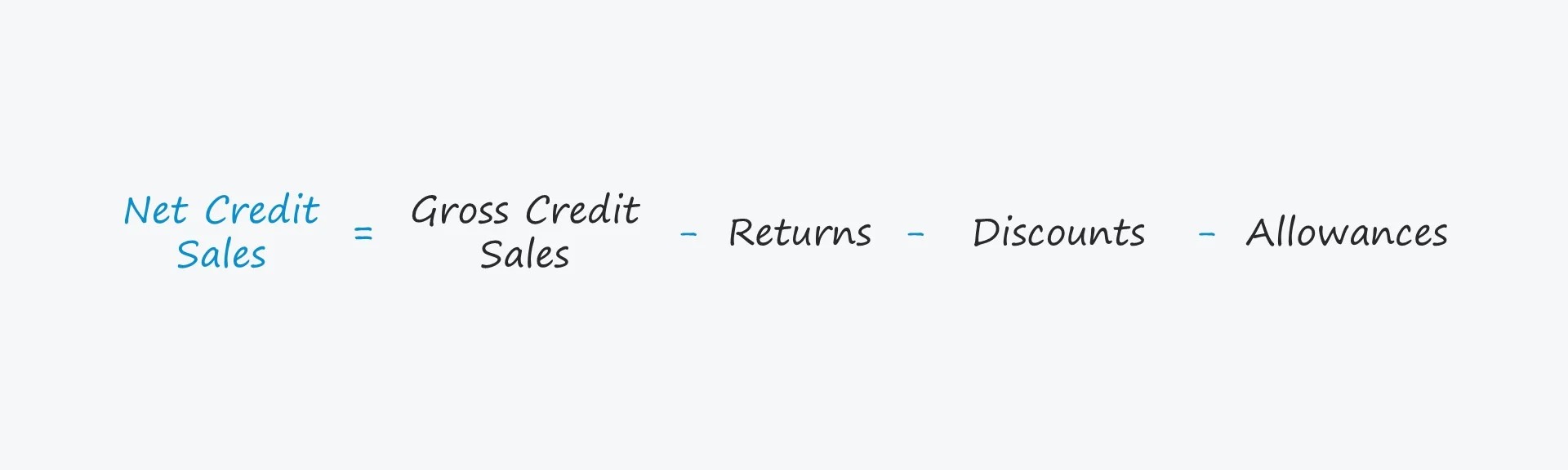

To calculate net credit sales, it is necessary to deduct three components from the total sales figure: sales returns and allowances, sales discounts, and any other adjustments related to credit sales. Sales returns and allowances are refunds or reductions in the sales amount due to customer dissatisfaction or product defects. Sales discounts are discounts offered to customers as an incentive for early payment.

The formula for calculating net credit sales is as follows:

Net Credit Sales = Total Sales – Sales Returns and Allowances – Sales Discounts

For example, let’s say a company has total sales of $100,000, sales returns and allowances of $5,000, and sales discounts of $3,000. The net credit sales for this company would be calculated as follows:

$100,000 – $5,000 – $3,000 = $92,000

This means that the company has $92,000 in revenue from credit sales after accounting for returns, allowances, and discounts.

Net credit sales provide valuable insights into a company’s revenue mix and its ability to generate sales on credit terms. It is a key performance indicator (KPI) that showcases the effectiveness of a company’s credit sales strategy and its ability to manage credit risk. By monitoring net credit sales, businesses can assess the success of their credit policies, identify trends in customer payment behavior, and make data-driven decisions to improve cash flow and profitability.

Importance of Net Credit Sales

Net credit sales play a crucial role in the financial performance and sustainability of a business. Understanding their importance can help companies make informed decisions about credit policies, risk management, and overall revenue growth. Here are some key reasons why net credit sales are important:

- Revenue Generation: Net credit sales contribute significantly to a company’s revenue stream. By offering credit terms to customers, businesses can attract more sales and potentially increase their market share. This provides an opportunity to generate revenue even when customers may not have immediate funds available.

- Customer Convenience: Offering credit sales can enhance customer satisfaction and loyalty. It allows customers to purchase goods and services without the immediate financial burden. By providing flexible payment options, businesses can build long-term relationships with their customers and increase customer retention rates.

- Competitive Advantage: In industries where credit sales are common, offering flexible credit terms can give a business a competitive edge. It can differentiate the company from its competitors and attract new customers who prefer the convenience of credit purchases. This can lead to increased market share and profitability.

- Understanding Creditworthiness: Analyzing net credit sales allows businesses to assess the creditworthiness of their customers. By monitoring payment patterns, companies can identify customers who consistently pay on time and those who may have a history of late or missed payments. This information helps companies make informed decisions about extending credit and setting appropriate credit limits.

- Risk Management: Net credit sales help businesses manage credit risk. By monitoring accounts receivable and tracking average collection periods, companies can identify potential cash flow issues and take prompt action to mitigate risk. Regular assessment of net credit sales helps companies identify overdue accounts and implement effective collection strategies to minimize bad debt.

- Financial Analysis: Net credit sales are a critical component in financial analysis. They help companies evaluate the efficiency and effectiveness of their sales practices, pricing strategies, and credit policies. By comparing net credit sales to total sales and analyzing trends over time, businesses can gain insights into their revenue mix and make data-driven decisions to improve profitability.

Overall, net credit sales provide valuable information for businesses to effectively manage credit risks, attract and retain customers, and optimize revenue generation. By understanding the importance of net credit sales, companies can develop strategies to maximize their revenue potential while minimizing credit-related challenges.

Calculation of Net Credit Sales

The calculation of net credit sales involves deducting sales returns and allowances, sales discounts, and any other adjustments related to credit sales from the total sales figure. This calculation helps businesses determine the revenue generated through credit transactions after accounting for reductions and adjustments. Here is a step-by-step guide on how to calculate net credit sales:

- Total Sales: Begin by identifying the total sales for a specific period. This can be obtained from the company’s sales records or financial statements.

- Sales Returns and Allowances: Review the sales returns and allowances for the same period. These are the amounts issued as refunds or reductions due to customer dissatisfaction, product defects, or other reasons. Deduct this figure from the total sales.

- Sales Discounts: Consider any sales discounts given to customers as an incentive for early payment. These discounts reduce the overall sales revenue. Subtract the amount of sales discounts from the figure obtained in the previous step.

- Other Adjustments: If there are any additional adjustments or allowances related to credit sales, account for them by subtracting their total from the previous figure. These adjustments may include bad debt write-offs, provision for doubtful accounts, or other credit-related expenses.

- Net Credit Sales: The final step is to subtract the total of sales returns and allowances, sales discounts, and other adjustments from the total sales. The result is the net credit sales figure.

The formula for calculating net credit sales is as follows:

Net Credit Sales = Total Sales – Sales Returns and Allowances – Sales Discounts – Other Adjustments

By performing this calculation, businesses can determine the revenue generated from credit sales after accounting for any deductions or adjustments. This metric provides valuable insights into the financial health of a company and helps in evaluating the success of credit policies and managing credit risk.

Factors Affecting Net Credit Sales

Net credit sales can be influenced by various factors that impact the credit sales process and customer buying behavior. Understanding these factors is crucial for businesses to effectively manage their credit policies, optimize sales, and maintain healthy cash flow. Here are some key factors that can affect net credit sales:

- Customer Creditworthiness: The creditworthiness of customers is a significant factor in determining net credit sales. Customers’ financial stability, credit history, and payment patterns can impact their ability to make timely payments. Assessing the creditworthiness of potential customers before extending credit can help businesses minimize the risk of late or non-payment.

- Industry and Market Conditions: The overall economic climate and industry-specific conditions can influence net credit sales. During economic downturns or when industries face challenges, customers may be more cautious with their spending and have difficulties fulfilling their credit obligations. Conversely, in times of growth, customers may be more willing to make purchases on credit, leading to higher net credit sales.

- Credit Terms and Policies: The specific credit terms and policies set by a business can affect net credit sales. Factors such as credit limits, payment periods, interest rates on overdue payments, and available payment methods can impact customer buying decisions. Offering favorable credit terms can attract more customers and increase net credit sales, while stringent credit policies may deter potential buyers.

- Competition: The competitive landscape can influence net credit sales as well. If competitors offer more attractive credit terms or lower prices, customers may choose to purchase from them instead. Understanding the credit offerings of competitors and adjusting credit policies accordingly can help businesses remain competitive and drive net credit sales.

- Customer Relationships: Strong customer relationships built on trust and loyalty can positively impact net credit sales. Customers who have a positive history with a business are more likely to make recurring purchases on credit. Building and nurturing customer relationships through exceptional service, personalized experiences, and effective communication can foster customer loyalty and increase net credit sales.

- Collection Efforts: The effectiveness of a company’s collection efforts can affect net credit sales. Prompt and consistent follow-up on late payments, having clear payment reminders and escalation procedures, and leveraging technology for efficient collection can improve cash flow and reduce credit risk. Effective collection efforts ensure timely receipt of payments and minimize the negative impact on net credit sales.

By considering these factors and adapting strategies accordingly, businesses can optimize net credit sales, minimize credit-related risks, and maintain a healthy financial position.

Managing Net Credit Sales

Proper management of net credit sales is essential for businesses to maintain a healthy cash flow, mitigate credit risks, and optimize revenue generation. Here are some key strategies for effectively managing net credit sales:

- Establish Clear Credit Policies: Develop well-defined credit policies that outline credit terms, credit limits, payment periods, and penalties for late payments. Clearly communicate these policies to customers and ensure they are consistently applied. This clarity helps set expectations and encourages timely payments.

- Screen and Assess Customers: Implement a thorough screening process to assess the creditworthiness of potential customers before extending credit. Review credit history, financial stability, and payment behavior to minimize the risk of default. Utilize credit checks, trade references, and credit scoring models to make informed decisions about credit limits and terms.

- Offer Incentives for Early Payments: Encourage prompt payment by offering discounts or other incentives for customers who pay ahead of the due date. This strategy can help improve cash flow and reduce the average collection period, ultimately increasing net credit sales.

- Monitor and Analyze Accounts Receivable: Regularly monitor accounts receivable to identify overdue payments and take immediate action for collection. Implement aging reports to track the status of outstanding invoices and identify potential cash flow issues. Conduct regular analysis of collection trends and customer payment behavior to adjust credit strategies accordingly.

- Effective Communication and Relationship Building: Maintain open lines of communication with customers regarding their credit accounts. Send timely and clear invoices and payment reminders. Cultivate strong relationships with customers through personalized interactions and exceptional customer service. Strong relationships foster trust and prompt payment.

- Implement Credit Insurance or Factoring: Consider implementing credit insurance or factoring arrangements to mitigate the risk of bad debt. Credit insurance protects against non-payment by customers, while factoring allows for the sale of accounts receivable to a third party at a discounted rate, ensuring immediate cash flow.

- Continuous Improvement: Regularly review and refine credit policies and procedures to adapt to changing market conditions. Monitor key performance indicators such as average collection period, bad debt percentage, and credit losses to identify areas for improvement. Continuously seek feedback from customers and adapt credit strategies accordingly.

By effectively managing net credit sales, businesses can minimize credit risks, improve cash flow, and maintain a healthy financial position. Implementing these strategies helps optimize revenue generation while ensuring timely payment from customers.

Conclusion

Net credit sales are a fundamental aspect of the financial operations of businesses that offer credit terms to their customers. Understanding and effectively managing net credit sales is essential for maintaining a healthy cash flow, mitigating credit risks, and optimizing revenue generation.

We have explored the definition of net credit sales, emphasizing its importance in evaluating a company’s financial health and assessing credit risk. By calculating net credit sales, businesses can gain insights into their revenue mix, customer payment behavior, and the effectiveness of their credit policies.

We have also discussed factors that can impact net credit sales, including customer creditworthiness, industry and market conditions, credit terms and policies, competition, customer relationships, and collection efforts. Understanding these factors enables businesses to adapt their strategies and optimize their net credit sales performance.

Effective management of net credit sales involves establishing clear credit policies, screening and assessing customers, offering incentives for early payments, monitoring accounts receivable, fostering effective communication and relationship building, and considering credit insurance or factoring arrangements.

Continuously reviewing and refining credit strategies, as well as monitoring key performance indicators, allows businesses to make data-driven decisions and implement continuous improvements to their credit management processes.

In conclusion, net credit sales are a crucial aspect of financial management for businesses offering credit to their customers. By implementing sound credit policies, managing customer relationships, and adopting effective collection strategies, businesses can achieve optimal net credit sales, drive revenue growth, and maintain a healthy financial position in today’s competitive business landscape.