Finance

Constituent Definition

Published: November 1, 2023

Learn what a constituent is in the world of finance and how it relates to investment portfolios and index funds. Understand the importance of constituents in market analysis and portfolio management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unleashing the Power of Finance: Your Complete Guide

Welcome to our Finance category! In this blog post, we will dive into the fascinating world of finance and explore the various aspects that can help you understand and manage your finances better. Whether you are a seasoned investor or just starting on your financial journey, this comprehensive guide will provide you with valuable insights and knowledge.

Key Takeaways:

- Understand the fundamentals of finance and how they impact your everyday life.

- Learn practical tips and strategies to achieve financial success and security.

The Essence of Finance

Before we embark on our finance voyage, let’s first define what finance is. Finance refers to the management of money, investments, and other financial assets and liabilities. It encompasses a broad range of activities such as budgeting, financial planning, investing, and risk management. Finance is the backbone of our economy, influencing not only personal wealth but also business growth and economic stability.

Now that we have a foundation, let’s explore some key aspects of finance:

1. Personal Finance: Navigating Your Financial Journey

Personal finance is all about managing your money effectively to achieve your financial goals. Whether you want to save for retirement, buy a house, or pay off debt, understanding the basics of personal finance is crucial. Here are some essential topics you can expect to explore in this category:

- Budgeting and money management

- Saving and investing

- Debt management and credit

- Retirement planning

- Insurance and risk management

2. Investment Strategies: Growing Your Wealth

If you want your money to work for you, understanding investment strategies is essential. Investing can help you grow your wealth over time, protect against inflation, and achieve long-term financial goals. In this category, you can expect to learn about:

- Stocks, bonds, and other investment vehicles

- Diversification and portfolio management

- Risk assessment and risk tolerance

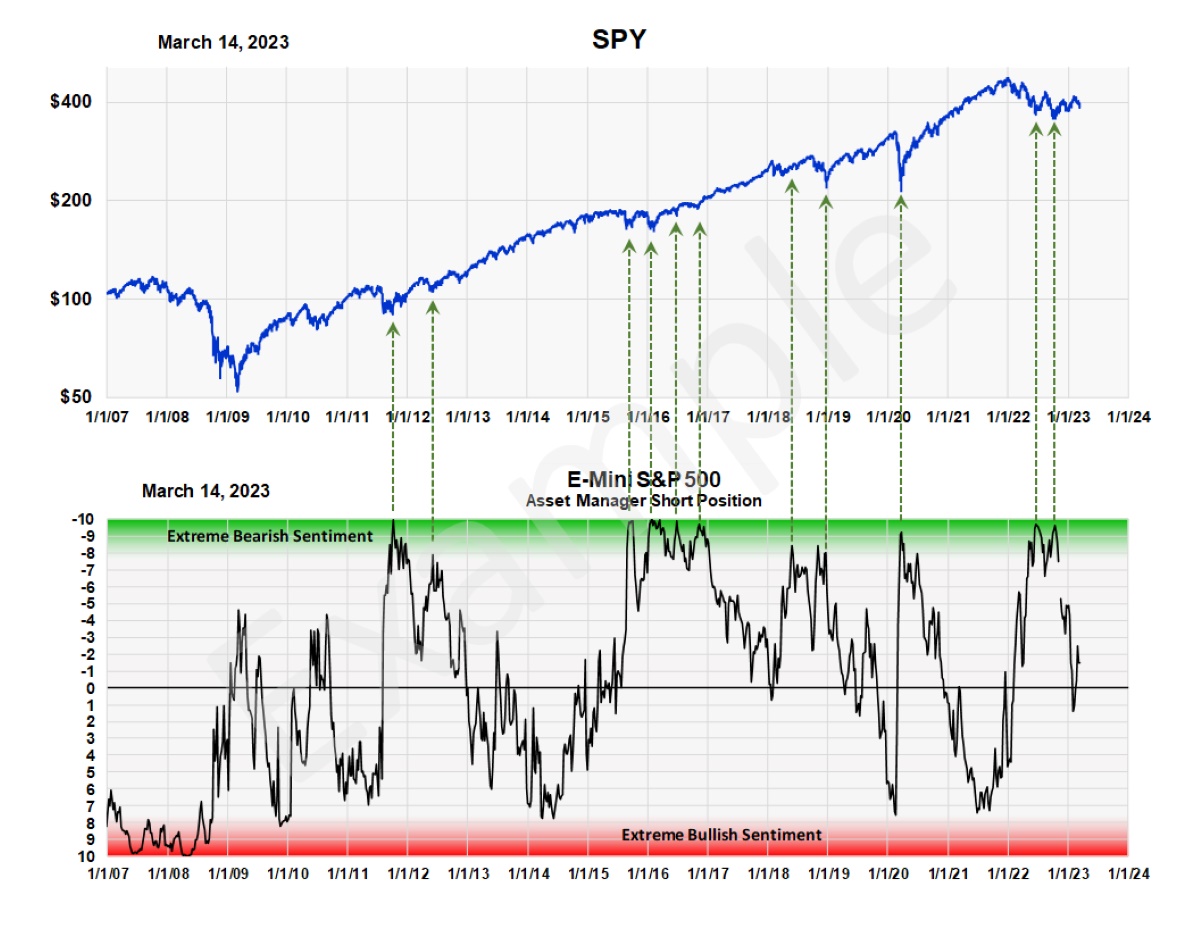

- Market analysis and trends

- Passive vs. active investing

3. Financial Planning: Building a Solid Foundation

Financial planning lays the groundwork for your financial success. It involves setting goals, creating a roadmap, and making informed decisions to achieve those goals. In this category, we will cover:

- Setting financial goals

- Creating a budget and sticking to it

- Developing an emergency fund

- Estate planning and wealth transfer

- Tax planning and optimization

4. Economic Trends: Understanding the Global Landscape

Finance is closely intertwined with the broader economic landscape. To make informed financial decisions, it’s essential to understand the factors shaping the global and local economies. In this category, we will explore:

- Macroeconomic indicators

- Monetary and fiscal policies

- Interest rates and inflation

- Global market dynamics

- Impact of geopolitical events

The Path to Financial Success

Finance can seem daunting, especially if you are new to the world of financial management. However, by gaining knowledge, adopting sound financial practices, and seeking professional guidance when needed, you can unlock the full potential of finance and create a secure future for yourself and your loved ones.

Remember these key takeaways:

- Understanding finance is essential for personal and business growth.

- Investing in your financial education can yield long-term benefits.

Join us on this financial expedition as we delve deeper into the fascinating world of finance. Together, we will uncover strategies, insights, and tips that will empower you to make informed financial decisions and achieve the financial success you deserve.