Finance

How Much Is A Spy Futures Contract On CME?

Published: December 24, 2023

Discover the current price of a spy futures contract on the CME exchange. Stay updated on the latest finance trends and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the exciting world of Spy Futures Contracts on the Chicago Mercantile Exchange (CME). If you’re savvy with finance and looking for an alternative investment opportunity, then look no further. Spy Futures Contracts offer a unique way to trade an index representing the 500 largest publicly traded companies in the United States, commonly known as the S&P 500.

But what exactly is a Spy Futures Contract? And how can you participate in this market? In this article, we will delve into the intricacies of Spy Futures Contracts, exploring their mechanics, trading strategies, and associated risks.

Spy Futures Contracts allow investors to speculate on the future price movements of the S&P 500 index. These contracts are standardized agreements to buy or sell the index at a predetermined price on a future date. Investors can profit from both upward and downward movements of the index, making Spy Futures Contracts a versatile tool for market participants.

One of the key advantages of trading Spy Futures Contracts is the leverage they provide. With a relatively small investment, traders can control a larger position in the market. This amplification of potential gains can be appealing but also comes with increased risk, which we will discuss later.

Before we delve deeper into the mechanics of Spy Futures Contracts, it is important to understand the factors that can influence their prices. By gaining a grasp on these factors, you can make more informed trading decisions and potentially improve your profitability.

Next, we will explore the various factors that can impact the prices of Spy Futures Contracts, including economic indicators, corporate earnings, geopolitical events, and market sentiment. Understanding these influences will help you navigate the dynamic nature of the market and adjust your trading strategies accordingly.

Now that we have laid the foundation, let’s take a closer look at how Spy Futures Contracts are traded on the Chicago Mercantile Exchange.

Continued in next section…

Understanding Spy Futures Contracts

Before diving into trading Spy Futures Contracts, it is essential to have a solid understanding of how they work. A Spy Futures Contract is a derivative instrument that represents an agreement to buy or sell the S&P 500 index at a predetermined price and date in the future.

The value of a Spy Futures Contract is directly tied to the performance of the underlying S&P 500 index. As the index fluctuates, so does the value of the contract. Traders can profit by accurately speculating on the future movement of the index.

Each Spy Futures Contract has a standardized size, which represents the dollar value of the underlying index. For example, one Spy Futures Contract may represent $250 multiplied by the current value of the S&P 500 index. This standardized size ensures consistency and liquidity in the market.

It is important to note that Spy Futures Contracts have expiration dates. They are categorized into different contract months, such as March, June, September, and December. As the expiration date approaches, traders will need to roll their positions into the next contract month to maintain exposure to the market.

Trading Spy Futures Contracts is done on the Chicago Mercantile Exchange (CME), which provides a regulated and transparent marketplace. The CME offers electronic trading platforms that allow traders to execute their trades efficiently and access real-time market information.

When trading Spy Futures Contracts, you have two main positions: long and short. Going long means you are buying a contract with the expectation that the value of the S&P 500 index will increase in the future. On the other hand, going short means you are selling a contract with the belief that the index value will decline.

Profit and loss in Spy Futures Contracts are determined by the difference between the entry price and the exit price of the contract. If the index value moves in your favor, you can realize gains. However, if the market moves against your position, losses can occur.

Spy Futures Contracts allow traders to employ various trading strategies, such as speculation, hedging, and arbitrage. Speculators aim to profit from price movements, while hedgers use the contracts to protect their portfolios against adverse market conditions. Arbitrageurs exploit price discrepancies between different markets or related instruments to make risk-free profits.

Continued in next section…

Factors Affecting Spy Futures Contract Prices

Spy Futures Contract prices are influenced by a multitude of factors, ranging from economic indicators to corporate earnings and geopolitical events. Understanding these factors can help traders make more informed decisions and better navigate the market.

1. Economic Indicators: Economic indicators, such as GDP growth, inflation rates, and employment data, have a significant impact on the performance of the S&P 500 index. Positive economic news often fuels optimism in the market, leading to higher Spy Futures Contract prices. Conversely, negative economic indicators can cause contract prices to decline.

2. Corporate Earnings: The quarterly earnings reports of companies included in the S&P 500 index play a crucial role in determining contract prices. Strong earnings growth can drive contract prices higher, as investors anticipate increased company valuations. Conversely, disappointing earnings can lead to lower contract prices.

3. Geopolitical Events: Geopolitical events, such as trade wars, political unrest, and natural disasters, can have a significant impact on the global economy and, subsequently, Spy Futures Contract prices. Uncertainty and instability in the geopolitical landscape often lead to increased volatility in the market.

4. Interest Rates and Monetary Policy: Changes in interest rates and monetary policy decisions by central banks, such as the Federal Reserve, can influence market sentiment and trading activity. Lower interest rates can stimulate economic growth and drive contract prices higher, while higher rates can have the opposite effect.

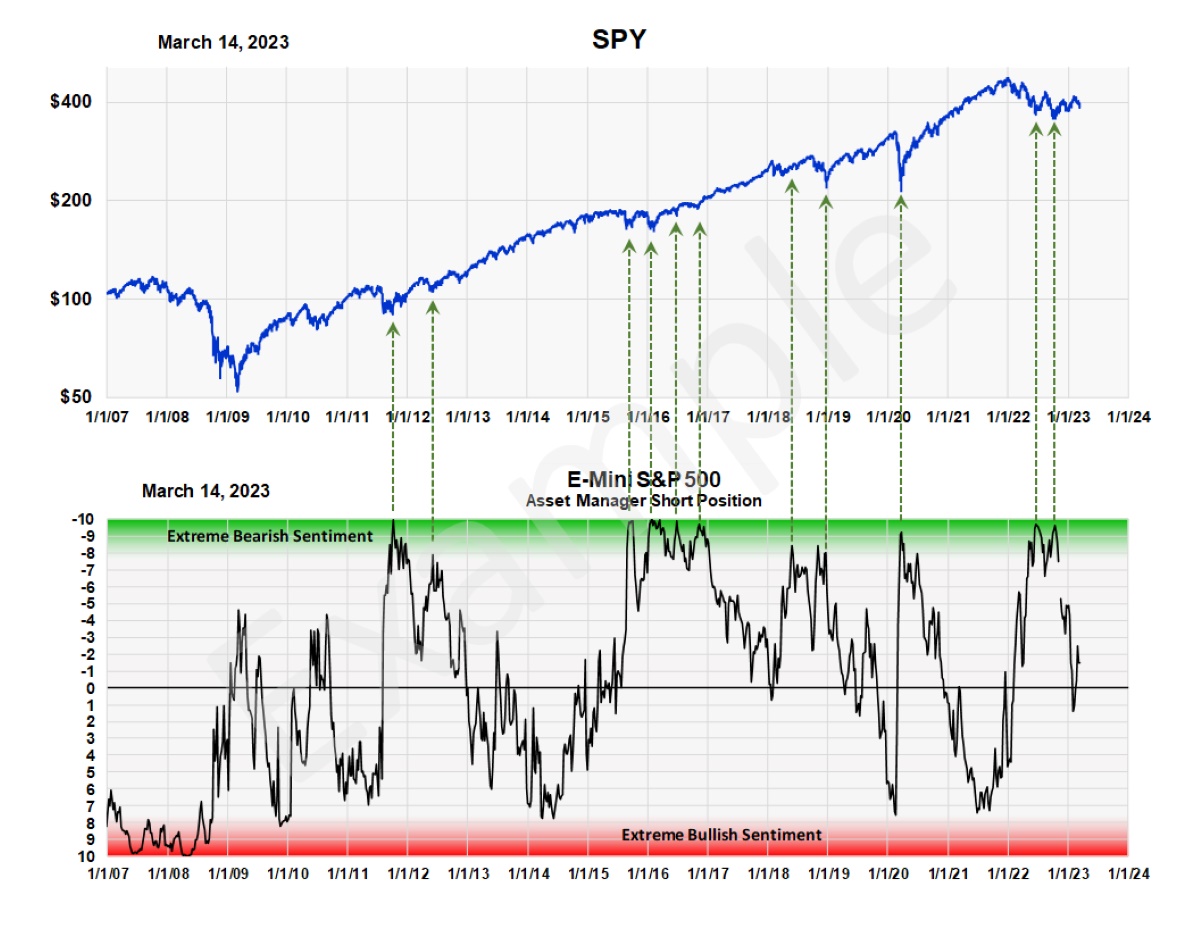

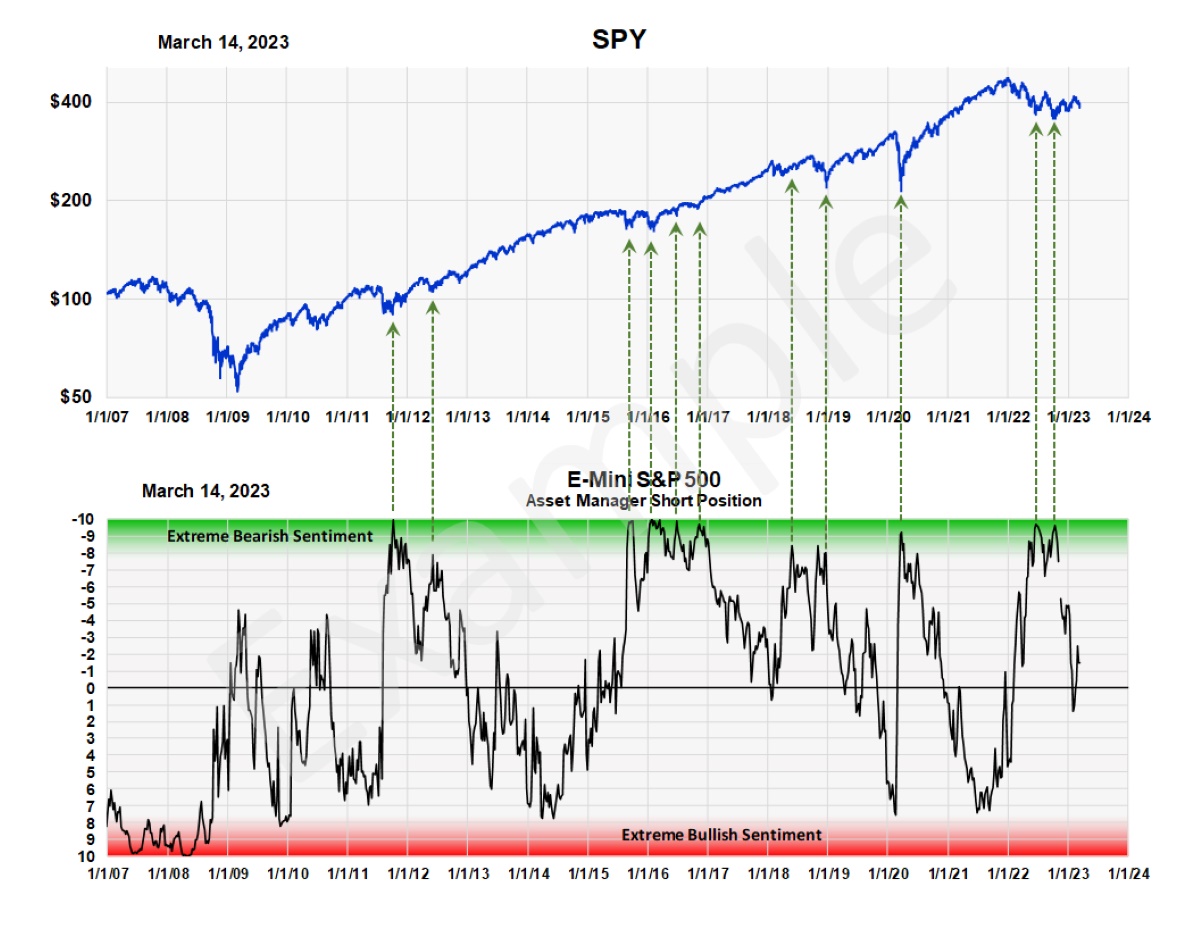

5. Market Sentiment: Investor sentiment and market psychology play a vital role in determining Spy Futures Contract prices. Positive sentiment, driven by optimism and bullishness, can push contract prices higher. Conversely, negative sentiment, driven by fear and bearishness, can lead to lower contract prices.

6. Technical Analysis: Traders often use technical analysis to analyze price patterns, trends, and support/resistance levels in Spy Futures Contracts. Technical indicators and chart patterns can provide insights into potential price movements and help traders make informed decisions.

7. Market Liquidity and Order Flow: The level of market liquidity and the flow of buy and sell orders can impact Spy Futures Contract prices. High liquidity generally leads to tighter bid-ask spreads and smoother trading, whereas low liquidity can result in wider spreads and increased volatility.

8. External Factors: External factors, such as changes in government regulations, shifts in investor sentiment, and global macroeconomic trends, can also influence contract prices. It is important for traders to stay informed about these external factors to make well-rounded trading decisions.

By keeping a close eye on these factors and conducting thorough analysis, traders can gain a better understanding of the market dynamics and potentially capitalize on profitable opportunities.

Continued in next section…

Trading Spy Futures on CME

The Chicago Mercantile Exchange (CME) provides a regulated and efficient marketplace for trading Spy Futures Contracts. Here are the key steps involved in trading these contracts on the exchange:

- Choose a brokerage: To trade Spy Futures Contracts on CME, you will need to open an account with a brokerage firm that offers access to the exchange. Ensure that the brokerage is reputable, reliable, and offers competitive commission rates.

- Research and analyze: Before placing any trades, conduct thorough research and analysis to identify potential trading opportunities. Analyze market trends, economic indicators, and company news to make informed decisions about the direction of the S&P 500 index.

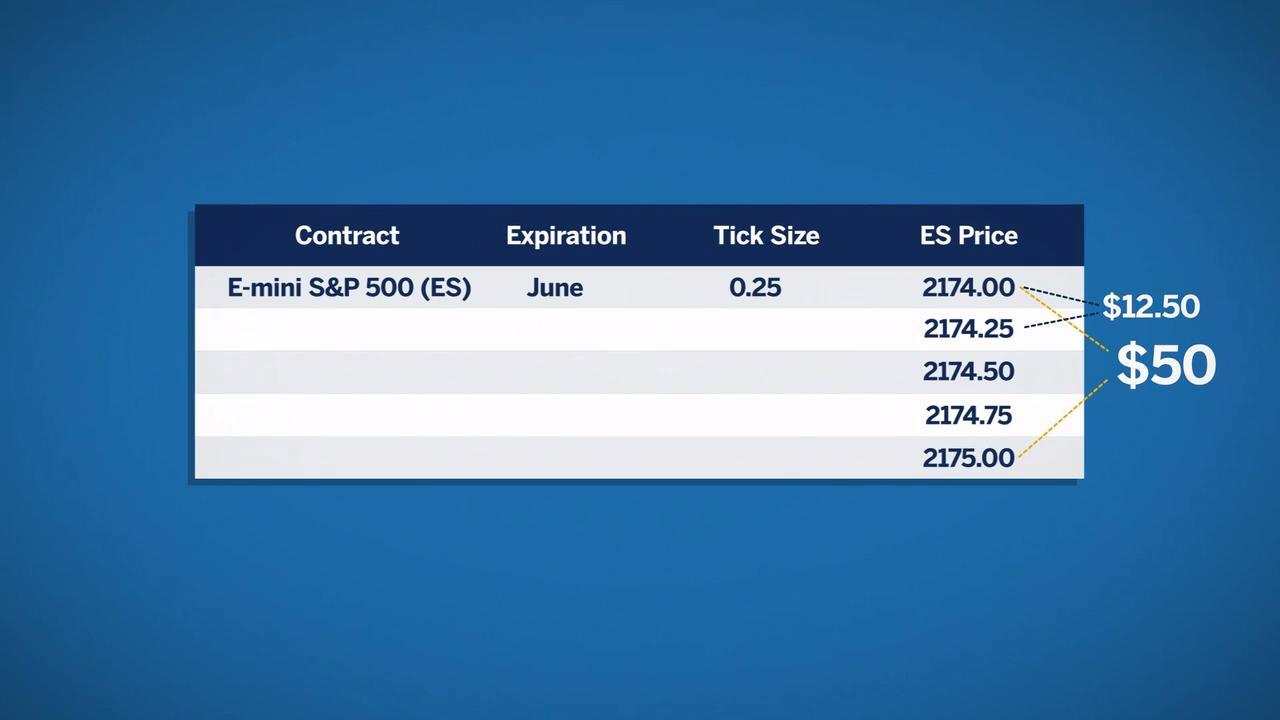

- Understand contract specifications: Familiarize yourself with the contract specifications of Spy Futures Contracts on CME. This includes details such as contract size, tick size, and minimum price fluctuation. Understanding these specifications will help you determine the appropriate position size and manage risk effectively.

- Select a trading strategy: Choose a trading strategy that aligns with your risk tolerance and investment goals. Whether you prefer trend-following strategies, mean-reversion approaches, or a combination of different strategies, having a clear plan in place can improve your chances of success.

- Execute your trades: Once you have identified a trading opportunity, enter the order into your brokerage’s trading platform. Specify the quantity, order type (such as market or limit), and any additional instructions. Monitor your trades closely and make adjustments as needed.

- Manage risk: Implement risk management techniques to protect your trading capital. Set stop-loss orders to limit potential losses and use trailing stops to lock in profits as the market moves in your favor. Regularly review and adjust your risk management strategies as market conditions change.

- Stay informed: Continuously monitor market news, economic announcements, and events that may impact the S&P 500 index and Spy Futures Contracts. Stay engaged with the market to identify new trading opportunities or make adjustments to existing positions.

- Roll over contracts: As the expiration date of your Spy Futures Contracts approaches, you will need to roll over your positions to the next contract month to maintain exposure to the market. Work with your broker to smoothly transition your positions to the new contracts.

Trading Spy Futures Contracts on CME requires discipline, knowledge, and continuous learning. It is essential to develop a trading plan, stick to your strategy, and manage risk appropriately. By doing so, you can take advantage of the opportunities presented by this dynamic market.

Continued in next section…

Analyzing Historical Spy Futures Contract Prices

Analyzing historical Spy Futures contract prices is a valuable practice for traders looking to gain insights into market trends, identify patterns, and develop trading strategies. By studying past price behavior, traders can make more informed decisions about future price movements. Here are some key steps to analyze historical Spy Futures contract prices:

- Access historical price data: Obtain access to historical price data for Spy Futures contracts. Many financial platforms and brokerage services provide historical data, which can be obtained in the form of price charts, spreadsheets, or through specialized data providers.

- Identify key price levels: Look for significant price levels in the historical data, such as support and resistance levels. These levels indicate areas where the market has historically shown strong buying or selling pressure, potentially leading to price reversals or continuations.

- Observe price patterns: Analyze the historical data for recurring price patterns, such as trends, reversals, and chart patterns. These patterns can provide insights into potential future price movements and help traders identify entry and exit points for their trades.

- Use technical indicators: Apply technical indicators to the historical price data to gain additional insights. Common technical indicators include moving averages, oscillators, and trend-following tools. These indicators can help confirm or invalidate potential trade setups.

- Study market correlations: Explore correlations between Spy Futures contract prices and other relevant market factors, such as economic data, sector performance, or commodity prices. Understanding these correlations can help traders gauge the broader market environment and refine their trading strategies.

- Backtest trading strategies: Utilize historical price data to backtest trading strategies. By applying your trading rules to past data, you can assess the effectiveness and profitability of your strategies. This allows you to refine and optimize your trading approach before implementing it in real-time.

- Monitor market volatility: Analyze historical price volatility to identify periods of high and low volatility. This information can help traders adjust their risk management strategies and adapt their trading approach accordingly.

- Consider fundamental factors: While historical price analysis primarily focuses on technical factors, it is also important to consider fundamental factors. Study the historical impact of economic events, earnings releases, and other market-moving news on Spy Futures contract prices.

Remember, historical price analysis serves as a guide, but it does not guarantee future price movements. Market conditions and dynamics can change, and past performance may not be indicative of future results. Therefore, it is crucial to use historical analysis as part of a comprehensive trading approach that incorporates other market information and risk management techniques.

Continued in next section…

Strategies for Investing in Spy Futures Contracts

Investing in Spy Futures Contracts requires a well-thought-out strategy to maximize potential returns while managing risks. Here are several strategies commonly utilized by traders when trading Spy Futures Contracts:

- Trend Following: This strategy involves identifying and trading in the direction of established market trends. Traders look for signals that indicate the continuation or reversal of trends, such as moving average crossovers or trendline breaks. By riding the trend, traders aim to capture substantial profits.

- Breakout Trading: Breakout traders seek to capitalize on price movements beyond predefined support or resistance levels. When the price breaks out of these levels, traders enter positions in the direction of the breakout, anticipating further price movement. This strategy requires careful monitoring of price patterns and volume to confirm the breakout.

- Mean Reversion: Mean reversion trading involves identifying overextended price movements and anticipating a reversion back to the mean or average price. Traders look for price divergences, overbought or oversold conditions, or extreme deviations from the historical price patterns. They then enter positions that align with the expected price reversal.

- Event-Based Trading: This strategy involves monitoring and trading based on significant market events such as economic data releases, corporate earnings reports, central bank announcements, or geopolitical developments. Traders aim to capitalize on the volatility and price movements generated by these events.

- Pairs Trading: Pairs trading involves taking simultaneous long and short positions in two correlated instruments, such as Spy Futures Contracts and another related asset. Traders look for divergences in the price movements of the two assets and profit from the anticipated reversion to their historical relationship.

- Hedging: Hedging strategies involve using Spy Futures Contracts to mitigate potential losses in an existing portfolio. By taking an offsetting position in Spy Futures Contracts, traders aim to protect their portfolio in case of adverse market movements. Hedging can be particularly useful during volatile market conditions or uncertain times.

- Volatility Trading: This strategy aims to profit from changes in market volatility. Traders monitor indicators of volatility, such as the VIX index, and enter positions based on their expectations of increased or decreased market volatility. Volatility strategies can involve options, futures, or other derivative instruments.

- Scalping: Scalping is a short-term, high-frequency trading strategy where traders aim to profit from small, incremental price movements. Traders rapidly enter and exit positions, aiming to accumulate small gains that can add up over time. This strategy requires quick decision-making, advanced technical analysis skills, and robust trading infrastructure.

These strategies represent a range of approaches for investing in Spy Futures Contracts. It is crucial to test and refine your chosen strategy, adapt it to changing market conditions, and employ proper risk management techniques to achieve consistent success.

Please note that trading strategies involve varying degrees of risk, and it is important to thoroughly analyze and understand the strategy before implementing it. Consider consulting with a financial advisor or professional trader to further enhance your understanding and optimize your trading approach.

Continued in next section…

Risks Associated with Spy Futures Trading

While trading Spy Futures Contracts offers potential rewards, it also comes with inherent risks that traders should be aware of. Understanding and effectively managing these risks is crucial for long-term success. Here are some of the key risks associated with Spy Futures trading:

- Market Volatility: The S&P 500 index can be subject to significant price volatility, which can lead to rapid and substantial price movements in Spy Futures Contracts. Unpredictable market conditions increase the risk of unexpected losses.

- Leverage: Spy Futures Contracts allow traders to control a larger position in the market with a relatively small investment, thanks to leverage. While leverage magnifies potential profits, it also amplifies losses. Traders must exercise caution and manage their position sizes accordingly.

- Liquidity Risk: In periods of low market liquidity, Spy Futures Contracts may experience wider bid-ask spreads, making it more challenging to enter and exit positions at desired prices. Illiquidity can lead to slippage and increased trading costs.

- Execution Risk: Due to the fast-paced nature of the futures market, there is a risk of execution delays or order fill anomalies. Traders must ensure they have a reliable and robust trading infrastructure and select a reputable broker to minimize execution risk.

- Overexposure: Taking on excessively large positions or failing to properly diversify a portfolio can increase the risk of significant losses. It is important to carefully manage position sizes and spread risk across different asset classes to avoid overexposure to a single market.

- Political and Geopolitical Events: Unexpected political or geopolitical developments, such as elections, trade disputes, or acts of terrorism, can cause market disruptions and volatility. Traders must stay updated on these events and be prepared for the potential impact on Spy Futures Contract prices.

- Margin Calls: Trading on margin exposes traders to the risk of margin calls. If the market moves against a trader’s position and their account equity falls below the required margin level, they may be required to deposit additional funds or face forced liquidation of their positions.

- System and Technology Failures: Technical issues, software glitches, or internet connectivity problems can disrupt trading operations and result in missed trading opportunities or incorrect order executions. Traders should have contingency plans in place to handle such situations.

- Psychological Factors: Emotions, such as fear and greed, can significantly impact trading decisions. Making impulsive or irrational trades can lead to costly mistakes. Traders should maintain discipline, adhere to their trading plans, and manage their emotions effectively.

It is important to assess and manage these risks by implementing proper risk management techniques, such as setting stop-loss orders, diversifying your portfolio, and continuously monitoring and adjusting your positions. Additionally, traders should educate themselves, stay informed about market developments, and regularly review their trading strategies to adapt to changing market conditions.

Trading Spy Futures Contracts can be potentially profitable, but it is essential to approach it with a realistic understanding of the risks involved and to trade responsibly.

Continued in next section…

Conclusion

Spy Futures Contracts on the Chicago Mercantile Exchange offer traders an exciting and versatile opportunity to participate in the movements of the S&P 500 index. By understanding the mechanics of these contracts, the factors that influence their prices, and utilizing effective trading strategies, investors can potentially capitalize on market trends and generate profits. However, it is important to approach Spy Futures trading with caution and be mindful of the associated risks.

Traders should diligently research, analyze historical data, and develop a well-defined trading plan before entering the market. It is crucial to stay informed about economic indicators, corporate earnings, geopolitical events, and market sentiment, as these factors can significantly impact Spy Futures Contract prices.

Implementing sound risk management techniques is crucial to mitigate potential losses. Understanding leverage, managing position sizes, and diversifying portfolios can help traders protect their capital and trade responsibly.

While Spy Futures trading requires discipline, knowledge, and continuous learning, it also offers opportunities for profit and growth. By utilizing effective trading strategies, adapting to market conditions, and staying informed, traders can increase their chances of success in this dynamic market.

Remember, trading Spy Futures Contracts involves a degree of uncertainty, and past performance is not always indicative of future results. It is recommended to seek professional advice, continuously educate yourself, and regularly assess and refine your trading approach to achieve your financial goals.

In summary, Spy Futures Contracts on CME provide a gateway to tapping into the diverse world of the S&P 500 index. By understanding the nuances of trading these contracts and managing risks effectively, traders can navigate the market with confidence, potentially generating profits and diversifying their investment portfolios. With thorough research, disciplined decision-making, and an adaptable approach, Spy Futures trading can be a rewarding journey for those willing to immerse themselves in the world of finance.