Finance

Rubber Check Definition

Published: January 22, 2024

Learn the meaning of rubber check in finance and how it affects your financial transactions. Understand the consequences of issuing a rubber check.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Rubber Check: A Comprehensive Financial Guide

Finance plays a vital role in our lives, affecting everything from how we manage our money to future planning. In the realm of finance, one common term that individuals may come across is a “rubber check.” But what does this term mean, and how does it impact our financial well-being? In this blog post, we’ll delve into the concept of a rubber check, exploring its definition, consequences, and potential solutions.

Key Takeaways:

- A rubber check refers to a check that bounces or gets declined due to insufficient funds in the payer’s account.

- Writing a rubber check can lead to a range of consequences, including penalties, fees, damage to credit scores, and potential legal repercussions.

What is a Rubber Check?

A rubber check, also known as a bounced check or a returned check, is a check that is rejected by the bank upon presentation for payment due to insufficient funds in the payer’s account. Essentially, when someone writes a rubber check, it means that the check bounces back and cannot be honored by the bank.

This situation typically occurs when an individual makes a payment using a check, but their bank account does not have sufficient funds to cover the payment amount. When the recipient or payee attempts to deposit or cash the check, the bank returns it unpaid. This can be an embarrassing and frustrating experience for both parties involved.

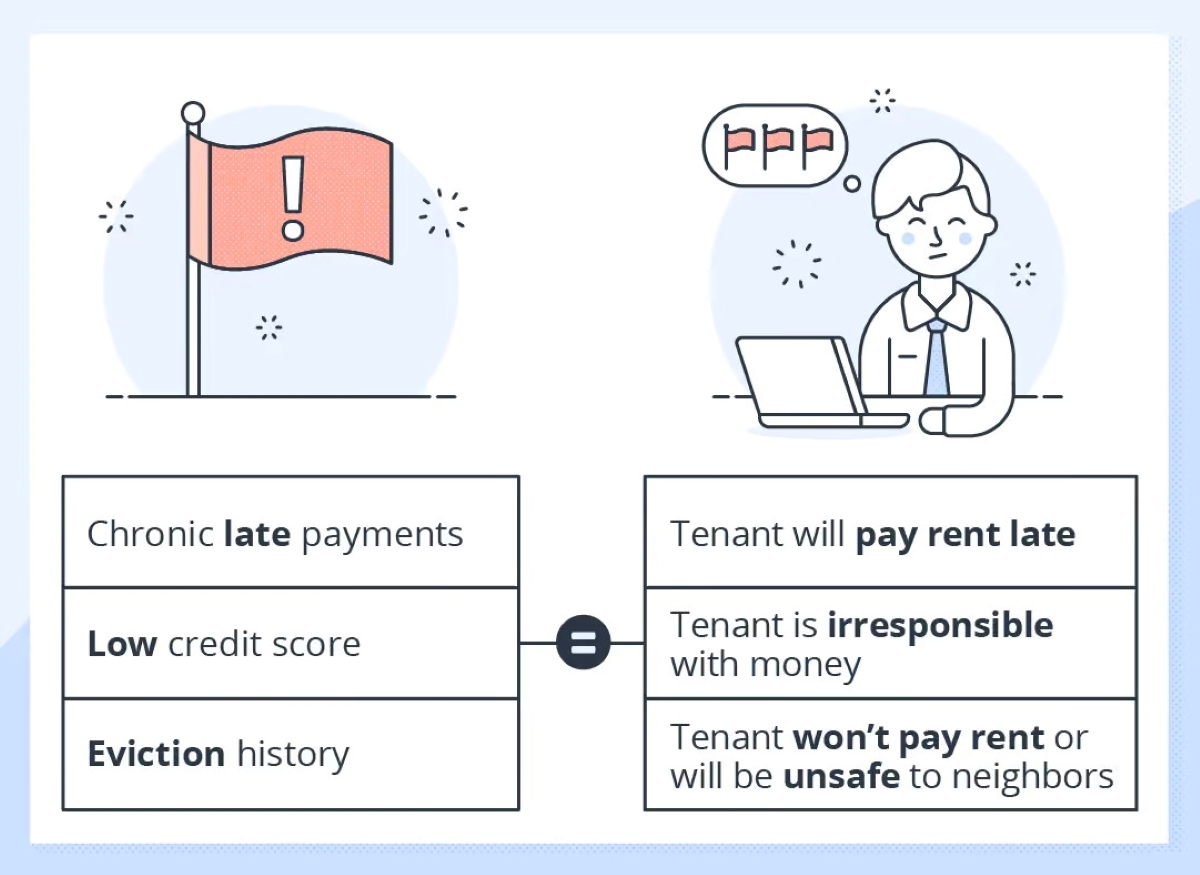

Consequences of Rubber Checks:

The ramifications of writing a rubber check can be significant and can impact various aspects of an individual’s financial life. Here are some potential consequences to consider:

- Penalties and Fees: When a check bounces, both the payer and the payee may incur fees from their respective banks. The payer’s bank may levy an insufficient funds fee, while the payee’s bank can also charge returned check fees.

- Damage to Credit Score: Consistently writing rubber checks or engaging in other financial mismanagement practices can harm your credit score. If the situation escalates and the payee reports the incident to credit bureaus, it can negatively impact your creditworthiness, making it difficult to obtain loans in the future.

- Potential Legal Repercussions: In some cases, writing a rubber check could lead to legal disputes. If the payee chooses to pursue legal action, the payer may face legal consequences, including fines or even imprisonment, depending on local laws and regulations.

- Strained Relationships: Writing a rubber check can strain relationships, especially when it involves friends, family members, or business partners. It can erode trust and create tension, which may be challenging to repair.

How to Prevent and Resolve Rubber Checks:

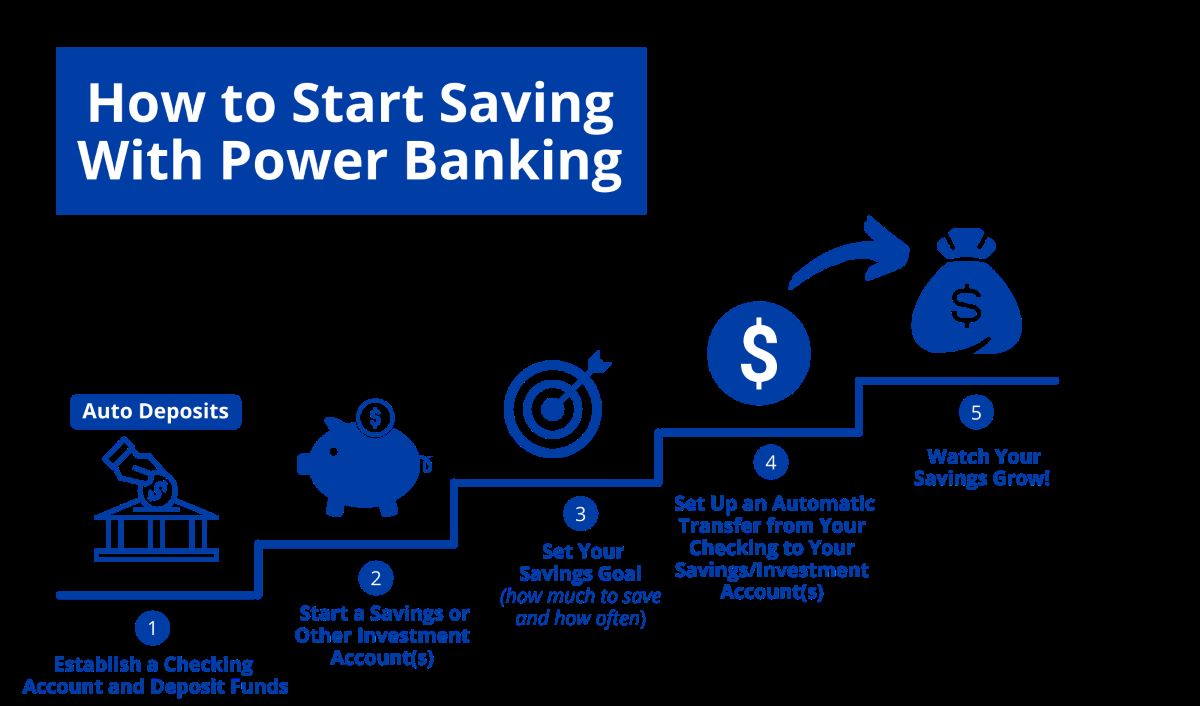

The best way to prevent rubber checks is to maintain good financial habits and ensure sufficient funds in your bank account before writing a check. Here are some tips to avoid writing rubber checks:

- Monitor your account: Keep a close eye on your bank account balance and transactions to avoid overdrawing your account unintentionally.

- Create a budget: Establishing a budget can help you manage your finances better and avoid overspending.

- Utilize electronic payments: Consider using electronic payment methods, such as online banking or mobile payment apps, which provide real-time balance updates and help you avoid writing checks when funds are low.

- Communicate with payees: If you anticipate any payment difficulties, communicate with the payee in advance to explore alternative payment options or make necessary arrangements.

If you find yourself in a situation where you have written a rubber check, it is essential to take immediate action to resolve the issue:

- Replenish your account: Deposit sufficient funds into your bank account to cover the check amount as soon as possible.

- Contact the payee: Inform the payee about the situation, apologize for the inconvenience caused, and offer an alternative payment method if necessary.

- Learn from the experience: Use the incident as a learning opportunity to improve your financial habits and ensure it does not happen again in the future.

Understanding the concept of a rubber check and its potential consequences is crucial for anyone navigating the world of finance. By practicing responsible financial habits and taking prompt action when faced with a rubber check situation, you can safeguard your financial well-being and maintain healthy financial relationships.