Finance

Credit Checking Definition

Modified: January 10, 2024

Learn the meaning of credit checking in finance and how it impacts your financial status. Understand the importance of credit checks and their role in assessing creditworthiness.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

A Closer Look at Credit Checking: Understanding the Definition and Importance

When it comes to managing our finances, one aspect that can have a significant impact on our financial well-being is our credit. But what exactly does credit checking mean? In this article, we will delve into the definition of credit checking and why it is crucial for individuals and businesses alike. Whether you’re a first-time borrower or a seasoned financial professional, understanding credit checking is essential for making informed financial decisions.

Key Takeaways:

- Credit checking refers to the process of evaluating an individual or business’ creditworthiness by examining their credit history, payment patterns, and overall financial behavior.

- Credit checks are performed by lenders, landlords, and other financial institutions to assess the risk of extending credit or entering into a financial relationship with an applicant.

So, what does credit checking actually involve? Essentially, credit checking is the evaluation of an individual or business’ creditworthiness. It involves reviewing credit reports, which detail an individual’s credit history, outstanding loans, payment patterns, and any past instances of delinquency or default. By conducting a credit check, lenders and financial institutions can determine the level of risk involved in extending credit to an applicant or entering into a financial agreement.

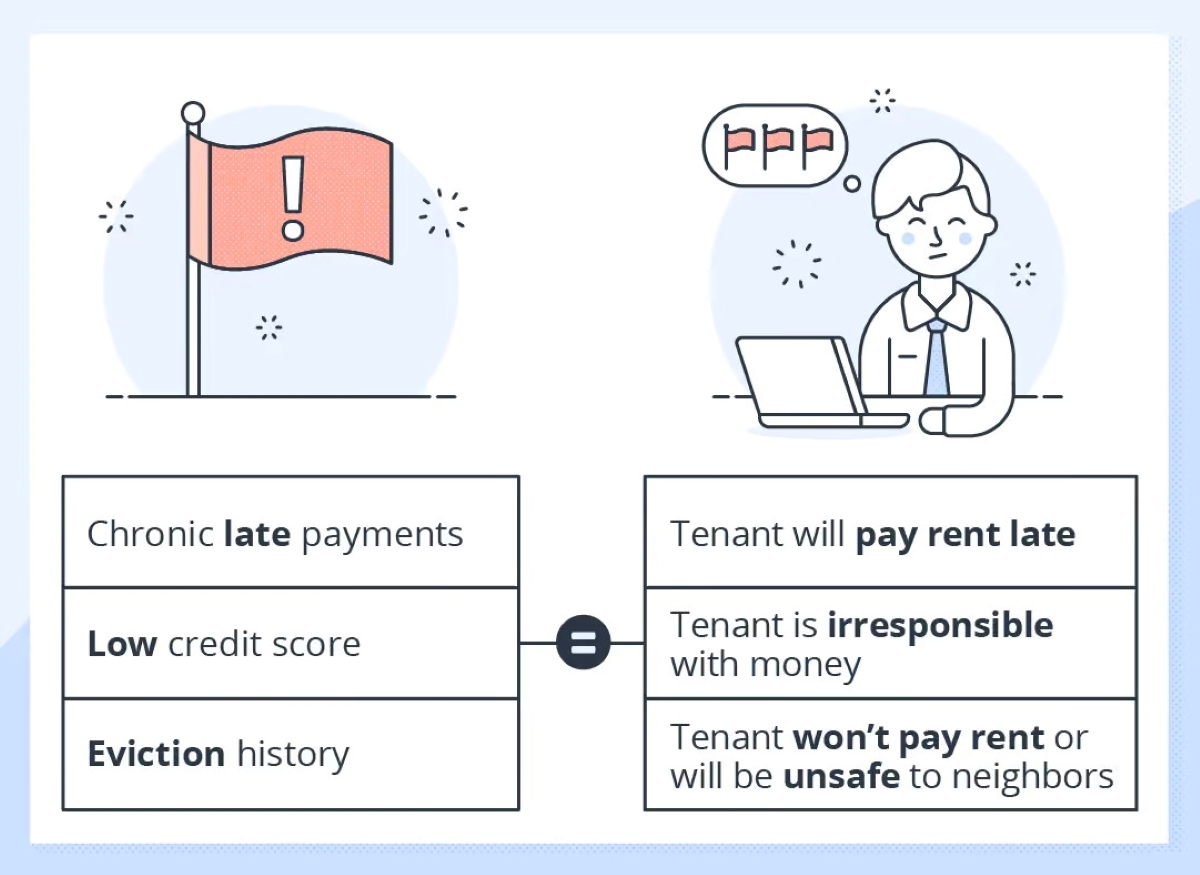

Credit checks are not only limited to loan applications; they are also commonly performed by landlords when considering potential tenants, by employers during background checks, and even by insurance companies when setting premium rates. These checks help these entities evaluate the financial reliability and responsibility of an individual or business before engaging in a financial relationship.

It’s important to note that credit checks can be classified into two categories:

- Soft Credit Checks: These types of checks occur when individuals or businesses request their own credit reports or when companies perform pre-screening checks for promotional offers. Soft credit checks do not impact credit scores and are only visible to the person conducting the check.

- Hard Credit Checks: Hard credit checks are typically performed by lenders during the loan application process or when individuals apply for credit cards or other forms of credit. These checks can temporarily lower credit scores by a few points and are visible to other lenders conducting credit checks.

Now that we understand what credit checking entails, let’s delve into its importance. Here are some key reasons why credit checking is crucial:

- Assessing Creditworthiness: Credit checking allows lenders and other financial institutions to determine the creditworthiness of applicants. By reviewing credit reports and scores, they can assess the likelihood of an applicant repaying their debts on time, which helps them make informed decisions about granting credit.

- Managing Risk: Credit checks help organizations manage risk by evaluating an individual or business’ financial behavior. This assessment helps lenders determine interest rates, credit limits, and other terms that may be offered to borrowers.

- Protecting Against Fraud: Credit checking plays a crucial role in preventing identity theft and fraudulent activities. By verifying an applicant’s identity and examining their credit history, financial institutions can detect any suspicious activity and protect themselves from potential losses.

In conclusion, credit checking is a fundamental process that plays a vital role in managing personal and business finances. Understanding the definition and importance of credit checking allows individuals to navigate the financial landscape more effectively and make informed decisions about borrowing, renting, or entering into financial agreements. So, next time you come across a credit check, you’ll have a better understanding of its purpose and significance.