Finance

S&P/ASX 200 VIX (A-VIX) Definition

Published: January 23, 2024

Learn the definition of S&P/ASX 200 VIX (A-VIX) in the world of finance. Understand the volatility index and its implications for investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is S&P/ASX 200 VIX (A-VIX)? Exploring the Definition and Its Significance in Finance

Welcome to another insightful blog post in our finance category! Today, we’re going to dive deep into the S&P/ASX 200 VIX (A-VIX) and explore its definition and significance within the world of finance. So, if you’ve ever wondered what this mysterious acronym represents, or how it impacts the financial market, you’ve come to the right place.

Key Takeaways:

- The S&P/ASX 200 VIX (A-VIX) is a volatility index that measures the expected volatility of the Australian stock market based on option prices.

- It reflects investors’ sentiment and perceptions about potential market fluctuations.

The S&P/ASX 200 VIX (A-VIX) is an essential tool that helps investors gauge market volatility, providing vital insights into the sentiment and expectations of market participants. But what exactly is it?

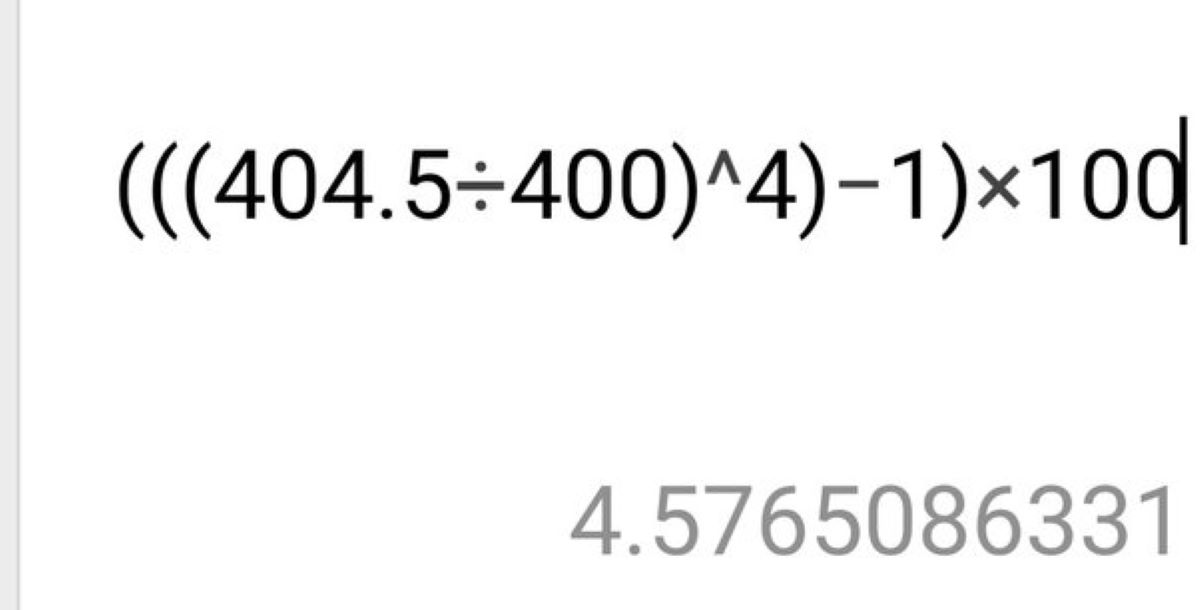

S&P/ASX 200 VIX (A-VIX) is a registered benchmark volatility index introduced by S&P Dow Jones Indices. It measures the expected volatility of the Australian stock market, specifically the S&P/ASX 200 Index, over the next 30 days based on the prices of listed options. In simpler terms, it quantifies the market’s anticipation of potential price fluctuations.

Now, you might be wondering why knowing the expected volatility matters. Well, here are a couple of key takeaways to help answer that question:

- 1. Assessing Risk: The S&P/ASX 200 VIX (A-VIX) allows investors to assess the level of risk associated with the Australian stock market. Higher index readings indicate increased market uncertainty and potential for larger price swings, while lower readings may suggest more stable market conditions.

- 2. Contrarian Indicator: The A-VIX can serve as a contrarian indicator, meaning it can be used by investors to identify potential buying or selling opportunities. When the index reaches extreme levels, it may signal an overbought or oversold condition, prompting investors to consider making contrarian moves.

By monitoring the S&P/ASX 200 VIX (A-VIX), investors can gain a better understanding of market sentiment, make more informed investment decisions, and potentially navigate market volatility more effectively.

While it’s important to note that the S&P/ASX 200 VIX (A-VIX) is just one of many tools available to investors, its significance lies in its ability to measure and predict market volatility, which can greatly impact investment strategies and risk management.

So, there you have it – a comprehensive overview of the S&P/ASX 200 VIX (A-VIX), its definition, and why it matters in the world of finance. By understanding this volatility index, investors can stay ahead of market fluctuations and make calculated investment decisions.

We hope you found this blog post helpful and informative. Stay tuned for more exciting topics in our finance category!