Home>Finance>What Is The APR On A 30 Year $200 000 Loan At 4.5% With No Points?

Finance

What Is The APR On A 30 Year $200 000 Loan At 4.5% With No Points?

Published: March 2, 2024

Learn how to calculate the APR on a 30-year $200,000 loan at 4.5% with no points. Understand the finance costs of your mortgage to make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Basics of APR for Home Loans

When it comes to securing a mortgage for a new home, understanding the intricacies of the Annual Percentage Rate (APR) is crucial. The APR encompasses the true cost of borrowing, offering a comprehensive view of the financial commitment associated with a mortgage. While the interest rate reflects the cost of borrowing the principal loan amount, the APR provides a more holistic perspective, incorporating additional fees and charges.

As a potential homeowner, being well-versed in the concept of APR can empower you to make informed decisions, ensuring that you select a mortgage that aligns with your financial goals and circumstances. By delving into the nuances of APR and its implications, you can navigate the mortgage landscape with confidence, ultimately securing a loan that is tailored to your needs.

In this article, we will explore the fundamentals of APR, shedding light on its significance in the realm of home loans. Additionally, we will embark on a comprehensive journey to calculate the APR for a 30-year $200,000 loan at a 4.5% interest rate with no points, unraveling the intricate process to demystify this crucial aspect of mortgage financing.

Understanding APR

Annual Percentage Rate (APR) serves as a vital metric for evaluating the true cost of borrowing, encompassing not only the interest rate but also additional fees and charges associated with a loan. While the interest rate reflects the cost of borrowing the principal amount, the APR offers a comprehensive overview by incorporating various expenses such as origination fees, points, mortgage insurance, and other closing costs.

It is essential to recognize that the APR enables borrowers to compare the actual costs of different loan products effectively. By considering the APR, individuals can make informed decisions, selecting a mortgage that best aligns with their financial circumstances and long-term objectives. Moreover, the inclusion of upfront costs and fees in the APR calculation provides a more accurate representation of the total expense associated with a particular loan, enabling borrowers to assess the overall affordability and value of the mortgage.

When evaluating mortgage options, borrowers should pay close attention to the APR, as it offers a more comprehensive perspective than the interest rate alone. By understanding the components included in the APR calculation, individuals can gain insight into the complete financial implications of a mortgage, facilitating a well-informed decision-making process.

Calculating the APR on a 30-Year $200,000 Loan at 4.5% with No Points

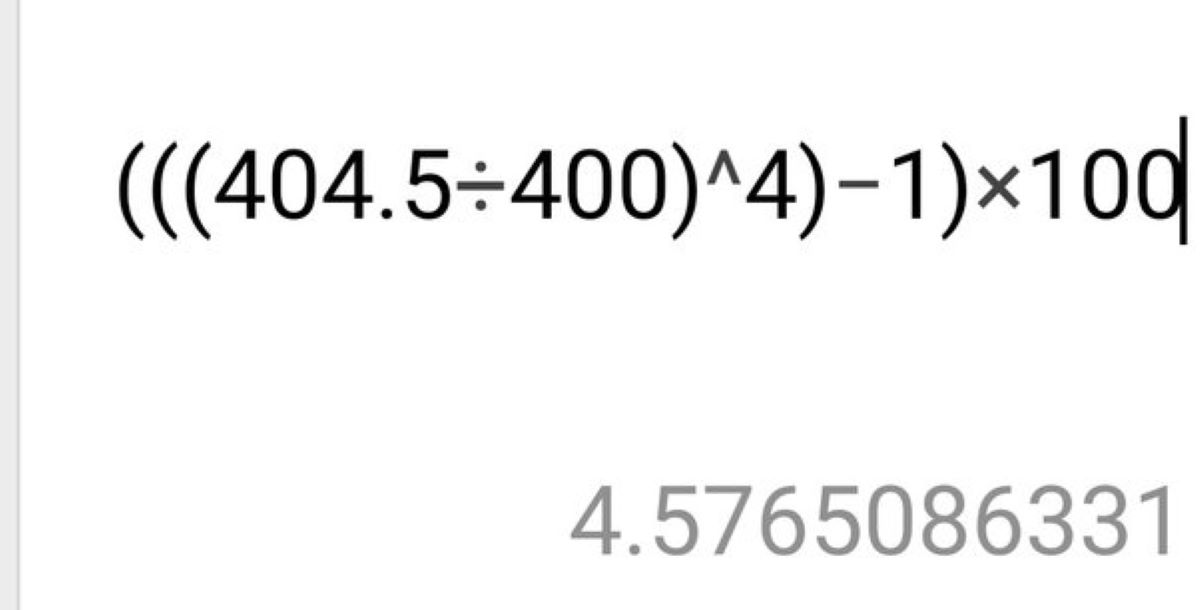

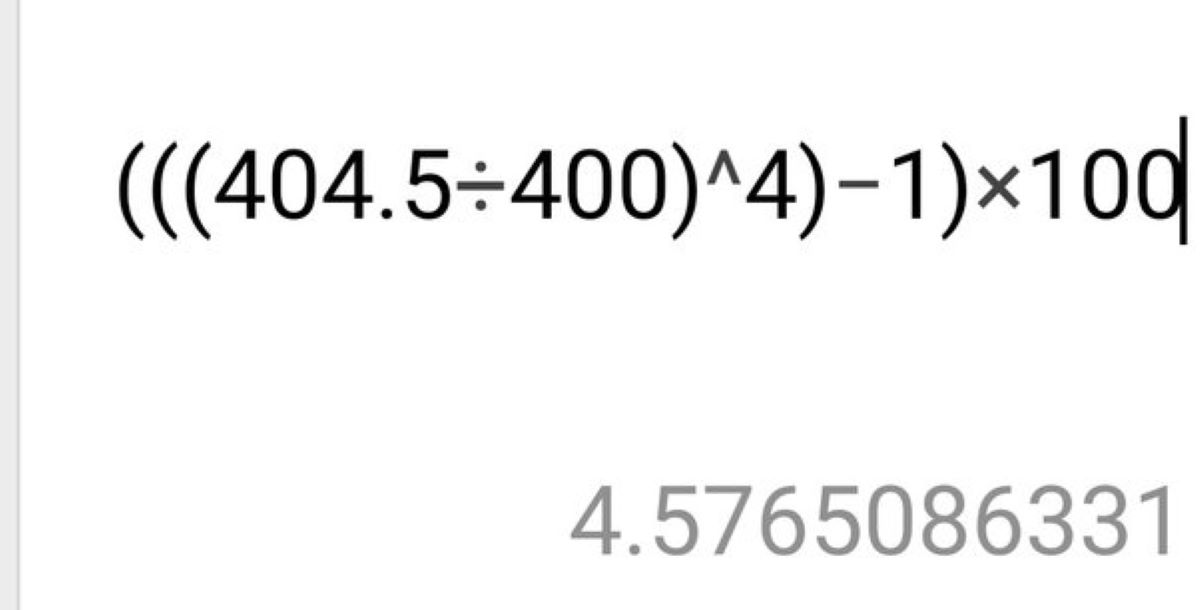

Calculating the APR for a 30-year $200,000 loan at a 4.5% interest rate with no points involves a meticulous process that integrates various components to derive the comprehensive cost of borrowing. To embark on this calculation, it is imperative to consider the principal loan amount, the annual interest rate, and any additional fees or costs associated with the loan. While the interest rate is a fundamental element, the APR delves deeper, encompassing other expenses to provide a more accurate representation of the total borrowing cost.

When computing the APR for the specified loan, it is essential to account for potential closing costs, origination fees, and other expenses that contribute to the overall borrowing expenditure. By factoring in these components, the APR calculation offers a more holistic view, enabling borrowers to gauge the true cost of the mortgage over its entire term. This comprehensive approach empowers individuals to compare loan products effectively, facilitating an informed decision-making process.

Furthermore, understanding the methodology behind APR calculation equips borrowers with the knowledge to assess the affordability and value of a mortgage accurately. By unraveling the intricacies of the APR computation, individuals can make informed choices, selecting a loan that aligns with their financial objectives and long-term plans.

By delving into the process of calculating the APR for a 30-year $200,000 loan at a 4.5% interest rate with no points, borrowers can gain a deeper understanding of the true cost of borrowing, empowering them to navigate the mortgage landscape with confidence and clarity.

Conclusion

In conclusion, comprehending the significance of the Annual Percentage Rate (APR) in the context of home loans is paramount for individuals seeking to secure a mortgage. The APR encapsulates the complete cost of borrowing, encompassing not only the interest rate but also additional fees and charges associated with the loan. By considering the APR, borrowers can make well-informed decisions, effectively comparing the actual costs of different loan products to select the most suitable option based on their financial circumstances and objectives.

Furthermore, the calculation of the APR for a 30-year $200,000 loan at a 4.5% interest rate with no points underscores the meticulous process involved in deriving the comprehensive cost of borrowing. By factoring in various components such as closing costs, origination fees, and other expenses, the APR calculation offers a holistic view, empowering borrowers to assess the true financial implications of the mortgage over its entire term.

Empowered with a deeper understanding of APR and its calculation, individuals can navigate the mortgage landscape with confidence, ensuring that the selected loan aligns with their long-term financial goals. By recognizing the significance of the APR and its role in facilitating informed decision-making, borrowers can embark on their homeownership journey equipped with the knowledge to make sound financial choices.

In essence, the APR serves as a crucial tool for borrowers, providing transparency and clarity regarding the complete cost of borrowing. By embracing the nuances of APR and its implications, individuals can embark on their homeownership endeavors with confidence, armed with the knowledge to select a mortgage that not only meets their immediate needs but also aligns with their overarching financial aspirations.