Home>Finance>What Are Some Disadvantages Of Being Locked Out Of The Traditional Banking System

Finance

What Are Some Disadvantages Of Being Locked Out Of The Traditional Banking System

Published: November 2, 2023

Being locked out of the traditional banking system can have significant disadvantages, leaving individuals without access to financial services and opportunities for growth in the finance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s modern world, having access to the traditional banking system is often taken for granted. However, there are those who find themselves locked out of this financial infrastructure, which can lead to a variety of disadvantages and challenges. Being unable to participate in the traditional banking system can have significant implications on an individual’s financial well-being, as well as their ability to conduct everyday financial activities.

When we talk about being locked out of the traditional banking system, it refers to individuals who are either unbanked or underbanked. The unbanked do not have a bank account at all, while the underbanked have limited access to financial services and rely on alternative financial institutions or services.

There are several reasons why individuals may find themselves excluded from the traditional banking system. It could be due to a lack of documentation, such as identification or proof of address, which are often required to open a bank account. It could also be a result of low income, a history of bad credit, or a distrust of banking institutions. Regardless of the reasons, being locked out of the traditional banking system can have significant disadvantages and impact one’s financial situation.

In this article, we will explore some of the main disadvantages of being locked out of the traditional banking system. From limited access to financial services to challenges in building wealth, we will delve into the various ways in which individuals without bank accounts or limited banking access face financial hurdles. Understanding these disadvantages is crucial to shed light on the importance of financial inclusion and finding alternative solutions to address these issues.

Lack of Access to Financial Services

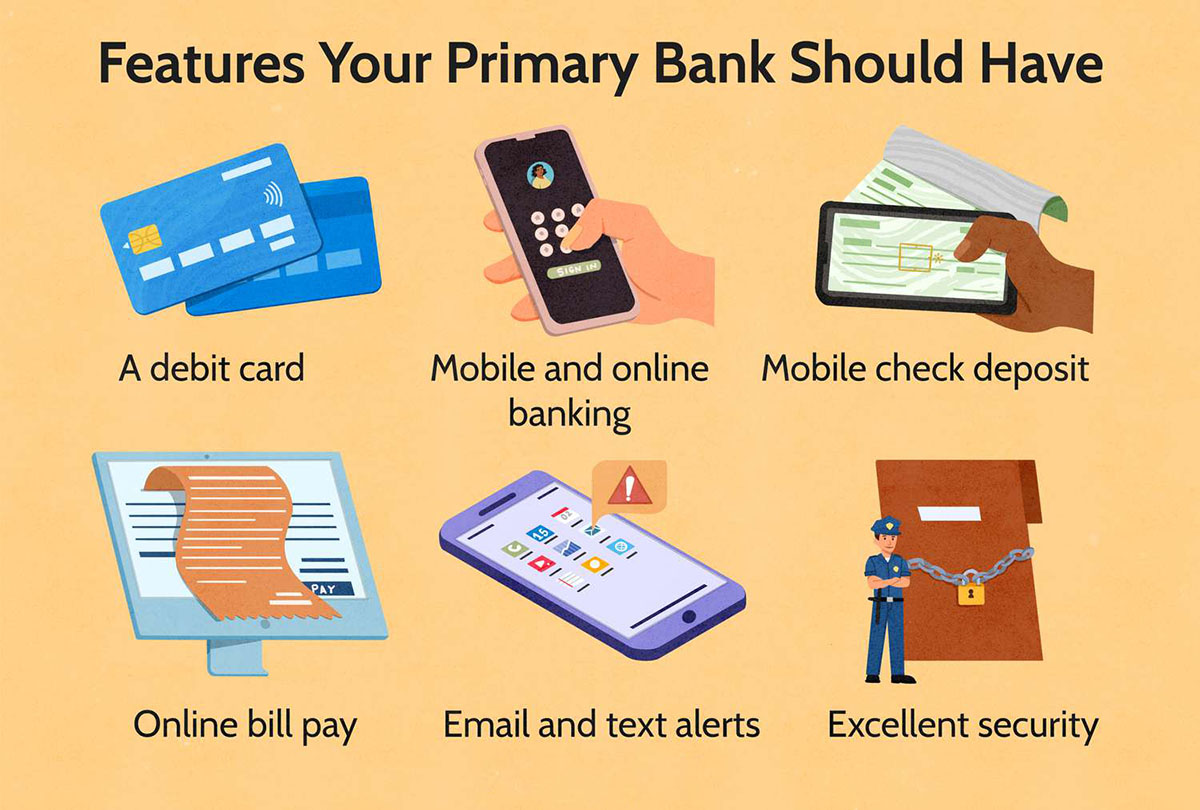

One of the primary disadvantages of being locked out of the traditional banking system is the lack of access to essential financial services. Without a bank account, individuals are unable to enjoy the convenience and security that comes with basic banking services.

For example, having a bank account allows individuals to easily deposit and withdraw money, manage their finances, and access loans and credit. It provides a safe place to store money and protects against the risk of theft or loss. Without a bank account, individuals are often left with limited options for managing their finances.

Moreover, being excluded from the traditional banking system means missing out on the benefits of electronic payments and online banking. In today’s digital age, many financial transactions are conducted online, such as paying bills, transferring funds, and making purchases. Without a bank account, individuals may have to rely on cash, which can be inconvenient and risky.

The lack of access to financial services also poses challenges for individuals in terms of financial stability and planning for the future. For example, without a bank account, it becomes much more difficult to save money or set aside funds for emergencies. Savings accounts offered by banks provide a safe and convenient way to save money, earn interest, and plan for long-term financial goals.

Furthermore, not having access to financial services can hinder an individual’s ability to establish a credit history and access credit. Credit is crucial for many financial activities, such as buying a home, financing education, or starting a business. Without a bank account or access to credit, individuals are often left with limited options and may turn to predatory lenders who charge exorbitant interest rates.

In summary, the lack of access to financial services due to being locked out of the traditional banking system can have far-reaching consequences. It limits individuals’ ability to manage their finances effectively, conduct basic financial transactions, and plan for the future. Finding alternative solutions to provide financial services to the unbanked and underbanked population is vital for promoting financial inclusion and reducing economic disparities.

Limited Payment Options

Being locked out of the traditional banking system also means limited payment options for individuals. Without a bank account, they may face difficulties in conducting various financial transactions and may have to rely on less convenient or more expensive methods of payment.

One of the main challenges is the lack of access to debit or credit cards. These cards are widely accepted for making purchases both online and in-person. They offer convenience and security, allowing individuals to track their expenses and make payments easily. However, without a bank account, individuals are often unable to obtain these cards, limiting their ability to make digital transactions.

Alternative payment methods, such as prepaid cards or mobile payment apps, may be available, but they come with their own limitations. Prepaid cards require individuals to load funds onto the card, which can be inconvenient and may carry additional fees. Mobile payment apps often require a linked bank account or credit card to function, further restricting access for those locked out of the traditional banking system.

Cash becomes the primary means of payment for individuals without a bank account. While cash is widely accepted, relying solely on cash can be burdensome. Carrying large amounts of cash poses a risk of theft or loss, and making change for large purchases can be challenging. Additionally, conducting online transactions or paying bills electronically becomes nearly impossible without a bank account.

Moreover, limited payment options can affect the ability to make timely bill payments. Many recurring bills, such as rent, utilities, and insurance, are commonly paid through automatic debits or online transfers. Without a bank account, individuals may struggle to find alternative methods to pay their bills, leading to late payments, penalties, and potential disruptions in essential services.

Overall, the limited payment options faced by those locked out of the traditional banking system can be a significant disadvantage. It restricts their ability to make convenient and secure transactions, hinders their participation in the digital economy, and may result in additional fees and complications in managing finances.

Difficulty in Receiving Payments

Another disadvantage of being locked out of the traditional banking system is the difficulty in receiving payments. Without a bank account, individuals may face challenges in receiving wages, government benefits, or other forms of income.

Many employers now prefer to pay their employees through direct deposit, where the funds are electronically transferred into the employee’s bank account. Without a bank account, individuals may have to rely on physical paychecks or alternative payment methods, such as prepaid cards. However, these methods often come with limitations and additional fees.

Similarly, individuals who rely on government benefits, such as social security or unemployment benefits, may encounter obstacles in accessing their funds. Government agencies often prefer to deposit benefits directly into a bank account for convenience and efficiency. Being locked out of the banking system can complicate the process, requiring individuals to find alternative means to receive their benefits.

In addition, receiving payments from freelance or self-employment work can become challenging without a bank account. Many clients prefer to transfer funds electronically, which requires a bank account. Without this option, individuals may have to rely on cash payments or seek alternative payment arrangements, which can be cumbersome and less secure.

The difficulty in receiving payments not only affects individuals’ ability to access their income but also has broader implications. It can limit their ability to save money, budget effectively, and plan for their financial future. Without a secure and convenient means of receiving payments, individuals may struggle to manage their finances and might be at a higher risk of losing or misplacing their funds.

In summary, the lack of a bank account or limited access to the traditional banking system can create significant difficulties in receiving payments. This can be particularly challenging for employees, government benefit recipients, and freelance workers. Finding alternative solutions to facilitate payment receipt for individuals locked out of the banking system is crucial to ensure financial inclusivity and provide them with the tools to effectively manage their income.

Higher Transaction Costs

Being locked out of the traditional banking system often translates to higher transaction costs for individuals. Without access to banking services, they are forced to rely on alternative financial institutions or services that may come with higher fees and charges.

One of the main reasons for higher transaction costs is the reliance on check cashing services. Without a bank account, individuals with physical checks often have to visit check cashing establishments to access their funds. These establishments charge a percentage of the check amount as a fee, which can be significant, especially for larger checks. These fees can add up over time and eat into the individual’s income.

In addition, individuals without bank accounts may need to utilize money transfer services, such as wire transfers or money orders, to send or receive money. These services typically charge fees for their use, which can vary based on the amount being transferred and the destination. These fees can significantly impact the cost of conducting financial transactions and reduce the amount of money individuals have available for their everyday expenses.

Moreover, individuals without a bank account may have limited access to ATMs or may have to use out-of-network ATMs, which often charge higher transaction fees. These fees can quickly add up, especially if individuals need to access cash frequently. The lack of access to in-network ATMs can also result in individuals resorting to withdrawing cash from other establishments that may charge even higher fees.

Overall, the higher transaction costs associated with being locked out of the traditional banking system can have a noticeable impact on individuals’ finances. These costs not only deplete their available funds but also make it more challenging to save money, pay bills, or conduct everyday financial transactions.

Addressing these higher transaction costs is essential for promoting financial inclusion and reducing financial inequalities. Providing affordable alternatives or access to low-cost banking services can help individuals reduce their financial burdens and have greater control over their finances.

Inability to Establish Credit

Being locked out of the traditional banking system poses a significant disadvantage when it comes to establishing credit. Without a bank account or limited access to financial services, individuals face difficulties in building a credit history and accessing credit opportunities.

Having a credit history is essential for various financial activities, such as obtaining loans, renting an apartment, or securing favorable insurance rates. Lenders and financial institutions rely on an individual’s credit history to assess their creditworthiness and determine whether to extend credit. However, without a bank account and access to banking services, individuals are unable to demonstrate their financial responsibility and establish a credit history.

Furthermore, individuals locked out of the traditional banking system may resort to alternative forms of borrowing, such as payday loans or rent-to-own agreements. These alternative sources of credit often come with high interest rates and unfavorable terms, compounding the financial challenges faced by individuals.

The inability to establish credit can create a cycle of financial exclusion, as individuals without credit histories are often seen as high-risk borrowers by lenders. This can lead to more limited access to credit and higher borrowing costs when credit opportunities are available. It becomes difficult to break free from this cycle, as a lack of credit access hinders the ability to build a credit history and improve creditworthiness.

Furthermore, the absence of a credit history can also impact other areas of financial life, such as insurance rates and rental applications. Insurance providers often consider an individual’s credit history when determining insurance premiums, and landlords may review credit histories as part of the tenant screening process. Without a credit history, individuals may face higher insurance rates or struggle to secure rental housing.

To address the challenges faced by individuals locked out of the traditional banking system, it is essential to explore alternative credit-building options. This can include the promotion of alternative credit reporting methods, such as rent payments and utility bill payments, or the development of credit-building programs specifically designed for individuals with limited banking access.

In summary, the inability to establish credit due to being locked out of the traditional banking system can significantly limit individuals’ financial opportunities. Finding innovative ways to establish and build credit for those without bank accounts is crucial for promoting financial inclusion and enabling individuals to access credit and improve their financial well-being.

Challenges in Building Wealth

Being locked out of the traditional banking system presents significant challenges when it comes to building wealth. Without access to critical financial services and opportunities, individuals face barriers to accumulating assets, saving for the future, and achieving long-term financial goals.

One of the main challenges is the lack of access to savings accounts and other investment vehicles offered by banks. Savings accounts provide a secure and convenient way to save money and earn interest over time. Without a bank account, individuals may resort to keeping their savings in cash, which can be easily spent or lost. This makes it difficult to build wealth steadily and exposes them to risks such as theft or inflation.

Additionally, being locked out of the traditional banking system limits individuals’ access to investment opportunities. Bank accounts often serve as a gateway to various investment products, such as certificates of deposit (CDs), mutual funds, or retirement accounts. These investment options allow individuals to grow their wealth over time through capital appreciation or earning dividends and interest. Without access to these options, individuals have fewer avenues to grow their money and potentially miss out on long-term wealth-building opportunities.

Furthermore, being excluded from the banking system can restrict individuals’ access to financial education and resources that are crucial for building wealth. Banks often provide resources and guidance on financial planning, budgeting, and investment strategies. Without access to these resources, individuals may lack the knowledge and skills necessary to make informed financial decisions and take advantage of opportunities for wealth accumulation.

Another factor that hinders wealth-building is the limited access to credit for major expenses such as homeownership or higher education. These investments can serve as significant wealth-building strategies, allowing individuals to build equity or increase earning potential. However, without access to credit, individuals locked out of the banking system may find it challenging to embark on these wealth-building paths or be limited to higher-cost alternative financing options.

It is important to address these challenges and promote financial inclusion to enable individuals to build wealth effectively. This can be done through initiatives that provide access to affordable banking services, financial education programs, and alternative credit-building options. By reducing barriers and expanding opportunities, individuals can overcome the challenges of building wealth and improve their long-term financial prospects.

Lack of Financial Security

Being locked out of the traditional banking system can result in a lack of financial security for individuals. Without access to the safeguards and protections provided by banking institutions, individuals may find themselves more vulnerable to financial risks and uncertainties.

One aspect of financial security that is compromised is the absence of deposit insurance. Bank accounts are typically insured by government-backed programs, such as the Federal Deposit Insurance Corporation (FDIC) in the United States, which provides protection for deposits up to a certain amount. This insurance ensures that even if a bank fails, individuals will not lose their deposited funds. However, without a bank account, individuals do not benefit from this safety net, putting their money at risk in case of unforeseen circumstances.

In addition, individuals without access to the banking system may struggle to protect their money from theft or loss. Keeping cash at home or carrying large sums of cash increases the risk of theft or misplacement. Without the security measures provided by banks, such as secure vaults and fraud monitoring systems, individuals become more susceptible to financial losses.

Another aspect of financial security that is compromised is the lack of access to identity theft protection and fraud prevention services. Banks often have advanced security measures and systems in place to detect and prevent fraudulent activities. Without access to these services, individuals may face greater risks of identity theft, unauthorized transactions, and other financial scams.

Furthermore, being excluded from the traditional banking system can limit individuals’ ability to access emergency funds. Having a bank account allows individuals to easily set aside money for emergencies and unexpected expenses. Without this financial buffer, individuals may find it difficult to cope with unforeseen circumstances, leading to greater financial instability and stress.

Lack of financial security can also hinder individuals’ ability to plan for the future and retire comfortably. Retirement savings options, such as employer-sponsored retirement plans or individual retirement accounts (IRAs), are often linked to banking services. Without a bank account, individuals have limited opportunities to save for retirement and may face a higher risk of financial insecurity in their later years.

Addressing the lack of financial security for individuals locked out of the banking system is critical for promoting financial inclusivity and reducing vulnerabilities. Providing alternative mechanisms for deposit insurance, access to secure financial services, and educating individuals about financial risks and strategies can greatly enhance their financial security and well-being.

Limited Financial Education and Resources

Being locked out of the traditional banking system often means limited access to financial education and resources. This lack of knowledge and guidance can have a significant impact on individuals’ financial well-being and their ability to make informed financial decisions.

Banks and financial institutions typically offer a wide range of educational resources, such as workshops, seminars, online tools, and personalized financial advice. These resources aim to enhance individuals’ financial literacy and provide them with the necessary knowledge to effectively manage their money, budget, invest, and plan for the future. However, without access to these resources, individuals may be left without the foundational information and strategies needed to navigate the complexities of personal finance.

Financial education is crucial for individuals to understand concepts like budgeting, saving, debt management, and investing. It empowers them to make sound financial decisions and build a strong financial foundation. Without this knowledge, individuals may struggle to make wise financial choices, which can lead to financial instability and missed opportunities for building wealth.

Furthermore, limited financial education can lead to a lack of awareness regarding alternative financial services and resources. When individuals are excluded from the traditional banking system, they may not be aware of the various financial alternatives available to them. This lack of knowledge can result in individuals relying on costly or predatory financial services that further exacerbate their financial challenges.

The absence of financial education also impacts individuals’ ability to access and effectively use online financial tools and resources. Online banking, budgeting apps, investment platforms, and other digital financial resources have become increasingly prevalent in managing personal finances. Without the necessary knowledge and skills, individuals may be hesitant or unable to take advantage of these tools, missing out on the convenience and benefits they offer.

Addressing the limited financial education and resources available to individuals locked out of the traditional banking system is crucial for promoting financial inclusivity. Efforts should be made to provide accessible and comprehensive financial education programs that cater to the specific needs of the unbanked and underbanked populations. By equipping individuals with the necessary knowledge and resources, they can make informed financial decisions, improve their financial well-being, and navigate the complexities of the financial world.

Social Stigma and Exclusion

Being locked out of the traditional banking system can lead to social stigma and exclusion for individuals. The stigma surrounding not having a bank account or limited access to financial services can have significant implications on various aspects of one’s life, including social interactions, employment opportunities, and access to essential services.

Having a bank account is considered a societal norm, and individuals without one may be viewed as financially vulnerable or lacking in financial responsibility. This can lead to social exclusion or judgments from others, which can be demoralizing and affect individuals’ sense of self-worth. The stigma can also lead to a lack of trust and may make it more challenging for individuals to establish relationships or seek assistance from others.

Employment opportunities can be limited for individuals without a bank account. Many employers prefer to facilitate payroll through direct deposit, and not having a bank account can be seen as a barrier to employment. This can further perpetuate the cycle of financial exclusion and limit individuals’ income-earning potential.

Access to essential services, such as housing or utilities, can also be impacted by not having a bank account. Landlords or utility providers may require bank account information for rental applications or setting up automatic bill payments. Without a bank account, individuals may face challenges in securing housing or may be subject to less desirable housing options.

Moreover, not having a bank account can limit access to financial services and resources that are vital for personal and professional growth. This includes access to credit, insurance, financial literacy programs, and entrepreneurial resources. The exclusion from these services and resources can further widen the economic disparities and hinder individuals’ ability to improve their financial circumstances.

Addressing the social stigma and exclusion faced by individuals locked out of the traditional banking system requires a multifaceted approach. Educating the public about the reasons behind financial exclusion, promoting empathy and understanding, and advocating for policies that support financial inclusion are crucial steps. Additionally, efforts should be made to dismantle barriers, such as identification requirements, that prevent individuals from accessing banking services and perpetuate the stigma.

By reducing the social stigma and fostering inclusive attitudes, we can create a more equitable society where everyone has the opportunity to access financial services and participate fully in the economy.

Conclusion

Being locked out of the traditional banking system presents numerous disadvantages and challenges for individuals. From limited access to financial services and higher transaction costs to the inability to establish credit and build wealth, the repercussions of financial exclusion are far-reaching.

Without access to essential banking services, individuals face difficulties in managing their finances, conducting everyday transactions, and planning for the future. Limited payment options, difficulty in receiving payments, and higher transaction costs become roadblocks that hinder financial stability and growth.

Moreover, the lack of a bank account or limited banking access makes it challenging to establish credit, hindering one’s ability to access loans and secure favorable insurance rates. The inability to build wealth and limited access to financial education and resources further contribute to the cycle of financial exclusion.

The social implications of being locked out of the banking system cannot be overlooked. There is a stigma associated with not having a bank account, leading to social exclusion and limited employment opportunities. Access to essential services may also be compromised due to the lack of a bank account, further exacerbating economic inequalities.

Addressing these disadvantages requires collective efforts from policymakers, financial institutions, and society as a whole. Promoting financial inclusion through accessible banking services, alternative credit-building options, and comprehensive financial education programs is crucial. By recognizing and challenging social stigmas, we can foster inclusive attitudes, reduce disparities, and provide individuals with the tools and resources they need to achieve financial security and well-being.

In conclusion, breaking the cycle of financial exclusion is essential for building a more equitable financial system. Empowering individuals by providing them with access to banking services, financial education, and resources can help bridge the gap and pave the way towards financial inclusion for all.