Finance

What Are The Disadvantages Of Online Banking

Published: November 2, 2023

Discover the drawbacks of online banking and its impact on finance. Explore the disadvantages and potential risks associated with managing your finances digitally.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

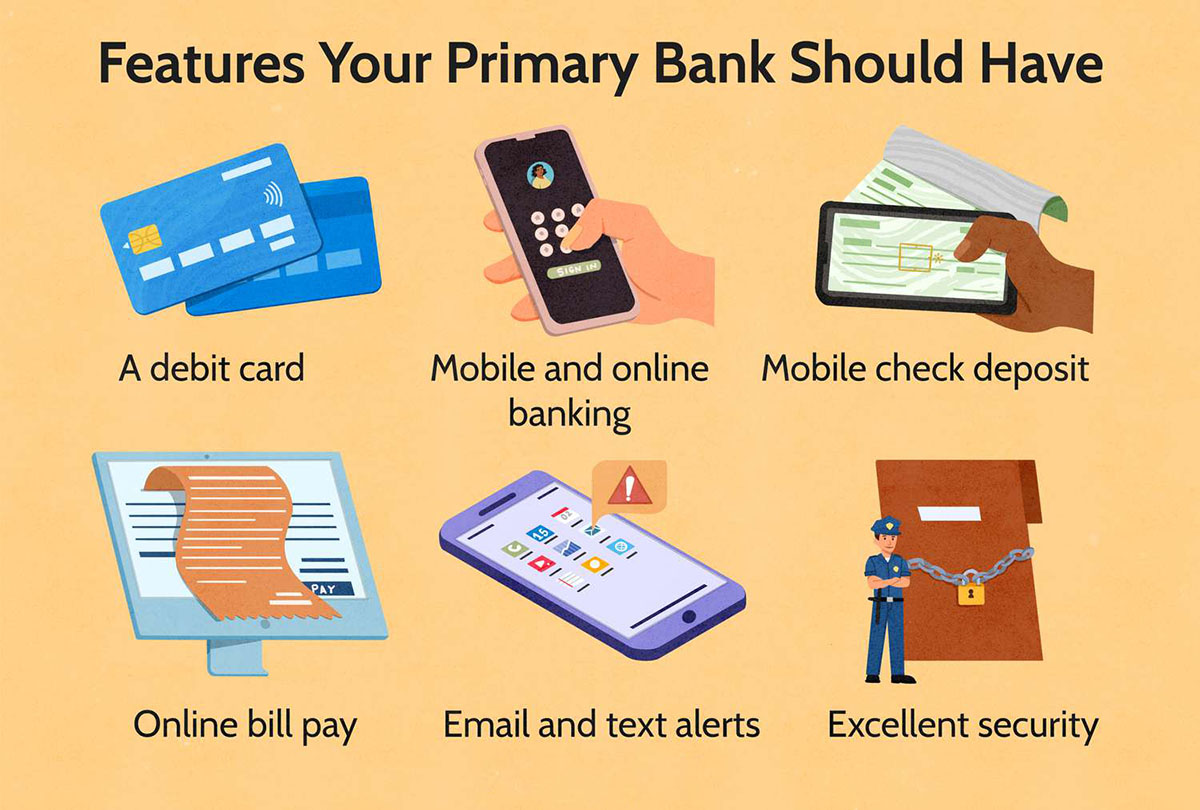

Online banking has revolutionized the way we manage our finances. With just a few clicks, we can check our account balance, transfer funds, pay bills, and even apply for loans. The convenience and ease of online banking have made it a popular choice for many individuals. However, like any other system, online banking also has its disadvantages. It is important to be aware of these drawbacks to make informed decisions about managing our finances.

While online banking offers numerous advantages, such as 24/7 accessibility and time-saving features, it is crucial to consider the potential downsides. This article will explore the disadvantages of online banking and shed light on the possible risks and challenges that users may face.

It is essential to note that these limitations and concerns vary depending on the specific online banking platform and the individual’s circumstances. It is advisable to research and choose a reputable online banking provider that offers robust security measures, user-friendly interfaces, and reliable customer support.

Let’s delve into the various disadvantages of online banking:

Lack of Physical Presence

One of the main disadvantages of online banking is the lack of physical presence. Unlike traditional banking methods, where you can visit a physical branch and interact with bank representatives face-to-face, online banking is conducted entirely through digital platforms. While this offers convenience and accessibility, it can also create a sense of detachment and limit assistance during complex transactions or issues.

Without physical branches, customers may find it challenging to seek immediate clarification or guidance about certain banking procedures or policies. While most online banking platforms provide customer support through call centers or online chat, the experience may not be as personalized or efficient as face-to-face interaction. Additionally, the absence of physical branches means that services like cash deposits, check cashing, or certified checks may be unavailable or limited.

Furthermore, for individuals who prefer the reassurance of physical documents or receipts, online banking may feel less tangible. While online transactions generate digital records, some people may feel more comfortable having physical copies of key documents or transaction confirmations.

Overall, the lack of physical presence in online banking can create a sense of detachment and limit access to in-person support and services. It is important for individuals to evaluate their banking needs and preferences to determine if the convenience of online banking outweighs the desire for physical presence and personal interactions.

Security Concerns

One of the primary concerns with online banking is the security of personal and financial information. As online banking involves the transmission of sensitive data over the internet, there is always a risk of unauthorized access and fraud. While banks implement various security measures to protect customer information, it is important for users to remain vigilant and take precautions to mitigate potential risks.

Phishing attacks are a common security threat in online banking. Cybercriminals may send fraudulent emails, pretending to be from a legitimate bank, in an attempt to deceive users into disclosing their login credentials or other personal information. These phishing emails often appear convincing, making it difficult for users to identify them as fraudulent. It is crucial to exercise caution and avoid clicking on suspicious links or downloading attachments from unknown sources.

Another significant concern is the possibility of malware and hacking. Malicious software can infect computers or mobile devices, allowing hackers to gain unauthorized access to banking credentials and sensitive data. Users should employ robust antivirus software, regularly update their devices, and avoid accessing online banking platforms on public or unsecured Wi-Fi networks.

While many banks employ multi-factor authentication and encryption techniques to protect user data, there is still a risk of data breaches and vulnerabilities in the system. Users should review their bank’s security policies, use strong and unique passwords, and enable additional security measures such as biometric authentication if available.

It is crucial to note that while online banking has security risks, traditional banking methods are not immune to fraud or security breaches either. The convenience and accessibility of online banking outweigh the risks for many individuals. Nevertheless, it is essential to stay informed about security best practices and take necessary precautions to protect personal and financial information.

Technical Issues

One of the drawbacks of online banking relates to the potential for technical issues. While online banking platforms strive to provide seamless user experiences, technical glitches and system failures can occur, disrupting access to accounts and transactions.

For example, intermittent internet connectivity or system maintenance can temporarily prevent users from accessing their accounts or conducting transactions. This can be frustrating, especially when urgent financial tasks need to be addressed. Additionally, software updates or compatibility issues with certain devices or operating systems may result in limited or inconsistent functionality.

Another technical concern is the possibility of system errors or incorrect transaction processing. While rare, there have been instances where online banking platforms have experienced glitches that resulted in inaccurate account balances or transaction histories. Such errors can cause confusion and require time-consuming efforts to rectify.

Furthermore, since online banking relies on digital platforms and technology, there is always a risk of cybersecurity breaches or system vulnerabilities. Hackers and cybercriminals are constantly evolving their techniques, and despite robust security measures, there is always a chance of unauthorized access or data breaches. It is imperative for online banking users to stay updated with security best practices and promptly report any suspicious activity.

While technical issues in online banking are relatively infrequent, they are crucial to consider. It is advisable to have alternative means of accessing accounts and obtaining financial information, such as keeping physical records or having a backup payment method available. Being aware of potential technical challenges and having contingency plans in place can help mitigate the impact of any disruptions and ensure a smoother online banking experience.

Dependency on Internet Connectivity

A significant disadvantage of online banking is the dependency on internet connectivity. Online banking services rely on a stable and reliable internet connection to access accounts, make transactions, and perform other financial activities. Consequently, any disruptions or limitations in internet connectivity can hinder the ability to utilize online banking services effectively.

In areas with poor or unreliable internet infrastructure, users may encounter difficulties accessing their accounts or face slow loading times. This can be particularly problematic when time-sensitive transactions need to be completed, such as bill payments or fund transfers. The reliance on internet connectivity also means that online banking services may be inaccessible during network outages or when there is no access to Wi-Fi.

Furthermore, while mobile banking offers convenience and flexibility, it is constrained by cellular network coverage. In areas with weak or limited cell reception, accessing online banking services on mobile devices may be challenging or even impossible. This can be a significant inconvenience for individuals who rely heavily on mobile banking for their financial management.

Moreover, dependency on internet connectivity exposes online banking users to potential security risks when accessing their accounts on public or unsecured Wi-Fi networks. These networks can be vulnerable to hackers or cybercriminals who may intercept sensitive data or launch attacks on unsuspecting users.

While internet connectivity has become more accessible and reliable over the years, there are still regions and situations where connection quality and availability are a concern. It is important for online banking users to consider alternative ways of accessing their accounts, such as offline banking apps or phone banking services, to alleviate the dependency on internet connectivity in case of emergencies or connectivity issues.

Ultimately, the reliance on internet connectivity in online banking can be a disadvantage for individuals in areas with limited access or unreliable internet infrastructure. It is crucial to evaluate one’s location and connectivity options before fully relying on online banking as the primary method of managing finances.

Limited Transaction Options

One of the limitations of online banking is the potential for limited transaction options compared to traditional banking methods. While online banking platforms offer a wide range of services, there are certain transactions that may not be available or may have limitations when conducted online.

One common limitation is the difficulty in depositing cash or checks through online banking. While some banks provide options for remote check deposit through mobile apps, the process may be subject to specific requirements, such as capturing clear images of the check and adhering to check endorsement guidelines. Depositing cash, on the other hand, often requires visiting a physical bank branch or using alternative methods such as depositing into a third-party service, which may have associated fees.

Additionally, certain banking transactions may require physical interaction or documentation. For example, opening a joint account, applying for a mortgage or loan, or notarizing documents may involve in-person visits or submission of physical paperwork. Online banking platforms typically provide alternative methods to complete these transactions, such as submitting digital documents, but this may vary depending on the bank’s policies and the specific requirements of the transaction.

Moreover, while online banking allows for electronic funds transfers and bill payments, there may be limitations on the amount and frequency of transactions. Banks often have maximum limits for transfers and bill payments to safeguard against fraudulent activities. This can be a potential drawback for individuals or businesses with higher transaction volumes or larger financial needs.

It is important to note that the extent of limited transaction options may vary among different banks and regions. Some banks may offer more comprehensive online banking services, while others may have certain transactions restricted to in-person visits. It is advisable to review the options and limitations of online banking services provided by the chosen bank to ensure they align with personal financial needs and expectations.

While online banking offers convenience and efficiency for many day-to-day transactions, users should be aware of the potential limitations they may encounter and consider alternative methods when needed, especially for transactions that cannot be easily completed online.

Lack of Personal Interaction

One drawback of online banking is the lack of personal interaction compared to traditional banking methods. Online banking transactions are often conducted through digital platforms, with limited or no face-to-face interaction with bank representatives.

For individuals who prefer the reassurance and personalized assistance of speaking to a bank teller or customer service representative, online banking may feel impersonal and detached. While most online banking platforms provide customer support through call centers or online chat, the experience may not be as immediate or tailored to individual needs.

In cases where complex banking transactions or financial advice is required, the absence of personal interaction can be a disadvantage. Online banking may not offer the same level of guidance or expertise that can be provided by a bank employee in a face-to-face setting. Customers may find it challenging to seek clarification, resolve issues, or receive personalized recommendations for their financial needs.

Furthermore, the lack of personal interaction can be a hindrance when attempting to resolve disputes or discrepancies in transactions. While online banking platforms usually have mechanisms to report and investigate errors or unauthorized activities, the process may involve lengthy correspondence and may not provide the same level of empathy or understanding that can be achieved through in-person interaction.

On the other hand, it is worth noting that online banking platforms often strive to provide efficient and reliable customer support, offering assistance through various channels, such as phone calls, live chat, or email. Many banks also provide extensive online resources and FAQs to address common inquiries and concerns.

Ultimately, the absence of personal interaction in online banking may be a disadvantage for individuals who value personalized assistance or prefer face-to-face communication. It is important for users to evaluate their own preferences and banking needs to determine if the convenience and accessibility of online banking outweigh the desire for in-person interactions and support.

Difficulty in Depositing Cash and Checks

One of the challenges of online banking is the difficulty in depositing cash and checks compared to traditional banking methods. While online banking platforms offer various convenient features, such as electronic funds transfers, there are limitations when it comes to depositing physical currency and checks.

Depositing cash through online banking can be a complicated process. Unlike traditional banking, where one can visit a bank branch and deposit cash directly into the account, online banking requires alternative methods. Some options may include depositing cash into a third-party service that is linked to the online banking account or utilizing a cash deposit machine if available. It is important to note that certain services or methods may have associated fees.

Similarly, depositing checks through online banking often requires the use of mobile banking apps that allow for remote check deposit. This involves capturing clear images of the front and back of the check using a smartphone or tablet. While this method offers convenience, it may be subject to specific guidelines and verification requirements to ensure the security and validity of the check. Additionally, some banks may place limits on the amount and frequency of check deposits through remote deposit capture.

In some cases, individuals may still need to visit a physical bank branch to deposit cash or checks. This can be inconvenient for those who prefer the ease and simplicity of conducting all banking activities online. It is important to consider the proximity and accessibility of bank branches when evaluating the suitability of online banking.

It’s worth noting that the availability and functionality of cash and check deposit options may vary depending on the specific online banking platform and the policies of the chosen bank. Some banks may offer more advanced technologies, such as cash deposit machines or expanded remote deposit capture services, while others may have more limited options.

Overall, the difficulty in depositing cash and checks through online banking may be a drawback for individuals who frequently handle physical currency or receive paper checks. It is advisable to consider alternative methods for depositing cash and checks, such as visiting a bank branch directly, using prepaid debit cards, or utilizing third-party payment services if online banking options prove to be limited.

Potential for Fraud and Identity Theft

One of the significant concerns with online banking is the potential for fraud and identity theft. While online banking platforms strive to implement robust security measures, cybercriminals are continually evolving their techniques to exploit vulnerabilities and gain unauthorized access to personal and financial information.

Phishing attacks are a common method used by fraudsters to trick individuals into revealing their login credentials or other sensitive information. These attacks often involve fraudulent emails or websites that mimic legitimate banking platforms, making it difficult for users to differentiate between genuine and fake communications. It is crucial for users to exercise caution and be vigilant about clicking on suspicious links or providing personal information in response to unsolicited requests.

Furthermore, online banking can be susceptible to malware and hacking. Malicious software can infiltrate devices and compromise the security of online banking transactions, exposing sensitive data to criminals. Users should implement robust antivirus software, regularly update their devices, and refrain from accessing online banking platforms on public or unsecured Wi-Fi networks to minimize the risk of malware and hacking incidents.

Another potential risk is the unauthorized access to online banking accounts. Weak passwords, using the same login credentials across multiple platforms, or falling victim to phishing attacks can all allow fraudsters to gain unauthorized access to personal banking information. It is crucial to create strong, unique passwords and enable additional security measures, such as multi-factor authentication, whenever possible.

Identity theft is another concern associated with online banking. If personal information, such as social security numbers, addresses, or account details, falls into the wrong hands, it can be used to commit identity theft, leading to financial loss and potential damage to credit scores. Users should refrain from sharing sensitive information online unless it is necessary and always be cautious about the information they provide on social media or other online platforms.

While online banking platforms have implemented various security protocols, it is impossible to completely eliminate the risk of fraud and identity theft. It is crucial for users to stay informed about the latest security threats and practices, regularly monitor their online banking activities, and promptly report any suspicious transactions or unauthorized access to their bank.

Overall, the potential for fraud and identity theft is a legitimate concern with online banking. However, with vigilance, awareness, and proactive measures, individuals can mitigate these risks and enjoy the convenience and benefits of online banking in a safe and secure manner.

Availability and Accessibility Issues

While online banking offers convenience, there can be limitations in terms of availability and accessibility, which can pose challenges for some individuals. These issues can be attributed to various factors, including technological constraints, infrastructure limitations, and individual circumstances.

One of the key concerns is the accessibility of online banking services in certain regions or areas with inadequate internet connectivity. In rural or remote locations, the availability and reliability of internet services may be limited, making it difficult for individuals to access their online banking accounts or perform transactions. This lack of access can restrict individuals’ ability to manage their finances efficiently and may require them to rely on traditional banking methods.

Furthermore, not all individuals have access to the necessary technology to engage in online banking. While smartphones and computers are becoming increasingly prevalent, there are still socioeconomic disparities that hinder certain individuals from owning or utilizing these devices. This can lead to unequal access to online banking services, particularly for marginalized communities or individuals with limited financial resources.

Another aspect of accessibility relates to individuals with disabilities. Online banking platforms may not always be fully accessible for individuals with vision impairments, hearing impairments, or other disabilities that may affect their ability to navigate digital interfaces. Banks should strive to ensure that their websites and applications comply with accessibility guidelines to accommodate individuals with disabilities and provide an inclusive banking experience.

Availability can also be a concern during system maintenance or unexpected outages. Online banking platforms require regular updates, which may result in temporary unavailability of certain services. Additionally, technical issues, cyber attacks, or natural disasters can disrupt the accessibility of online banking platforms, causing inconvenience and hindrance to individuals who rely on these services for their financial management.

It is important for individuals to assess their own circumstances and consider the availability and accessibility of online banking services before fully relying on them as their primary banking method. It may be necessary to have alternative means of accessing finances, such as physical branches or phone banking services, for situations when online banking services are unavailable or inaccessible.

While online banking offers numerous benefits, it is essential to address the challenges related to availability and accessibility. Banks and financial institutions should work towards improving internet infrastructure, ensuring equal access to technology, and enhancing the accessibility of online banking platforms to create a more inclusive and seamless banking experience for all individuals.

Conclusion

Online banking has revolutionized the way we manage our finances, offering convenience, accessibility, and time-saving features. However, it is important to consider the disadvantages that come with this modern banking method. Understanding the limitations and risks associated with online banking enables individuals to make informed decisions about their financial management.

From the lack of physical presence and personal interaction to the potential for fraud and identity theft, online banking presents challenges that may not be encountered with traditional banking methods. Difficulties in depositing cash and checks, as well as the dependency on internet connectivity, can also have an impact on individuals’ banking experiences and choices.

While these drawbacks exist, it is important to remember that online banking offers numerous advantages and has become an integral part of our financial lives. The convenience, accessibility, and efficiency it provides outweigh many of the disadvantages for the majority of users. Banks continuously enhance their security measures and strive to improve the user experience, ensuring that online banking remains a safe and reliable option for individuals around the world.

As technology continues to advance, it is crucial for individuals to stay informed about the best practices, security measures, and updates related to online banking. By adopting secure habits, being aware of potential risks, and utilizing the available tools and resources provided by banks, individuals can enjoy the benefits of online banking while minimizing the associated downsides.

Ultimately, the decision to embrace online banking should be based on personal preferences, banking needs, and the level of comfort with digital platforms. It is advisable to do thorough research, choose a reputable online banking provider, and regularly assess and update security measures to ensure a safe and reliable online banking experience.

Online banking is undoubtedly shaping the future of financial management, and by understanding its advantages and disadvantages, we can make the most informed decisions about our personal finances.