Home>Finance>What Are Some Features Of The OTC Market For Bonds

Finance

What Are Some Features Of The OTC Market For Bonds

Published: October 14, 2023

Learn about the key features of the OTC market for bonds, including its importance in finance and how it differs from traditional exchange trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of the OTC Market for Bonds

- Why Invest in the OTC Market for Bonds?

- Features of the OTC Market for Bonds

- Centralized Trading

- Flexibility in Trading

- Wide Range of Bonds Available

- Lower Costs and Fees

- Less Stringent Regulations

- Market Transparency and Liquidity

- Customization of Bond Terms

- Access to a Diverse Investor Base

- Conclusion

Introduction

Welcome to the world of finance, where various markets and investment opportunities exist for individuals and institutions alike. One such market that plays a significant role in the bond market is the Over-the-Counter (OTC) market for bonds. In this article, we will explore the features and benefits of investing in the OTC market for bonds.

The OTC market for bonds is an important segment of the overall bond market, providing investors with opportunities to trade bonds that are not listed on formal exchanges. Unlike the more well-known exchange-traded bonds, which are traded on organized exchanges like the New York Stock Exchange or NASDAQ, OTC bonds are traded directly between two parties without the need for an intermediary.

Investing in the OTC market for bonds offers a range of advantages and features that can enhance portfolio diversification and potentially generate attractive returns. This market segment provides investors with flexibility, a wide range of bond offerings, lower costs and fees, and access to a diverse investor base.

Throughout this article, we will delve into the various features of the OTC market for bonds, highlighting the advantages that make it an appealing option for both individual and institutional investors. So, let’s dive in and explore the world of OTC bonds and the unique opportunities they present.

Definition of the OTC Market for Bonds

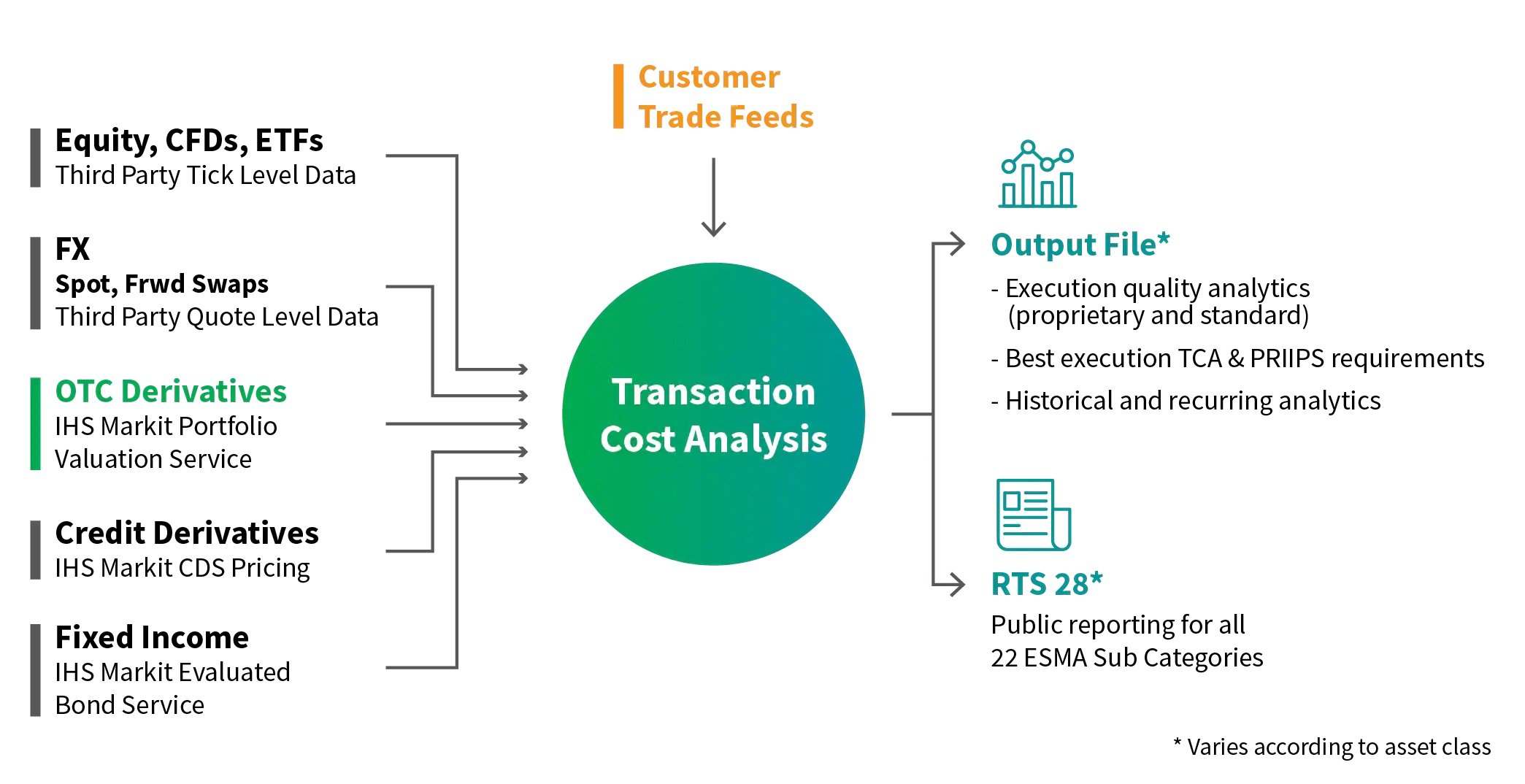

The Over-the-Counter (OTC) market for bonds is a decentralized market where individuals and institutions can trade bonds directly with each other, without the need for a centralized exchange. Unlike exchange-traded bonds, which are listed on formal exchanges and traded through intermediaries, OTC bonds are traded bilaterally, meaning that buyers and sellers negotiate and execute trades directly with each other.

OTC bonds include a wide range of debt securities, such as corporate bonds, government bonds, municipal bonds, and mortgage-backed securities. These bonds are typically issued by companies, governments, and other entities to raise capital. Investors can participate in the OTC market for bonds to buy or sell these debt securities, either as individual instruments or in larger bond portfolios.

One key characteristic of the OTC market for bonds is its decentralization. While exchange-traded bonds are traded on organized exchanges with standardized rules and procedures, the OTC market operates through a network of dealers and brokers. These intermediaries facilitate trades by matching buyers and sellers, providing price quotes, and offering liquidity.

Unlike exchange-traded bonds, which are subject to strict listing requirements and regulations, OTC bonds are not bound by the same level of regulatory oversight. This allows for greater flexibility in trading, as well as a wider variety of bond offerings. However, it is important to note that OTC bonds do still adhere to legal and regulatory requirements, such as disclosure and reporting obligations.

The OTC market for bonds operates 24 hours a day, five days a week, allowing investors to trade bonds at any time, regardless of exchange hours. This flexibility is particularly beneficial for global investors who may be in different time zones or have specific trading needs.

Overall, the OTC market for bonds provides a platform for investors to trade debt securities directly, offering flexibility, a wide range of bond offerings, and accessibility outside of traditional exchange hours. Now that we have a clear understanding of what the OTC market for bonds entails, let us explore the various advantages it offers to investors.

Why Invest in the OTC Market for Bonds?

The OTC market for bonds offers several compelling reasons for investors to consider allocating a portion of their portfolio to this market segment. Let’s explore some of the key reasons why you should consider investing in the OTC market for bonds:

- Diversification: Investing in the OTC market for bonds enables diversification beyond traditional exchange-traded bonds. By having exposure to a broader range of bond offerings, investors can reduce the risk associated with holding a concentrated portfolio of bonds.

- Access to Unique Bonds: OTC bonds often include unique and specialized debt securities that may not be available on organized exchanges. This provides investors with the opportunity to invest in bonds that align with their specific investment objectives and risk appetite.

- Customized Investment Strategies: The OTC market for bonds allows for greater flexibility in structuring and customizing bond portfolios. Investors can work directly with counterparties to negotiate and tailor terms such as maturity, coupon payments, and redemption features to meet their specific investment needs.

- Lower Costs and Fees: Trading in the OTC market for bonds can often result in lower transaction costs and fees compared to exchange-traded bonds. Since trades are executed directly between buyers and sellers, there is no need to pay fees to intermediaries or exchanges.

- Access to Yield Enhancement Strategies: The OTC market for bonds provides investors with the opportunity to implement yield enhancement strategies, such as yield curve positioning, credit spread trades, and interest rate swaps. These strategies can potentially generate higher returns by taking advantage of market inefficiencies and price differentials.

By investing in the OTC market for bonds, investors can benefit from diversification, access to unique bond offerings, customized investment strategies, lower costs and fees, and the potential to enhance yields. However, it is important to note that investing in the OTC market for bonds also carries its own set of risks. Investors should carefully evaluate the creditworthiness of issuers, analyze market conditions, and consider working with a knowledgeable financial advisor to navigate this market segment.

Features of the OTC Market for Bonds

The OTC market for bonds offers several distinctive features that differentiate it from the exchange-traded bond market. These features contribute to the unique appeal and benefits of investing in OTC bonds. Let’s explore some of these features:

- Centralized Trading: Unlike exchange-traded bonds, which are traded on formal exchanges, the OTC market for bonds is decentralized. Trades are conducted directly between buyers and sellers, either bilaterally or with the assistance of intermediaries such as dealers or brokers.

- Flexibility in Trading: The OTC market for bonds provides flexibility in terms of trade execution, allowing investors to negotiate and tailor the terms of a bond contract to meet their specific needs. Investors can work directly with counterparties to determine the bond’s maturity, coupon payments, and other features.

- Wide Range of Bonds Available: The OTC market for bonds offers a vast selection of bond offerings, including corporate bonds, government bonds, municipal bonds, and mortgage-backed securities. This variety allows investors to diversify their portfolios and find bonds that align with their risk tolerance and investment objectives.

- Lower Costs and Fees: Trading in the OTC market for bonds can result in lower transaction costs compared to exchange-traded bonds. Since trades are conducted directly between buyers and sellers, there is no need to pay fees to intermediaries or exchanges, resulting in potential cost savings for investors.

- Less Stringent Regulations: While OTC bonds are subject to legal and regulatory requirements, they generally have less stringent regulations compared to their exchange-traded counterparts. This flexibility allows for greater innovation and a broader range of bond offerings in the OTC market.

- Market Transparency and Liquidity: The OTC market for bonds provides transparency through the availability of price quotes and transaction information. While not as transparent as exchange-traded bonds, investors can still access market data and trade with confidence. Additionally, liquidity in the OTC market can be provided by dealers and brokers, ensuring that investors can buy or sell bonds efficiently.

- Customization of Bond Terms: With OTC bonds, investors have the opportunity to customize the terms of the bond contract. This includes negotiating the maturity, coupon rate, and other key features to align with their investment strategy and risk profile.

- Access to a Diverse Investor Base: The OTC market for bonds attracts a diverse investor base, including individual investors, institutional investors, and foreign investors. This broad participation provides liquidity and enhances the overall trading experience in the market.

The features of the OTC market for bonds, such as centralized trading, flexibility, a wide range of bond offerings, lower costs and fees, less stringent regulations, market transparency and liquidity, customization of bond terms, and access to a diverse investor base, contribute to its distinctive appeal and benefits. These features provide investors with unique opportunities to diversify their portfolios, customize their investment strategies, and potentially enhance their returns.

Centralized Trading

Centralized trading is a key feature of the Over-the-Counter (OTC) market for bonds. Unlike exchange-traded bonds that are traded on organized exchanges, OTC bonds are traded in a decentralized manner. This means that trades take place directly between buyers and sellers, either bilaterally or with the assistance of dealers or brokers.

In a centralized trading system, such as an exchange, all trades are routed through a central marketplace where buyers and sellers are matched through predetermined rules. This centralized structure provides transparency, standardization, and a regulated environment for trading. However, the OTC market for bonds operates differently.

In the OTC market, the lack of a central exchange means that trades can be executed more directly and efficiently. Buyers and sellers can negotiate the terms of the trade, such as price and quantity, with the counterparty. This flexibility allows for customization of the trade to meet the specific needs of the participants.

Furthermore, the decentralized nature of the OTC market for bonds means that it is not bound by the strict listing requirements and regulations of formal exchanges. This enables the market to offer a wider range of bond offerings, including unique and specialized debt securities that may not be available on organized exchanges.

An important aspect of centralized trading in the OTC market for bonds is the role of dealers and brokers. These intermediaries act as facilitators, connecting buyers and sellers and providing liquidity to the market. Dealers may hold an inventory of bonds, buying from sellers and selling to potential buyers. Brokers, on the other hand, help match buyers and sellers without taking possession of the bonds themselves.

Centralized trading in the OTC market for bonds allows for direct and customizable transactions between market participants. It provides flexibility, efficiency, and access to a wide range of bonds. However, it is important to note that while the OTC market offers advantages through decentralized trading, it also requires participants to conduct thorough due diligence on counterparties and carefully assess the creditworthiness and reliability of the bonds being traded.

Flexibility in Trading

The Over-the-Counter (OTC) market for bonds offers investors a high degree of flexibility in trading compared to the more regulated and standardized exchange-traded bond market. This flexibility is one of the primary attractions for investors looking to customize their investment strategies and meet their specific needs.

In the OTC market for bonds, investors have the ability to negotiate and tailor the terms of a bond contract directly with counterparties. This means they can determine key features such as the maturity date, coupon payments, and redemption features to align with their investment objectives and risk appetite. This customization allows investors to structure their bond portfolios according to their specific preferences and market views.

Moreover, the flexibility in trading extends to the ability to execute trades outside of traditional exchange hours. Unlike exchange-traded bonds that operate with specific trading hours, the OTC market for bonds is open 24 hours a day, five days a week. This global availability enables investors across different time zones to trade bonds at their convenience, ensuring access to liquidity when opportunities arise.

Additionally, the OTC market for bonds provides investors with the flexibility to execute large transactions. Since trades are conducted directly between buyers and sellers, without the need for intermediaries, investors have the potential to negotiate favorable prices and terms for large bond purchases or sales. This can be particularly advantageous for institutional investors or those seeking to execute complex investment strategies.

Furthermore, the OTC market for bonds allows for flexibility in trading structures, such as executing block trades or providing anonymity in transactions. Block trades involve the buying or selling of a large quantity of bonds in a single transaction, which can be more efficiently executed in the OTC market due to the direct negotiations between parties. Anonymity in trading provides privacy for investors who prefer to keep their identities confidential, which is particularly beneficial for large or sensitive transactions.

Overall, the flexibility in trading offered by the OTC market for bonds empowers investors to tailor their investment strategies, execute trades at their convenience, negotiate favorable terms for large transactions, and choose from various trading structures. However, it is important for investors to conduct thorough research, due diligence, and risk assessment when engaging in flexible trading in the OTC market for bonds.

Wide Range of Bonds Available

The Over-the-Counter (OTC) market for bonds offers investors a wide range of bond offerings, providing access to a diverse universe of debt securities. This diverse selection includes corporate bonds, government bonds, municipal bonds, mortgage-backed securities, and more. The availability of such a wide range of bonds is a significant advantage and appeals to investors seeking portfolio diversification and the ability to find bonds that align with their specific investment objectives.

One of the key benefits of the OTC market for bonds is the inclusion of unique and specialized debt securities that may not be available on organized exchanges. These bonds may be issued by companies, governments, or other entities, offering investors the opportunity to invest in sectors or industries that may be underserved or less accessible in the exchange-traded bond market. This allows investors to customize their portfolios and potentially capitalize on niche opportunities.

Furthermore, the OTC market for bonds enables investors to access bonds issued by smaller or emerging market entities. These issuers may not meet the strict listing requirements of traditional exchanges, but they still offer attractive investment opportunities. Investing in bonds from these issuers can provide diversification benefits and potentially higher yields, while also supporting economic development in these regions.

Moreover, the OTC market for bonds allows investors to explore bonds with varying credit ratings and risk profiles. This means that investors can choose from investment-grade bonds, which generally have lower credit risk, or high-yield bonds, which offer potentially higher yields but come with a higher level of credit risk. The wide range of bond offerings caters to investors with different risk appetites and investment strategies.

Another advantage of the OTC market for bonds is the availability of customized structured products. These products may include convertible bonds, which can be converted into the issuer’s stock, or callable bonds, which can be redeemed by the issuer before maturity. Such products offer investors additional investment choices and the potential for enhanced returns based on their outlook for the underlying stock or interest rate movements.

Overall, the wide range of bonds available in the OTC market provides investors with the flexibility to diversify their portfolios, access unique and specialized debt securities, invest in emerging market issuers, choose from varying credit ratings, and explore customized structured products. This breadth of offerings allows investors to construct portfolios that align with their risk profiles, investment goals, and market outlooks.

Lower Costs and Fees

The Over-the-Counter (OTC) market for bonds offers investors the advantage of lower costs and fees compared to exchange-traded bond markets. This can result in cost savings and improved net returns for investors. Let’s explore the reasons why the OTC market for bonds tends to have lower costs and fees:

Direct Trading: In the OTC market, trades are executed directly between buyers and sellers. This eliminates the need for intermediaries, such as brokers or market makers, who typically charge fees for executing trades on organized exchanges. By bypassing these intermediaries, investors can avoid paying their associated fees.

No Exchange Listing Fees: Exchange-traded bonds have to meet listing requirements, which often include paying listing fees. These fees are incurred by issuers who list their bonds on regulated exchanges. However, OTC bonds are not subjected to the same listing requirements and associated fees, making them a cost-effective option for issuers and, by extension, investors.

Negotiated Pricing: In the OTC market, buyers and sellers negotiate the price directly. This allows for price discovery based on market conditions and the specific characteristics of the bond being traded. The absence of standardized exchange-traded prices and bid-ask spreads can lead to potential cost savings for investors, particularly on large or complex bond transactions.

Lower Clearing and Settlement Costs: Clearing and settlement costs associated with OTC bond transactions are typically lower compared to exchange-traded bonds. Clearing and settlement processes in the OTC market are often streamlined and less complex, resulting in reduced operational costs. This can translate into lower transaction costs for investors.

Reduced Regulatory Costs: While OTC bonds are subject to legal and regulatory requirements, they generally have less stringent regulations compared to their exchange-traded counterparts. This reduced regulatory burden can result in lower compliance costs for issuers and, subsequently, lower costs for investors.

While the OTC market for bonds offers cost savings in terms of lower costs and fees compared to exchange-traded bonds, it is important to note that conducting thorough due diligence and carefully assessing the creditworthiness and reliability of the bonds is crucial. Investors should also consider transaction costs, such as bid-ask spreads and any markup charges imposed by dealers, in their evaluation of the overall cost-effectiveness of OTC bond trading.

Overall, lower costs and fees in the OTC market for bonds can contribute to improved net returns for investors. The absence of intermediary fees, reduced exchange listing fees, negotiation of pricing, lower clearing and settlement costs, and potentially lower regulatory costs make the OTC market an attractive option for investors looking to minimize expenses and enhance their investment outcomes.

Less Stringent Regulations

The Over-the-Counter (OTC) market for bonds offers investors the advantage of less stringent regulations compared to the exchange-traded bond market. This regulatory flexibility provides certain benefits and opportunities for investors. Let’s explore why the OTC market for bonds often operates with less stringent regulations:

Customization and Innovation: The OTC market allows for greater flexibility in the structuring and customization of bond contracts. Investors have the freedom to negotiate the terms of the bond directly with their counterparties, including setting the maturity date, coupon payments, and other features. This customization and innovation are possible because OTC bonds are not bound by the strict listing requirements and standardized regulations of organized exchanges.

Access to Unique Bond Offerings: The OTC market for bonds includes a diverse range of debt securities issued by various entities, including corporations, governments, and municipalities. These bonds may have unique features, such as convertible bonds or bonds with specialized payment structures. The less stringent regulations of the OTC market allow for the inclusion of these unique bond offerings that may not meet the strict criteria required for listing on exchanges.

Smaller Issuers and Emerging Markets: The OTC market accommodates bonds issued by smaller or emerging market entities that may not meet the requirements for listing on organized exchanges. These issuers often have limited resources or are in the early stages of development, making it difficult for them to comply with the regulatory obligations of larger exchanges. By providing a platform with less stringent regulations, the OTC market facilitates access to capital for these issuers, allowing investors to participate in potential growth opportunities from emerging markets.

Reduced Reporting and Disclosure Requirements: While OTC bonds are subject to legal and regulatory requirements, they generally have less extensive reporting and disclosure obligations compared to exchange-traded bonds. This reduces the administrative burden on issuers and may result in cost savings. However, it’s important to note that investors should still carefully evaluate the creditworthiness of issuers and conduct thorough due diligence to mitigate risks.

It is crucial to understand that while the OTC market for bonds operates with less stringent regulations, investors should still exercise caution and conduct thorough research before investing. The reduced regulatory oversight in the OTC market necessitates the need for investors to perform their due diligence on issuers and assess the creditworthiness and reliability of the bonds being traded.

In summary, the less stringent regulations of the OTC market for bonds offer flexibility in customization, access to unique bond offerings, opportunities in emerging markets, and potentially reduced reporting and disclosure requirements. These characteristics make the OTC market an attractive option for investors seeking more innovative and diverse investment opportunities beyond the confines of traditional exchange-traded bonds.

Market Transparency and Liquidity

The Over-the-Counter (OTC) market for bonds provides a level of market transparency and liquidity that enables investors to buy and sell bonds efficiently. While the OTC market may not offer the same level of transparency as organized exchanges, it still provides key advantages in terms of accessibility and liquidity. Let’s explore the market transparency and liquidity of the OTC market for bonds:

Price Quotes and Transparency: In the OTC market, investors can access price quotes and transaction information, allowing them to gauge the current market conditions and make informed trading decisions. While price quotes may not be as readily available or as transparent as in exchange-traded markets, the OTC market still provides essential data to investors to help assess bond valuations and market sentiment.

Intermediaries: Dealers and brokers play an important role in the OTC market by providing liquidity and facilitating trades between buyers and sellers. These intermediaries offer market expertise, price discovery, and access to a network of potential counterparties, enhancing market transparency and liquidity. Their presence ensures that investors can trade bonds efficiently, especially for less frequently traded or illiquid bonds.

Liquidity: The OTC market for bonds offers liquidity through the participation of dealers and brokers. These market participants actively buy and sell bonds, providing an ongoing market for investors to transact. While liquidity may vary depending on market conditions and the specific bond being traded, the OTC market generally provides sufficient liquidity to facilitate trading activity.

Flexibility in Pricing: The OTC market allows for flexibility in pricing because trades are negotiated directly between buyers and sellers. This flexibility can enable investors to potentially obtain better pricing, especially in larger or complex bond transactions. However, it’s important for investors to conduct thorough due diligence on pricing and consider factors such as bid-ask spreads and potential markup charges imposed by dealers.

Access to Market Data: Although the OTC market may not provide as extensive public reporting requirements as organized exchanges, investors can still access market data through various sources. Financial news platforms, trading platforms, and industry publications provide valuable insights and information about the OTC market, helping investors stay informed and make informed trading decisions.

While the OTC market for bonds offers a level of market transparency and liquidity, it’s important for investors to understand that the OTC market may have less transparency compared to organized exchanges. It requires investors to conduct their due diligence and carefully assess the creditworthiness and reliability of the bonds they wish to trade.

Overall, the transparency provided by price quotes, the role of intermediaries, the presence of liquidity, pricing flexibility, and the availability of market data contribute to the market transparency and liquidity of the OTC market for bonds. These attributes enhance investors’ ability to buy and sell bonds efficiently, contributing to the overall attractiveness of the OTC market as a trading venue for bonds.

Customization of Bond Terms

The Over-the-Counter (OTC) market for bonds provides investors with the ability to customize the terms of bond contracts to meet their specific investment objectives and preferences. This flexibility in customizing bond terms is a significant advantage of the OTC market, allowing investors to tailor their investments to suit their unique needs. Let’s explore the customization of bond terms in more detail:

Maturity Dates: In the OTC market, investors have the flexibility to negotiate the maturity dates of bonds directly with counterparties. This means that investors can choose bonds with shorter or longer maturities, depending on their investment horizon and objectives. Customizing the maturity dates of bonds offers investors greater control over the timing of their investment returns and aligns with their specific investment strategies.

Coupon Payments: Coupon payments, also known as interest payments, can be customized in the OTC market for bonds. Investors have the freedom to negotiate the coupon rate, payment frequency, and payment dates to suit their income needs and preferences. This customization allows investors to optimize their bond portfolios based on their desired cash flow requirements.

Redemption Features: The OTC market allows for customization of redemption features, such as the ability to call or redeem bonds before their maturity date. Investors can negotiate bond contracts that include call options, enabling the issuer to redeem the bonds early under certain conditions, or put options, granting the investor the right to sell the bonds back to the issuer. These redemption features provide investors with additional flexibility and potential profit opportunities.

Convertible Bonds: The OTC market often includes convertible bonds, which offer investors the option to convert their bonds into a specified number of the issuer’s common stock. This feature allows investors to participate in any potential upside of the issuer’s equity. The customization of convertible bonds gives investors the flexibility to choose between fixed income and equity exposure based on their market outlook and risk appetite.

Structured Products: The OTC market offers a variety of structured products, which combine elements of both debt and derivatives. These customized products provide investors with unique investment opportunities and potential returns associated with specific market scenarios. Examples include structured notes or collateralized debt obligations (CDOs), which can be tailored to meet investors’ risk-return preferences and investment objectives.

With the ability to customize bond terms in the OTC market, investors can construct bond portfolios that align with their investment strategies, risk profiles, and income needs. This flexibility ensures that investors have control over important aspects of their bond investments, enabling them to optimize their portfolios according to changing market conditions and their personal preferences.

It’s important to note that while customization offers advantages, investors should carefully evaluate the creditworthiness of issuers and conduct thorough due diligence before entering into customized bond contracts. Understanding the risks associated with customized bond terms is crucial to make informed investment decisions in the OTC market.

In summary, the customization of bond terms in the OTC market provides investors with the flexibility to tailor the maturity dates, coupon payments, redemption features, and other terms of their bond contracts. This customization allows investors to align their bond investments with their specific investment objectives, risk profiles, and income needs, enhancing the appeal and benefits of the OTC market for bonds.

Access to a Diverse Investor Base

The Over-the-Counter (OTC) market for bonds provides investors with access to a diverse investor base, creating opportunities for liquidity, price discovery, and expanding the potential for bond transactions. This broad participation enhances the overall trading experience and offers numerous advantages to investors. Let’s explore the significance of accessing a diverse investor base in the OTC market:

Liquidity: The diverse investor base in the OTC market contributes to increased liquidity. With a larger pool of buyers and sellers, there is a higher likelihood of finding counterparties for bond transactions. This liquidity makes it easier for investors to buy or sell bonds efficiently, especially for less frequently traded or illiquid bonds.

Price Discovery: The presence of a diverse investor base introduces a range of opinions and perspectives, promoting accurate price discovery. With multiple participants bringing different information, insights, and trading strategies, the OTC market benefits from a robust marketplace that reflects a broader consensus on bond valuations. This transparency aids investors in making informed investment decisions.

Efficient Market Conditions: The OTC market benefits from the participation of various types of investors, including individual investors, institutional investors, and foreign investors. This mix of participants creates vibrant market conditions and fosters healthy competition. The involvement of different types of investors often leads to efficient pricing, as each participant brings their own investment preferences, risk appetite, and trading objectives to the market.

Access to Diverse Perspectives:

A diverse investor base brings a variety of perspectives and investment strategies. Individual investors often focus on personal wealth management and long-term investment goals. Institutional investors, such as pension funds, insurance companies, or hedge funds, have specific investment mandates and risk management objectives. Foreign investors may bring regional expertise, global market insights, and diversification benefits to the OTC market. The presence of diverse perspectives enriches the trading environment, promoting idea sharing and fostering new investment opportunities.

Broad Investment Opportunities: With access to a diverse investor base, investors in the OTC market can take advantage of a wide range of investment opportunities. Investors can find potential buyers or sellers for different types of bonds, ranging from corporate bonds to government bonds and municipal bonds. This broad investment landscape allows investors to create portfolios tailored to their risk profiles and investment preferences.

By participating in the OTC market, investors benefit from the vibrant and diverse investor base. The presence of numerous buyers and sellers enhances liquidity, promotes price discovery, creates efficient market conditions, and provides access to a broad range of investment opportunities. Investors can leverage this diversity to execute trades efficiently, obtain fair prices, and connect with counterparties with differing perspectives and investment strategies.

It is important to note that while a diverse investor base offers many advantages, investors should always conduct thorough due diligence and assess the creditworthiness and reliability of prospective counterparties in the OTC market.

In summary, accessing a diverse investor base in the OTC market for bonds offers increased liquidity, fosters accurate price discovery, promotes efficient market conditions, provides access to diverse perspectives, and expands the range of investment opportunities. This broad participation contributes to a robust and dynamic marketplace that enhances the trading experience and benefits investors in the OTC market.

Conclusion

The Over-the-Counter (OTC) market for bonds offers a unique and appealing opportunity for investors looking to diversify their bond portfolios and customize their investment strategies. Throughout this article, we have explored the various features and advantages of investing in the OTC market for bonds.

The OTC market provides investors with flexibility in trading, allowing for the negotiation and customization of bond terms to align with specific investment objectives. The wide range of bond offerings in the OTC market offers investors access to unique and specialized debt securities that may not be available on organized exchanges. Additionally, investing in the OTC market for bonds often comes with lower costs and fees compared to exchange-traded bonds, leading to potential cost savings and improved net returns.

The OTC market for bonds operates with less stringent regulations, offering investors the ability to customize their investments and access a diverse range of issuers, including smaller entities and emerging markets. The market also provides a level of transparency and liquidity through price quotes, intermediaries, and access to market data, facilitating efficient trading.

Furthermore, the presence of a diverse investor base in the OTC market enhances liquidity, ensures efficient pricing and price discovery, and offers access to a broad range of investment perspectives and opportunities. This diverse participation creates a dynamic and competitive marketplace.

As with any investment, it is crucial for investors to conduct thorough research, assess the creditworthiness of issuers, and carefully evaluate the risks associated with investing in the OTC market for bonds. Working with a knowledgeable financial advisor or broker can provide valuable guidance in navigating this market segment.

In conclusion, the OTC market for bonds provides investors with an alternative avenue for bond investments, offering flexible trading, a wide range of bond offerings, lower costs and fees, less stringent regulations, market transparency, liquidity, customization of bond terms, and access to a diverse investor base. By understanding and leveraging the features and advantages of the OTC market for bonds, investors can build diversified portfolios and potentially enhance their returns in the world of fixed income investments.