Finance

What Are OTC Derivatives

Published: October 5, 2023

Discover the basics of OTC derivatives in finance and understand how they are used in the market. Learn about their benefits and risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of OTC derivatives! In the vast realm of finance, where various instruments and products facilitate trading and risk management, OTC derivatives hold a significant position. These instruments play a crucial role in enabling parties to hedge risks, speculate on price movements, and manage financial exposures.

OTC, which stands for Over-the-Counter, refers to trading conducted directly between two parties without the involvement of a centralized exchange. This distinct characteristic sets OTC derivatives apart from exchange-traded derivatives, such as futures and options, which are traded on regulated platforms.

OTC derivatives cover a wide range of financial instruments, including swaps, forwards, and options. These contracts are tailor-made agreements that derive their value from underlying assets such as equities, bonds, commodities, or interest rates.

In the context of OTC derivatives, it is essential to understand the notion of derivatives themselves. Derivatives, as the name suggests, derive their value from an underlying asset or reference rate. They are financial contracts that provide investors with exposure to price movements or fluctuations in the value of the underlying asset, without the need to own the asset outright.

The primary purpose of OTC derivatives is to manage financial risk. These instruments allow for customization and flexibility, as market participants can design contracts that suit their specific needs. Whether it’s managing interest rate risks, currency fluctuations, or commodity price exposures, OTC derivatives provide companies and investors with tools to mitigate potential losses.

OTC derivatives are traded by a wide range of market participants, including banks, insurance companies, corporations, and hedge funds. The notional value of OTC derivatives transactions runs into trillions of dollars, making it a vital component of the global financial system.

Throughout this article, we will delve into the various aspects of OTC derivatives, including their types, features, benefits, risks, and regulatory framework. By gaining a comprehensive understanding of OTC derivatives, you will be able to navigate the complex world of derivatives markets and its implications for the wider financial landscape.

Definition of OTC Derivatives

OTC derivatives, or Over-the-Counter derivatives, refer to financial contracts that are traded directly between two parties without the involvement of a centralized exchange. These derivatives derive their value from an underlying asset or reference rate and are customized agreements that cater to the specific needs of the parties involved.

Unlike exchange-traded derivatives, such as futures and options, which are standardized contracts traded on regulated platforms, OTC derivatives offer greater flexibility in terms of contract design and customization. This flexibility allows market participants to tailor trades to their risk management requirements and specific market conditions.

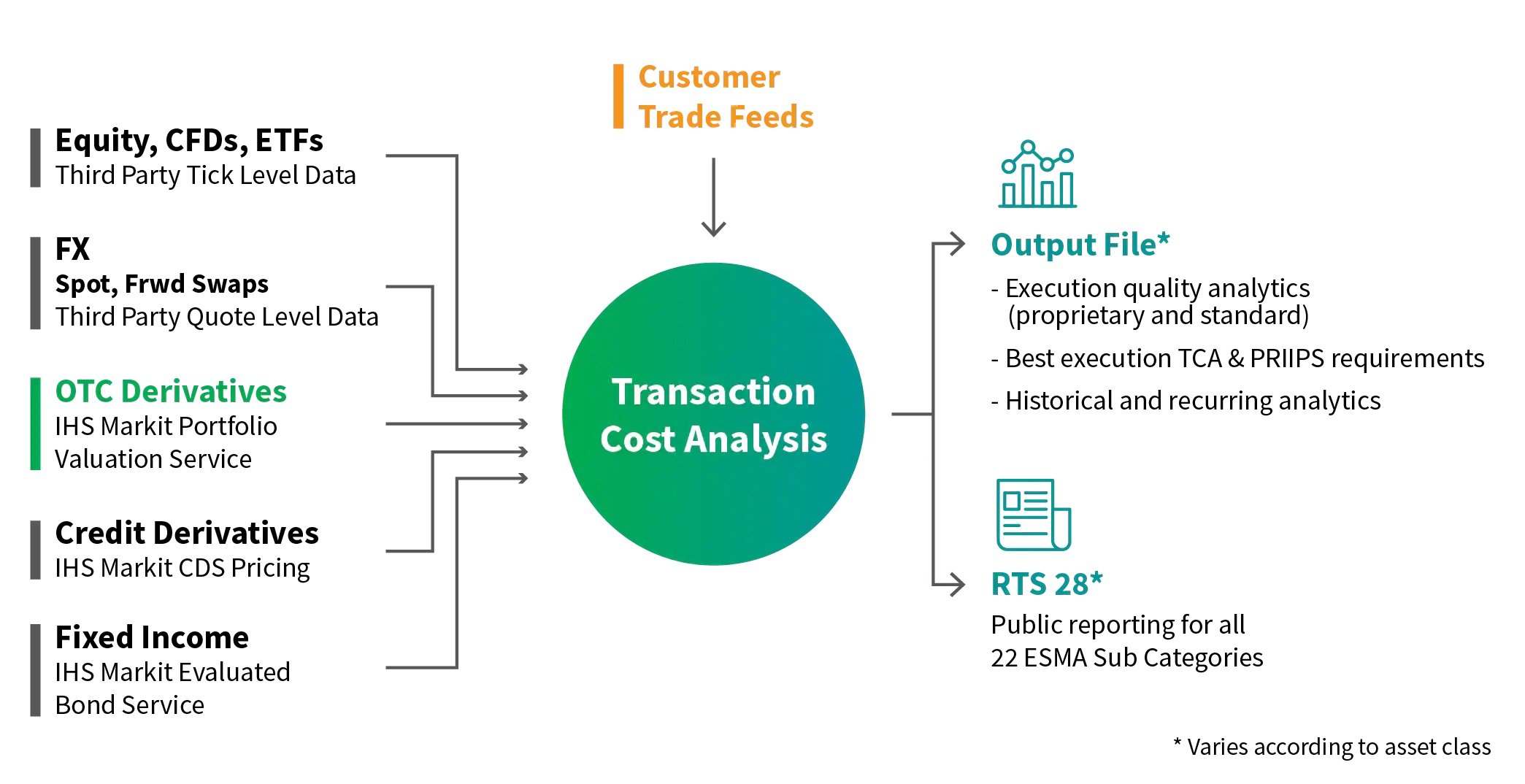

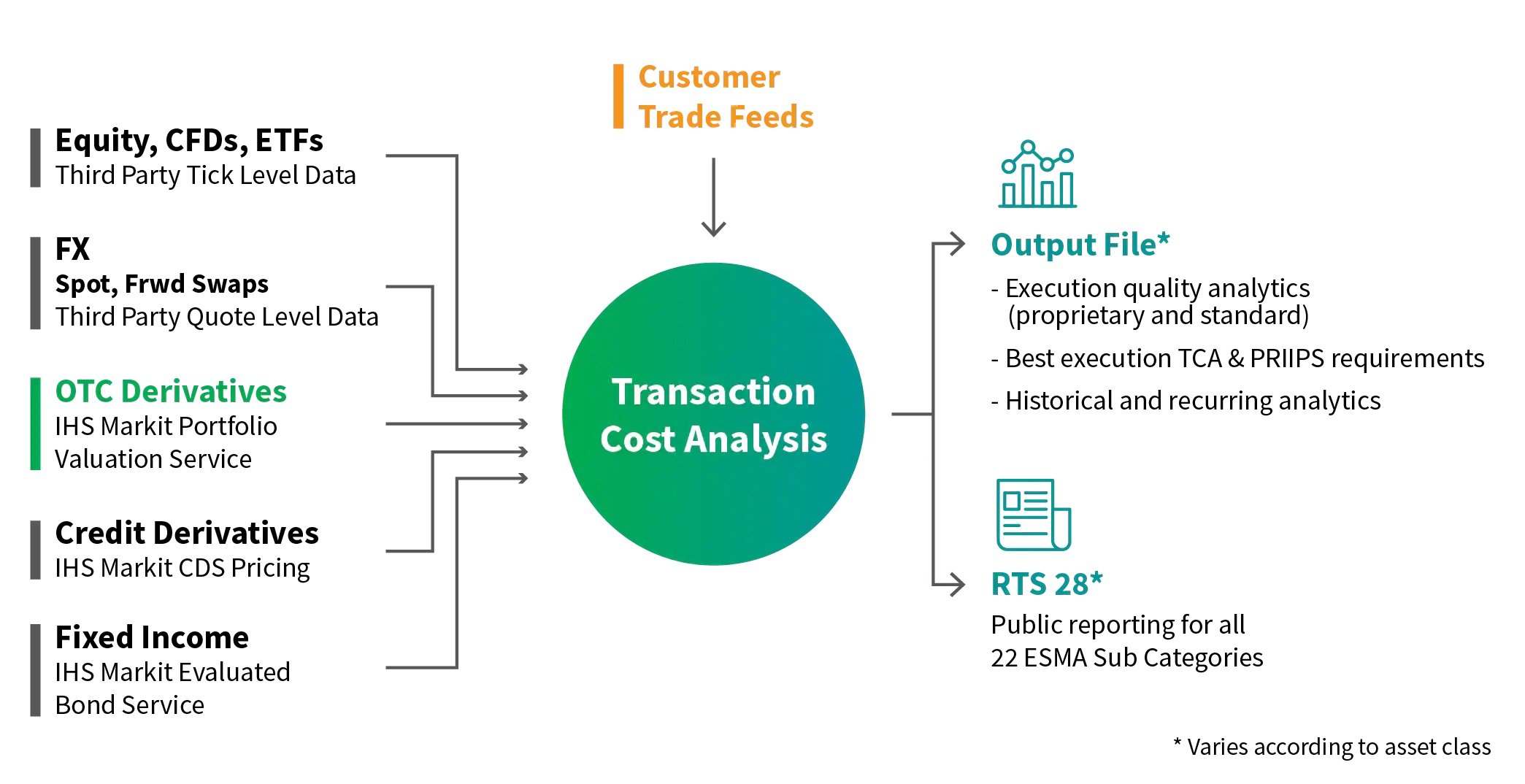

OTC derivatives encompass a wide range of financial instruments, including interest rate swaps, currency forwards, credit default swaps, commodity options, and equity derivatives. These contracts can be bilateral, involving two parties, or multilateral, involving multiple parties.

It is important to note that OTC derivatives are not limited to a specific type of underlying asset. They can be based on a variety of assets, including stocks, bonds, commodities, interest rates, and foreign exchange rates. The underlying asset determines the value and cash flows of the derivative contract.

One of the key characteristics of OTC derivatives is their decentralized nature. As there is no regulated exchange involved, the terms and conditions of these contracts are negotiated directly between the parties involved. This negotiation process allows for greater customization in terms of maturity, notional amount, payment schedules, and other contract specifications.

OTC derivatives are primarily used for risk management purposes. They allow market participants to hedge against price fluctuations, manage interest rate risks, offset currency exposures, and protect against credit default events. By utilizing these instruments, parties can reduce their exposure to potential losses and enhance their overall risk management strategies.

It is worth mentioning that OTC derivatives may involve counterparty risk. Since these contracts are privately negotiated, the creditworthiness of the counterparties involved becomes crucial. In the event of one party defaulting on its obligations, the other party may incur significant losses.

As the world of finance continues to evolve, OTC derivatives play a vital role in enabling market participants to manage risks, enhance investment strategies, and navigate dynamic market conditions. Understanding the definition and characteristics of OTC derivatives is essential for anyone involved in the financial markets and seeking to make informed investment decisions.

Types of OTC Derivatives

OTC derivatives encompass a wide array of financial instruments that provide market participants with various ways to manage risks, speculate on price movements, or enhance investment strategies. Here, we will explore some of the most common types of OTC derivatives:

- Interest Rate Swaps: Interest rate swaps are one of the most widely traded OTC derivatives. In this type of agreement, two parties exchange fixed and floating interest rate payments based on a specified notional amount. Interest rate swaps allow market participants to manage and hedge against interest rate risks by swapping their floating or fixed interest rate exposures.

- Currency Forwards: Currency forwards are contracts that facilitate the exchange of one currency for another at a predetermined exchange rate and future date. These derivatives are commonly used by businesses and investors to hedge against fluctuations in foreign exchange rates when conducting international transactions.

- Credit Default Swaps (CDS): Credit default swaps are OTC derivatives that allow investors to protect themselves against the default of a specific debt issuer. In a CDS contract, one party pays regular premiums to the other party in exchange for protection against a credit event, such as the default or bankruptcy of the underlying debt issuer.

- Commodity Options: Commodity options are OTC derivatives that give the holder the right, but not the obligation, to buy or sell a specific commodity at a predetermined price within a specified time period. These derivatives are commonly used by commodity producers and consumers to hedge against price fluctuations and manage their exposure to commodity markets.

- Equity Derivatives: Equity derivatives are OTC contracts that derive their value from underlying stocks or equity indices. These derivatives include equity swaps, equity options, and equity forwards. Equity derivatives are widely used by investors and traders for hedging, speculating, and portfolio management purposes.

- Other OTC Derivatives: Apart from the aforementioned types, OTC derivatives also include a range of other instruments, such as weather derivatives, inflation swaps, and volatility derivatives. These derivatives cater to specific risk management needs or market exposures that may not be covered by more traditional derivatives.

These are just a few examples of the types of OTC derivatives available in the financial markets. The wide variety of OTC derivatives allows market participants to tailor their trading and risk management strategies to suit their specific needs and market conditions. However, it is essential to note that OTC derivatives involve various risks and complexities, and proper understanding and due diligence are necessary before engaging in these markets.

Features and Characteristics of OTC Derivatives

OTC derivatives possess distinctive features that set them apart from other financial instruments. Understanding these features is crucial for market participants looking to engage in OTC derivative transactions. Here are some key characteristics of OTC derivatives:

- Customization: OTC derivatives offer a high degree of customization compared to exchange-traded derivatives. Market participants have the flexibility to negotiate and tailor the terms of the contract to meet their specific needs. They can customize factors such as notional amount, maturity, payment schedules, and contract specifications to address their risk management requirements.

- Decentralized Trading: OTC derivatives are transacted directly between two parties without the need for a centralized exchange. This decentralized trading structure allows for greater privacy and confidentiality in transactions. It also enables market participants to negotiate terms and conditions directly with their counterparties.

- Underlying Asset Flexibility: OTC derivatives can be based on a wide range of underlying assets, including stocks, bonds, commodities, interest rates, and foreign exchange rates. This flexibility allows market participants to tailor derivatives to specific market exposures or risk management needs. The underlying assets determine the value and cash flows of the derivative contract.

- Counterparty Risk: OTC derivatives involve counterparty risk, which refers to the risk of one party defaulting on its contractual obligations. Since OTC derivatives are privately negotiated, the creditworthiness and financial stability of the counterparties become crucial. Market participants need to assess and manage counterparty risk by conducting thorough due diligence and utilizing risk mitigation tools such as collateral agreements or credit default swaps.

- Regulatory Flexibility: While OTC derivatives are subject to regulatory oversight, they generally offer more flexibility than exchange-traded derivatives. The absence of a centralized exchange allows for customized contract terms and a less standardized trading process. However, regulatory frameworks are continuously evolving to enhance transparency, mitigate systemic risks, and promote market stability in OTC derivatives markets.

- Margin Requirements: OTC derivatives are typically not subject to initial margin requirements like exchange-traded derivatives. Instead, market participants often rely on bilateral agreements and collateral arrangements to mitigate counterparty risk. These agreements stipulate the posting of collateral to cover potential losses in the event of default. Margin requirements vary depending on the counterparties involved, the nature of the derivative, and regulatory requirements.

These features and characteristics of OTC derivatives make them a versatile tool for market participants in managing risks, hedging exposures, and enhancing investment strategies. However, it is important to recognize the complexities and risks associated with OTC derivatives, and market participants should have a sound understanding of these features before engaging in OTC derivative transactions.

Benefits of OTC Derivatives

OTC derivatives offer numerous benefits to market participants, including businesses, investors, and financial institutions. These benefits have contributed to the widespread use and popularity of OTC derivatives in financial markets. Here are some key advantages of OTC derivatives:

- Risk Management: OTC derivatives play a crucial role in managing risks. Market participants can utilize derivatives to hedge against potential losses caused by price fluctuations, interest rate changes, or currency fluctuations. OTC derivatives provide a mechanism for market participants to transfer and manage their exposure to various types of financial risks.

- Customization: One of the significant advantages of OTC derivatives is their high degree of customization. Unlike exchange-traded derivatives, which have standardized contracts, OTC derivatives allow market participants to tailor the terms of the contracts to meet their specific risk management needs. This customization enables market participants to address their unique risk profiles and investment objectives.

- Liquidity: OTC derivatives offer liquidity to market participants. Being able to trade directly with counterparties provides greater flexibility and access to a wide range of buyers and sellers. This liquidity allows market participants to enter and exit positions more easily, enhancing their ability to manage their portfolios efficiently.

- Diversification: OTC derivatives provide opportunities for diversification, allowing market participants to spread their risks across different asset classes or markets. By diversifying their portfolios with derivatives, market participants can potentially enhance returns and reduce overall portfolio risk by not being solely dependent on a single asset.

- Efficiency and Cost-effectiveness: OTC derivatives can offer cost-effectiveness and efficiency in managing risks. The ability to customize contracts and negotiate terms directly with counterparties can lead to more efficient risk management strategies. This can result in lower transaction costs compared to exchange-traded derivatives and allow market participants to implement precise risk management strategies.

- Market Access: OTC derivatives provide market participants with access to markets and assets that may be otherwise inaccessible or have limited liquidity. For instance, OTC derivatives allow investors to gain exposure to diverse commodities, exotic currencies, or specialized indices that are not readily available through exchange-traded derivatives.

These benefits have made OTC derivatives a preferred choice for market participants seeking effective risk management tools, customized solutions, and efficient access to various markets. However, it is essential to recognize the risks associated with OTC derivatives and employ proper risk management practices to fully leverage these benefits.

Risks and Challenges of OTC Derivatives

While OTC derivatives offer numerous benefits, they also come with inherent risks and challenges. It is crucial for market participants to be aware of these risks and take appropriate measures to mitigate them. Here are some key risks and challenges associated with OTC derivatives:

- Counterparty Risk: OTC derivatives involve counterparty risk, which refers to the risk of one party defaulting on its contractual obligations. As OTC derivatives are privately negotiated, market participants must assess the creditworthiness and financial stability of their counterparties. Failure to do so could result in significant financial losses if a counterparty fails to fulfill its obligations.

- Market Risk: OTC derivatives are subject to market risks, including price fluctuations, interest rate changes, and currency fluctuations. Market participants can face substantial losses if the underlying market moves against their positions. Proper risk management practices, such as diversification and ongoing monitoring of market conditions, are crucial to mitigate market risks.

- Operational Risk: OTC derivatives transactions can be complex, involving intricate operational processes. This complexity can contribute to operational risks, such as errors in contract documentation, settlement failures, or inadequate systems and processes. Market participants need robust operational controls and procedures to mitigate operational risks effectively.

- Liquidity Risk: OTC derivatives may be less liquid compared to exchange-traded derivatives, which can pose liquidity risks. Market participants may face challenges in exiting positions quickly, especially during times of market stress. Illiquidity in the OTC derivatives market can result in wider bid-ask spreads and difficulties in achieving fair prices for trades.

- Regulatory and Legal Risk: OTC derivatives are subject to evolving regulatory frameworks, and compliance with these regulations can be complex and costly. Failure to comply with regulatory requirements can lead to legal and reputational risks. Market participants must stay updated on regulatory changes and ensure proper adherence to legal and compliance obligations.

- Complexity and Lack of Transparency: OTC derivatives can be highly complex financial instruments, making them challenging to understand and evaluate. Lack of transparency in pricing and valuation can create difficulties in assessing the fair value of derivatives. This complexity can lead to mispricing, ineffective risk management, or incorrect assessment of the financial health of counterparties.

Market participants engaging in OTC derivatives must be vigilant in managing these risks and challenges. Implementing robust risk management practices, conducting thorough due diligence on counterparties, accessing reliable market data, and maintaining effective operational controls are crucial to mitigate the risks associated with OTC derivatives.

Regulation of OTC Derivatives

Over the years, regulatory bodies around the world have implemented frameworks to enhance transparency, mitigate systemic risks, and promote the stability of OTC derivatives markets. The regulation of OTC derivatives aims to address the risks associated with these instruments and establish guidelines for market participants. Here are some key aspects of the regulation of OTC derivatives:

- Reporting and Transparency: Regulatory authorities require market participants to report OTC derivatives transactions to recognized trade repositories. This reporting helps improve transparency by providing regulators with a comprehensive view of market activity, enabling them to monitor systemic risks and identify any potential threats to market stability.

- Clearing and Central Counterparties (CCPs): Regulatory frameworks often promote the use of central counterparties (CCPs) for clearing OTC derivatives transactions. CCPs act as intermediaries, assuming the counterparty risk and ensuring the completion of trades. Clearing OTC derivatives through CCPs helps mitigate counterparty risk and enhances the overall stability of the derivatives market.

- Margin Requirements: Regulatory authorities have implemented margin requirements for OTC derivatives to reduce systemic risk and enhance the financial resilience of market participants. These requirements mandate the posting of initial margin and variation margin for non-centrally cleared derivatives. Margin requirements aim to ensure that market participants have adequate collateral to cover potential losses and protect against counterparty defaults.

- Trade Execution: Regulatory frameworks promote the use of electronic trading platforms or regulated trading venues for the execution of OTC derivatives. The objective is to enhance market efficiency, transparency, and price discovery. The shift towards electronic trading platforms allows for greater access and improved market integrity.

- Capital Requirements: Regulatory authorities impose capital requirements on institutions that engage in OTC derivatives transactions. These capital requirements ensure that market participants have sufficient capital buffers and risk management practices to absorb potential losses. Capital requirements are designed to safeguard the stability of financial institutions and reduce the likelihood of systemic risks.

- Legal and Documentation Standards: Regulatory frameworks establish standards for legal agreements and documentation of OTC derivatives transactions. These standards aim to enhance clarity, consistency, and enforceability of contractual terms. Market participants are required to adhere to standard documentation, such as the International Swaps and Derivatives Association (ISDA) Master Agreement, to ensure a common understanding of rights and obligations.

The regulation of OTC derivatives aims to strike a balance between promoting market stability and supporting innovation in these markets. The evolving regulatory landscape underscores the importance of market participants staying informed about regulatory developments and ensuring compliance with applicable requirements.

Role of OTC Derivatives in Financial Markets

OTC derivatives play a significant role in financial markets, providing market participants with valuable tools to manage risks, enhance investment strategies, and facilitate efficient capital allocation. Here are some key roles that OTC derivatives serve in financial markets:

- Risk Management: OTC derivatives are widely used for risk management purposes. Market participants can utilize derivatives to hedge against potential losses caused by adverse price movements, interest rate fluctuations, or currency volatility. By effectively managing risks through derivatives, market participants can protect themselves from unexpected market events and smooth out their financial outcomes.

- Price Discovery: OTC derivative markets contribute to price discovery by providing a platform for market participants to trade and express their views on the future direction of various underlying assets. The continuous trading and pricing of OTC derivatives help establish reliable market prices for underlying assets, benefiting market participants who rely on these prices to make informed investment decisions.

- Efficient Capital Allocation: OTC derivatives enable more efficient capital allocation in financial markets. By providing opportunities to gain exposure to a wide range of assets and markets without the need for physical ownership, derivatives allow investors to diversify their portfolios and access diverse investment opportunities. This enhances the allocation of capital across different sectors, regions, and asset classes, ultimately promoting market efficiency.

- Liquidity Enhancement: OTC derivatives contribute to market liquidity by providing a platform for market participants to buy and sell derivative contracts. The ability to execute transactions directly with counterparties enhances market liquidity, allowing investors to enter or exit positions more efficiently. This liquidity is essential for ensuring smooth market functioning and facilitating price discovery.

- Financial Innovation: OTC derivative markets serve as a hub for financial innovation. The flexibility and customization offered by derivatives allow market participants to design new contracts and tailor instruments to fit specific risk management needs or investment strategies. This innovation drives market development, creates new trading opportunities, and fosters continuous improvement in risk management practices.

- Portfolio Optimization: OTC derivatives provide market participants with tools to optimize their investment portfolios. By gaining exposure to different asset classes and employing various derivative strategies, investors can enhance returns, reduce risk through diversification, and tailor their portfolios to their specific investment goals and risk tolerance.

The role of OTC derivatives in financial markets is dynamic and evolving. While they offer opportunities for risk management and investment strategies, market participants must also recognize and manage the risks associated with derivatives to ensure their effective use in achieving desired financial outcomes.

Conclusion

OTC derivatives play a crucial role in the complex and interconnected world of finance. These instruments offer market participants a wide range of benefits, including risk management, customization, liquidity, and efficient capital allocation. By enabling parties to hedge against price fluctuations, manage financial exposures, and enhance investment strategies, OTC derivatives contribute to the stability and growth of financial markets.

However, it is important to recognize that OTC derivatives also come with inherent risks and challenges. Counterparty risk, market risk, operational risk, and regulatory requirements are just a few of the considerations that market participants must navigate. Vigilance, due diligence, and effective risk management practices are essential in harnessing the benefits while mitigating the associated risks.

The regulation of OTC derivatives has evolved over time to enhance transparency, promote stability, and protect market participants. Reporting and transparency requirements, clearing through central counterparties, margin requirements, and the use of electronic trading platforms are among the regulatory measures aimed at addressing these objectives.

As financial markets continue to evolve and innovate, OTC derivatives will remain a vital component of the global financial system. They provide market participants with the tools needed to manage risks, enhance investment strategies, and access diverse markets and asset classes. Understanding the features, benefits, risks, and regulatory framework surrounding OTC derivatives is essential for market participants looking to navigate these markets effectively.

So, whether it’s a company hedging against currency fluctuations, an investor diversifying their portfolio, or a financial institution managing interest rate risk, OTC derivatives offer valuable solutions. By harnessing the potential of these instruments with careful consideration of risks and compliance with regulatory standards, market participants can leverage OTC derivatives to achieve their financial objectives in an ever-changing financial landscape.