Finance

What Is A Credit Bid

Published: January 12, 2024

Learn what a credit bid is in the world of finance and how it can impact your financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financial transactions and investments, understanding the various terms and strategies is crucial. One concept that often comes up in the world of finance is the credit bid. Whether you’re involved in bankruptcy proceedings, real estate auctions, or other financial dealings, it’s important to grasp the concept and implications of a credit bid.

A credit bid refers to a unique type of bid where a creditor offers their outstanding debt as collateral in lieu of cash or other forms of payment. In simple terms, it allows a creditor to use their debt claim as a way to bid on an asset. This practice is commonly seen in bankruptcy cases and real estate auctions, but it can also occur in other financial transactions.

Understanding how credit bids work and their advantages and disadvantages can help both creditors and debtors navigate the complex world of finance more effectively. In this article, we will delve deeper into the mechanics of credit bidding and explore its role in various financial settings.

Definition of a Credit Bid

A credit bid is a bidding strategy in which a creditor offers their outstanding debt as a form of payment instead of cash or other assets when participating in an auction or bankruptcy proceeding. This unique approach allows the creditor to use their debt claim on a specific asset as collateral to acquire that asset.

Let’s break down the components of a credit bid:

- Creditor: A creditor is an individual or entity that is owed a debt. This can include banks, financial institutions, lenders, or any party that is owed money.

- Debt: Debt refers to the owed amount by the debtor to the creditor. It can be in the form of a loan, mortgage, or any other financial obligation.

- Credit Bid: A credit bid is when a creditor uses their outstanding debt claim as a method of payment in an auction or legal proceeding.

Credit bidding is commonly used in bankruptcy cases and real estate auctions. In a bankruptcy setting, a creditor may choose to bid their outstanding debt to acquire the debtor’s assets. This allows the creditor to potentially recoup a portion or all of their owed debt by taking possession of the debtor’s property.

It’s important to note that the value of the credit bid is typically based on the fair market value of the asset in question. If the creditor’s debt claim exceeds the fair market value, they may only be allowed to credit bid up to the value of the asset. However, if the debt claim is less than the fair market value, the creditor may have the opportunity to credit bid up to the full amount of the debt.

Now that we have a clear understanding of what a credit bid entails, let’s explore how credit bids work in different financial scenarios.

How Credit Bids Work

Credit bids operate on the principle that a creditor’s outstanding debt can be used as a form of payment in financial transactions. The process of credit bidding varies depending on the specific situation, but the general steps involved are as follows:

- Evaluation of the Asset: The first step in a credit bid is evaluating the asset that the creditor wishes to acquire. This involves determining the fair market value of the asset to ensure that the credit bid is aligned with its worth. The creditor may conduct their own assessment or rely on professional appraisers.

- Approval by the Court or Auction Organizer: In cases such as bankruptcy proceedings or real estate auctions, the creditor must seek approval from the court or auction organizer to make a credit bid. This ensures that the bidding process is fair and transparent, protecting the rights of both debtors and other interested parties.

- Submission of the Credit Bid: Once approval is obtained, the creditor can then submit their credit bid. This typically involves providing documentation that supports their claim and detailing the amount of the outstanding debt they are offering as collateral.

- Competing Bids and Acceptance: In some situations, there may be other parties interested in acquiring the same asset. If competing bids are submitted, a bidding process occurs to determine the highest and most favorable offer. The court or auction organizer will consider all bids, including the credit bid, before making a decision.

- Transfer of Ownership: If the credit bid is successful and accepted, the ownership of the asset transfers to the creditor. This means that the creditor now holds rights to the property or asset based on the amount of debt they bid. The debtor’s outstanding debt is considered satisfied or reduced by the value of the credit bid.

It’s important to note that while credit bidding can be a useful strategy for creditors, it also depends on other factors such as the financial health of the debtor, the value of the asset, and any potential restrictions or regulations specific to the industry or legal framework governing the transaction.

Now that we’ve explored the mechanics of credit bidding, let’s look at its role in bankruptcy cases.

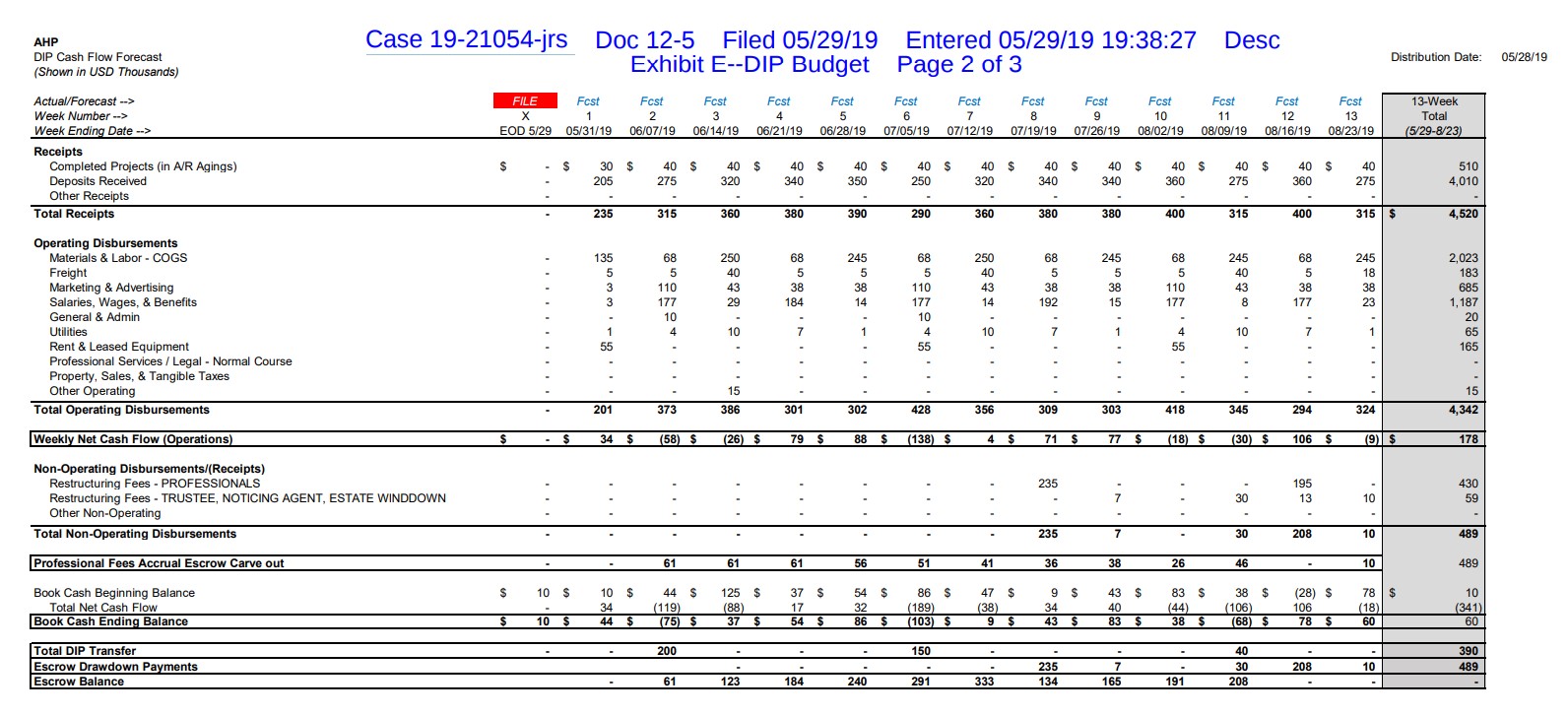

Credit Bidding in Bankruptcy Cases

In the realm of bankruptcy law, credit bidding plays a significant role in the resolution of outstanding debts and the distribution of assets. When a debtor files for bankruptcy, their assets are often sold to repay creditors. Creditors can participate in the sale process by submitting credit bids to acquire these assets.

One of the key benefits of credit bidding in bankruptcy cases is that it allows creditors to protect their interests and potentially recover a greater portion of their debt. By offering their outstanding debt as collateral, creditors have the opportunity to acquire the debtor’s assets without the need for additional cash or resources.

Bankruptcy courts recognize the value of credit bidding as it encourages active participation from creditors and promotes a competitive bidding process. It ensures that the debtor’s assets are sold for fair market value and maximizes the potential recovery for all parties involved.

The ability to credit bid in bankruptcy cases can be beneficial for both secured and unsecured creditors. Secured creditors, who have a lien or security interest in specific assets, can credit bid to protect their security interest and potentially recover the full outstanding debt. Unsecured creditors, who do not have specific collateral, have the opportunity to convert their unsecured claim into the ownership of the debtor’s assets by utilizing a credit bid.

It’s worth noting that not all bankruptcy cases allow for credit bidding. In some situations, there may be limitations or restrictions imposed by the bankruptcy court or specific regulations governing the process. These restrictions are in place to ensure a fair and efficient resolution of the bankruptcy proceedings.

Overall, credit bidding in bankruptcy cases provides a mechanism for creditors to actively participate in the sale of the debtor’s assets, potentially recouping their outstanding debt and mitigating financial losses. It promotes transparency, fairness, and the maximization of asset value, which are key principles in the bankruptcy process.

Now that we understand the advantages of credit bidding in bankruptcy cases, let’s explore some of the risks and disadvantages associated with this bidding strategy.

Advantages of Credit Bids

Credit bidding offers several advantages for both creditors and debtors in various financial transactions. Let’s explore some of the key benefits:

- Potential to Recover Debt: For creditors, the primary advantage of credit bidding is the opportunity to recover a portion or all of their outstanding debt. By using their debt claim as collateral, creditors can acquire the debtor’s assets without the need for additional cash or resources.

- Preservation of Interests: Credit bidding enables secured creditors to protect their interests in specific collateral. Instead of relying on the sale proceeds, secured creditors can credit bid to retain the assets that secure their claims, which can help preserve their investment and potentially generate further value in the future.

- Conversion of Debt into Assets: Credit bidding can allow unsecured creditors to convert their unsecured claims into the ownership of the debtor’s assets. This presents a valuable opportunity to acquire tangible assets that can potentially increase in value or be sold to generate a return.

- Maximization of Asset Value: By actively participating in the bidding process, credit bidding can help maximize the value of the debtor’s assets. It promotes competition among bidders, potentially resulting in higher bids and a more favorable outcome for all parties involved.

- Efficiency of Resolution: Credit bidding can streamline the resolution of financial transactions, particularly in bankruptcy cases. It eliminates the need for additional financing or the sale of assets through traditional means, allowing for a quicker and more efficient resolution of debt repayment and asset distribution.

These advantages emphasize the utility and value that credit bidding offers to creditors and debtors alike. However, it’s important to also consider the risks and disadvantages associated with credit bids, which I will discuss in the next section.

Now that we’ve explored the advantages of credit bidding, let’s examine some of the risks and disadvantages that creditors and debtors should be aware of when considering this bidding strategy.

Risks and Disadvantages of Credit Bids

While credit bidding offers several advantages, it is not without its risks and disadvantages. It’s crucial for creditors and debtors to consider these factors before deciding to utilize a credit bid. Let’s delve into the potential drawbacks:

- Limited Cash Recovery: One of the main disadvantages for creditors is that credit bidding may result in limited cash recovery. By using their outstanding debt as collateral, creditors may not receive immediate cash payments, reducing their ability to use those funds for other purposes.

- Overvaluation Risk: Credit bidding relies on the fair market value of the asset being bid on. If the valuation is inaccurate or inflated, the creditor may end up acquiring an asset that has a lower value than anticipated. This can result in financial loss or a diminished return on investment.

- Competition from Cash Bidders: In auctions where cash bidders are present, there is a risk of losing the bid to a competitor with cash resources. Cash bidders, who can offer immediate payment, may have an advantage over credit bidders as they can potentially present more attractive offers to the seller.

- Legal and Regulatory Constraints: Credit bidding is subject to legal and regulatory constraints that may limit its feasibility in certain situations. Bankruptcy courts or industry-specific regulations may impose restrictions on credit bidding, such as requiring a minimum cash component or imposing a cap on credit bid amounts.

- Contingent Risks: Credit bidding may involve contingent risks, such as potential liabilities associated with the acquired assets. Creditors must thoroughly assess the potential risks and obligations they may inherit, including environmental liabilities, ongoing litigation, or other encumbrances.

It’s important for both creditors and debtors to carefully evaluate the potential risks and disadvantages of credit bids in relation to their specific financial circumstances. Engaging legal and financial professionals who specialize in the relevant industry can provide valuable guidance and help mitigate potential pitfalls.

Now that we’ve explored the risks and disadvantages of credit bids, let’s take a look at some real-life examples of credit bidding in real estate auctions.

Examples of Credit Bids in Real Estate Auctions

Real estate auctions are a common setting where credit bidding can be seen in action. Here are a few examples of how credit bids have been utilized in real estate auctions:

- Foreclosure Auctions: In a foreclosure auction, where a property is being sold to satisfy outstanding mortgage debt, the mortgage lender may choose to credit bid. By using the outstanding debt as collateral, the lender has the opportunity to acquire the property without the need for additional cash. This allows the lender to potentially recoup their investment and mitigate losses.

- Bankruptcy Auctions: In bankruptcy cases, real estate assets may be sold through auctions. Creditors with outstanding debt claims on the property can utilize credit bidding to potentially acquire the assets and recover their debts. This allows the creditors to convert their claims into tangible assets, either for their own use or for subsequent sale.

- Distressed Property Sales: When a property is in financial distress and needs to be sold quickly, credit bidding can be a viable option. Creditors who hold debt claims on the property can credit bid to acquire it, potentially avoiding a lengthy traditional selling process. This benefits both the creditor, who can recover their debt, and the debtor, who can swiftly resolve their financial obligations.

These examples illustrate how credit bidding can be employed in the real estate auction market to facilitate the sale of properties and satisfy outstanding debts. It provides a mechanism for creditors to actively participate in the bidding process, potentially recovering their investments, and for debtors to resolve their financial obligations efficiently.

It’s important to note that the specific rules and regulations surrounding credit bidding in real estate auctions may vary depending on the jurisdiction and the type of auction. Real estate professionals and legal experts should be consulted to ensure compliance with local laws and to navigate the intricacies of the auction process.

Now that we’ve explored real estate auctions and credit bids, let’s summarize the key points discussed in this article.

Conclusion

Credit bidding is a unique and valuable strategy in the world of finance that allows creditors to use their outstanding debt as collateral when participating in auctions or bankruptcy proceedings. It offers advantages for both creditors and debtors, providing an opportunity for debt recovery and asset acquisition.

Credit bidding can be particularly beneficial in bankruptcy cases, allowing creditors to actively participate in the sale process and potentially recover their outstanding debt. It promotes a competitive bidding process and maximizes the value of the debtor’s assets. In real estate auctions, credit bidding enables creditors to secure their interests in specific collateral or convert their unsecured claims into tangible assets.

While credit bidding offers advantages, there are risks and disadvantages to consider. Limited cash recovery and the potential for overvaluation are some of the drawbacks. Competition from cash bidders and legal and regulatory constraints can also pose challenges.

Real estate auctions serve as an illustrative example of how credit bids are utilized. From foreclosure auctions to distressed property sales, credit bidding provides a mechanism for creditors to actively participate in the bidding process and potentially recover their debts through asset acquisition.

It’s important for both creditors and debtors to carefully evaluate the feasibility and potential risks associated with credit bids in their specific circumstances. Engaging professionals with expertise in the relevant industry can provide valuable guidance in navigating the complexities of credit bidding.

In conclusion, credit bidding is a powerful financial tool that allows creditors to utilize their outstanding debt as collateral. It offers advantages for debt recovery, preservation of interests, and the conversion of debt into tangible assets. However, it is essential to weigh the risks and disadvantages before implementing credit bidding in any financial transaction. Being informed and strategic will enable both creditors and debtors to make sound decisions that align with their financial goals and aspirations.