Home>Finance>When Cross-Hedging, One Has To Find One Currency That Has A Positive Correlation

Finance

When Cross-Hedging, One Has To Find One Currency That Has A Positive Correlation

Published: January 15, 2024

Cross-hedging in Finance requires finding a currency with a positive correlation, ensuring effective risk management and potential gains.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing financial risk, hedging plays a crucial role in protecting investments from potential losses. Hedging involves taking an offsetting position in a financial instrument to reduce or eliminate the impact of adverse price movements. For investors involved in international trade or holding foreign assets, currency risk is one of the key areas that require hedging.

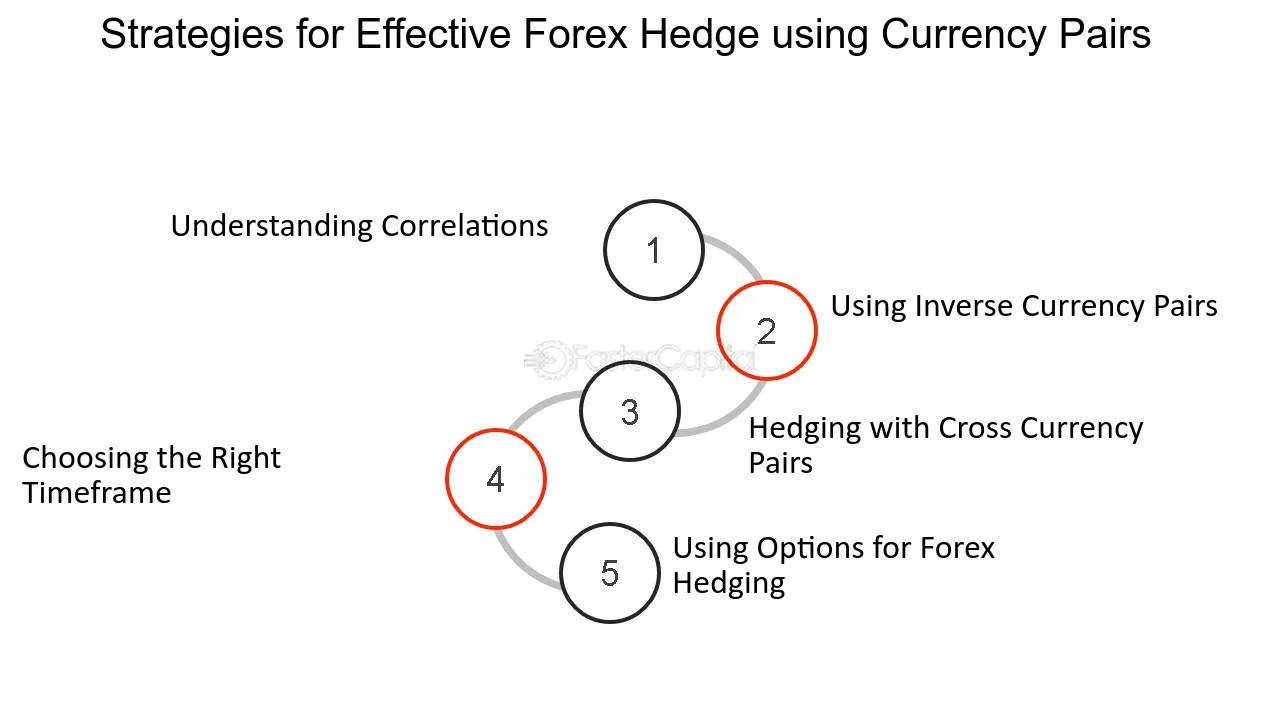

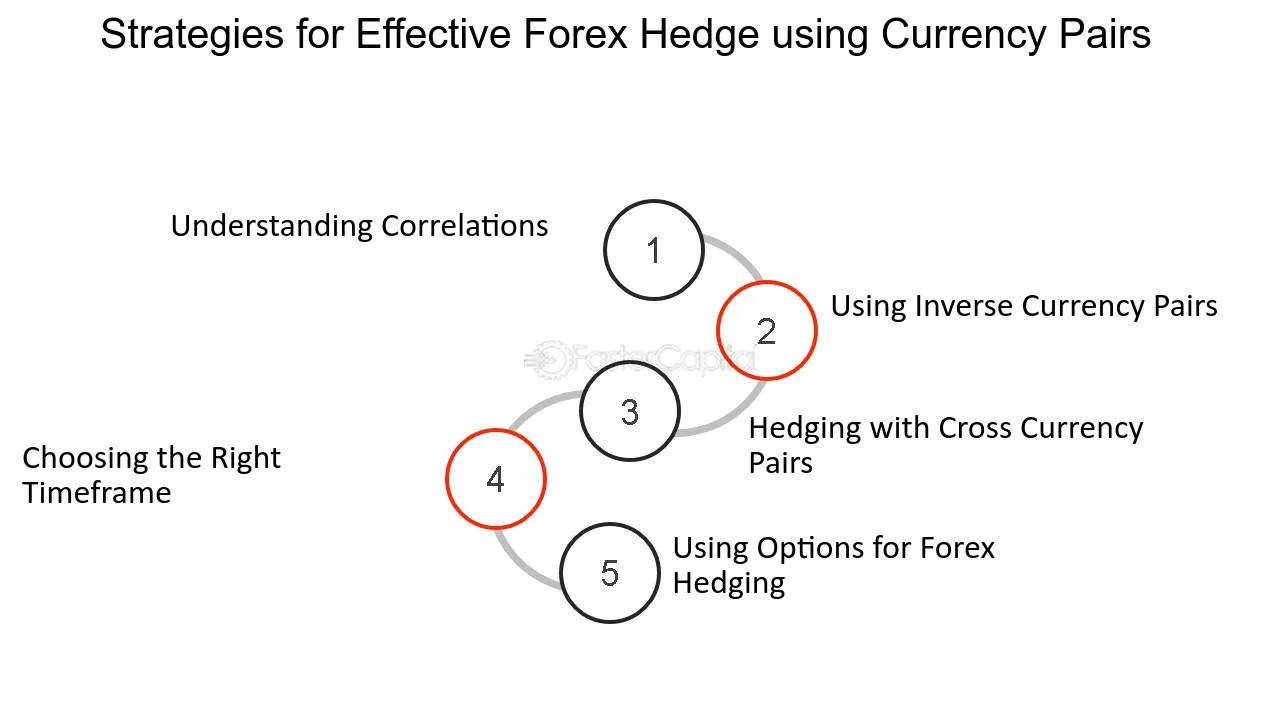

However, hedging currency risk is not always straightforward, especially when the desired hedging instrument is not directly available. This is where cross-hedging comes into play. Cross-hedging involves using a financial instrument that is not perfectly correlated with the underlying asset being protected, but still offers some degree of protection. In the context of currency risk, cross-hedging involves finding a currency that has a positive correlation with the currency being hedged.

The goal of cross-hedging is to minimize losses in the event of adverse currency movements, by finding a correlated instrument that moves in a similar direction to the currency being hedged. This allows investors to reduce their exposure to currency risk without directly hedging with the exact currency involved.

In this article, we will delve deeper into the concept of cross-hedging when managing currency risk. We will explore the importance of positive correlation in cross-hedging, the process of identifying a currency with positive correlation, the factors to consider when cross-hedging, and the benefits and risks associated with this strategy.

Understanding Cross-Hedging

Cross-hedging is a risk management technique used to protect against price fluctuations in a particular asset or instrument by using a related, but not identical, asset or instrument. It is commonly employed when the desired hedging instrument is not available or when the cost of direct hedging is prohibitively high.

When it comes to currency risk, cross-hedging involves hedging one currency with another currency that has a positive correlation. The idea is to use a currency pair that tends to move in the same direction as the currency being hedged, even though they may not be directly related.

To better understand cross-hedging, let’s consider an example. Imagine you are an exporter based in the United States and you have a significant amount of revenue denominated in Japanese Yen (JPY) that you expect to receive in three months. You are concerned about the potential depreciation of the JPY against the US dollar (USD), which would result in a loss when converting your revenue back into USD.

To hedge this currency risk, you could directly hedge the JPY/USD currency pair if it is available and liquid. However, if the JPY/USD market is illiquid or the cost of hedging is high, you might consider cross-hedging with a related currency pair, such as the USD/JPY. While the USD/JPY is the inverse of the JPY/USD pair, it still offers some degree of correlation, as both pairs generally move in the same direction.

By taking a long position in the USD/JPY pair, you are essentially protecting yourself against any potential depreciation of the JPY. If the JPY does indeed depreciate, your loss in the JPY revenue will be offset by the gain in the USD/JPY position. However, it’s important to note that cross-hedging does not provide a perfect hedge due to the lack of perfect correlation between the two currency pairs.

In summary, cross-hedging is a risk management strategy that involves using a related financial instrument to hedge against price fluctuations in another asset. When it comes to currency risk, cross-hedging allows investors to find a currency pair that has a positive correlation with the currency being hedged. While cross-hedging may not provide a perfect hedge, it can still offer some degree of protection against adverse currency movements.

Importance of Positive Correlation

When engaging in cross-hedging to manage currency risk, the correlation between the hedging instrument and the underlying currency is a crucial factor to consider. Positive correlation is particularly important because it indicates that the hedging instrument and the currency being hedged tend to move in the same direction.

The significance of positive correlation lies in the ability of the hedging instrument to provide a measure of protection against adverse currency movements. If the hedging instrument has a positive correlation with the currency being hedged, it means that when the currency being hedged depreciates, the hedging instrument is likely to appreciate. This inverse relationship helps to offset the losses incurred in the underlying currency and limits the overall risk exposure.

For example, let’s say you are a company based in Europe and you have a significant amount of revenue denominated in British Pounds (GBP). You are concerned about the potential depreciation of GBP against the Euro (EUR), as this would reduce your revenue when converting it back into EUR. To hedge this risk, you decide to cross-hedge by taking a long position in the EUR/GBP currency pair. If there is a positive correlation between the EUR/GBP and GBP/EUR pairs, a depreciation in GBP would likely result in an appreciation of the EUR/GBP pair, thereby helping to offset the losses.

On the other hand, if the correlation between the hedging instrument and the underlying currency is negative, it can undermine the effectiveness of the cross-hedging strategy. In this case, an adverse movement in the currency being hedged would likely be mirrored by a corresponding movement in the hedging instrument, amplifying the overall loss.

It’s important to note that while positive correlation is desirable, it is not always possible to find a perfectly correlated hedging instrument. In some cases, there may only be loosely related instruments available for cross-hedging. In such situations, it is crucial to assess the historical correlation and the underlying factors driving the correlation between the instruments to determine their suitability for cross-hedging.

In summary, positive correlation is crucial in cross-hedging to effectively manage currency risk. It allows the hedging instrument to act as a protective measure against adverse currency movements by moving in the opposite direction. While finding perfectly correlated instruments may not always be possible, understanding the correlation and assessing the suitability of the hedging instrument is essential for a successful cross-hedging strategy.

Identifying a Currency with Positive Correlation

When implementing a cross-hedging strategy to manage currency risk, identifying a currency with a positive correlation to the currency being hedged is crucial. By finding a currency pair that tends to move in the same direction as the currency being hedged, investors can effectively mitigate the impact of adverse currency fluctuations.

There are several approaches to identify a currency pair with positive correlation:

1. Historical Correlation Analysis: One of the primary methods is to analyze historical data of currency pairs to identify their correlation. By studying the price movements and calculating correlation coefficients, one can determine the degree of positive correlation between different pairs. This analysis can provide insights into how the currencies have moved in relation to each other in the past, indicating their potential for positive correlation in the future.

2. Economic Relationship: Another approach is to consider the economic relationship between the countries whose currencies are being compared. Countries with close economic ties, such as significant trade partnerships or similar monetary policies, are more likely to have currencies with positive correlation. Factors like economic indicators, interest rates, and geopolitical events can influence the correlation between currency pairs.

3. Commodity Linkages: Some currencies exhibit positive correlation due to their dependence on similar commodities. For example, countries that are major exporters of the same commodity, such as oil or gold, may experience positive correlation between their currencies. As commodity prices fluctuate, the currencies of these countries tend to move in a similar direction.

4. Regional Factors: Currencies within the same region can often exhibit positive correlation due to shared regional economic factors and monetary policies. For instance, countries within the European Union using the Euro as their common currency may exhibit positive correlation among their respective currency pairs.

It is essential to conduct thorough research and analysis to identify the currency pair with the highest positive correlation to the currency being hedged. This involves studying historical data, understanding economic relationships, considering commodity linkages, and regional factors. By identifying a currency pair with positive correlation, investors can effectively protect themselves against adverse currency fluctuations and reduce their overall risk exposure.

However, it is important to note that correlations can change over time due to shifts in market dynamics and global events. Therefore, continuous monitoring and reassessment of correlations are necessary to ensure the suitability of the chosen currency pair for cross-hedging purposes.

In summary, identifying a currency pair with positive correlation is crucial when implementing a cross-hedging strategy. By considering historical correlation, economic relationships, commodity linkages, and regional factors, investors can select a currency pair that tends to move in the same direction as the currency being hedged. This allows for effective risk mitigation and protection against adverse currency fluctuations. Continuous monitoring and assessment of correlation is essential to adapt to changing market conditions.

Factors to Consider when Cross-Hedging

When implementing a cross-hedging strategy to manage currency risk, there are several important factors to consider. These factors can greatly impact the effectiveness and success of the cross-hedging approach. Let’s explore the key factors that should be taken into account:

1. Correlation Strength: The strength of correlation between the hedging instrument and the currency being hedged is vital. A higher correlation indicates a higher likelihood of the two moving in the same direction. It is essential to assess the historical correlation between the currency pairs and ensure that the correlation is relatively stable and reliable. As correlation strength can change over time, monitoring and reassessing the correlation on an ongoing basis is crucial.

2. Liquidity: Liquidity is a critical factor when selecting a hedging instrument. It is necessary to choose a cross-hedging instrument that is sufficiently liquid to enter and exit positions without significant slippage. A liquid market ensures that there is enough volume and participants to provide competitive pricing and minimize execution risks.

3. Transaction Costs: Transaction costs, including spreads, commissions, and fees, can significantly impact the effectiveness of cross-hedging. Consideration should be given to the costs associated with entering and exiting positions in the chosen cross-hedging instrument. High transaction costs can eat into potential gains or increase losses, reducing the overall effectiveness of the strategy.

4. Market Conditions: Assessing the prevailing market conditions is essential for successful cross-hedging. Factors such as volatility, economic events, and geopolitical developments can influence currency movements. Understanding the market environment helps in determining the optimal timing for entering and exiting cross-hedging positions.

5. Time Horizon: The time horizon of the cross-hedging strategy is an important consideration. Different instruments and currency pairs may exhibit varying correlation strengths over short-term and long-term periods. It is important to align the time horizon of the cross-hedging strategy with the expected time frame of the underlying currency exposure to ensure suitable protection.

6. Risk-to-Reward Ratio: Evaluating the risk-to-reward ratio of the cross-hedging strategy is crucial. Assess the potential downside risk and the expected magnitude of the protective gains. It is important to weigh the potential benefits against the risks, considering factors such as the correlation strength, historical volatility, and market conditions.

7. Risk Management: Implementing proper risk management techniques is essential in cross-hedging. Setting stop-loss orders and defining risk limits can help mitigate potential losses. Regular monitoring and adjustment of positions based on changes in correlation and market conditions are necessary to ensure risk exposure remains within acceptable levels.

By carefully considering these factors when cross-hedging, investors can enhance the effectiveness of their risk management strategy. It is important to conduct thorough research, seek professional advice if needed, and continuously monitor and reassess positions to adapt to changing market conditions.

Benefits and Risks of Cross-Hedging

Cross-hedging can offer several benefits when managing currency risk, but it is important to understand and assess the associated risks. Let’s explore the benefits and risks of cross-hedging:

Benefits:

1. Cost Effectiveness: Cross-hedging allows investors to manage currency risk even when the desired direct hedging instrument is not available or is too costly. By using a correlated instrument, investors can achieve some degree of protection at a potentially lower cost.

2. Diversification: Cross-hedging introduces diversification benefits by using a different asset or instrument to hedge currency risk. Diversification can help reduce the overall risk exposure, as losses in one asset or currency may be offset by gains in another.

3. Flexibility: Cross-hedging provides flexibility in hedging strategies as it allows investors to choose different instruments or currencies to offset currency risk. This flexibility enables customization of hedging techniques to suit specific needs and market conditions.

4. Enhanced Risk Management: By effectively managing currency risk through cross-hedging, investors can protect their investments against adverse currency movements and minimize potential losses. It allows for better risk management and helps stabilize cash flows and profitability.

Risks:

1. Limited Perfect Correlation: Cross-hedging does not offer a perfect hedge, as the correlated instrument may not have an identical price relationship with the currency being hedged. Imperfect correlation can lead to losses if the currency being hedged behaves differently from the hedging instrument.

2. Correlation Breakdown: Correlations between assets and currencies can change over time due to various factors, such as economic events and market conditions. It is essential to monitor and reassess the correlation regularly to ensure its continued effectiveness.

3. Transaction Costs: Engaging in cross-hedging can incur additional transaction costs, such as spreads, commissions, and fees. These costs can reduce the overall returns of the hedging strategy and need to be considered in the risk-to-reward assessment.

4. Liquidity Risks: If the cross-hedging instrument is illiquid, it may be challenging to enter or exit positions at desired prices. This can lead to slippage or significant execution risks, impacting the effectiveness of the cross-hedging strategy.

5. Market Volatility: Cross-hedging can be affected by market volatility, which can introduce price fluctuations and increase the risk of losses. Rapid and unpredictable currency movements can hinder the effectiveness of cross-hedging strategies.

6. Regulatory and Compliance Considerations: Cross-hedging involves dealing with financial instruments that may be subject to regulatory requirements and compliance obligations. It is important to understand and adhere to relevant rules and regulations when implementing cross-hedging strategies.

In summary, cross-hedging offers cost-effectiveness, diversification, flexibility, and enhanced risk management when managing currency risk. However, it comes with risks, including limited perfect correlation, potential correlation breakdown, transaction costs, liquidity risks, market volatility, and regulatory considerations. To effectively utilize cross-hedging, investors must carefully assess these factors and continually monitor and adjust their strategies to maintain the desired level of risk protection.

Conclusion

Cross-hedging is a valuable risk management strategy when it comes to managing currency risk. By finding a correlated instrument that moves in a similar direction to the currency being hedged, investors can effectively mitigate the impact of adverse currency fluctuations. While cross-hedging may not provide a perfect hedge, it offers benefits such as cost-effectiveness, diversification, flexibility, and enhanced risk management.

When implementing a cross-hedging strategy, it is important to consider factors such as correlation strength, liquidity, transaction costs, market conditions, time horizon, risk-to-reward ratio, and risk management. Conducting thorough research, assessing historical correlation, and monitoring correlations on an ongoing basis are essential to ensure the suitability and effectiveness of the chosen cross-hedging instrument.

Despite the benefits, cross-hedging comes with risks, including limited perfect correlation, potential correlation breakdown, transaction costs, liquidity risks, market volatility, and regulatory considerations. These risks should be carefully evaluated and managed to minimize potential losses and optimize the effectiveness of the cross-hedging strategy.

In conclusion, cross-hedging can be a valuable tool for managing currency risk, offering a viable alternative when direct hedging instruments are not available or costly. By understanding the importance of positive correlation, identifying suitable currency pairs, and considering key factors, investors can enhance their risk management practices and protect their investments from adverse currency fluctuations. Through continuous monitoring and adjustment, cross-hedging strategies can provide stability and profitability in an ever-changing global financial landscape.