Home>Finance>How To Develop Money Management Skills For A Person With Developmental Disabilities

Finance

How To Develop Money Management Skills For A Person With Developmental Disabilities

Published: February 28, 2024

Learn how to improve financial literacy and money management skills for individuals with developmental disabilities. Discover practical tips and resources to help them achieve financial independence and security.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the realm of personal finance can be a daunting task for anyone, and for individuals with developmental disabilities, it may present unique challenges. However, with the right guidance and support, it is possible for individuals with developmental disabilities to develop essential money management skills that can empower them to achieve financial independence and security.

Understanding the nuances of money management is crucial for individuals with developmental disabilities, as it equips them with the knowledge and confidence to make sound financial decisions. From setting achievable financial goals to creating and adhering to a budget, each aspect of money management plays a pivotal role in fostering financial autonomy.

In this comprehensive guide, we will delve into the fundamental principles of money management, tailored to the specific needs of individuals with developmental disabilities. By exploring the intricacies of setting financial goals, creating a budget, tracking expenses, saving and investing, utilizing financial tools and resources, and seeking professional help when needed, we aim to provide actionable insights and strategies to facilitate the development of robust money management skills.

Through this exploration, we hope to empower individuals with developmental disabilities to take control of their financial well-being, paving the way for a more secure and fulfilling future. Let's embark on this enlightening journey toward financial empowerment and independence.

Understanding Money Management

Money management encompasses a broad spectrum of financial skills and practices that are essential for achieving financial stability and success. For individuals with developmental disabilities, understanding the core principles of money management is a critical step toward fostering independence and financial security.

At its core, money management involves effectively handling one’s finances, including income, expenses, savings, and investments. It encompasses the ability to make informed financial decisions, prioritize spending, and plan for the future. Understanding the value of money, the concept of budgeting, and the importance of saving are foundational aspects of money management that can positively impact an individual’s financial well-being.

For individuals with developmental disabilities, comprehending the nuances of money management may require tailored approaches and personalized support. It is essential to provide accessible and digestible financial education, utilizing visual aids, simplified language, and interactive learning methods to ensure comprehension and retention.

By fostering an understanding of money management, individuals with developmental disabilities can gain a sense of control over their financial resources, cultivate responsible spending habits, and develop the confidence to navigate the complexities of personal finance. This foundational knowledge serves as a cornerstone for building a solid financial future and paves the way for greater independence and self-sufficiency.

Setting Financial Goals

Setting clear and achievable financial goals is a fundamental aspect of effective money management for individuals with developmental disabilities. Financial goals provide a sense of purpose and direction, guiding individuals toward prudent financial decisions and long-term stability.

When establishing financial goals, it is important to consider both short-term and long-term objectives. Short-term goals may include building an emergency fund, paying off debts, or saving for a specific purchase, while long-term goals could encompass retirement planning, homeownership, or funding higher education.

For individuals with developmental disabilities, the process of setting financial goals should be approached with patience and understanding. It is essential to align the goals with the individual’s capabilities and aspirations, taking into account their unique circumstances and support needs. By breaking down larger objectives into manageable steps, individuals can experience a sense of accomplishment as they progress toward their financial aspirations.

Encouraging individuals to articulate their financial goals, whether through verbal expression, visual aids, or written statements, can enhance their sense of ownership and commitment. Additionally, celebrating milestones and achievements along the way can provide motivation and reinforce positive financial behaviors.

Ultimately, setting financial goals empowers individuals with developmental disabilities to envision a future that is financially secure and fulfilling. By instilling a sense of purpose and direction, financial goals serve as a catalyst for proactive financial decision-making and prudent resource allocation, laying the groundwork for long-term financial well-being.

Creating a Budget

Developing a comprehensive budget is a cornerstone of effective money management for individuals with developmental disabilities. A budget serves as a roadmap for managing income and expenses, fostering financial discipline, and working toward financial goals.

When creating a budget, it is essential to start by identifying sources of income, which may include earnings from employment, benefits, or other forms of financial support. Understanding the inflow of funds provides a clear picture of available resources for budget allocation.

Next, individuals should meticulously outline their recurring expenses, such as housing costs, utilities, transportation, food, and healthcare. It is crucial to differentiate between essential expenses and discretionary spending, recognizing the importance of prioritizing needs over wants within the budget framework.

For individuals with developmental disabilities, the process of creating a budget may benefit from visual aids, simplified budget templates, or interactive tools to facilitate comprehension and engagement. Breaking down the budgeting process into manageable steps and utilizing supportive resources can enhance the individual’s ability to grasp and apply budgeting concepts effectively.

Moreover, promoting regular budget reviews and adjustments can instill a sense of adaptability and financial awareness. By evaluating spending patterns and aligning them with financial goals, individuals can refine their budget to reflect changing needs and circumstances, ensuring its relevance and effectiveness over time.

Ultimately, a well-crafted budget empowers individuals with developmental disabilities to take control of their finances, make informed spending decisions, and cultivate a sense of financial responsibility. By adhering to a thoughtfully constructed budget, individuals can work toward achieving their financial aspirations while maintaining financial stability and security.

Tracking Expenses

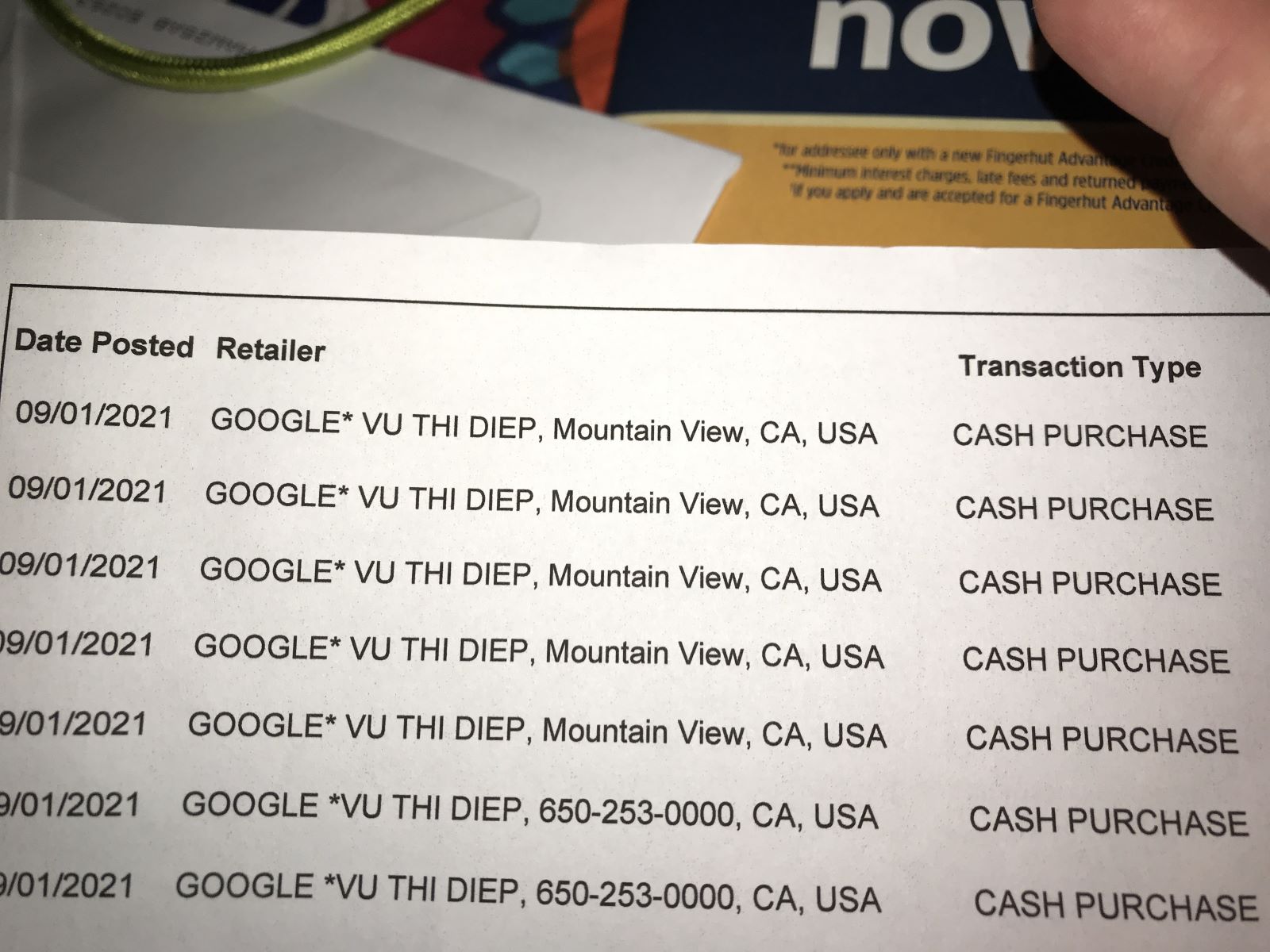

Tracking expenses is a fundamental practice that plays a pivotal role in effective money management for individuals with developmental disabilities. By diligently monitoring and recording expenditures, individuals can gain valuable insights into their spending habits, identify areas for potential savings, and maintain financial accountability.

Encouraging individuals to track their expenses through accessible and user-friendly methods, such as mobile apps, expense tracking tools, or simplified spreadsheets, can streamline the process and enhance engagement. Visual representations of spending patterns, such as charts or graphs, can provide a clear overview of expenses, facilitating comprehension and informed decision-making.

For individuals with developmental disabilities, the process of tracking expenses should be approached with patience and tailored support, ensuring that the chosen method aligns with their cognitive abilities and preferences. By incorporating interactive elements and positive reinforcement, individuals can develop a sense of ownership and accomplishment as they actively participate in expense tracking.

Regularly reviewing expense records and categorizing expenditures into essential and non-essential items can empower individuals to make informed choices and prioritize spending in alignment with their financial goals. This practice fosters a heightened awareness of financial decisions and encourages thoughtful consideration of resource allocation.

By cultivating the habit of tracking expenses, individuals with developmental disabilities can build a strong foundation for prudent financial management, fostering a sense of control and mindfulness in their financial dealings. This proactive approach to expense tracking not only facilitates informed decision-making but also contributes to the overall financial well-being and empowerment of individuals with developmental disabilities.

Saving and Investing

Encouraging individuals with developmental disabilities to cultivate saving and investing habits is a crucial component of their financial empowerment. Saving and investing not only provide a means to accumulate financial resources but also foster a mindset of long-term financial planning and security.

When introducing the concept of saving, it is important to emphasize the value of setting aside a portion of income for future needs or unexpected expenses. By promoting the habit of regular saving, individuals can build a financial safety net and develop a sense of financial preparedness, contributing to their overall financial well-being.

For individuals with developmental disabilities, the concept of investing may be introduced in simplified terms, highlighting the potential benefits of long-term wealth accumulation. Exploring accessible investment options, such as savings accounts or low-risk investment vehicles, can provide individuals with opportunities to engage in basic investment practices while minimizing potential complexities.

Moreover, leveraging visual aids and interactive tools to demonstrate the growth potential of savings and investments can enhance comprehension and motivation. By showcasing the concept of compounding returns and the impact of consistent saving and investing behaviors, individuals can develop a tangible understanding of the benefits of long-term financial planning.

Instilling the principles of saving and investing empowers individuals with developmental disabilities to take proactive steps toward securing their financial future. By nurturing these fundamental financial habits, individuals can build a foundation for financial resilience, independence, and the pursuit of long-term financial goals.

Using Financial Tools and Resources

Accessing and utilizing appropriate financial tools and resources is integral to enhancing the money management skills of individuals with developmental disabilities. By leveraging tailored tools and accessible resources, individuals can navigate the complexities of personal finance with confidence and autonomy.

Financial institutions and organizations offer a variety of user-friendly tools and resources designed to simplify financial management. For individuals with developmental disabilities, it is essential to explore resources such as budgeting apps, simplified financial literacy materials, and accessible online banking platforms to facilitate their engagement with financial matters.

Visual aids, simplified language, and interactive interfaces can significantly enhance the accessibility and usability of financial tools and resources for individuals with developmental disabilities. These accommodations can empower individuals to actively participate in managing their finances, fostering a sense of independence and self-efficacy.

Moreover, seeking out community-based support services and financial literacy programs tailored to the needs of individuals with developmental disabilities can provide valuable guidance and education. These programs often offer workshops, one-on-one counseling, and peer support, creating a supportive environment for individuals to enhance their financial knowledge and skills.

By equipping individuals with developmental disabilities with the necessary financial tools and resources, they can develop a strong foundation for effective money management. Access to accessible and tailored financial tools empowers individuals to make informed financial decisions, track their progress, and actively participate in shaping their financial future.

Seeking Professional Help

For individuals with developmental disabilities, seeking professional assistance in managing their finances can provide invaluable support and guidance, contributing to their overall financial well-being and independence. Professional help can come in various forms, including financial advisors, disability advocates, and legal professionals, each offering specialized expertise to address unique financial needs.

Financial advisors can play a pivotal role in providing personalized financial guidance tailored to the specific circumstances and goals of individuals with developmental disabilities. These professionals can offer insights on investment strategies, retirement planning, and long-term financial management, empowering individuals to make informed decisions aligned with their aspirations.

Disability advocates and support organizations specialize in addressing the unique financial challenges faced by individuals with developmental disabilities. These advocates can provide assistance in navigating government benefits, accessing support services, and advocating for financial inclusion, ensuring that individuals receive the resources and accommodations necessary for their financial well-being.

Legal professionals, such as special needs attorneys, can offer expertise in estate planning, guardianship arrangements, and the establishment of trusts, safeguarding the long-term financial security and welfare of individuals with developmental disabilities. By seeking legal counsel, individuals and their families can proactively plan for future financial contingencies and ensure the protection of assets.

Empowering individuals with developmental disabilities to seek professional help fosters a sense of agency and ensures that their financial needs are comprehensively addressed. By leveraging the expertise of financial professionals and advocates, individuals can navigate complex financial landscapes with confidence, ultimately enhancing their financial independence and security.

Conclusion

Developing money management skills is a transformative journey that holds immense potential for individuals with developmental disabilities. By understanding the core principles of money management, setting achievable financial goals, creating a comprehensive budget, tracking expenses, and embracing saving and investing habits, individuals can cultivate a strong foundation for financial independence and security.

It is essential to provide tailored support and accessible resources to empower individuals with developmental disabilities to navigate the intricacies of personal finance. Visual aids, simplified language, and interactive tools can enhance comprehension and engagement, fostering a sense of control and confidence in managing financial resources.

Furthermore, seeking professional assistance from financial advisors, disability advocates, and legal professionals can provide invaluable guidance and support, ensuring that individuals receive comprehensive and personalized financial assistance tailored to their unique needs.

Ultimately, the development of money management skills for individuals with developmental disabilities is a journey of empowerment, fostering independence, resilience, and the pursuit of financial aspirations. By nurturing these essential skills and providing the necessary support, we can pave the way for a future where individuals with developmental disabilities can confidently navigate the financial landscape, achieve their goals, and secure their financial well-being.