Home>Finance>How To Apply Chase Rewards To Your Statement Balance

Finance

How To Apply Chase Rewards To Your Statement Balance

Published: March 2, 2024

Learn how to maximize your finances by applying Chase rewards to your statement balance. Discover the steps to make the most of your rewards and save money.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Welcome to the world of Chase Rewards! If you're a Chase credit card holder, you're in for a treat. Chase offers a robust rewards program that allows you to earn points on your everyday purchases, and one of the most rewarding ways to use these points is by applying them to your statement balance. In this article, we'll delve into the intricacies of Chase Rewards and guide you through the process of applying your hard-earned points to reduce your statement balance. Whether you're new to the world of credit card rewards or a seasoned points aficionado, this guide will provide valuable insights and tips for making the most of your Chase Rewards.

Chase Rewards are a valuable currency that can help you save money and offset your credit card expenses. By understanding the nuances of this program and learning how to leverage your points effectively, you can unlock a world of possibilities and enjoy the financial benefits that come with smart credit card management. So, let's embark on this journey together and explore the ins and outs of applying Chase Rewards to your statement balance. Whether you're eyeing that dream vacation, aiming to reduce your monthly expenses, or simply seeking to make the most of your credit card perks, this guide will equip you with the knowledge and strategies to achieve your goals. Let's dive in!

**

Word count: 197

**

**

Understanding Chase Rewards

**

Before delving into the process of applying Chase Rewards to your statement balance, it’s essential to grasp the fundamentals of this enticing program. Chase Rewards, offered through select Chase credit cards, allow cardholders to earn points for their everyday spending. These points can be accrued through various categories, including dining, travel, groceries, and more, depending on the specific rewards structure of your credit card.

Chase offers a diverse range of credit cards, each tailored to different lifestyles and spending habits. Whether you’re a frequent traveler, a food enthusiast, or someone who prioritizes cash back, there’s likely a Chase credit card designed to align with your preferences. The points you earn through these cards can be incredibly versatile, offering opportunities for redemption across travel, statement credits, gift cards, and merchandise.

One of the key attractions of Chase Rewards is the flexibility it affords. Unlike some other rewards programs, Chase allows cardholders to combine points from multiple Chase credit cards, amplifying the potential for earning and redeeming rewards. This feature enables you to maximize your points accumulation and unlock greater value when it comes to utilizing your rewards.

Furthermore, Chase has established strategic partnerships with various travel and hospitality providers, amplifying the value of your points when used for travel-related redemptions. Whether you’re eyeing a luxurious hotel stay, a flight to your dream destination, or a car rental for your upcoming adventure, Chase’s travel partners can offer compelling redemption options that make your points stretch further.

Understanding the earning potential and redemption options of Chase Rewards is crucial for making informed decisions about how to utilize your points effectively. By familiarizing yourself with the intricacies of this program, you can optimize your point accrual and make strategic choices when it comes to redeeming your rewards. Now that we’ve laid the groundwork for understanding Chase Rewards, let’s delve into the specifics of applying these points to reduce your statement balance.

**

Word count: 305

**

**

Applying Chase Rewards to Your Statement Balance

**

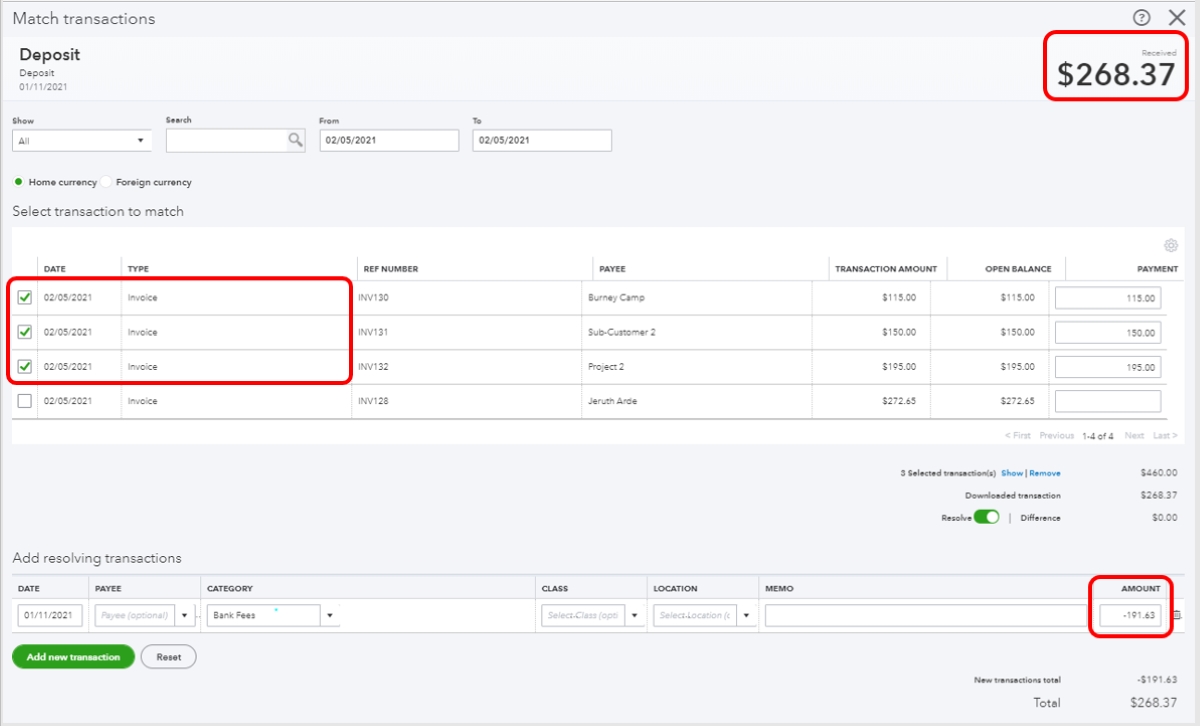

Now that you’ve earned a substantial amount of Chase Rewards, it’s time to reap the financial benefits by applying them to your statement balance. This process can provide tangible savings and reduce the amount you owe, contributing to a healthier financial outlook. The steps for applying Chase Rewards to your statement balance are straightforward, and understanding the process empowers you to make the most of your hard-earned points.

The first step is to log in to your Chase online account or mobile app. Once you’ve accessed your account, navigate to the rewards section, where you’ll likely find a dedicated area for managing your points. Within this section, look for the option to apply your points to your statement balance. Chase typically provides a user-friendly interface that simplifies the redemption process, allowing you to select the number of points you wish to apply and confirming the corresponding reduction in your statement balance.

When applying your Chase Rewards to your statement balance, it’s important to consider the value you’re receiving for your points. While statement credits can be a convenient way to offset your expenses, it’s prudent to assess whether there are more lucrative redemption options available. For instance, if you have upcoming travel plans, you might find greater value by transferring your points to Chase’s travel partners or utilizing the Chase travel portal for booking flights, hotels, or experiences.

However, if you prioritize the immediate reduction of your credit card balance, applying your points to your statement can offer a sense of financial relief and contribute to better debt management. By regularly monitoring your points balance and staying attuned to special promotions or bonus redemption opportunities, you can optimize the impact of your Chase Rewards on your statement balance.

Moreover, Chase occasionally introduces limited-time offers or enhanced redemption rates for specific categories, presenting opportunities to extract more value from your points. Keeping an eye on these promotions can lead to significant savings and a more rewarding redemption experience.

By understanding the process of applying Chase Rewards to your statement balance and evaluating the potential alternatives for redeeming your points, you can make informed decisions that align with your financial goals and preferences. Whether you choose to reduce your statement balance, embark on a memorable journey, or indulge in retail therapy, your Chase Rewards can serve as a valuable asset in enhancing your financial well-being.

**

Word count: 382

Tips for Maximizing Chase Rewards

**

Maximizing your Chase Rewards involves strategic planning and a keen understanding of the various opportunities available for earning and redeeming points. By implementing the following tips, you can elevate your rewards game and extract optimal value from your Chase credit card:

- Leverage Bonus Categories: Many Chase credit cards offer bonus points in specific spending categories, such as dining, travel, groceries, or gas stations. To maximize your points accumulation, use the card that offers the highest rewards rate for your everyday purchases. This simple strategy can significantly boost your points balance over time.

- Explore Chase’s Travel Partners: If you’re a travel enthusiast, familiarize yourself with Chase’s network of travel partners. Transferring your points to these partners can unlock exceptional value, allowing you to book flights, hotel stays, and other travel experiences at favorable redemption rates. Researching the best ways to utilize your points for travel can lead to memorable adventures while stretching your rewards further.

- Stay Informed About Promotions: Chase periodically introduces limited-time promotions and bonus earning opportunities. By staying informed about these promotions, you can capitalize on enhanced rewards rates and special offers, accelerating your points accumulation and potentially accessing exclusive redemption options.

- Consider the Ultimate Rewards Portal: Explore the Chase Ultimate Rewards portal, which provides a platform for redeeming your points for travel, gift cards, cash back, and merchandise. Assessing the redemption rates and available options on the portal can help you make informed decisions about the most advantageous ways to utilize your rewards.

- Combine Points from Multiple Cards: If you hold multiple Chase credit cards that accrue Ultimate Rewards points, consider combining your points into a single account. Consolidating your points allows for more substantial redemptions and provides greater flexibility in utilizing your rewards for various purposes.

- Monitor Point Expiration Dates: Chase Rewards points typically have no expiration date as long as your credit card account remains open. However, if you decide to close a credit card account, be mindful of any impending point expiration dates and plan your redemptions accordingly to avoid forfeiting your hard-earned rewards.

By implementing these tips and remaining attuned to the evolving landscape of rewards opportunities, you can optimize your Chase Rewards and elevate your overall credit card experience. Whether you’re aiming to offset expenses, embark on exciting travels, or indulge in valuable redemptions, strategic utilization of your points can pave the way for a more rewarding financial journey.

**

Word count: 387

Conclusion

**

Congratulations on delving into the realm of Chase Rewards and gaining valuable insights into the art of maximizing your credit card perks. As you’ve discovered, Chase Rewards present a wealth of opportunities for earning and redeeming points, offering a versatile platform for enhancing your financial well-being and unlocking rewarding experiences.

By understanding the intricacies of Chase Rewards, you’ve equipped yourself with the knowledge to make informed decisions about utilizing your points effectively. Whether you’re applying your rewards to reduce your statement balance, embarking on exhilarating travels, or indulging in valuable redemptions, your Chase Rewards serve as a valuable asset in your financial arsenal.

As you navigate the world of credit card rewards, remember to leverage bonus categories, explore Chase’s travel partners, and stay attuned to promotional opportunities. By implementing strategic approaches to maximizing your rewards, you can extract optimal value from your Chase credit card and elevate your overall rewards experience.

Furthermore, the flexibility and diverse redemption options offered by Chase Rewards empower you to tailor your points utilization to align with your unique lifestyle and aspirations. Whether you’re a frequent traveler, a culinary enthusiast, or someone seeking to offset everyday expenses, Chase’s rewards program caters to a wide array of preferences, allowing you to customize your redemption strategy according to your individual priorities.

As you continue your journey with Chase Rewards, remember to monitor your points balance, stay informed about special promotions, and assess the most advantageous ways to utilize your rewards. By remaining proactive and engaged with your rewards program, you can amplify the impact of your points and unlock a world of possibilities.

Ultimately, Chase Rewards are not merely points—they represent opportunities, experiences, and financial advantages that can enrich your life in meaningful ways. Whether you’re planning your next adventure, seeking to reduce your statement balance, or treating yourself to well-deserved rewards, your Chase Rewards stand ready to enhance your journey toward financial prosperity and fulfillment.

Thank you for joining us on this exploration of Chase Rewards, and may your credit card endeavors be filled with rewarding moments and valuable savings.

**

Word count: 336

**