Finance

How To Categorize Merchant Fees In QuickBooks

Published: February 24, 2024

Learn how to effectively categorize merchant fees in QuickBooks to streamline your finance management. Optimize your accounting process with these essential tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Navigating the intricacies of financial transactions is an essential aspect of managing a business. Among the various financial considerations, understanding and categorizing merchant fees is crucial for accurate bookkeeping. In this comprehensive guide, we will delve into the process of categorizing merchant fees in QuickBooks, a popular accounting software used by businesses of all sizes. By gaining a thorough understanding of this process, you can ensure that your financial records are precise and reflective of your business's performance.

Merchant fees encompass a range of charges incurred by businesses when processing customer payments through credit or debit cards. These fees may include interchange fees, assessment fees, and processing fees, among others. Categorizing these fees correctly is vital for maintaining accurate financial records and gaining insights into your business's financial health.

In the following sections, we will explore the nuances of merchant fees, the setup of merchant accounts in QuickBooks, and the process of categorizing and recording merchant fees within the software. Additionally, we will discuss the creation of custom categories for merchant fees and how to generate reports for analysis. By the end of this guide, you will have a comprehensive understanding of how to effectively manage merchant fees in QuickBooks, empowering you to maintain precise financial records and make informed business decisions.

Understanding Merchant Fees

Merchant fees, often associated with credit and debit card transactions, encompass the charges imposed by payment processors and card networks for enabling businesses to accept electronic payments. These fees typically consist of several components, including interchange fees, assessment fees, and processing fees. Understanding the breakdown of these fees is crucial for businesses to comprehend the cost structure of processing card payments and to effectively manage their financial records.

Interchange Fees: These fees are paid to the card-issuing bank and are determined based on various factors, such as the type of card used, the transaction method, and the industry of the business. Interchange fees form a significant portion of the overall merchant fees and can vary based on the specific circumstances of each transaction.

Assessment Fees: Charged by card networks such as Visa, Mastercard, and Discover, assessment fees are another component of merchant fees. These fees contribute to the operational costs and profitability of the card networks and are typically calculated as a percentage of the transaction amount.

Processing Fees: Payment processors, including merchant service providers and acquirers, levy processing fees to cover the costs associated with facilitating electronic payments. These fees may encompass a variety of expenses, such as authorization and capture fees, statement fees, and monthly service charges.

By comprehending the breakdown of merchant fees, businesses can gain insights into the cost structure of processing card payments and make informed decisions regarding their payment processing strategies. Additionally, understanding the components of merchant fees is essential for accurately categorizing and recording these expenses in accounting software such as QuickBooks.

Setting up Merchant Accounts in QuickBooks

Before delving into the categorization of merchant fees in QuickBooks, it is essential to ensure that your merchant accounts are accurately set up within the software. QuickBooks provides functionality to create and manage merchant accounts, allowing businesses to streamline the recording and tracking of transactions related to card payments.

To set up a merchant account in QuickBooks, begin by navigating to the “Chart of Accounts” section within the software. Here, you can create a new account specifically designated for tracking transactions related to merchant fees and card payments. It is crucial to accurately label and categorize the account to facilitate seamless recording and reporting of relevant financial data.

When setting up the merchant account, consider the specific details of your business’s payment processing activities. This may include the types of cards accepted, the frequency of transactions, and any unique aspects of your payment processing setup. By customizing the merchant account settings to align with your business’s requirements, you can ensure that the tracking of merchant fees and related transactions is tailored to your specific operational needs.

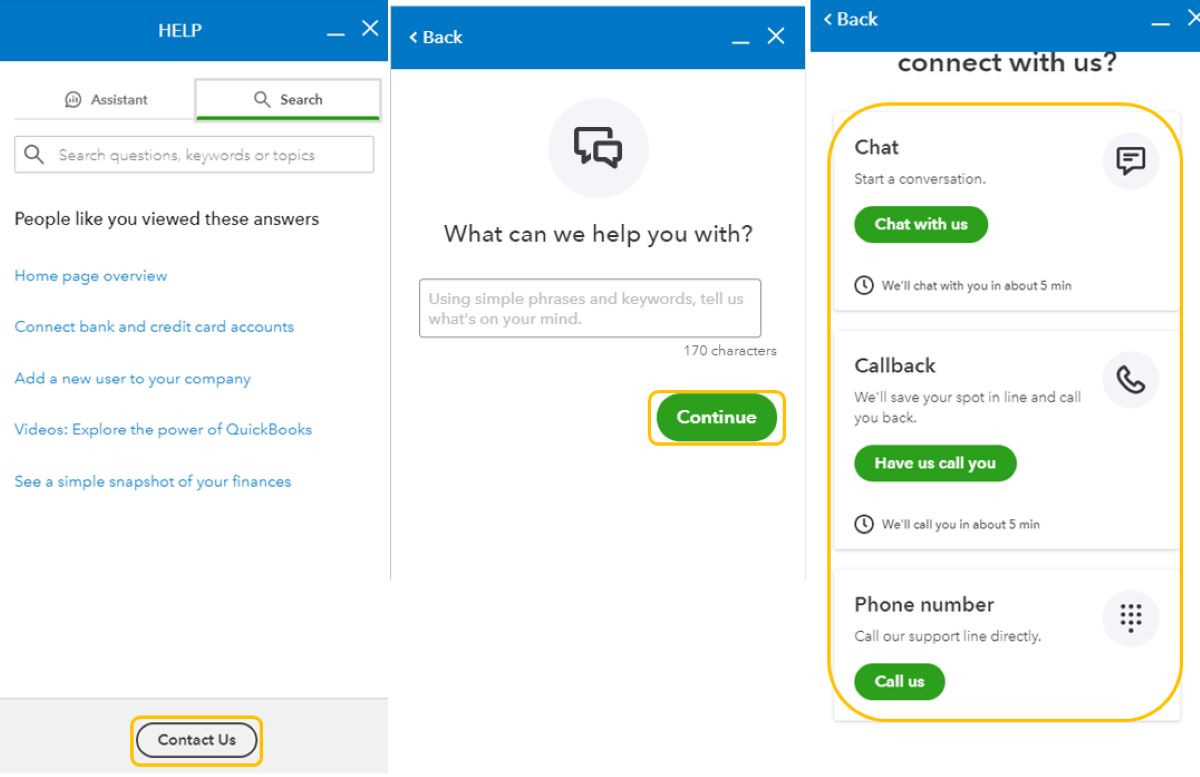

Furthermore, QuickBooks offers integration with various payment processing services and platforms, allowing businesses to link their merchant accounts directly to the software. This integration can streamline the reconciliation of transactions and the recording of merchant fees, providing a cohesive financial management experience.

By setting up merchant accounts in QuickBooks and customizing the account settings to align with your business’s payment processing activities, you can establish a solid foundation for accurately categorizing and managing merchant fees within the software. This foundational step is essential for ensuring that your financial records reflect the intricacies of your card payment transactions and associated fees.

Categorizing Merchant Fees in QuickBooks

Effectively categorizing merchant fees in QuickBooks is pivotal for maintaining accurate financial records and gaining insights into the costs associated with processing card payments. QuickBooks provides a structured framework for categorizing expenses, allowing businesses to meticulously track and analyze their financial data. When categorizing merchant fees, it is essential to align the process with the specific components of the fees and the nuances of your business’s payment processing activities.

One approach to categorizing merchant fees in QuickBooks involves creating dedicated expense accounts that correspond to the various components of the fees. For example, you can establish separate accounts for interchange fees, assessment fees, and processing fees within the “Chart of Accounts” section of QuickBooks. This granular approach enables businesses to distinctly track each type of merchant fee, facilitating detailed analysis and reporting.

Additionally, QuickBooks allows for the creation of sub-accounts within expense categories, providing further granularity in categorizing merchant fees. By leveraging sub-accounts, businesses can establish a hierarchical structure for tracking merchant fees, offering a comprehensive view of the expenses incurred during payment processing.

Furthermore, businesses can utilize QuickBooks’ customization features to create custom fields or tags specifically tailored to merchant fees. This customization empowers businesses to add additional context to their transactions, such as identifying the specific card networks or payment processors associated with the fees. By incorporating custom fields or tags, businesses can enhance the categorization and tracking of merchant fees, contributing to more robust financial analysis.

When categorizing merchant fees in QuickBooks, it is imperative to maintain consistency and accuracy to ensure that the financial records reflect the true cost of processing card payments. Regular reconciliation of transactions and merchant fee categorization is essential to uphold the integrity of the financial data and facilitate informed decision-making.

By leveraging QuickBooks’ capabilities for expense categorization and customization, businesses can establish a robust framework for accurately tracking and categorizing merchant fees, ultimately contributing to a comprehensive understanding of the costs associated with payment processing.

Creating Custom Categories for Merchant Fees

While QuickBooks offers a range of predefined categories and accounts for expense tracking, businesses can further enhance their financial management by creating custom categories specifically tailored to merchant fees. Custom categories provide a tailored approach to tracking and analyzing expenses related to payment processing, offering a more nuanced view of the costs incurred.

One approach to creating custom categories for merchant fees involves establishing specific sub-accounts or sub-categories within the expense tracking framework of QuickBooks. These sub-accounts can be dedicated to different types of merchant fees, such as interchange fees, assessment fees, and processing fees. By creating custom sub-accounts, businesses can gain a detailed breakdown of their merchant fee expenses, facilitating comprehensive financial analysis and reporting.

Additionally, businesses can leverage QuickBooks’ customization features to create custom fields or tags that align with their unique payment processing activities. For example, custom fields can be utilized to denote the specific card networks or payment processors associated with each transaction, providing additional context for the categorization of merchant fees. This level of customization enables businesses to capture detailed insights into their payment processing costs and optimize their financial management strategies.

Furthermore, businesses can establish custom categories for merchant fees based on specific business units or departments. By creating tailored expense categories for different segments of the business, such as retail operations, e-commerce activities, or service offerings, businesses can gain a granular view of the merchant fees incurred by each operational unit. This approach enhances cost allocation and facilitates targeted analysis of payment processing expenses across diverse business functions.

By creating custom categories for merchant fees, businesses can align their expense tracking with the unique aspects of their payment processing activities, gaining a comprehensive understanding of the costs associated with accepting card payments. This tailored approach to categorization empowers businesses to make informed financial decisions and optimize their payment processing strategies based on detailed insights derived from customized expense tracking.

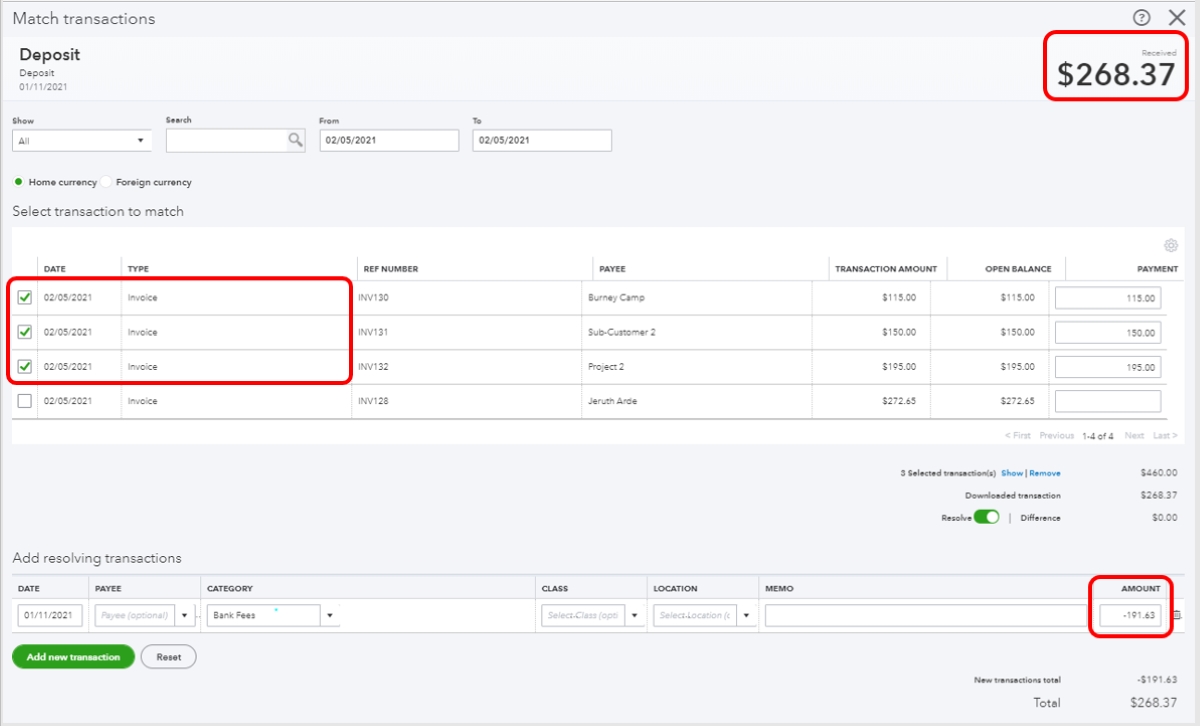

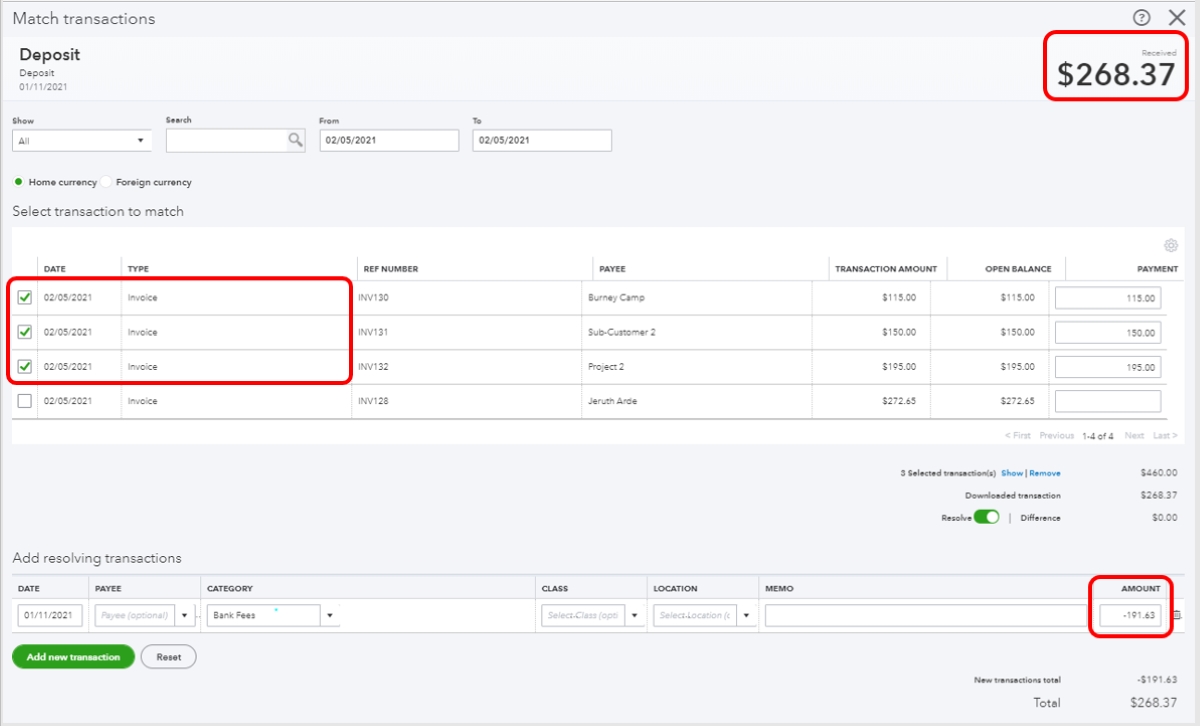

Recording Merchant Fees in QuickBooks

Recording merchant fees accurately in QuickBooks is essential for maintaining precise financial records and gaining insights into the costs associated with payment processing. QuickBooks provides a structured framework for entering and categorizing expenses, enabling businesses to meticulously track their merchant fees and associated transactions.

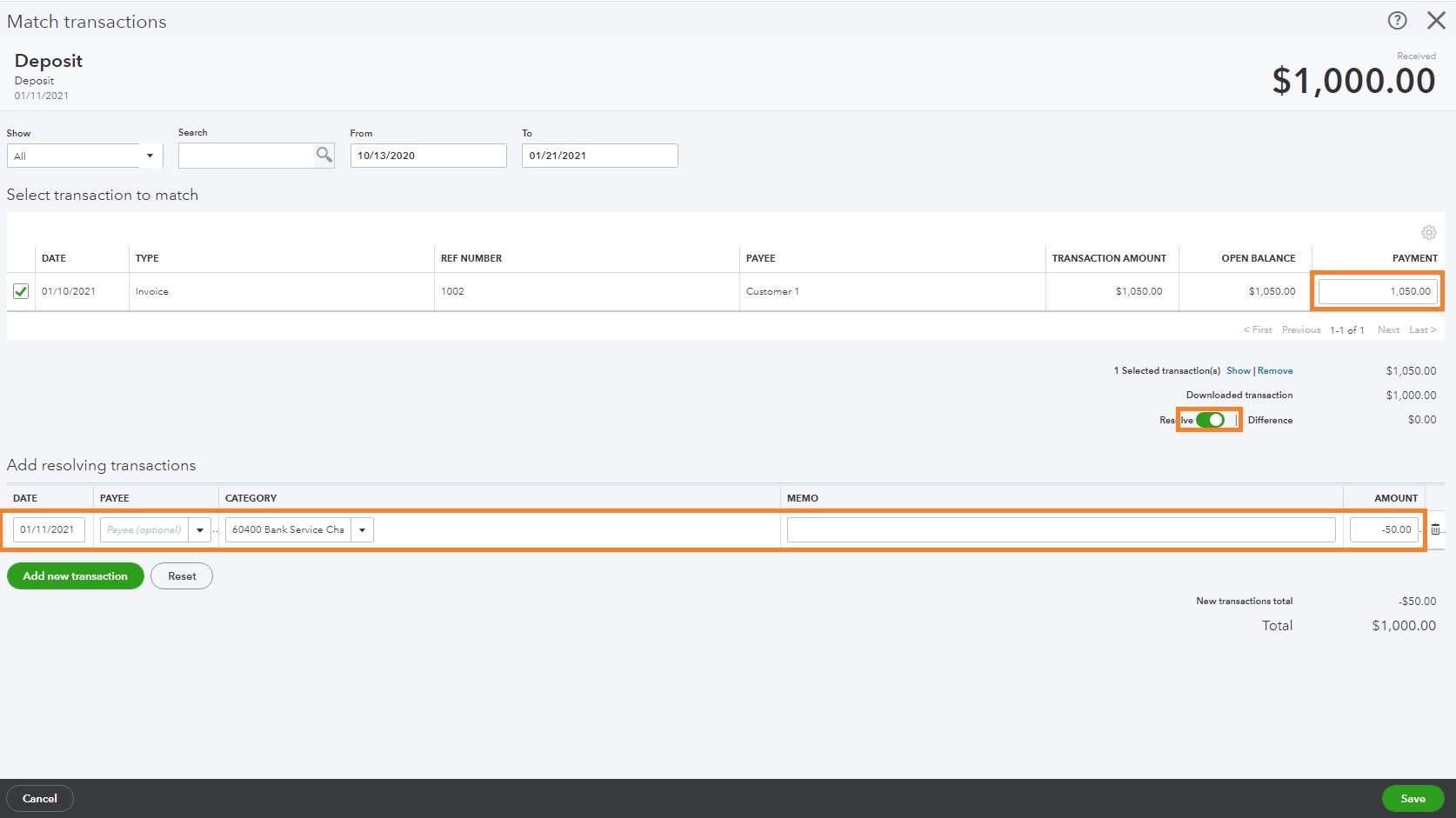

When recording merchant fees in QuickBooks, businesses should ensure that each transaction is appropriately categorized to reflect the specific components of the fees. This involves assigning the transactions to the corresponding expense accounts or custom categories established for interchange fees, assessment fees, processing fees, and other relevant components of merchant fees. By accurately categorizing each transaction, businesses can capture a detailed breakdown of their payment processing costs, facilitating comprehensive financial analysis.

Furthermore, businesses should reconcile their bank and merchant account statements with the recorded transactions in QuickBooks to ensure accuracy and completeness. Reconciliation involves verifying that all transactions, including merchant fees, are accurately reflected in QuickBooks and align with the actual financial activities of the business. This process helps identify discrepancies and ensures that the financial records are up to date and reflective of the business’s financial position.

QuickBooks offers features for batch recording of transactions, allowing businesses to efficiently enter multiple merchant fee transactions in a streamlined manner. By leveraging batch recording functionality, businesses can expedite the process of entering and categorizing merchant fees, saving time and enhancing operational efficiency.

Additionally, businesses can utilize QuickBooks’ reporting capabilities to generate detailed reports on merchant fees and payment processing expenses. These reports offer valuable insights into the costs associated with accepting card payments, enabling businesses to analyze trends, identify cost-saving opportunities, and make informed financial decisions based on comprehensive data.

By meticulously recording merchant fees in QuickBooks and leveraging the software’s reconciliation, batch recording, and reporting features, businesses can maintain accurate financial records and gain a comprehensive understanding of their payment processing costs. This proactive approach to expense recording contributes to informed decision-making and strategic financial management.

Reporting and Analyzing Merchant Fees in QuickBooks

QuickBooks offers robust reporting and analysis features that empower businesses to gain valuable insights into their merchant fees and payment processing expenses. By leveraging these capabilities, businesses can generate comprehensive reports, analyze trends, and make informed decisions to optimize their payment processing strategies.

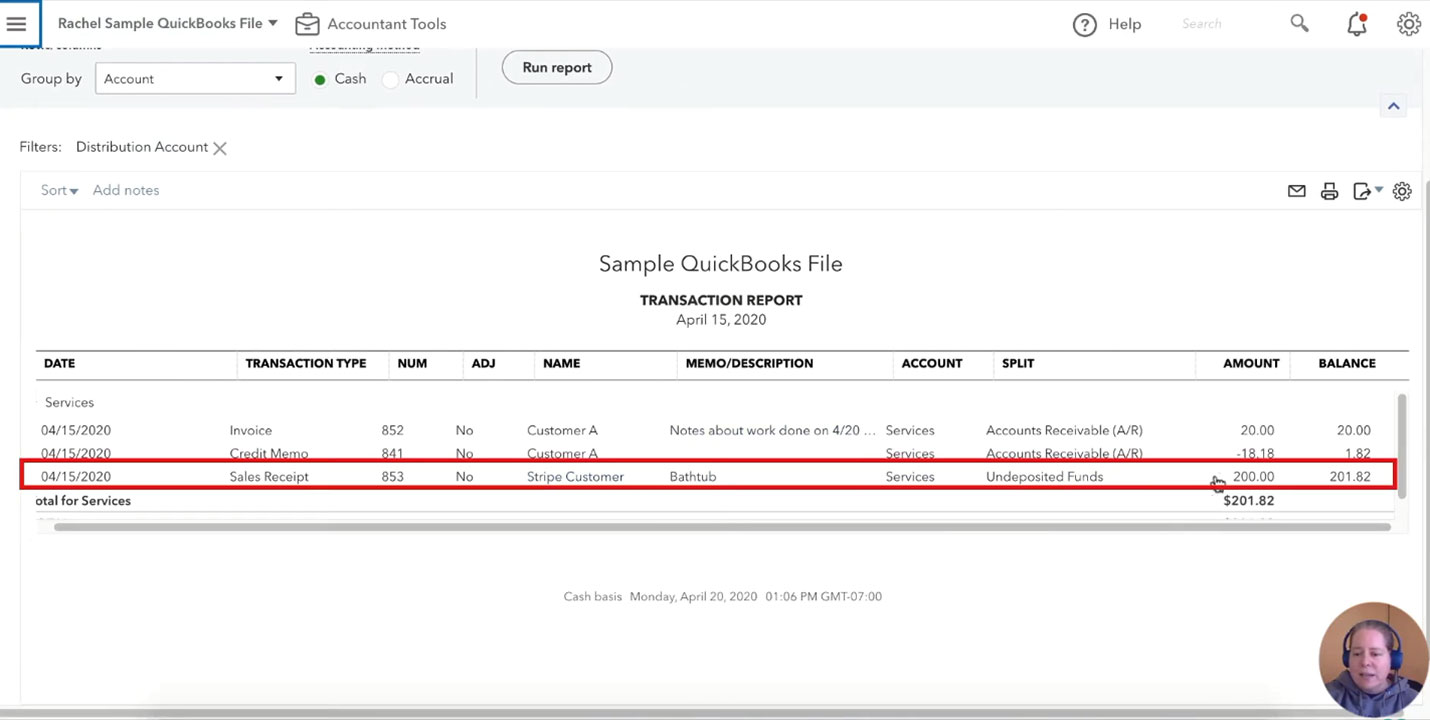

One of the key reporting features in QuickBooks is the ability to generate expense reports specifically focused on merchant fees. These reports provide a detailed breakdown of the costs associated with processing card payments, including interchange fees, assessment fees, processing fees, and other relevant expenses. By analyzing these reports, businesses can gain a comprehensive understanding of their payment processing costs and identify opportunities for cost optimization.

Furthermore, businesses can utilize QuickBooks’ customizable reporting tools to tailor the analysis of merchant fees based on specific parameters. For example, businesses can generate reports that segment merchant fees by payment processor, card network, transaction volume, or customer segments. This level of customization enables businesses to gain targeted insights into their payment processing expenses, facilitating strategic decision-making.

QuickBooks also offers features for comparative analysis, allowing businesses to compare merchant fees over different time periods, such as monthly, quarterly, or annually. This comparative analysis enables businesses to identify trends in their payment processing costs, pinpoint fluctuations, and assess the impact of operational changes on merchant fee expenses.

Additionally, businesses can integrate QuickBooks with business intelligence and analytics tools to further enhance the analysis of merchant fees. By leveraging advanced analytics platforms in conjunction with QuickBooks data, businesses can gain deeper insights into their payment processing expenses, identify correlations with other operational metrics, and derive actionable insights to optimize their financial strategies.

By harnessing QuickBooks’ reporting and analysis capabilities, businesses can gain a comprehensive understanding of their merchant fees, identify opportunities for cost optimization, and make data-driven decisions to enhance their payment processing efficiency. This proactive approach to reporting and analysis contributes to strategic financial management and empowers businesses to maximize the value of their payment processing activities.

Conclusion

Effectively managing and categorizing merchant fees in QuickBooks is a fundamental aspect of maintaining accurate financial records and gaining insights into the costs associated with processing card payments. By understanding the components of merchant fees, setting up merchant accounts, and leveraging QuickBooks’ categorization, recording, and reporting features, businesses can optimize their financial management strategies and make informed decisions based on comprehensive data.

Through a meticulous approach to categorizing merchant fees, businesses can establish a granular view of their payment processing expenses, allowing for targeted analysis and cost optimization. Custom categories and sub-accounts tailored to interchange fees, assessment fees, processing fees, and other components of merchant fees enable businesses to capture detailed insights into their payment processing costs, contributing to a comprehensive understanding of their financial landscape.

Recording merchant fees accurately in QuickBooks and reconciling transactions with bank and merchant account statements ensures the integrity of financial records and facilitates informed decision-making. The software’s batch recording functionality expedites the process of entering and categorizing merchant fees, saving time and enhancing operational efficiency.

Furthermore, QuickBooks’ reporting and analysis features empower businesses to generate comprehensive reports on merchant fees, analyze trends, and make data-driven decisions to optimize their payment processing strategies. Customizable reporting tools enable businesses to tailor their analysis based on specific parameters, facilitating targeted insights and strategic decision-making.

In conclusion, by harnessing the capabilities of QuickBooks for managing and analyzing merchant fees, businesses can enhance their financial management practices, identify opportunities for cost optimization, and make informed decisions to maximize the value of their payment processing activities. This proactive approach to financial management contributes to the overall efficiency and success of businesses in navigating the complexities of payment processing costs.