Home>Finance>Canceled Check Definition And How To Get A Copy

Finance

Canceled Check Definition And How To Get A Copy

Published: October 22, 2023

Learn what a canceled check is in finance and how to obtain a copy. Get the definition and find out the steps to get a copy of your canceled checks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Canceled Check?

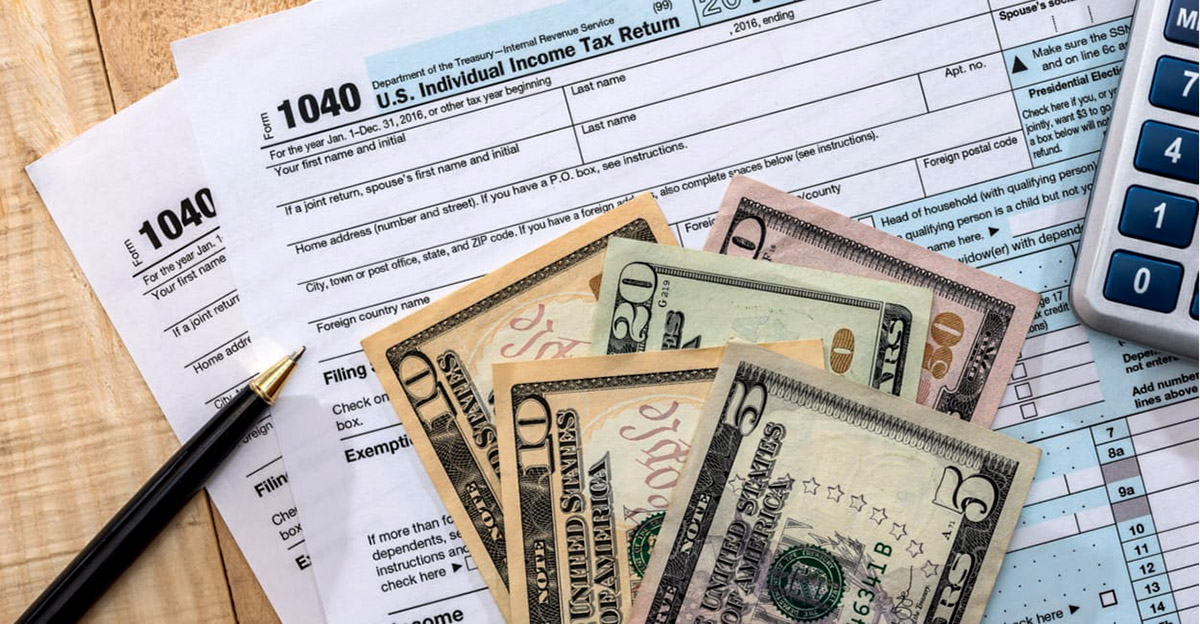

When it comes to managing your finances and keeping track of your expenses, canceled checks play an important role. But what exactly is a canceled check? In simple terms, a canceled check is a check that has been processed and cleared by the bank. Once a check is canceled, it cannot be cashed again, making it an essential proof of payment and a valuable financial record.

Key Takeaways:

- A canceled check is a check that has been processed and cleared by the bank.

- It serves as proof of payment and is a valuable financial record.

Why Are Canceled Checks Important?

Now that we know what a canceled check is, let’s explore why it is important to keep track of them:

- Proof of Payment: A canceled check serves as proof that you have made a payment to a specific individual or organization. It contains details such as the payee’s name, the payment amount, and the check number. In case of any disputes or misunderstandings, a canceled check can serve as evidence of the transaction.

- Record Keeping: Keeping a record of your canceled checks enables you to track your expenses and manage your finances effectively. By reviewing your canceled checks, you can identify any discrepancies, detect fraudulent activities, and have a clear understanding of your spending habits.

How to Get a Copy of a Canceled Check?

If you need a copy of a canceled check for any reason, here are a few steps you can follow:

- Contact Your Bank: The first step is to reach out to your bank and request a copy of the canceled check. Most banks offer online banking services, where you can access and download digital copies of canceled checks. Alternatively, you can visit the bank in person or call their customer service for assistance.

- Provide Relevant Information: In order to obtain a copy of a canceled check, you may need to provide specific details such as the date of the transaction, the check number, and the payee’s name. Make sure to have this information ready when contacting your bank.

- Pay a Fee: Depending on your bank’s policies, there might be a fee associated with obtaining a copy of a canceled check. Check with your bank regarding any applicable fees and payment methods.

- Keep Records: Once you have received a copy of the canceled check, it is important to store it in a safe place for future reference. Consider maintaining a digital or physical file to organize your canceled checks efficiently.

Conclusion

Canceled checks are essential financial records that serve as proof of payment and help in tracking expenses. Understanding what canceled checks are and how to obtain a copy is crucial for every individual or organization that aims to maintain accurate financial records. By keeping track of your canceled checks, you can ensure transparency in financial transactions and have peace of mind when it comes to managing your finances effectively.