Finance

Car Title Loan Defined

Published: October 23, 2023

Get the financial assistance you need with a car title loan. Our experts are ready to help you secure the funds you require quickly and easily. Apply today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Car Title Loan Defined: A Comprehensive Guide on Car Title Loans

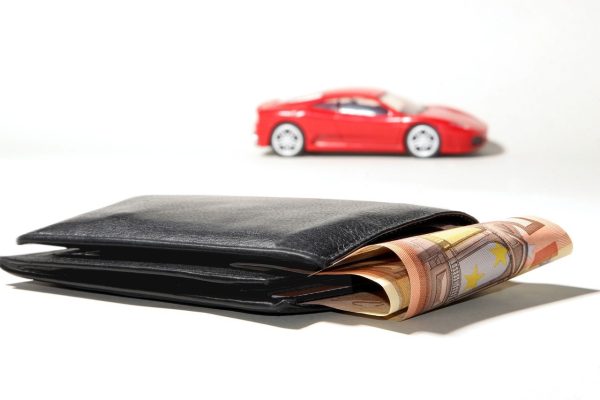

In the vast world of finance, there are several loan options available to individuals in need of quick cash. One such option is a car title loan which provides borrowers with a short-term loan using their vehicle title as collateral. If you’re looking for a detailed explanation of what a car title loan is and how it works, you’ve come to the right place. In this article, we will demystify the concept of car title loans and offer insights that will help you make an informed decision.

Key Takeaways:

- A car title loan is a short-term loan where a borrower uses their vehicle title as collateral.

- The loan amount is determined by the equity in the borrower’s vehicle and their ability to repay the loan.

What is a Car Title Loan?

A car title loan, also known as an auto title loan or pink slip loan, is a type of secured loan where the borrower uses their vehicle title as collateral. This type of loan is designed for individuals who need immediate access to cash but may not qualify for traditional bank loans due to poor credit history or financial constraints. With a car title loan, borrowers can access funds quickly by leveraging the value of their vehicle.

How Does a Car Title Loan Work?

The process of obtaining a car title loan typically involves the following steps:

- Application: The borrower completes an application form, providing information about their vehicle, such as the make, model, year, and mileage. They also need to provide proof of ownership of the vehicle by submitting the vehicle title.

- Vehicle Inspection: The lender may require a physical inspection of the vehicle to assess its condition and value. This step helps the lender determine the loan amount.

- Loan Approval: Once the application and vehicle inspection are complete, the lender reviews the borrower’s documentation and assesses their ability to repay the loan. If approved, the lender determines the loan amount based on the equity in the vehicle and the borrower’s financial situation.

- Loan Repayment: The borrower agrees to repay the loan according to the terms and conditions set by the lender. This typically includes making regular payments, including the principal amount borrowed and any interest or fees.

- Vehicle Ownership: During the loan repayment period, the lender holds onto the vehicle’s title. Once the loan is fully repaid, the lender releases the title back to the borrower.

Benefits and Considerations of Car Title Loans

Car title loans offer several benefits for individuals seeking quick access to cash, including:

- No Credit Check: Since car title loans are secured by collateral (the vehicle), lenders typically do not perform credit checks, making it an option for individuals with poor credit history.

- Fast Approval and Disbursement: Car title loans are known for their quick approval process, with funds often available within a day. This makes them a favorable choice for those needing immediate financial assistance.

- Flexible Loan Amounts: The loan amount is determined by the value of the borrower’s vehicle, allowing individuals to borrow amounts that meet their specific financial needs.

However, it is important to consider the following factors before deciding to pursue a car title loan:

- Repayment Terms: Car title loans often come with high interest rates and short repayment periods, making it crucial to assess your ability to repay the loan on time.

- Risk of Vehicle Repossession: If a borrower fails to repay the loan according to the agreed terms, the lender may repossess their vehicle and sell it to recover their funds.

In Conclusion

Car title loans can be a useful financial tool for individuals in need of immediate cash, especially for those with poor credit history. However, it is essential to consider the associated risks and repayment terms before opting for this type of loan. Understanding your financial situation and exploring other loan options can help you make an informed decision that aligns with your needs and goals.

Remember, always consult with qualified professionals or financial advisors to ensure that car title loans or any financial decision you make suit your specific circumstances.