Finance

Celler-Kefauver Act Definition

Published: October 25, 2023

Discover the meaning and significance of the Celler-Kefauver Act in the world of finance, its impact on mergers and acquisitions, and how it shaped the modern financial landscape.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the Celler-Kefauver Act: Preserving Competition in the Finance Industry

Welcome to our finance category blog post! Today, we will delve into the intricacies of the Celler-Kefauver Act, a significant piece of legislation that aims to preserve competition within the finance industry. Whether you’re a finance enthusiast or just curious about the regulatory measures put in place to ensure a fair marketplace, you’ve come to the right place. In this post, we’ll explore the definition of the Celler-Kefauver Act, its importance, and how it shapes the financial landscape.

Key Takeaways:

- The Celler-Kefauver Act was enacted in 1950 and is a cornerstone of antitrust legislation.

- It amends the Clayton Act, further preventing anti-competitive mergers and acquisitions.

Now, let’s dive into the details. The Celler-Kefauver Act, formally known as the Cellar-Kefauver Antimerger Act, was enacted in 1950 with the aim of strengthening antitrust laws in the United States. This legislation primarily amended the Clayton Act, further limiting anti-competitive practices in the marketplace, particularly concerning mergers and acquisitions.

But why is this act so crucial in the finance industry? Well, the finance sector plays a vital role in our economy, facilitating lending, investment, and capital allocation. The Celler-Kefauver Act ensures that competition remains robust in this sector, preventing dominant firms from stifling competition and potentially harming consumers.

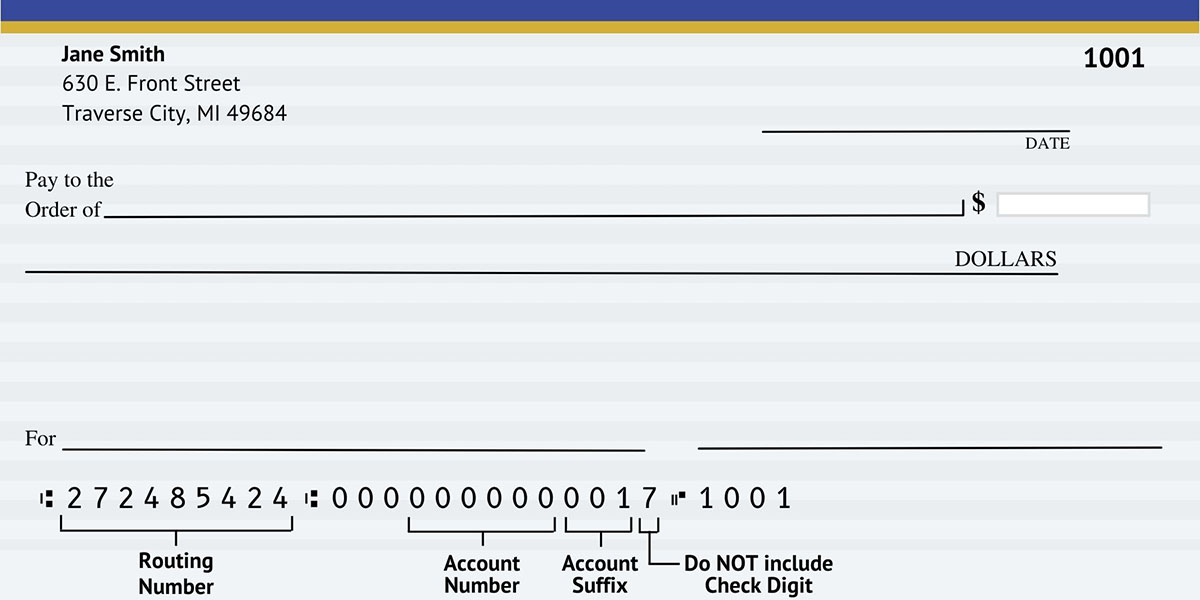

Under the Celler-Kefauver Act, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are empowered to scrutinize mergers and acquisitions, assessing their potential impact on competition. If a proposed transaction is deemed likely to substantially lessen competition, it may be challenged or blocked.

So, how does the Celler-Kefauver Act achieve its objectives? Here are a few notable provisions:

- Expanded Scope: The Celler-Kefauver Act expanded the definition of what constitutes a merger or acquisition, ensuring that potential anti-competitive transactions would not go unnoticed.

- No-Change-in-Control Test: Unlike the earlier Clayton Act, the Celler-Kefauver Act considers not only acquisitions involving a transfer of shares but also those where there is a substantial acquisition of assets or voting securities.

- Prevention of Dominant Mergers: This act explicitly prevents mergers or acquisitions that may result in a dominantly large corporation that could impede competition within a particular industry or market segment.

In essence, the Celler-Kefauver Act ensures that the finance industry remains competitive, fostering innovation, lower prices, and increased consumer choices. By carefully evaluating proposed mergers and acquisitions, antitrust regulators can prevent situations where a single company holds excessive market power, safeguarding the interests of both businesses and consumers.

In conclusion, the Celler-Kefauver Act is a fundamental part of antitrust legislation within the finance industry. By upholding competition and preventing anti-competitive mergers and acquisitions, this act serves to protect the marketplace and the individuals and businesses that participate in it. So, the next time you come across discussions on finance regulations, remember the Celler-Kefauver Act and its crucial role in maintaining a fair and dynamic finance sector.