Finance

Where Is No Sweat Insurance?

Published: November 18, 2023

Looking for No Sweat Insurance? Find the best deals and options for insurance at Finance, your one-stop destination for all your financial needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s fast-paced world, insurance has become an essential aspect of our lives. Whether it’s protecting our homes, cars, or health, insurance provides us with a sense of security and peace of mind. However, for some individuals, the process of obtaining insurance can be challenging and time-consuming. That’s where “No Sweat Insurance” comes into play.

No Sweat Insurance is a concept that aims to simplify the insurance process and make it hassle-free for individuals. It focuses on providing insurance coverage without the need for extensive paperwork, lengthy application processes, or complicated underwriting procedures. With No Sweat Insurance, individuals can obtain the coverage they need quickly and easily.

This innovative approach to insurance has gained significant attention in recent years, particularly among busy professionals and millennials who value convenience and efficiency. No Sweat Insurance recognizes the evolving needs of consumers and aims to meet those needs by offering a seamless insurance experience.

Unlike traditional insurance, which often requires extensive documentation, No Sweat Insurance streamlines the process by leveraging technology and digital platforms. This allows customers to complete the entire insurance application online, eliminating the need for physical paperwork and multiple in-person visits to insurance offices.

Furthermore, No Sweat Insurance aims to simplify the language and terms used in insurance policies. Traditional insurance policies are notorious for their complex language, making it challenging for individuals to understand the coverage they have and the process involved in filing a claim. No Sweat Insurance uses clear, concise language that enables policyholders to easily comprehend their coverage and deal with any claims.

Overall, No Sweat Insurance caters to the modern lifestyle, where convenience and efficiency are of utmost importance. It represents a paradigm shift in the insurance industry, offering a user-friendly, digitalized experience that saves time and effort for policyholders.

In the following sections, we will explore the demand for No Sweat Insurance, the challenges in implementing it, the current availability, potential solutions to expand its reach, and the benefits and limitations of this innovative approach to insurance.

Definition of No Sweat Insurance

No Sweat Insurance is a term used to describe a simplified and streamlined approach to insurance that aims to eliminate the complexities and frustrations often associated with traditional insurance processes. It is designed to provide individuals with a hassle-free and convenient insurance experience.

This concept focuses on removing obstacles and reducing the time and effort required to obtain insurance coverage. It leverages technological advancements and digital platforms to streamline the entire insurance process, from application to claims settlement.

No Sweat Insurance emphasizes quick and easy access to insurance policies without the need for extensive paperwork, lengthy application procedures, or complicated underwriting processes. It allows policyholders to apply for coverage online, eliminating the need for physical forms and multiple visits to insurance offices.

In addition to simplifying the application process, No Sweat Insurance also aims to make insurance policies easier to understand. Traditional insurance policies are often filled with complex language and legal jargon, making it difficult for policyholders to fully comprehend their coverage. No Sweat Insurance uses clear and concise language to ensure policyholders understand the terms and conditions of their policies.

Furthermore, No Sweat Insurance embraces the power of technology to enhance the insurance experience. It leverages data analytics to provide personalized insurance options based on an individual’s specific needs and preferences. It may also utilize artificial intelligence and automation to simplify the claims filing process and expedite claims settlement.

In essence, No Sweat Insurance puts the customer at the forefront by prioritizing convenience, transparency, and simplicity. It aims to revolutionize the insurance industry by providing individuals with a user-friendly and stress-free way to protect their assets and mitigate risks.

As the digital landscape continues to evolve and individuals seek more efficient and convenient solutions, No Sweat Insurance is emerging as a viable alternative to traditional insurance practices. Its focus on saving time, reducing paperwork, and simplifying complex terminology makes it an appealing choice for those looking to secure insurance coverage with minimal hassle.

In the next sections, we will delve into the demand for No Sweat Insurance, the challenges it faces in implementation, its current availability in the market, potential solutions for its expansion, and the benefits and limitations associated with this innovative insurance approach.

The Demand for No Sweat Insurance

In today’s fast-paced and technologically-driven society, there is a growing demand for insurance solutions that provide convenience, simplicity, and efficiency. This demand has given rise to the popularity of No Sweat Insurance.

One of the main driving factors behind the demand for No Sweat Insurance is the increasing reliance on digital platforms and technology. Individuals are accustomed to completing tasks online, whether it’s shopping, banking, or booking travel. They expect the same level of convenience and accessibility when it comes to insurance.

Traditional insurance processes often involve time-consuming paperwork, in-person visits to insurance offices, and complex underwriting procedures. This can be overwhelming and frustrating for individuals who have busy schedules and limited time. No Sweat Insurance addresses these concerns by offering an online application process that significantly reduces the time and effort required to obtain insurance coverage.

Furthermore, the use of clear and concise language in No Sweat Insurance policies resonates with customers who value transparency and understanding their insurance coverage. Traditional insurance policies are often filled with convoluted terminology, making it difficult for policyholders to grasp the details of their coverage. No Sweat Insurance simplifies the language used in policies, ensuring policyholders can easily comprehend their insurance terms and conditions.

Another factor contributing to the demand for No Sweat Insurance is the desire for personalized and tailored insurance solutions. Individuals want insurance coverage that is specific to their needs and preferences. No Sweat Insurance utilizes data analytics and technology to offer personalized insurance options, enabling individuals to select the coverage that suits their requirements.

Busy professionals and millennials, in particular, are drawn to the simplicity and efficiency of No Sweat Insurance. They value time-saving solutions that can be accessed at their convenience. With the ability to complete the entire insurance process online, from application to claims settlement, No Sweat Insurance caters to their needs and aligns with their digital lifestyles.

The demand for No Sweat Insurance is also influenced by the desire for a seamless and hassle-free claims experience. In traditional insurance processes, filing a claim can be a complex and time-consuming process. No Sweat Insurance aims to simplify this by leveraging automation and artificial intelligence to streamline the claims filing and settlement processes, ensuring that policyholders experience minimum disruptions and receive timely assistance when needed.

Overall, the demand for No Sweat Insurance arises from the need for a customer-centric and technologically advanced solution that simplifies the insurance experience. Its appeal lies in its ability to save time, provide clarity and transparency, offer personalized options, and deliver a stress-free claims process. As more individuals seek convenience and efficiency in their insurance interactions, the demand for No Sweat Insurance is likely to continue growing.

In the next sections, we will explore the challenges associated with implementing No Sweat Insurance, the current availability of this type of insurance in the market, potential solutions for expanding its reach, and the benefits and limitations it offers to policyholders.

Challenges in Implementing No Sweat Insurance

While No Sweat Insurance offers numerous benefits and addresses many pain points associated with traditional insurance, its implementation is not without its challenges. As with any innovative disruption to an established industry, there are several hurdles that need to be overcome for widespread adoption and success.

One of the primary challenges in implementing No Sweat Insurance is resistance from traditional insurance providers. The insurance industry has long operated under a certain set of processes and structures, which may be resistant to change. Adapting to a digitalized, streamlined approach like No Sweat Insurance may require significant investments in technology and infrastructure, as well as shifts in organizational culture. Convincing entrenched players to embrace this new paradigm can be a challenge.

Data privacy and security concerns also present a significant hurdle. No Sweat Insurance relies heavily on digital platforms and the collection and analysis of customer data to create personalized insurance solutions. However, this raises concerns about data privacy and the protection of sensitive information. Ensuring robust security measures are in place to safeguard customer data is crucial to gain trust and foster adoption among potential policyholders.

Regulatory compliance is another challenge in implementing No Sweat Insurance. The insurance industry is heavily regulated to protect consumers and ensure fair practices. Adhering to these regulations while offering a streamlined and digitally-driven experience can be complex. Insurers must navigate the regulatory landscape and ensure they meet all legal requirements while still providing a seamless user experience for customers.

Additionally, there may be challenges in achieving effective communication and understanding between customers and insurers with the simplified language used in No Sweat Insurance. While the intention is to make policies more accessible, there’s a risk of oversimplification, which could lead to misinterpretation or misunderstanding of coverage. Striking the right balance between clarity and completeness is essential to avoid potential disputes or dissatisfaction from policyholders.

Moreover, implementing No Sweat Insurance requires a significant investment in technology and infrastructure. Building and maintaining a robust online platform that can handle the influx of applications, facilitate smooth transactions, and provide prompt customer service requires financial resources and technical expertise. Insurers may need to partner with technology companies or invest in their own digital capabilities, which can be challenging, particularly for smaller insurance companies with limited resources.

Lastly, overcoming the challenge of customer mindset and trust is crucial. Traditional insurance processes have been ingrained in the minds of consumers, and convincing them to embrace a new approach can be a hurdle. Building trust in the digital process, securing customer data, and delivering on promises of convenience and efficiency are essential to overcome resistance and gain acceptance of No Sweat Insurance.

Despite these challenges, the potential benefits and demand for No Sweat Insurance make it a compelling proposition for insurers and customers alike. By addressing these challenges head-on and finding innovative solutions, insurance providers can effectively implement No Sweat Insurance and revolutionize the industry.

In the following sections, we will discuss the current availability of No Sweat Insurance, potential solutions for expanding its reach, and the benefits and limitations that policyholders may encounter with this innovative approach to insurance.

Current Availability of No Sweat Insurance

No Sweat Insurance, with its focus on simplifying and streamlining the insurance process, has gained traction in recent years. While it is still an emerging concept, there are already a number of insurance providers that have embraced this approach and offer No Sweat Insurance options to consumers.

These insurance providers, both established companies and startups, recognize the evolving needs and expectations of customers in the digital age and have developed innovative platforms and solutions to cater to them. They leverage technology and data analytics to provide a seamless and user-friendly insurance experience.

The availability of No Sweat Insurance varies across different insurance sectors. In the health insurance sector, for example, there are providers that offer online enrollment and a simplified claims process. Policyholders can apply for coverage online, submit claims through a mobile app, and receive prompt reimbursement without the need for extensive paperwork or manual intervention.

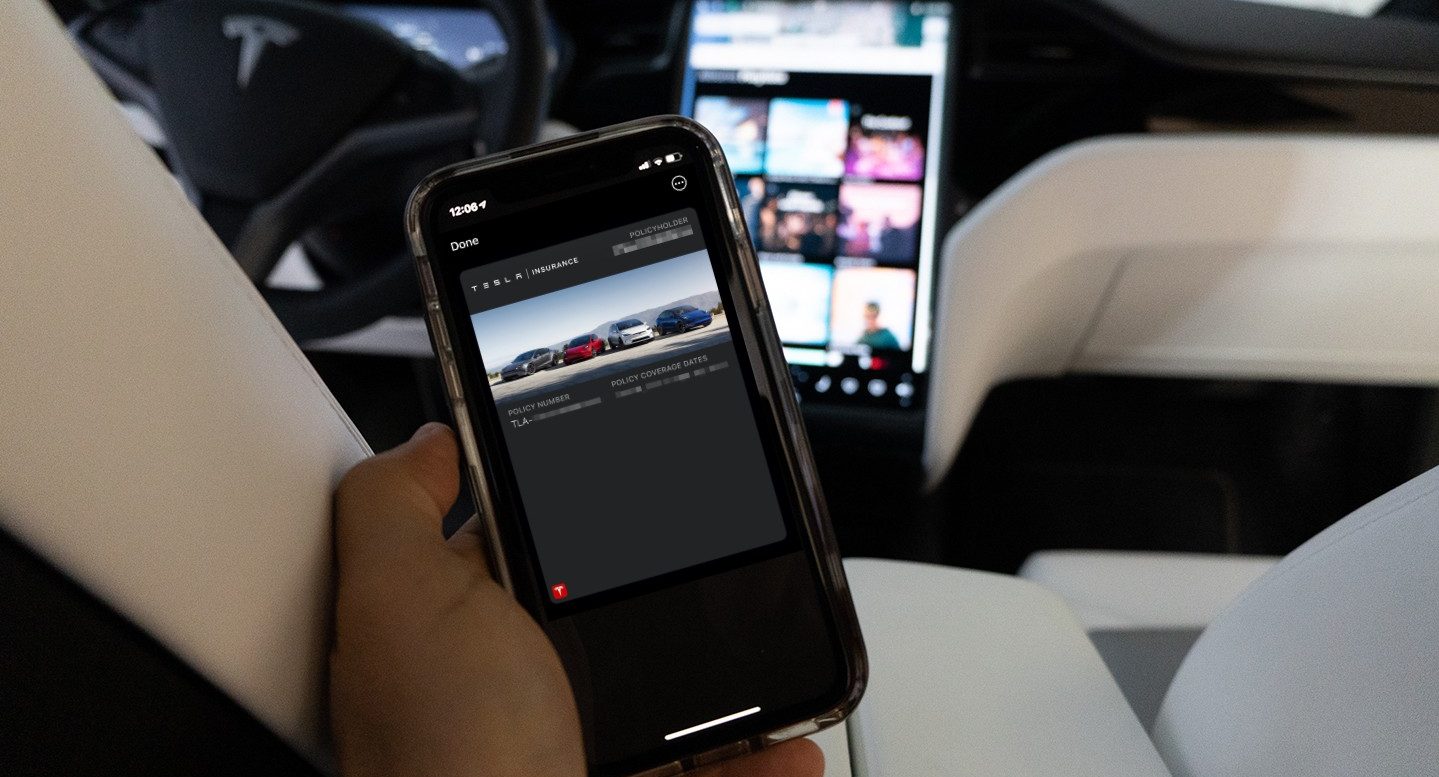

In the auto insurance sector, some companies offer usage-based insurance, where premiums are calculated based on actual driving behavior and data collected through telematics devices or smartphone apps. This not only provides a more personalized insurance experience but also eliminates the hassle of obtaining quotes and filling out lengthy applications.

Similarly, in the home insurance sector, there are insurers that allow policyholders to obtain quotes and purchase coverage directly through their websites or mobile apps. The use of digital platforms streamlines the application process and eliminates the need for face-to-face interactions.

Additionally, some insurtech startups have entered the market with a specific focus on simplifying the insurance process. These companies leverage innovative technologies such as artificial intelligence and machine learning to automate underwriting and claims processes, reducing the time and effort required from policyholders. They offer transparent and easy-to-understand policies, enabling customers to make informed decisions about their coverage.

While the availability of No Sweat Insurance is growing, it is important to note that it may still be limited in certain regions or insurance sectors. The adoption of this innovative approach takes time and requires investment and collaboration among insurers, technology providers, and regulatory bodies. However, as the demand for convenience and efficiency in insurance continues to rise, it is expected that the availability and accessibility of No Sweat Insurance will expand in the coming years.

Consumers can explore the options available to them by researching insurance providers that prioritize a streamlined and user-friendly experience. Comparison websites and online insurance marketplaces can also assist in identifying insurers that offer No Sweat Insurance options.

In the next section, we will discuss potential solutions for expanding the reach of No Sweat Insurance to meet the growing demand and address the challenges associated with its implementation.

Potential Solutions to Expand No Sweat Insurance

To meet the increasing demand for No Sweat Insurance and overcome the challenges in its implementation, several potential solutions can be considered. These solutions aim to expand the availability and accessibility of this simplified and streamlined approach to insurance.

1. Collaboration between traditional insurers and insurtech companies: Traditional insurers can partner with insurtech startups to leverage their technological expertise and innovation in the insurance industry. This collaboration can lead to the development of digital platforms and tools that enable a seamless and user-friendly insurance experience. By combining the resources and industry knowledge of traditional insurers with the technological advancements of insurtech companies, No Sweat Insurance can be expanded faster and more effectively.

2. Regulatory support and encouragement: Government and regulatory bodies play a vital role in facilitating the growth of No Sweat Insurance. By providing clear guidelines and regulations that support digitalization and innovation in the insurance industry, policymakers can encourage insurers to adopt and develop No Sweat Insurance solutions. This support can help overcome regulatory compliance challenges and create an enabling environment for the expansion of No Sweat Insurance.

3. Customer education and awareness: Enhancing customer awareness and understanding of No Sweat Insurance is crucial for its widespread adoption. Insurance providers can invest in educational campaigns to educate consumers about the benefits and advantages of No Sweat Insurance. Clear and transparent communication regarding the simplified process, reduced paperwork, and digital access to insurance services can help in building trust and gaining acceptance from potential policyholders.

4. Seamless integration of technology: Technology integration is a key aspect of No Sweat Insurance. Insurance providers should focus on ensuring a seamless and intuitive digital experience for customers. This can include user-friendly interfaces, mobile apps, and automated processes that simplify policy management, claims filing, and communication with policyholders. By continuously improving and refining the technological infrastructure, insurers can enhance the convenience and accessibility of No Sweat Insurance.

5. Collaboration with data analytics companies: Data analytics plays a significant role in providing personalized insurance solutions. Insurers can collaborate with data analytics companies to leverage customer data effectively and offer tailored coverage options. Advanced analytics models can be used to analyze customer behavior, risk profiles, and market trends, allowing insurers to provide more accurate and competitive premiums based on individual needs and preferences.

6. Partnerships with digital platforms: Collaborating with digital platforms, such as e-commerce websites, fintech platforms, or insurance aggregators, can expand the reach of No Sweat Insurance to a wider customer base. By integrating No Sweat Insurance options into these existing platforms, insurers can tap into the existing user base and provide a seamless insurance experience to customers who are already familiar with those platforms.

7. Continued innovation and adaptation: The insurance industry is constantly evolving, and insurers need to continuously innovate and adapt to meet changing customer needs. This includes keeping pace with emerging technologies, being open to new business models, and regularly refining No Sweat Insurance offerings based on customer feedback and market trends. By staying agile and responsive, insurers can provide an insurance experience that truly meets the demands of modern consumers.

By implementing these potential solutions, the availability and accessibility of No Sweat Insurance can be expanded, making it a more prevalent and preferred option for individuals seeking a simplified and user-friendly insurance experience.

In the next section, we will explore the benefits and limitations of No Sweat Insurance to provide a comprehensive understanding of its impact on policyholders.

Benefits and Limitations of No Sweat Insurance

No Sweat Insurance offers several benefits that make it an attractive option for policyholders seeking a simplified and streamlined insurance experience. However, it also has its limitations. Let’s explore the benefits and limitations of No Sweat Insurance.

Benefits:

- Convenience: No Sweat Insurance eliminates the need for extensive paperwork and in-person visits to insurance offices. Policyholders can apply for coverage, make changes to their policies, and file claims online from the comfort of their homes or on-the-go, providing convenience and saving time.

- Simplified Language: No Sweat Insurance utilizes clear and concise language in policy documents, making it easier for policyholders to understand their coverage. This increased transparency helps individuals make informed decisions about their insurance and reduces the likelihood of disputes due to misunderstood terms and conditions.

- Data-driven Personalization: With No Sweat Insurance, insurers utilize data analytics to offer personalized insurance options. Policyholders can receive tailored coverage based on their specific needs, resulting in more accurate and competitive premiums.

- Faster Claims Processing: No Sweat Insurance leverages technology to automate claims processes, enabling faster claims filing and settlement. Policyholders can submit claims online and track their progress in real-time, eliminating the need for lengthy paperwork and reducing the time it takes for claims to be processed.

- Improved Customer Experience: No Sweat Insurance aims to provide a user-friendly and seamless insurance experience. By offering intuitive online platforms, prompt customer service, and simplified processes, insurers can enhance customer satisfaction and loyalty.

Limitations:

- Loss of Personal Touch: By relying heavily on digital platforms and automation, No Sweat Insurance may lack the personal touch that some individuals prefer in their insurance interactions. The absence of face-to-face interactions with insurance agents may lead to a perceived loss of personalized advice and guidance.

- Data Privacy Concerns: No Sweat Insurance heavily relies on the collection and analysis of customer data to provide personalized options and streamline processes. This raises concerns about data privacy and security. Insurers must ensure robust measures are in place to protect sensitive customer information and gain the trust of policyholders.

- Exclusion of Complex Policies: No Sweat Insurance may be better suited for straightforward insurance products, such as auto or home insurance, where risks are relatively standardized. Complex policies requiring extensive underwriting and risk assessment may be more difficult to simplify and offer in a streamlined manner.

- Technical Challenges: Implementing and maintaining the necessary technology infrastructure for No Sweat Insurance can be challenging. Insurers need to invest in robust online platforms, mobile applications, and IT systems to provide a seamless digital experience. Smaller insurance companies with limited resources may find it more difficult to overcome these technical challenges.

- Regulatory Compliance: No Sweat Insurance must adhere to regulatory requirements to protect consumer rights and ensure fair practices. Striking a balance between providing a simplified insurance experience and complying with complex regulations can be a challenge for insurers.

While No Sweat Insurance offers significant benefits, it is important for individuals to consider their specific insurance needs and preferences. Some individuals may value the convenience and efficiency of No Sweat Insurance, while others may prefer a more traditional, hands-on approach. Understanding both the benefits and limitations of No Sweat Insurance can help individuals make informed decisions regarding their insurance coverage.

In the concluding section, we will summarize the key points discussed throughout this article and emphasize the potential impact of No Sweat Insurance on the insurance industry.

Conclusion

No Sweat Insurance represents a significant shift in the insurance industry, catering to the evolving needs and expectations of customers in the digital age. This innovative concept offers a simplified and streamlined insurance experience, reducing paperwork, enhancing convenience, and leveraging technology to provide personalized coverage options.

The demand for No Sweat Insurance is driven by individuals seeking a hassle-free and efficient way to obtain and manage their insurance coverage. The convenience of online applications, simplified policy language, and faster claims processing resonates with busy professionals and millennials who value time-saving solutions and digital accessibility.

However, implementing No Sweat Insurance comes with challenges. Resistance from traditional insurance providers, data privacy concerns, regulatory compliance, and technical hurdles must be overcome for widespread adoption. Close collaboration between insurers and insurtech companies, regulatory support, and continuous innovation can help expand the availability and accessibility of No Sweat Insurance.

Despite limitations such as the potential loss of personal touch and the need to strike a balance between simplicity and comprehensive coverage, the benefits of No Sweat Insurance are substantial. Convenience, transparency, personalized options, and improved customer experience are just a few advantages that make it an appealing option for policyholders.

As insurers embrace digitalization and technology, No Sweat Insurance has the potential to transform the insurance landscape. By offering user-friendly experiences, leveraging data analytics, and providing seamless solutions, insurance providers can meet the rising demand for a simplified and streamlined insurance process.

While No Sweat Insurance is still an emerging concept, the market is gradually adapting to this new approach. The continued evolution of insurance offerings and the integration of technology will shape the future of insurance, and No Sweat Insurance is poised to play a significant role in this transformation.

As consumers seek convenience, efficiency, and personalized experiences in insurance, it is expected that the availability and accessibility of No Sweat Insurance will continue to grow. By addressing challenges, focusing on customer needs, and staying ahead of technological advancements, insurers can provide policyholders with the seamless and hassle-free insurance experience they desire.

In summary, No Sweat Insurance offers a promising alternative to traditional insurance processes, simplifying the insurance journey and enhancing customer satisfaction. As the insurance industry embraces digitalization and customer-centric approaches, No Sweat Insurance will continue to evolve, reshape the industry, and ultimately improve the way individuals protect their assets and mitigate risks.