Finance

Channeling Definition

Published: October 26, 2023

Learn about the meaning and importance of channeling in finance, and how it can impact your investment strategy. Find out how to effectively utilize channels for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Finance: A Guide to Mastering Your Money

Finance is a fundamental aspect of our daily lives, yet many people find it intimidating and complex. Whether you’re just starting your financial journey or looking to enhance your money management skills, this blog post is here to help you navigate the world of finance with ease.

Key Takeaways:

- Finance plays a crucial role in managing personal and business finances.

- By understanding key financial concepts and strategies, you can make informed decisions for a secure financial future.

So, what exactly is finance? At its core, finance encompasses the management, creation, and study of money, investments, and various financial instruments. It is all about allocating resources, making sound investment decisions, and controlling monetary risks to achieve financial goals.

With that in mind, let’s delve into the essentials of finance that can help you gain a better understanding of how money works and how you can optimize your financial well-being.

The Basics of Personal Finance

Personal finance focuses on managing your individual or household finances. It involves planning, budgeting, saving, and investing to meet your financial goals and lead a financially secure life. Here are some key aspects of personal finance:

- Budgeting: Create a budget to track your expenses and income. This will help you identify areas where you can save and prioritize your spending.

- Saving: Develop a savings strategy and set aside money for emergencies, future goals, and retirement.

- Investing: Learn about different investment opportunities, such as stocks, bonds, real estate, or mutual funds. Make informed decisions to grow your wealth over time.

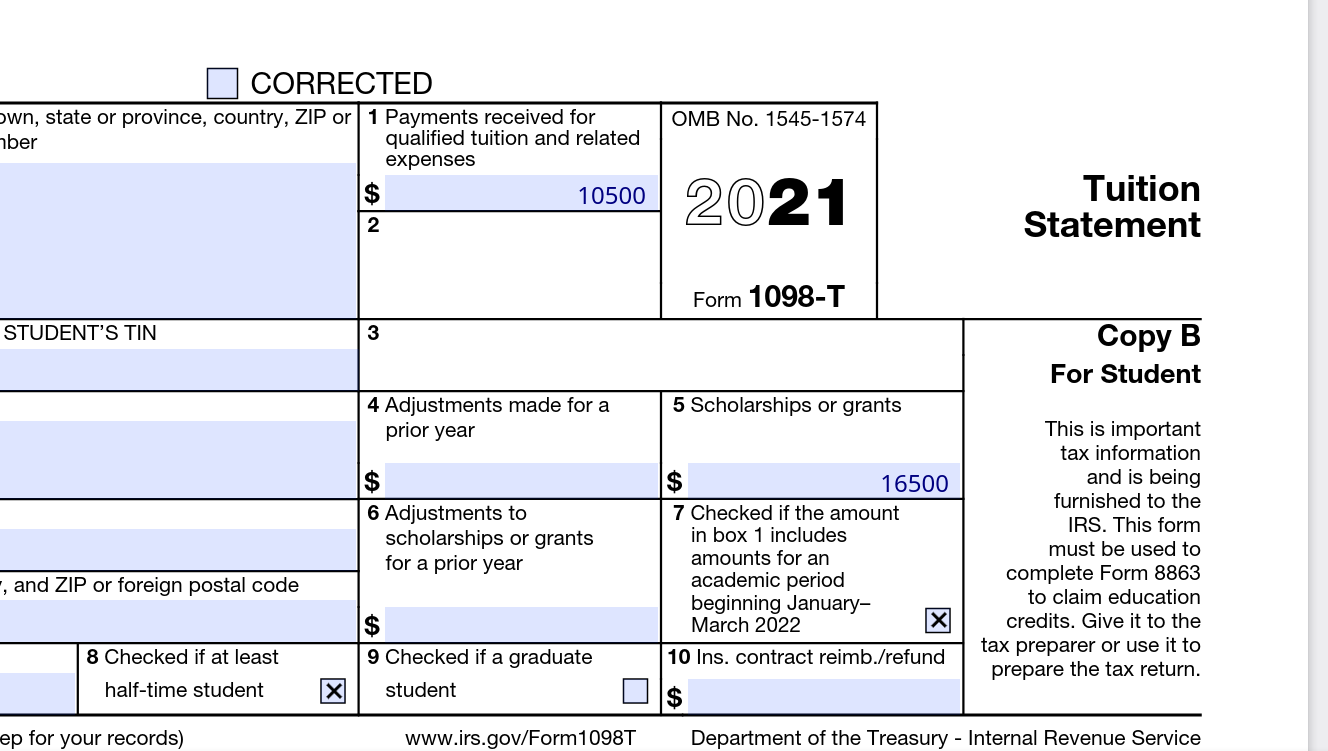

- Debt Management: Understand how to effectively manage and pay off debts, such as credit card balances, student loans, and mortgages.

- Insurance: Protect yourself and your assets by having the right insurance coverage, such as health insurance, auto insurance, or homeowner’s insurance.

The World of Corporate Finance

Corporate finance deals with the financial activities of corporations and businesses. It involves raising capital, making investment decisions, and managing financial risks. If you’re interested in understanding the world of corporate finance, here are some key areas to explore:

- Capital Budgeting: Evaluate investment opportunities and decide how to allocate funds within a company.

- Financial Analysis: Analyze financial statements, ratios, and trends to assess the financial health and performance of a company.

- Debt and Equity Financing: Understand the various methods companies use to raise capital, such as taking on loans or issuing stocks and bonds.

- Risk Management: Identify and mitigate financial risks, including interest rate risks, market risks, and operational risks.

- Mergers and Acquisitions: Learn about the financial aspects involved in acquiring or merging with other companies.

Mastering Finance for a Secure Future

Now that you have a glimpse into the vast domain of finance, it’s important to remember that financial literacy is a journey. Stay curious, educate yourself about financial concepts, and seek professional advice when needed. By taking control of your finances and making informed decisions, you can pave the way for a prosperous and secure future.

Key Takeaways:

- Finance encompasses the management, creation, and study of money and investments.

- Understanding personal finance helps with budgeting, saving, investing, debt management, and insurance.

- Corporate finance focuses on capital budgeting, financial analysis, financing methods, risk management, and mergers and acquisitions.

So why wait? Start your financial journey today and unlock the power of finance to achieve your goals and secure your financial future!