Home>Finance>What Will The Cost Of Equity Be If The Firm Switches To The Leveraged Capital Structure

Finance

What Will The Cost Of Equity Be If The Firm Switches To The Leveraged Capital Structure

Published: December 25, 2023

Explore how the firm's cost of equity may change with a switch to a leveraged capital structure in the field of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cost of Equity

- Explanation of Leveraged Capital Structure

- Implications of Switching to a Leveraged Capital Structure

- Factors Influencing the Cost of Equity

- Calculation of Cost of Equity Before the Switch

- Calculation of Cost of Equity After the Switch

- Comparison of the Two Cost of Equity Figures

- Conclusion

Introduction

Welcome to our comprehensive guide on understanding the cost of equity and the implications of switching to a leveraged capital structure. In the world of finance, companies often face important decisions regarding their capital structure, which refers to how a firm finances its operations through a mix of debt and equity. While debt financing is common, it also carries certain risks and costs. One crucial aspect of capital structure is the cost of equity, which represents the return that investors expect to receive for bearing the risk of owning a company’s stock.

The cost of equity plays a significant role in a company’s financial decision-making process, as it directly impacts the cost of capital, valuation, and overall business operations. When a firm decides to switch to a leveraged capital structure, meaning it increases its use of debt, it can have important implications for its cost of equity and the overall risk profile of the company.

In this article, we will delve into the concept of cost of equity and explore the potential effects of transitioning to a leveraged capital structure. Additionally, we will analyze the factors that influence the cost of equity and provide a step-by-step calculation of the cost of equity both before and after the switch.

By understanding the intricacies of the cost of equity and the impact of a leveraged capital structure, companies can make informed decisions that optimize their capital structure and drive growth and profitability. So, let’s dive into the fascinating field of finance and explore the cost of equity and its relationship with a leveraged capital structure.

Definition of Cost of Equity

The cost of equity refers to the rate of return that investors require to invest in a company’s common stock. It represents the potential return on investment necessary to compensate shareholders for the level of risk associated with owning the company’s equity.

Equity financing allows companies to raise capital by selling shares of ownership in the company to investors. Unlike debt financing, which involves borrowing money and paying interest, equity financing does not require repayment of principal or interest. Instead, equity investors become partial owners of the company and share in its profits and losses.

The cost of equity is important for companies to determine their expected return on equity and make informed decisions about capital allocation and investment opportunities. It is also used as a benchmark for evaluating the performance of a company’s management and assessing the attractiveness of investing in its stock.

The cost of equity is influenced by several factors, including the company’s risk profile, the expected return of the overall market, and the company’s past performance. Investors generally demand a higher return for investing in riskier stocks or companies with a history of underperformance.

There are various methods to calculate the cost of equity, including the dividend discount model (DDM), the capital asset pricing model (CAPM), and the earnings capitalization model (ECM). These models take into account factors such as dividends, stock price volatility, and market risk to estimate the appropriate rate of return.

Ultimately, the cost of equity is a crucial element in determining a company’s overall cost of capital and plays a significant role in investment decision-making. By understanding and accurately calculating the cost of equity, companies can evaluate the feasibility of new projects, make strategic investment decisions, and attract and retain investors.

Explanation of Leveraged Capital Structure

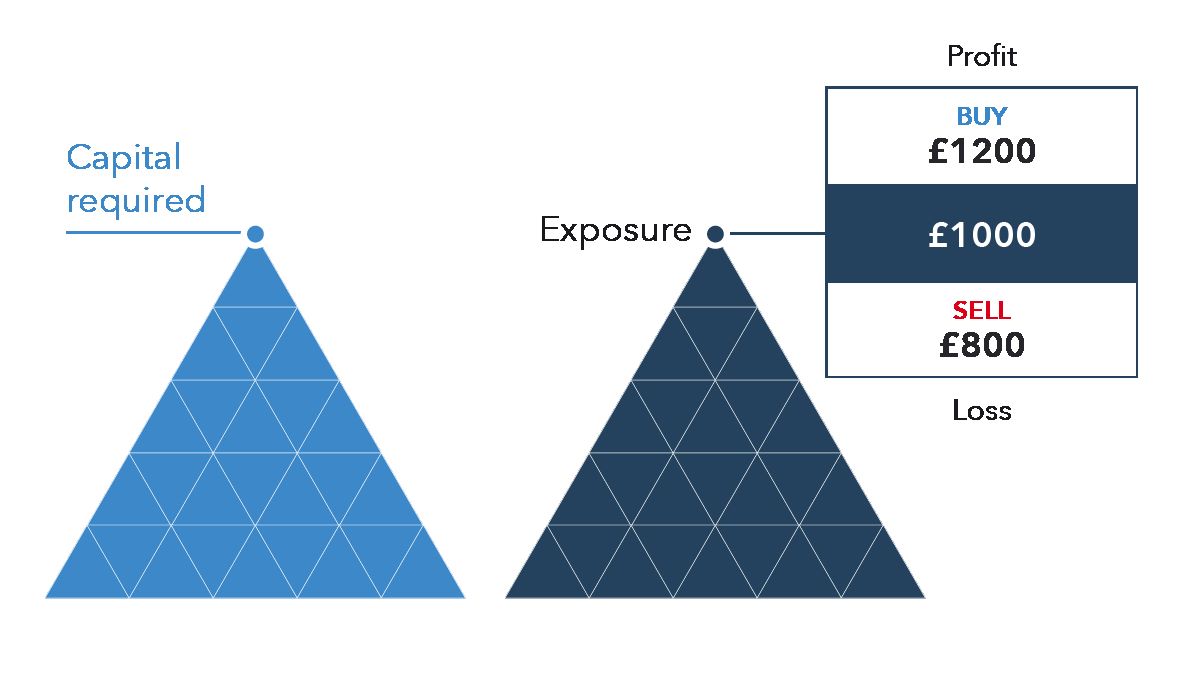

A company’s capital structure refers to the way it finances its operations through a combination of debt and equity. A leveraged capital structure, also known as a highly leveraged or debt-heavy structure, indicates that a significant portion of the company’s financing comes from debt.

When a company employs a leveraged capital structure, it increases its reliance on debt financing to fund its operations and investments. This can be achieved through various forms of debt, such as bank loans, corporate bonds, or other financial instruments. By taking on more debt, a company can benefit from the potential tax advantages of interest expense deductibility, as well as potentially increase shareholders’ returns through the use of leverage.

A key characteristic of a leveraged capital structure is that it amplifies the potential returns for equity investors but also increases the associated risks. By using debt, a company magnifies its financial leverage, meaning that a small change in income can have a substantial impact on equity returns. In other words, the returns for equity investors become more volatile as a result of the increased financial risk.

While a leveraged capital structure can enhance equity returns when things go well, it also poses risks during challenging times. If a company faces financial difficulties or experiences a decline in earnings, the burden of debt servicing becomes more challenging, potentially putting the company at risk of default. This risk is particularly significant if the company’s earnings are not sufficient to cover the interest expenses on the debt.

Companies must carefully assess the advantages and disadvantages of a leveraged capital structure. On the one hand, it may provide opportunities for higher returns on equity and tax advantages. On the other hand, it exposes the company to higher financial risks and potentially limits its financial flexibility.

It is important to note that the optimal capital structure for a company depends on various factors, including industry dynamics, the company’s risk appetite, its growth prospects, and the current economic conditions. A thorough analysis of these factors is essential to determine the most appropriate capital structure for a company and ensure its long-term financial stability and success.

Implications of Switching to a Leveraged Capital Structure

Switching to a leveraged capital structure can have significant implications for a company. While it may offer potential benefits, such as increased returns on equity and tax advantages, it also introduces additional risks and considerations that need to be carefully evaluated.

1. Increased financial risk: By relying more on debt financing, a company exposes itself to higher financial risk. This is because debt comes with fixed interest payments that need to be met, regardless of the company’s financial performance. If the company faces economic downturns or experiences a decline in revenue, it may struggle to meet its debt obligations, potentially leading to financial distress or even bankruptcy.

2. Higher interest expenses: A leveraged capital structure invariably means higher interest expenses. This can put pressure on a company’s cash flow, diverting funds that could have been used for other purposes such as research and development, marketing, or expansion. It is crucial for companies to carefully analyze whether the anticipated benefits of leveraging outweigh the increased interest costs.

3. Impact on credit ratings: A higher level of debt can negatively impact a company’s credit rating. Rating agencies assess the financial health and creditworthiness of companies, and a higher debt-to-equity ratio can result in a downgrade of the company’s credit rating. This, in turn, can increase the cost of borrowing and limit access to future financing options.

4. Shareholder expectations: When a company switches to a leveraged capital structure, it is essentially signaling to investors that it is willing to take on higher risk to potentially generate higher returns on equity. This can impact investor expectations for future dividends and capital appreciation. Shareholders may expect higher dividends or a faster growth rate to compensate for the increased risk they are assuming.

5. Limited financial flexibility: A higher level of debt can limit a company’s financial flexibility. With more financial obligations, the company may have less ability to invest in new projects, pursue strategic opportunities, or weather unexpected financial challenges. It is important for companies to carefully analyze their cash flow projections and ensure that they can comfortably meet their debt obligations while also retaining sufficient financial flexibility.

Companies considering a switch to a leveraged capital structure should conduct a thorough analysis of their financial situation, risk tolerance, and growth prospects. It is essential to assess the potential benefits and risks of leveraging and consider alternative financing options. Engaging the expertise of financial advisors can be advantageous in evaluating the implications of this strategic decision and ensuring it aligns with the company’s long-term goals and objectives.

Factors Influencing the Cost of Equity

The cost of equity is influenced by several factors that investors consider when assessing the risk and potential return of investing in a company’s stock. Understanding these factors is crucial for accurately estimating the cost of equity and making sound financial decisions. Here are some key factors that influence the cost of equity:

1. Risk-free rate of return: The risk-free rate refers to the hypothetical rate of return on an investment that carries no risk. Typically, it is based on the yield of government bonds, such as U.S. Treasury bonds. The higher the risk-free rate, the higher the cost of equity, as investors will demand a greater return for taking on the risk of investing in stocks rather than risk-free assets.

2. Equity risk premium: The equity risk premium is the additional return that investors require to invest in stocks instead of risk-free assets. It compensates investors for the greater volatility and uncertainty associated with stock investments. The equity risk premium is influenced by factors such as economic conditions, market sentiment, and investor expectations.

3. Beta: Beta measures the sensitivity of a company’s stock price to fluctuations in the overall market. It represents the systematic risk of the stock. A beta greater than 1 indicates that the stock is more volatile than the overall market, while a beta less than 1 suggests that the stock is less volatile. The higher the beta, the higher the cost of equity, as investors demand a greater return for bearing higher market risk.

4. Company-specific risk: Apart from market risk, the cost of equity also reflects the specific risks associated with a particular company. Factors such as the company’s financial health, competitive position, industry dynamics, management quality, and growth prospects all contribute to the company-specific risk premium. A riskier company is likely to have a higher cost of equity.

5. Dividend policy: A company’s dividend policy, including the amount and consistency of dividend payments, can influence the cost of equity. Companies that have a history of paying steady and increasing dividends are often perceived as more stable and attractive to investors, resulting in a lower cost of equity. Conversely, companies with irregular or no dividend payments may have a higher cost of equity.

6. Market conditions: Market conditions, such as economic growth, inflation rates, interest rates, and investor sentiment, can also impact the cost of equity. During periods of economic expansion and optimism, investors may demand a lower cost of equity, reflecting a lower risk perception. Conversely, during periods of economic uncertainty or recession, investors may demand a higher cost of equity to compensate for the perceived increase in risk.

It is important for companies to carefully consider these factors when estimating and evaluating their cost of equity. A comprehensive analysis of these factors can help companies understand the expectations of investors and make informed decisions regarding their capital structure, investment projects, and overall financial strategies.

Calculation of Cost of Equity Before the Switch

Calculating the cost of equity before a company switches to a leveraged capital structure is essential for understanding the baseline return that investors expect. While there are various methods to calculate the cost of equity, one commonly used approach is the Capital Asset Pricing Model (CAPM).

The CAPM is based on the principle that the cost of equity is determined by the risk-free rate of return, the equity risk premium, and the company’s systematic risk (measured by its beta). Here’s how to calculate the cost of equity using the CAPM:

- Determine the risk-free rate: Start by identifying the risk-free rate, typically based on government bond yields. For instance, if the risk-free rate is 3%, this represents the return an investor would expect to receive without taking on any investment risk.

- Estimate the equity risk premium: The equity risk premium represents the additional return investors demand for investing in stocks instead of risk-free assets. It varies depending on market conditions, but a commonly used estimate is around 6% to 8%.

- Calculate the company’s beta: Beta measures the sensitivity of a company’s stock price to market fluctuations. A beta of 1 indicates that the stock moves in line with the overall market, while a beta greater than 1 means the stock is more volatile. Use financial databases or regression analysis to determine the company’s beta.

- Apply the CAPM formula: Use the following formula to calculate the cost of equity before the switch:

Cost of Equity = Risk-Free Rate + (Beta x Equity Risk Premium)

For example, if the risk-free rate is 3%, the equity risk premium is 7%, and the company’s beta is 1.2, the calculation would be:

Cost of Equity = 3% + (1.2 x 7%) = 11.4%

By following the CAPM methodology, companies can estimate the cost of equity before transitioning to a leveraged capital structure. This figure represents the expected return that shareholders require for investing in the company’s equity without considering the influence of debt. It serves as a benchmark for evaluating the potential benefits and risks associated with implementing a leveraged capital structure.

Calculation of Cost of Equity After the Switch

When a company switches to a leveraged capital structure, it introduces additional financial risk that can impact the cost of equity. The cost of equity after the switch takes into account the effects of increased leverage on the company’s risk profile. While the calculation will still involve the same factors as before the switch, the inputs will be adjusted to reflect the new capital structure.

To calculate the cost of equity after the switch, you will need to consider the following steps:

- Estimate the new beta: With the higher level of debt in the capital structure, the company’s systematic risk may change. As debt introduces additional financial risk, the beta is likely to increase. Adjust the beta accordingly to reflect the anticipated change in systematic risk.

- Recalculate the risk-free rate: The risk-free rate remains the same as before the switch, as it represents the hypothetical return on risk-free assets. However, it is important to ensure that the risk-free rate used is still relevant and in line with market conditions.

- Consider changes in the equity risk premium: Switching to a leveraged capital structure may influence investor perceptions of risk. If the increased debt makes the company riskier, it may lead to a higher equity risk premium. Conversely, if the company is able to leverage effectively and reduce other risks, the equity risk premium may decrease. Assess the new equity risk premium based on the company’s revised risk profile.

- Apply the CAPM formula: Use the same formula as before, Cost of Equity = Risk-Free Rate + (Beta x Equity Risk Premium), but with the adjusted inputs reflecting the post-switch capital structure. Calculate the cost of equity using the new beta, risk-free rate, and equity risk premium.

By recalculating the cost of equity after the switch, companies can evaluate the potential impact of the leveraged capital structure on the required return that investors expect. This revised figure represents the updated cost of equity, factoring in the increased risk associated with the higher debt levels. It helps companies assess the feasibility and risk-reward trade-offs associated with their new capital structure.

Comparison of the Two Cost of Equity Figures

Comparing the cost of equity figures before and after the switch to a leveraged capital structure is crucial to determine the impact of the capital structure change on the required return that investors expect. By comparing these figures, companies can evaluate the potential benefits and risks associated with the switch and make informed financial decisions. Here are some considerations when comparing the two cost of equity figures:

1. Magnitude of change: Assess the magnitude of the change in the cost of equity between the two figures. If the cost of equity significantly increases after the switch, it indicates that the leveraged capital structure has introduced higher risk and expectations among shareholders. Conversely, if the cost of equity decreases or remains relatively stable, it suggests that the company has successfully managed its risk and potential return to maintain investor confidence.

2. Impact on cost of capital: The cost of equity is a component of the cost of capital, which represents the overall financing cost for a company. Compare how the switch to a leveraged capital structure affects the cost of capital. If the cost of equity increases, it may contribute to a higher cost of capital. This, in turn, may have implications for the company’s investment decisions, valuation, and overall financial performance.

3. Investor perception of risk: Consider the implications of the cost of equity figures on investor perception of risk. A significant increase in the cost of equity after the switch may signal to investors that the company has become riskier and that they now require a higher return to compensate for the additional risk. This can impact the attractiveness of the company’s stock and potentially affect its ability to raise capital or attract new investors.

4. Alignment with financial goals: Evaluate the cost of equity figures in the context of the company’s financial goals and strategic objectives. The cost of equity should align with the company’s desired return on investment and growth targets. If the cost of equity after the switch is not conducive to achieving these goals, it may require a reassessment of the capital structure decision or the implementation of additional strategies to mitigate the increased risk.

5. Influence on financing options: Analyze how the cost of equity figures impact the company’s future financing options. A higher cost of equity may make it more expensive for the company to raise capital through equity offerings or initial public offerings. Conversely, a lower cost of equity may make the company more attractive to equity investors and increase its access to additional funding sources.

By carefully comparing the two cost of equity figures, companies can gain insights into the effects of the switch to a leveraged capital structure. This analysis will help them understand the trade-offs between risk and potential return, align their decision-making with financial goals, and effectively manage their capital structure to optimize their performance and shareholder value.

Conclusion

Understanding the cost of equity and the implications of switching to a leveraged capital structure is essential for companies navigating the complex world of finance. The cost of equity represents the return that investors require for bearing the risk of owning a company’s stock, while a leveraged capital structure involves increasing debt reliance to finance operations.

We explored the factors that influence the cost of equity, such as the risk-free rate, equity risk premium, beta, company-specific risk, dividend policy, and market conditions. These factors play a crucial role in determining the required return on equity and aid in evaluating investment opportunities and strategic decisions.

Switching to a leveraged capital structure can impact the cost of equity and introduce additional risks, including increased financial risk, higher interest expenses, potential changes in credit ratings, and limited financial flexibility. Companies must carefully assess the potential benefits and risks before making this transition.

To assess the impact of the switch, we discussed the calculation of the cost of equity both before and after the change. The cost of equity figures allow companies to compare the required returns and evaluate the influence on the cost of capital, investor perception of risk, financial goals alignment, and financing options.

In conclusion, understanding the cost of equity and the implications of a leveraged capital structure empowers companies to make informed financial decisions. By carefully considering the factors influencing the cost of equity, calculating it accurately, and comparing the figures before and after the switch, companies can optimize their capital structure, manage risks effectively, attract investors, and drive long-term success and value creation.