Finance

Contract Unit Definition

Published: November 2, 2023

Enhance your financial knowledge with our comprehensive guide to contract unit definition in finance. Learn how this concept impacts your investments and decision making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Contract Unit Definition

When it comes to finance, there are many terms and concepts that can seem complex and intimidating. One such concept is contract unit definition. But fear not! In this blog post, we will demystify this concept and provide you with a clear understanding of what a contract unit is and why it is important in finance.

Key Takeaways:

- Contract unit definition refers to the standard quantity in which a financial contract or instrument is traded.

- Understanding contract unit definition is crucial for investors and traders to properly evaluate their investment and manage risk.

What is a Contract Unit?

A contract unit is a specific quantity or number of an asset or financial instrument that serves as the basis for trading contracts. It determines how these contracts are structured and traded in financial markets, providing a standardized way for investors and traders to buy and sell these instruments.

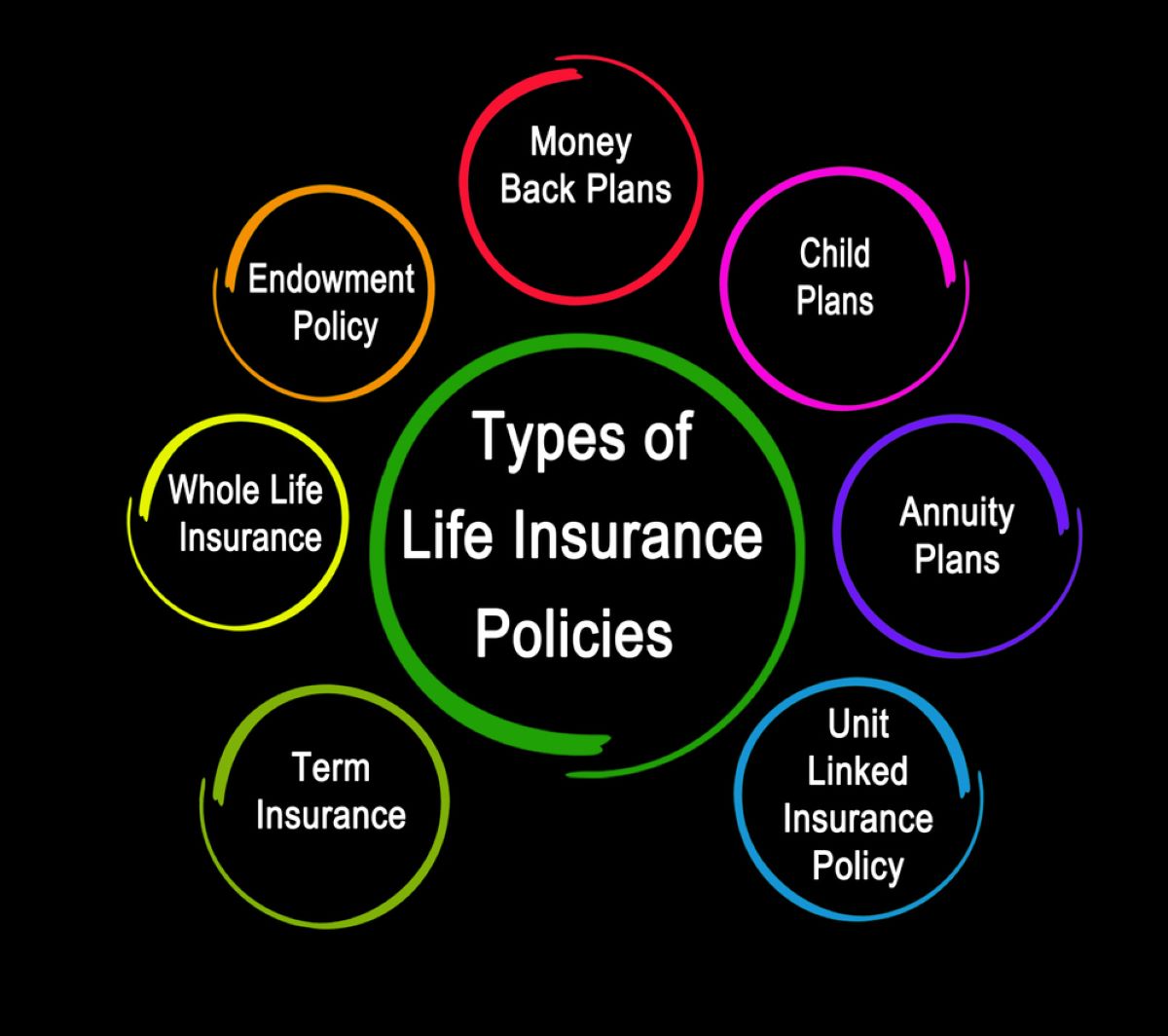

Contract units can vary depending on the financial instrument or asset being traded. For example:

- In commodities trading, a contract unit for crude oil futures might be 1,000 barrels of oil.

- In currency trading, a contract unit for Euro/US Dollar futures might be 125,000 euros.

- In stock trading, a contract unit for options contracts might be 100 shares of a particular stock.

It is essential to understand the contract unit of the financial instrument you are trading. This knowledge allows you to calculate the value of your position and manage your risk effectively.

Why is Contract Unit Definition Important?

Contract unit definition is crucial for investors and traders for several reasons:

- Standardization: Contract units provide a standardized way to trade financial instruments, ensuring consistency and fairness in the marketplace.

- Valuation: Understanding the contract unit helps investors calculate the value of their positions accurately. By knowing the contract unit’s size, an investor can determine the total worth of their investment based on the prevailing market price.

- Risk Management: Contract unit definition is a vital aspect of risk management. By knowing the contract unit size, investors can assess the potential risk and reward of a trade more effectively. This knowledge is crucial in setting stop-loss levels, determining position size, and managing overall portfolio risk.

Ultimately, having a clear understanding of contract unit definition empowers traders and investors to make more informed decisions, navigate the financial markets with confidence, and manage their investments effectively.

In Conclusion

Contract unit definition is a fundamental concept in finance that determines the standard trading quantities for various financial instruments. By understanding the contract unit of a particular instrument, investors and traders can accurately value their positions and manage their risk effectively. With standardized contract units, financial markets become more transparent and efficient, benefiting all participants. So the next time you come across the term “contract unit,” you will have the knowledge to navigate this aspect of finance with ease.