Finance

What Is A Unit Of Life Insurance?

Published: November 6, 2023

Learn what a unit of life insurance is and how it can help secure your financial future. Gain insights into the importance of finance and protection through this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Unit of Life Insurance

- Types of Units in Life Insurance

- Key Features of a Unit of Life Insurance

- Benefits and Drawbacks of Units in Life Insurance

- Factors Affecting the Value of a Unit in Life Insurance

- Unit Pricing and Valuation Methods

- Real-Life Examples of Unit of Life Insurance

- Conclusion

Introduction

Life insurance is a vital financial product that provides individuals and their loved ones with financial security in the event of death. When purchasing a life insurance policy, individuals have the option to choose different units of coverage. A unit of life insurance refers to a specific portion or quantity of insurance coverage that a policyholder can purchase. It is an essential concept to understand when considering life insurance policies and their benefits.

In simple terms, a unit of life insurance represents a standardized value or quantity of coverage within a policy. The value of a unit can vary depending on the insurance provider and the specific policy terms. The more units an individual purchases, the greater the coverage amount.

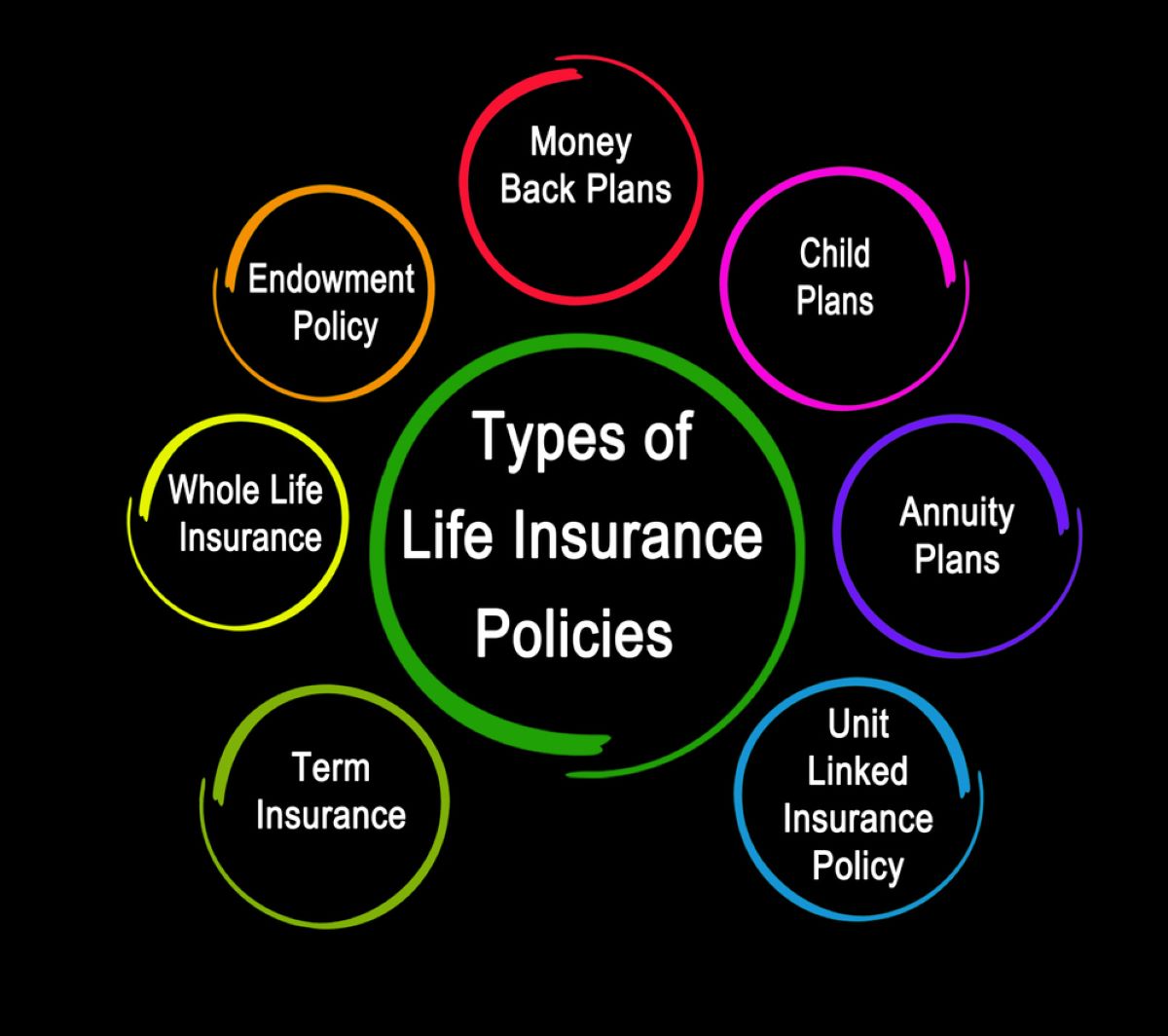

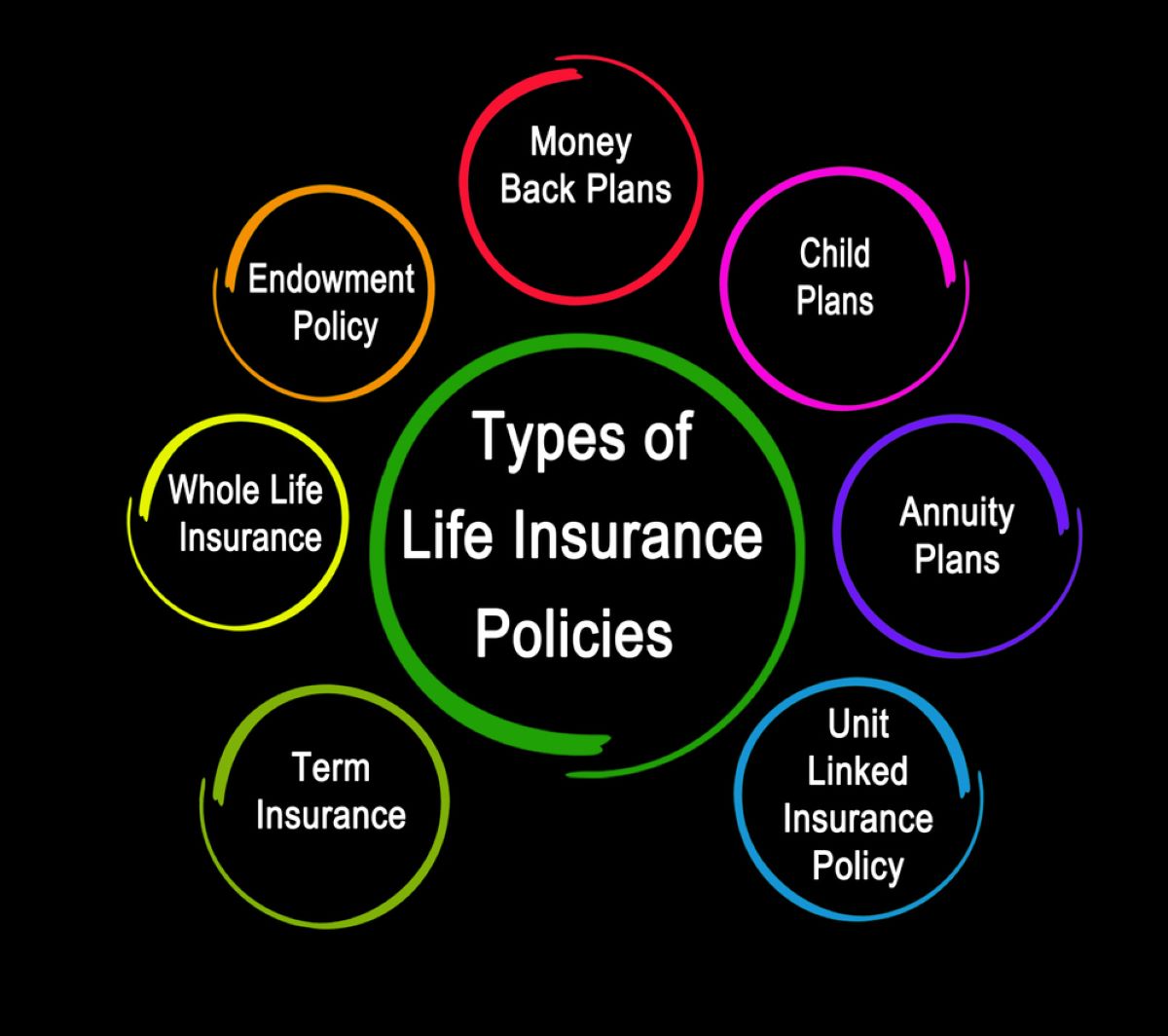

Units may be used in various types of life insurance policies, including term life insurance, whole life insurance, and universal life insurance. The way units are structured and function can differ based on the policy type and the insurance company.

In this article, we will delve into the ins and outs of units in life insurance, exploring their definition, types, features, benefits, drawbacks, valuation methods, and real-life examples. Whether you are considering purchasing a life insurance policy or want to expand your knowledge in the financial field, understanding units of life insurance will provide you with important insights.

Definition of a Unit of Life Insurance

A unit of life insurance refers to a standardized portion or quantity of coverage within a life insurance policy. It represents a specific value that policyholders can purchase to protect themselves and their loved ones financially in the event of death. Units serve as a measurement for determining the amount of coverage in a policy and play a crucial role in determining the premium and payout amount.

The value of a unit can vary depending on the insurance provider and the specific policy terms. Insurance companies often determine the unit value based on factors such as the insured’s age, health, occupation, and lifestyle. Policyholders can purchase multiple units to increase their coverage amount, with the premium cost adjusted accordingly.

It is important to note that the concept of units is more commonly used in certain types of life insurance policies, such as unit-linked insurance plans (ULIPs) and variable life insurance. In these policies, units are associated with investment funds, and policyholders have the option to allocate their premiums into different funds. The performance of these funds directly affects the value of the units and, ultimately, the potential payout.

Units are not limited to a fixed value and can fluctuate with market conditions and the performance of underlying investment funds. This aspect makes units in life insurance different from traditional fixed coverage amounts.

While the exact nature and structure of units may vary across insurance companies and policies, understanding the concept is crucial for individuals considering life insurance coverage. The unit system allows policyholders to customize their coverage according to their needs and financial goals, providing flexibility and control over their life insurance policy.

Types of Units in Life Insurance

There are different types of units in life insurance, each serving a specific purpose and offering unique features. Understanding these types can help individuals make informed decisions when selecting a life insurance policy that aligns with their financial goals and risk tolerance.

1. Basic Units: Basic units are the most straightforward form of units in life insurance. They represent a fixed amount of coverage within a policy. For example, a basic unit could be $100,000 of coverage. Policyholders can purchase multiple basic units to increase their total coverage amount.

2. Investment-Linked Units: Investment-linked units are primarily associated with unit-linked insurance plans (ULIPs) and variable life insurance policies. These units are tied to investment funds, allowing policyholders to allocate their premiums into different funds based on their risk appetite and investment objectives. The value of investment-linked units fluctuates based on the performance of the underlying investment funds, providing the potential for both growth and downside risk.

3. Bonus Units: Some life insurance policies offer the opportunity to earn bonus units. These units are additional units granted by the insurance company based on factors such as the policy’s duration, good claim history, or participation in certain wellness programs. Bonus units effectively enhance the overall coverage amount, providing additional financial protection to the policyholder.

4. Surrender Value Units: Units that represent the surrender value of a life insurance policy are known as surrender value units. In the event that a policyholder decides to surrender their policy before its maturity, these units determine the cash value that the policyholder will receive. The surrender value is influenced by factors such as the duration of the policy, premium payments made, and any applicable surrender charges.

5. Paid-Up Units: Paid-up units are associated with policies that offer the option to stop making premium payments after a certain period while maintaining the coverage. These units represent the fixed coverage amount that remains in force even without further premium contributions. Paid-up units provide individuals with the opportunity to have lifelong coverage without the need for ongoing premium payments.

It’s important to note that the availability of these different types of units may vary based on the insurance company and the specific policy. Policyholders should review the policy terms and consult with their insurance advisor to understand the types of units available and their implications on coverage and premiums.

Key Features of a Unit of Life Insurance

A unit of life insurance possesses several key features that play a significant role in the policyholder’s overall coverage and financial protection. Understanding these features is essential for individuals considering life insurance policies to make informed decisions:

1. Fixed Value: Each unit in a life insurance policy has a fixed value that represents a specific amount of coverage. This fixed value determines the premium cost and the potential payout in the event of the insured’s death. Policyholders can purchase multiple units to increase their coverage amount according to their individual needs.

2. Customizable Coverage: Units allow policyholders to customize their coverage by choosing the number of units they wish to purchase. This customization option helps individuals align their life insurance coverage with their financial goals, responsibilities, and risk tolerance.

3. Flexible Premiums: The premium cost for life insurance policies is directly influenced by the number of units purchased. Policyholders have the flexibility to choose the number of units they can afford and adjust their premiums accordingly. This feature allows individuals to manage their life insurance expenses based on their budget and financial circumstances.

4. Potential for Growth: In certain types of life insurance policies, such as unit-linked insurance plans and variable life insurance, units are associated with investment funds. These funds have the potential to generate returns and increase the value of the units over time. This feature allows policyholders to benefit from potential growth and build cash value within their life insurance policy.

5. Convertibility: Some life insurance policies offer the option to convert units into different types of coverage, such as switching from term insurance to whole life insurance. This convertibility feature provides policyholders with the flexibility to adapt their coverage to their evolving financial needs and goals, without the need for additional underwriting or medical exams.

6. Death Benefit Payout: When the insured passes away, the units in the life insurance policy determine the death benefit payout to the beneficiaries. The value of the units at the time of the insured’s death determines the monetary amount that will be paid out to the beneficiaries.

7. Surrender Value: Units may have a surrender value, which represents the cash value that a policyholder will receive if they decide to surrender or cancel their policy before its maturity. The surrender value is influenced by factors such as the duration of the policy, premium payments made, and any applicable surrender charges.

Understanding these key features of units in life insurance is crucial for individuals to make informed decisions about their coverage and financial well-being. It enables policyholders to select a life insurance policy that aligns with their needs, budget, and long-term goals.

Benefits and Drawbacks of Units in Life Insurance

Units in life insurance offer several benefits and drawbacks that individuals should consider when choosing a life insurance policy. Understanding these pros and cons can help policyholders make informed decisions that align with their financial goals and risk tolerance:

Benefits:

1. Customizable Coverage: Units provide policyholders with the flexibility to customize their coverage by choosing the number of units they want to purchase. This allows individuals to tailor their life insurance policy to meet their specific needs and financial goals.

2. Potential for Growth: In policies with investment-linked units, the performance of the underlying investment funds can lead to potential growth in the value of the units. This feature provides policyholders with the opportunity to build cash value within their life insurance policy.

3. Convertibility Options: Some life insurance policies allow policyholders to convert units into different types of coverage, offering greater flexibility to adapt to changing financial needs and goals without the need for additional underwriting or medical exams.

4. Control Over Premiums: The ability to choose the number of units purchased gives policyholders control over their premium costs. Individuals can adjust their coverage according to their budget and financial circumstances.

Drawbacks:

1. Market-Based Risks: In policies with investment-linked units, the value of units can fluctuate based on the performance of the underlying investment funds. This exposes policyholders to market-based risks, and the value of their coverage can decrease in certain market conditions.

2. Complex Investment Elements: Policies with investment-linked units come with investment components that require policyholders to have a basic understanding of investment principles. This complexity may not be suitable for individuals with limited investment knowledge or risk tolerance.

3. Volatility in Coverage: The value of units in life insurance policies can change over time based on market conditions and fund performance. This volatility means that the actual coverage amount may be uncertain and could potentially be lower than expected.

4. Surrender Charges: Policies with surrender value units may impose charges if the policy is surrendered before maturity. These charges can reduce the surrender value received by the policyholder and may impact the overall value of the policy.

It is important for individuals to weigh the benefits and drawbacks of units in life insurance before making a decision. Engaging with a knowledgeable insurance advisor can help individuals navigate the intricacies of unit-based policies and determine if they align with their risk tolerance, financial goals, and long-term objectives.

Factors Affecting the Value of a Unit in Life Insurance

The value of a unit in life insurance is influenced by several factors that determine the coverage amount and premium cost for policyholders. Understanding these factors is essential for individuals considering life insurance policies with units:

1. Age: The age of the insured individual is a significant factor in determining the value of a unit. Generally, the younger the policyholder, the lower the premium cost per unit. This is because younger individuals typically have a longer life expectancy, resulting in a lower risk for the insurance company.

2. Health: The health condition of the insured has a direct impact on the value of a unit. Those who are in good health are considered lower risk, resulting in lower premium costs per unit. Conversely, individuals with pre-existing medical conditions or high-risk occupations may face higher premium costs per unit.

3. Lifestyle Factors: Certain lifestyle factors, such as smoking or engaging in high-risk activities, can increase the premium cost per unit. Insurance companies often conduct comprehensive underwriting to assess these factors and determine the appropriate value of units.

4. Gender: In some cases, gender may be a factor in determining the value of a unit. Actuarial data suggests that women generally have a longer life expectancy compared to men, which may result in lower premium costs per unit for females.

5. Policy Duration: The duration of the life insurance policy can influence the value of a unit. Policies with longer terms may have lower premium costs per unit compared to policies with shorter terms. This is because longer-term policies spread the risk over a longer time frame.

6. Underwriting Factors: The insurance company’s underwriting guidelines and risk assessment play a crucial role in determining the value of units. Factors taken into consideration during underwriting include medical history, family health history, occupation, and lifestyle habits.

7. Insurance Company Practices: Different insurance companies may have varying practices when it comes to valuing units. Each company may apply their own factors and methodologies for determining the value of units, resulting in variation in premium costs.

It is important to note that the specific weight assigned to each factor can vary among insurance companies. This is why it is crucial for individuals to compare quotes and policies from multiple insurers to find the most suitable coverage at a competitive price.

Understanding the factors that affect the value of a unit in life insurance allows individuals to assess their eligibility for a policy and estimate the potential premium costs. Consulting with an insurance advisor can provide further guidance in navigating these factors and securing the most appropriate coverage.

Unit Pricing and Valuation Methods

Unit pricing and valuation methods are crucial components of life insurance policies with units. They determine the value of individual units and play a significant role in calculating premium costs, policy benefits, and cash values. Here are some common unit pricing and valuation methods:

1. Net Asset Value (NAV) Method: This method is commonly used in policies with investment-linked units. It calculates the value of each unit based on the fund’s net asset value. The net asset value represents the total value of the fund’s assets minus any liabilities. The NAV method ensures that the unit’s value is directly linked to the underlying investments within the policy, providing transparency and reflecting the market performance.

2. Actuarial Valuation: In traditional life insurance policies, where units represent a fixed amount of coverage, actuarial valuation methods are used to determine the value of units. Actuaries consider factors such as the insured’s age, gender, health, and expected mortality rates to calculate the unit value. Actuarial tables and mortality tables guide these calculations, ensuring that the unit price accurately reflects the risk involved for the insurance company.

3. Market-Based Valuation: For policies with investment-linked units, market-based valuation methods may be used. The value of the units is determined based on the performance of the underlying investment funds. This method takes into account the fluctuations in the market and the returns generated by the fund’s investments. The resulting unit value reflects the current market conditions and provides a real-time assessment of the coverage amount.

4. Surrender Value Calculation: Surrender value units, which are associated with policies that have a cash value component, are valued using surrender value calculations. These calculations take into account factors such as the duration of the policy, the premiums paid, any applicable surrender charges, and the accumulated cash value. The surrender value represents the cash value that a policyholder will receive if they surrender or cancel their policy before its maturity.

5. Bonus Unit Allocations: In some cases, insurance companies may offer the allocation of bonus units based on factors such as the policy’s duration, good claim history, or participation in certain wellness programs. The value of bonus units is typically determined by the insurance company and can enhance the overall coverage amount, providing additional financial protection.

It’s important to note that different insurance companies may employ different unit pricing and valuation methods. Therefore, potential policyholders should carefully review the policy terms and consult with their insurance advisor to understand how the value of units is determined within a specific policy.

By understanding the unit pricing and valuation methods, policyholders can gain insight into how the value of their coverage is calculated and make informed decisions about their life insurance policies.

Real-Life Examples of Unit of Life Insurance

To understand how units work in real-life scenarios, let’s explore a couple of examples:

Example 1: Term Life Insurance

Sarah, a 35-year-old non-smoker, purchases a term life insurance policy with a coverage amount of $500,000. The policy is structured with units, where each unit represents $10,000 of coverage. Sarah decides to purchase 50 units, totaling $500,000 in coverage.

Each unit costs $5, resulting in a premium cost of $250 per unit. Therefore, Sarah’s total premium cost for her policy with 50 units is $12,500 annually. If Sarah passes away during the term of the policy, her beneficiaries will receive the full $500,000 payout.

Example 2: Investment-Linked Life Insurance

John, a 40-year-old investor, opts for an investment-linked life insurance policy. He chooses a policy that offers units tied to different investment funds. John allocates his premium payments into a diversified fund, an equity fund, and a bond fund.

Each unit’s value depends on the performance of the respective investment funds. If the funds perform well, the value of John’s units may increase, potentially increasing his coverage amount and cash value. However, if the funds underperform, the value of the units may decrease, affecting the overall coverage and cash value of the policy.

These examples illustrate how units function in different types of life insurance policies. In the first example, units represent a fixed amount of coverage in a term life insurance policy, whereas in the second example, units are associated with investment funds in an investment-linked life insurance policy.

The specific details, including the premium cost per unit, coverage amount per unit, and how the units are valued, will vary depending on the insurance company and policy terms.

It is important for individuals to carefully review and understand the terms and conditions of their life insurance policies when it comes to units. Consulting with an insurance advisor can provide further clarity and help individuals make informed decisions based on their unique needs and financial goals.

Conclusion

Units in life insurance play a significant role in determining the coverage amount, premium cost, and potential growth of a policy. Whether it’s a basic unit representing a fixed amount of coverage or investment-linked units tied to underlying funds, understanding the concept of units is crucial for individuals considering life insurance.

By customizing the coverage through the purchase of units, individuals can tailor their life insurance policies to meet their specific needs and financial goals. The flexibility to adjust the number of units allows policyholders to manage their premium costs and control their coverage according to their budget and life circumstances.

However, it’s important to weigh the benefits and drawbacks of units in life insurance. While investment-linked units offer the potential for growth and customization, they also come with market-based risks and complexity. Traditional units in life insurance provide fixed coverage amounts but may not offer the flexibility and potential for growth associated with investment-linked units.

The value of units is influenced by factors such as age, health, lifestyle, policy duration, and insurance company practices. These factors affect the premium costs, valuation methods, and potential cash value of the policy. Understanding these factors allows individuals to estimate their coverage costs, assess eligibility, and choose the most suitable life insurance policy.

Real-life examples demonstrate how units work in different types of policies, such as term life insurance and investment-linked policies. Term life insurance policies use units to determine coverage amounts, while investment-linked policies offer units tied to investment funds, with potential growth dependent on market performance.

When considering life insurance policies with units, it is crucial for individuals to carefully review the policy terms, consult with insurance advisors, and compare quotes from different insurers. This helps individuals make informed decisions based on their financial goals, risk tolerance, and long-term objectives.

In conclusion, understanding units in life insurance empowers individuals to navigate the complex world of life insurance and make choices that provide financial security and peace of mind for themselves and their loved ones.