Home>Finance>Credit Cycles: Definition, Factors, And Use In Investing

Finance

Credit Cycles: Definition, Factors, And Use In Investing

Modified: January 15, 2024

Understand credit cycles and their impact on investments with this comprehensive guide. Explore the definition, key factors, and how finance professionals utilize them for strategic decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Credit Cycles: Definition, Factors, and Use in Investing

Welcome to our Finance category where we delve into various aspects of the financial world. In today’s blog post, we will be exploring the intriguing concept of credit cycles. What are credit cycles, you might ask, and how do they impact investors? Well, fret not, dear reader, as we are here to shed light on this fascinating topic. So, let’s dive right in!

Key Takeaways

- Credit cycles refer to the periodic fluctuations in the availability and cost of credit in financial markets.

- Understanding the factors driving credit cycles can help investors identify investment opportunities and mitigate risks.

What Are Credit Cycles?

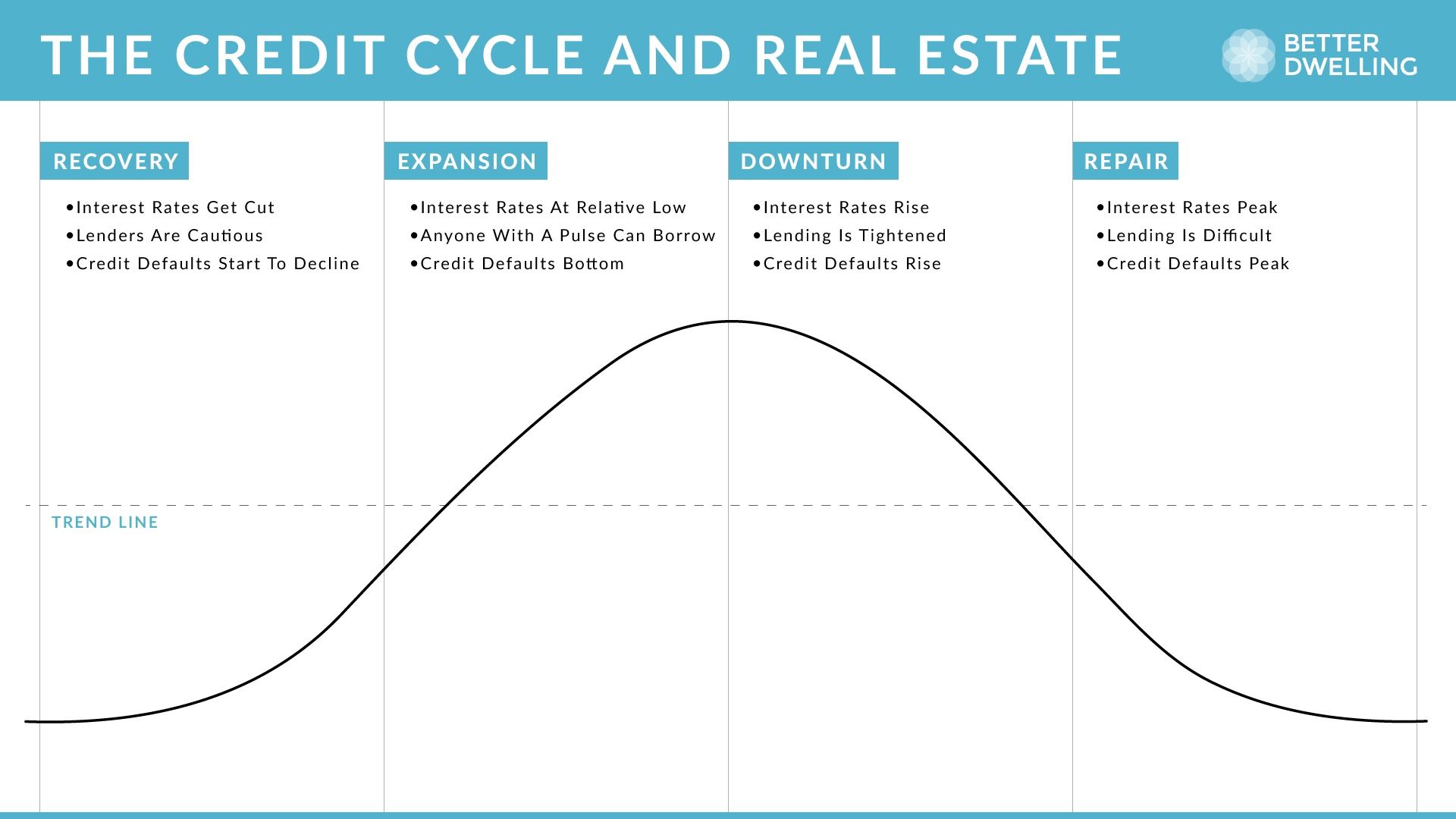

Picture this: the economy experiences a surge in lending, with banks and financial institutions extending credit to businesses and consumers at a rapid pace. Interest rates are low, and the availability of credit is abundant. This phase is often referred to as the expansionary phase of the credit cycle. However, as time goes on, cracks begin to appear, and defaults start to rise. Lenders become cautious, leading to a contraction in lending, higher interest rates, and reduced credit availability. This phase is known as the contractionary phase of the credit cycle. Thus, credit cycles represent the cyclical nature of credit conditions in financial markets, shifting from expansion to contraction and back again.

Factors Influencing Credit Cycles

Understanding the factors that drive credit cycles is essential for investors seeking to navigate these fluctuations successfully. Here are some of the key factors that influence the credit cycle:

- Economic Conditions: The state of the overall economy, including factors like GDP growth, employment levels, and inflation rates, plays a significant role in shaping credit cycles. During periods of economic expansion, lending tends to increase, whereas economic recessions can lead to a contraction in lending.

- Monetary Policy: Central banks’ actions and monetary policies can have a profound impact on credit cycles. Lower interest rates and accommodative monetary policies generally contribute to credit expansion, while tightening policies can trigger a contraction.

- Regulation: Changes in financial regulations can influence credit cycles. Stricter regulations may lead to a more conservative lending environment, limiting credit availability, while lax regulations can potentially fuel excessive lending and credit booms.

- Consumer and Business Sentiment: Sentiment and confidence levels among consumers and businesses can impact credit cycles. Optimistic sentiment tends to drive increased borrowing and spending, while negative sentiment can lead to decreased credit demand.

Using Credit Cycles in Investing

Credit cycles can provide valuable insights for investors. By understanding the stage of the credit cycle, investors can adjust their investment strategies and manage risks effectively. Here are a few ways credit cycles can be used in investing:

- Identifying Opportunities: During the expansionary phase of the credit cycle, certain sectors such as technology, consumer goods, and real estate may thrive. Investors can capitalize on these opportunities by targeting companies and assets within these sectors.

- Managing Risks: Recognizing the potential risks associated with the contractionary phase of the credit cycle, investors can take proactive measures to protect their investments. This may involve reducing exposure to highly leveraged assets or assets sensitive to interest rate changes.

- Diversification: Credit cycles can impact different industries and sectors unevenly. By diversifying their portfolios across various sectors and assets classes, investors can mitigate the impact of credit cycles on their overall investment performance.

In conclusion, credit cycles represent the ebb and flow of credit conditions in financial markets. Understanding the factors driving these cycles and using them to inform investment decisions can be invaluable for investors. So, keep an eye on those credit cycles, dear readers, and let the waves guide you towards financial success!