Finance

What Is A Credit Cycle

Published: January 12, 2024

Learn about the credit cycle and its impact on finance. Understand the dynamics of credit expansion and contraction in the financial industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, understanding the concept of a credit cycle is crucial. A credit cycle refers to the periodic expansion and contraction of credit in an economy. It is driven by factors such as interest rates, economic conditions, and borrowing behavior. The credit cycle plays a significant role in influencing the availability of credit, investment opportunities, and overall economic growth.

During an expansion phase of the credit cycle, borrowing is encouraged as credit is readily available and interest rates are low. This stimulates economic activity, leading to increased consumer spending, business investment, and job creation. As the economy reaches its peak, however, the contraction phase begins. Credit becomes tighter, interest rates rise, and borrowing becomes more challenging. This contraction phase can lead to a slowdown in economic growth, reduced investment, and potential financial instability.

Understanding the phases of a credit cycle and the factors that influence it is essential for policymakers, investors, and individuals alike. By anticipating shifts in the credit cycle, financial decisions can be better informed, allowing for more effective risk management and capital allocation. Ultimately, having a deep understanding of the credit cycle can help navigate economic challenges and seize opportunities within the market.

In this article, we will explore the definition of a credit cycle, the different phases it goes through, and the factors that influence it. We will also discuss the indicators of a credit cycle and the impact it has on the overall economy. By the end, you will have a comprehensive understanding of the credit cycle and its significance in the financial world.

Definition of a Credit Cycle

A credit cycle can be defined as the recurring pattern of expansion and contraction in the availability of credit within an economy. It represents the cyclical nature of credit conditions and how they influence lending and borrowing activities. The credit cycle is driven by various economic factors, including interest rates, monetary policy, and market conditions.

When the economy is in an expansion phase, credit is typically abundant, interest rates are low, and lending standards are relaxed. This encourages businesses and individuals to take on debt, leading to increased investment, consumption, and economic growth. As borrowing increases, lenders become more willing to extend credit, leading to a positive feedback loop of credit expansion. This phase of the credit cycle is often characterized by optimism, buoyant financial markets, and a general sense of economic prosperity.

However, as the expansion phase continues, there is a point where excessive credit and debt levels can become unsustainable. This marks the transition to the peak phase of the credit cycle. Lenders start to tighten their lending standards, interest rates begin to rise, and borrowing becomes more difficult. This tightening of credit conditions can be a result of various factors such as macroeconomic imbalances, regulatory changes, or a decline in market confidence.

The peak phase of the credit cycle is often associated with increased financial stress and heightened risk. It is the culmination of the positive credit feedback loop, where overstretched borrowers begin to struggle with debt repayment, leading to potential defaults and financial instability. As credit conditions continue to tighten, the economy enters the contraction phase of the credit cycle.

During the contraction phase, credit becomes less accessible, interest rates rise further, and borrowing becomes even more challenging. This leads to a decrease in spending, investment, and economic activity. The contraction phase can be characterized by a slowdown in economic growth, rising unemployment rates, and the potential for financial crises or recessions.

The trough phase represents the bottom of the credit cycle, where credit conditions are at their tightest, and the economy reaches its lowest point. It is a period of adjustment and consolidation, where excesses from the previous expansion phase are unwound, and the economy begins to stabilize. Eventually, as credit conditions improve, the economy enters a new expansion phase, restarting the credit cycle.

Understanding the different phases of the credit cycle is crucial for policymakers and market participants, as it provides insights into the state of the economy and potential risks and opportunities. By monitoring credit conditions and anticipating shifts in the credit cycle, individuals and organizations can make more informed financial decisions and manage their exposure to credit-related risks.

Phases of a Credit Cycle

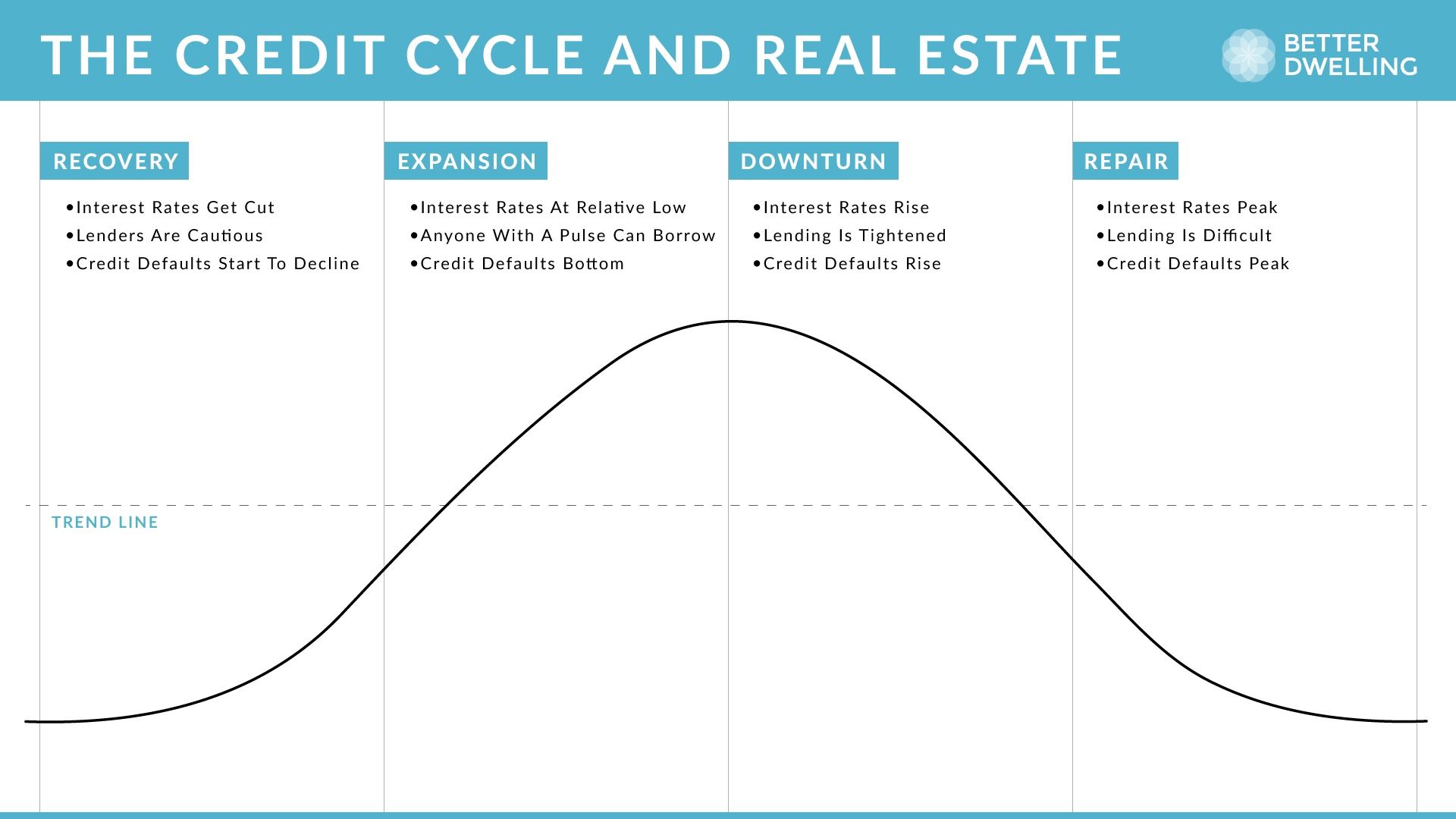

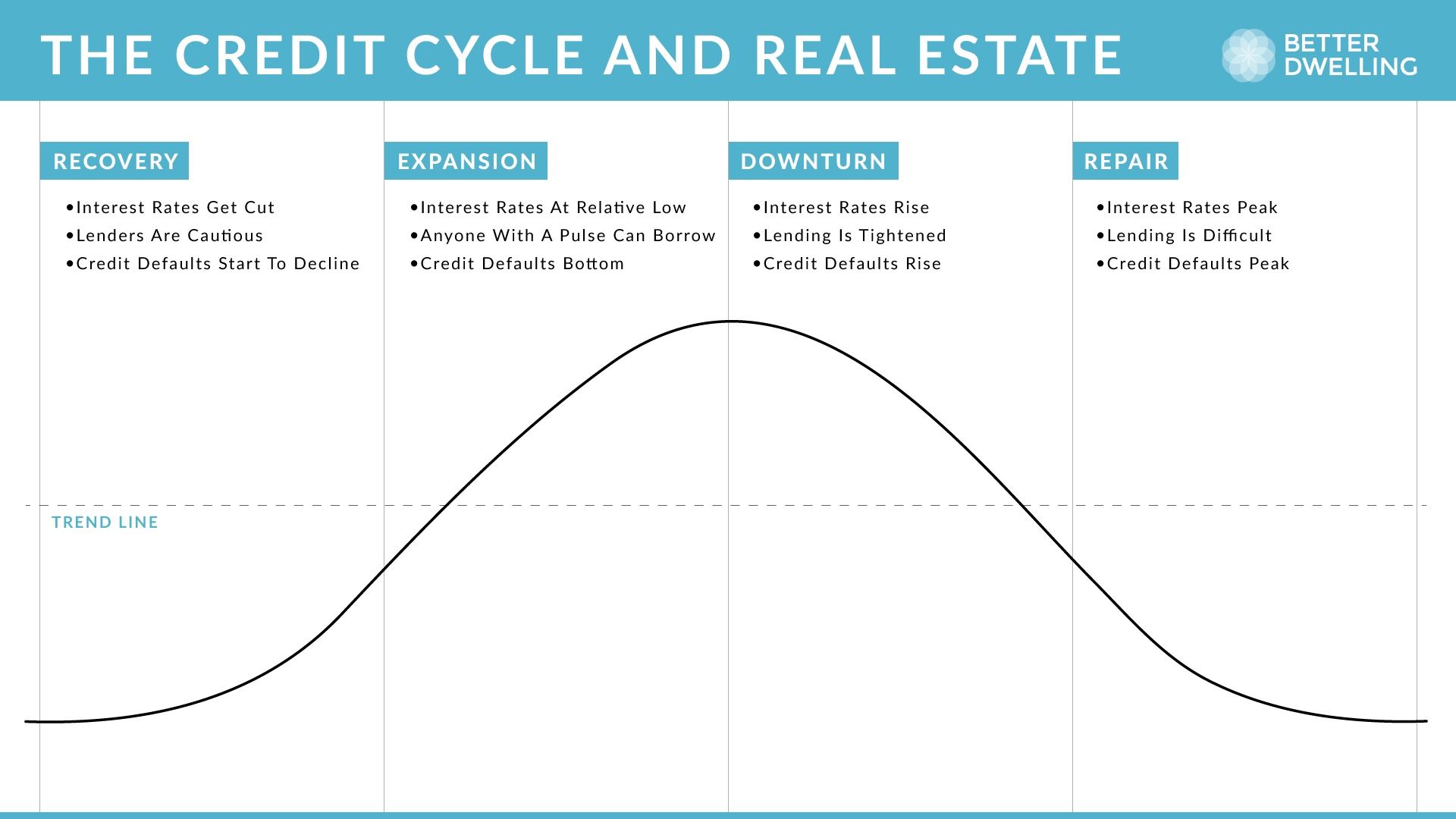

The credit cycle consists of four main phases: expansion, peak, contraction, and trough. These phases represent the different stages of credit availability and economic activity within an economy. Understanding each phase is essential for analyzing the state of the credit cycle and its potential impact on the overall economy.

1. Expansion Phase: The expansion phase marks the beginning of the credit cycle. During this phase, credit is easily accessible, borrowing costs are low, and economic activity is robust. Lenders are more willing to extend credit, leading to increased investment, consumption, and economic growth. The expansion phase is characterized by rising asset prices, low unemployment rates, improving business confidence, and overall optimism in the market.

2. Peak Phase: The peak phase represents the turning point in the credit cycle. At this stage, credit conditions begin to tighten, borrowing becomes more challenging, and interest rates start to rise. Lenders become more cautious, leading to a slowdown in credit expansion. The peak phase is often accompanied by elevated levels of debt, potential financial imbalances, and overheated asset markets. It is a period of transition from the expansion phase to the contraction phase.

3. Contraction Phase: The contraction phase is characterized by a decline in credit availability and economic activity. Lenders tighten their lending standards, interest rates continue to rise, and borrowing becomes more difficult. This leads to reduced investment, decreased consumer spending, and an overall slowdown in economic growth. The contraction phase is often associated with rising unemployment rates, declining asset prices, and potential financial stress as overleveraged borrowers struggle to meet their debt obligations.

4. Trough Phase: The trough phase represents the bottom of the credit cycle. It is the point where credit conditions are at their tightest, and the economy reaches its lowest point. During this phase, excesses from the previous expansion phase are unwound, and the economy stabilizes. Lenders may start to ease their lending standards, interest rates begin to decline, and borrowing gradually becomes more accessible. The trough phase sets the stage for the next expansion phase of the credit cycle.

It’s important to note that the duration and intensity of each phase can vary across different credit cycles and economies. While some credit cycles may undergo rapid shifts between phases, others may experience prolonged periods in a particular phase. Various economic factors, such as monetary policy decisions, government interventions, and external shocks, can influence the timing and duration of each phase.

By analyzing the different phases of the credit cycle, policymakers, investors, and individuals can gain insights into the overall health of the economy, anticipate potential risks, and make informed financial decisions. Understanding how the credit cycle evolves can help navigate economic challenges, identify investment opportunities, and mitigate the impact of downturns.

Expansion Phase

In the credit cycle, the expansion phase is the period of economic growth and credit expansion. During this phase, credit is abundant, interest rates are low, and borrowing is readily accessible. Lenders are more willing to extend credit to individuals, businesses, and governments, leading to increased investment, consumption, and economic activity.

One of the key drivers of the expansion phase is the accommodative monetary policy set by central banks. Central banks lower interest rates to stimulate borrowing and investment, thereby promoting economic growth. Lower interest rates reduce the cost of borrowing, making it more attractive for individuals and businesses to take on debt. This leads to increased consumer spending, business expansion, and job creation, contributing to economic expansion.

During the expansion phase, there is a general sense of optimism and positive market sentiment. Rising asset prices, such as stocks and real estate, create wealth effects, which in turn boost consumer confidence and spending. Business confidence also tends to be high, encouraging companies to invest in new projects and expand their operations.

The expansion phase is often characterized by robust economic indicators. Gross domestic product (GDP) growth rates are typically strong, indicating a healthy and growing economy. Unemployment rates tend to be low as businesses increase hiring to meet the growing demand. Inflation remains moderate as the supply of goods and services matches the rising demand.

Financial markets tend to perform well during the expansion phase. Stock markets experience bullish trends, with rising stock prices and increased trading volumes. Bond markets may also see increased issuance as companies and governments take advantage of low interest rates to borrow funds for investment or refinancing purposes.

However, it is important to note that excessive credit expansion during this phase can lead to potential risks. Rapidly rising levels of debt, both by individuals and corporations, can create imbalances in the financial system. If not properly managed, these imbalances can lead to asset bubbles, increased financial vulnerability, and potential economic instability in the subsequent phases of the credit cycle.

Overall, the expansion phase of the credit cycle is a period of economic growth and optimism. Credit is readily available, and interest rates are low, leading to increased borrowing, investment, and consumption. However, it is crucial to monitor the pace of credit expansion and maintain prudent lending practices to mitigate potential risks and ensure sustainable economic growth throughout the entire credit cycle.

Peak Phase

The peak phase is a critical stage in the credit cycle, representing the culmination of the expansion phase and the transition towards a contraction phase. During this phase, credit conditions begin to tighten, borrowing becomes more challenging, and interest rates start to rise.

One of the key drivers of the peak phase is the increase in lending standards by financial institutions. As lenders start to observe potential signs of overheating in the economy, they become more cautious about extending credit. This tightening of lending standards can be attributed to concerns about rising debt levels or potential imbalances in specific sectors of the economy.

Interest rates, which were kept low during the expansion phase to stimulate economic growth, start to rise as central banks aim to control inflation and manage potential financial risks. Higher interest rates increase the cost of borrowing, making it more expensive for individuals and businesses to access credit. As a result, borrowing and investment activities begin to slow down.

The peak phase is often associated with elevated levels of debt and potential financial imbalances. Excessive credit expansion during the expansion phase may have led to overleveraging, where borrowers have taken on more debt than they can comfortably manage. As interest rates rise and borrowing becomes more challenging, financially stressed borrowers may struggle to meet their debt obligations, leading to potential defaults and nonperforming loans.

Furthermore, the peak phase is characterized by the potential for asset market bubbles. Rising asset prices, such as stocks, real estate, or commodities, may be driven by speculative activity rather than fundamental factors. As market participants become more cautious and uncertain about the sustainability of asset price growth, the risk of a market correction or a bursting of the bubble increases.

During the peak phase, economic growth starts to slow down, and signs of overheating in the economy become evident. GDP growth rates may moderate, job creation may slow, and consumer and business confidence may begin to wane. Financial markets may experience increased volatility as investors become more risk-averse and adjust their portfolios in anticipation of a potential downturn in the credit cycle.

It is important for policymakers, lenders, and investors to closely monitor the peak phase of the credit cycle. Prudent risk management practices, including disciplined lending standards, careful assessment of borrowers’ ability to repay debts, and stress testing of financial institutions, can help mitigate potential risks and vulnerabilities that arise during this phase.

Overall, the peak phase of the credit cycle signals a turning point from the expansion phase toward a contraction phase. It is a period of assessment and adjustment, as credit conditions tighten, borrowing becomes more challenging, and potential financial imbalances come to light. Managing these risks effectively is crucial to ensure financial stability and pave the way for the subsequent phases of the credit cycle.

Contraction Phase

The contraction phase is a significant stage in the credit cycle, following the peak phase. During this phase, credit becomes less accessible, interest rates rise, and borrowing becomes more difficult for individuals, businesses, and governments. Economic activity begins to slow down, leading to a decline in investment, consumption, and overall economic growth.

One of the primary drivers of the contraction phase is the tightening of credit conditions by financial institutions. Lenders become more risk-averse as they aim to mitigate potential losses and strengthen their balance sheets. This leads to stricter lending standards, higher collateral requirements, and reduced credit availability. As a result, individuals and businesses face difficulties in obtaining loans and financing, which can significantly impact spending and investment decisions.

As credit tightens, interest rates tend to rise. Central banks increase interest rates to control inflation, manage potential financial imbalances, and stabilize the economy after a period of expansion. Higher interest rates increase the cost of borrowing and discourage new borrowing, leading to a slowdown in economic activity. The rising cost of debt can also put further pressure on borrowers who may struggle to make repayments, potentially leading to defaults and loan delinquencies.

The contraction phase is often characterized by deleveraging and a reduction in debt levels. Overleveraged borrowers, who accumulated excessive debt during the expansion phase, may now have difficulties meeting their obligations. This can lead to debt restructuring, bankruptcies, and a decrease in credit demand. As borrowers deleverage, it puts additional pressure on spending and investment, further contributing to the economic slowdown.

During the contraction phase, various economic indicators reflect the slowdown in economic activity. GDP growth rates decline, job creation slows down, and consumer and business confidence weaken. Unemployment rates may rise as businesses cut back on hiring or downsize operations. Financial markets may experience increased volatility and a decline in asset prices as investors become more risk-averse and adjust their portfolios.

In response to the contraction phase, central banks and governments may implement expansionary monetary and fiscal policies to stimulate the economy. Central banks may reduce interest rates, inject liquidity into the financial system, or implement quantitative easing measures to encourage borrowing and investment. Governments may enact fiscal stimulus packages, such as increased public spending or tax incentives, to support economic activity and job creation.

Successfully navigating the contraction phase requires careful risk management, prudent financial decision-making, and proactive measures by policymakers. For individuals and businesses, it may involve adjusting spending patterns, managing debt levels, and exploring alternative sources of funding. Policymakers need to carefully monitor economic indicators, evaluate the effectiveness of monetary and fiscal policies, and implement measures to mitigate the effects of the contraction phase on the overall economy.

Overall, the contraction phase of the credit cycle represents a period of economic slowdown, tightening credit availability, and rising interest rates. Understanding this phase and its potential impacts can help individuals, businesses, and policymakers prepare and adapt to the changing economic conditions and make informed financial decisions.

Trough Phase

The trough phase is a crucial stage in the credit cycle, following the contraction phase. It represents the bottom of the cycle, where credit conditions are at their tightest, and the economy reaches its lowest point. The trough phase marks a period of adjustment, consolidation, and stabilization, laying the foundation for the next expansion phase.

During the trough phase, credit availability remains limited, and borrowing continues to be challenging. Lending standards may still be strict, and interest rates may remain elevated, as financial institutions cautiously assess potential risks and uncertainties. Borrowers, especially those who experienced financial difficulties during the contraction phase, may continue to face challenges in securing credit.

However, as the trough phase progresses, there are signs of stabilization and a gradual recovery. Central banks may maintain accommodative monetary policies to provide liquidity to the financial system and support economic activity. Interest rates may begin to decline, albeit slowly, providing some relief to borrowers. As the economy shows signs of bottoming out, lenders may gradually ease their lending standards, allowing for a modest increase in credit availability.

The trough phase is also characterized by efforts to address the economic imbalances that may have contributed to the preceding contraction phase. Policymakers may implement structural reforms, fiscal stimulus measures, or financial regulatory policies to promote stability and support economic recovery. These initiatives aim to strengthen the financial sector, restore investor confidence, and create an environment conducive to renewed borrowing and investment.

During the trough phase, economic indicators may continue to show weakness, but at a diminishing rate. GDP growth may be minimal or slightly negative, indicating a slow recovery. Unemployment rates may still be elevated as businesses cautiously rehire or stabilize their workforce. Consumer and business confidence may gradually improve as economic conditions stabilize and prospects for growth become more promising.

Financial markets may experience increased volatility during the trough phase as investors react to economic data and assess the prospects of recovery. Asset prices may remain depressed but could show signs of resilience as investors seek out value opportunities. As credit conditions begin to improve, financial institutions may experience reduced credit risk, leading to renewed investor confidence in the banking sector.

The trough phase provides opportunities for individuals and businesses to reevaluate their financial strategies and position themselves for the eventual upturn. It is a period for prudent financial management, such as debt restructuring, building liquidity buffers, and identifying attractive investment opportunities. For businesses, it may involve reassessing business models, exploring cost efficiencies, and identifying new growth avenues.

Overall, the trough phase of the credit cycle signifies a period of stabilization and gradual recovery after the contraction phase. It is a period of adjustment and consolidation, where excesses from the previous phases are unwound, and the economy rebuilds its foundation. By navigating this phase thoughtfully and strategically, individuals, businesses, and policymakers can position themselves for the next expansion phase of the credit cycle.

Factors Influencing Credit Cycles

The credit cycle is influenced by a complex interplay of various economic and financial factors. These factors can shape the availability of credit, the willingness of borrowers to take on debt, and the overall state of the economy. Understanding the key factors that influence credit cycles is essential for assessing the health of the credit market and anticipating shifts in economic conditions.

1. Monetary Policy: The actions of central banks play a significant role in shaping the credit cycle. Central banks use monetary policy tools, such as adjusting interest rates and controlling the money supply, to influence borrowing costs and liquidity in the financial system. Lower interest rates and increased liquidity encourage borrowing, while higher interest rates and tighter monetary conditions can limit credit expansion.

2. Economic Conditions: The overall health of the economy is closely tied to the credit cycle. During periods of strong economic growth, credit tends to expand as businesses and individuals have greater confidence in their ability to repay debts. Conversely, during economic downturns or recessions, credit tightens as lenders become more risk-averse and borrowers face difficulties in meeting their obligations.

3. Investor Confidence: Investor sentiment and confidence can impact the credit cycle. Optimistic investors are more likely to take on risk and invest in credit instruments, leading to credit expansion. Conversely, a loss of investor confidence can result in a contraction of credit availability as investors become more risk-averse and demand higher yields for the loans they make.

4. Financial Regulations: Government regulations and policies can influence credit cycles by imposing restrictions on lending practices and risk-taking behaviors. Stricter regulation can lead to tighter credit conditions, as financial institutions become cautious about extending credit to comply with regulatory requirements. Looser regulations, on the other hand, can foster credit expansion, but may also increase the risk of excessive lending and potential financial instability.

5. Consumer and Business Confidence: The confidence of consumers and businesses is a crucial factor in determining the direction of the credit cycle. In an environment of high confidence, consumers are more likely to borrow to finance spending, while businesses are encouraged to invest and expand. Conversely, low consumer and business confidence can lead to reduced credit demand and tighter credit conditions.

6. External Economic Factors: Global economic conditions, such as changes in trade policies, geopolitical tensions, or fluctuations in commodity prices, can impact the credit cycle. These external factors can influence economic growth, investor sentiment, and the stability of international financial markets, thereby impacting the availability of credit and the overall credit cycle.

7. Government Intervention: Government policies and interventions, particularly during times of economic crisis or recession, can play a significant role in influencing the credit cycle. Fiscal stimulus measures, such as increased government spending or tax incentives, can stimulate economic activity and support credit expansion. Government-backed loan guarantee programs or liquidity injections can also provide stability to the financial sector during periods of credit tightening.

Understanding these factors and their interrelationships is essential for assessing the dynamics of the credit cycle. By monitoring and analyzing these factors, policymakers, lenders, and investors can better anticipate shifts in credit conditions, identify potential risks, and make informed decisions that contribute to a stable and healthy credit market.

Indicators of Credit Cycles

Indicators of credit cycles are essential for assessing the state of the credit market and predicting shifts in economic conditions. These indicators provide insights into the availability of credit, borrowing behaviors, and potential risks within the financial system. By understanding and monitoring these indicators, policymakers, lenders, and investors can make more informed decisions and navigate the credit cycle more effectively.

1. Credit Growth: One of the key indicators of a credit cycle is the rate of credit growth. An accelerating rate of credit expansion is often associated with the expansion phase, indicating increased borrowing and lending activity. Conversely, a deceleration or contraction in credit growth suggests a tightening of credit conditions, potentially signaling the onset of a contraction phase.

2. Debt-to-Income Ratio: The debt-to-income ratio measures the level of debt relative to an individual or household’s income. A rising debt-to-income ratio may indicate increasing levels of debt burden and potential financial stress. As debt surpasses sustainable levels, it can lead to reduced credit demand and a contraction phase in the credit cycle.

3. Nonperforming Loan (NPL) Ratio: The NPL ratio measures the proportion of loans that are delinquent or in default. An increasing NPL ratio suggests potential credit quality deterioration and can be an early warning sign of financial distress. A rapidly rising NPL ratio may indicate a turn in the credit cycle and tighter credit conditions.

4. Credit Spreads: Credit spreads refer to the difference in yields between riskier credit instruments, like corporate bonds, and safer assets, like government bonds. Widening credit spreads suggest increased investor risk aversion and concerns about creditworthiness, signaling a potential contraction phase. Conversely, narrowing credit spreads indicate improved market sentiment and credit conditions associated with an expansion phase.

5. Loan-to-Value (LTV) Ratios: LTV ratios measure the loan amount relative to the value of the underlying asset, such as a home or commercial property. Rapidly rising LTV ratios may indicate excessive lending and potential asset price bubbles, which can lead to financial instability and a subsequent contraction phase in the credit cycle.

6. Financial Stress Indexes: Financial stress indexes aggregate various financial indicators to provide a comprehensive measure of stress within the financial system. An increasing financial stress index may indicate potential risks and vulnerabilities in the credit market, signaling an approaching contraction phase.

7. Business and Consumer Confidence Surveys: Business and consumer confidence surveys capture sentiment and expectations about economic conditions. Increasing confidence levels often correspond to an expansion phase, as businesses and consumers become more willing to borrow and invest. Declining confidence levels may indicate a potential contraction phase, as economic uncertainty leads to reduced credit demand.

8. Central Bank Policy Decisions: Central banks play a crucial role in influencing the credit cycle through their monetary policy decisions. Monitoring central bank actions, such as adjustments to interest rates or changes in liquidity provisions, can provide insights into the direction of credit conditions and the overall credit cycle.

These indicators should be analyzed in conjunction with each other to gain a holistic view of the credit cycle. While no single indicator can provide a definitive signal of the credit cycle’s phase, a combination of these indicators can help identify potential turning points and shifts in credit conditions.

By closely monitoring these indicators, stakeholders can better anticipate changes in the credit cycle, identify potential risks, and make informed decisions to navigate the credit market effectively.

Impacts of Credit Cycles on the Economy

The credit cycle has significant implications for the overall economy, influencing various sectors and aspects of economic activity. Understanding the impacts of credit cycles is essential for policymakers, businesses, and individuals to prepare for and manage the potential consequences that arise during different phases of the cycle.

1. Economic Growth: Credit cycles have a direct impact on economic growth. During the expansion phase, the availability of credit stimulates investment, consumption, and overall economic activity, leading to robust economic growth. Conversely, during the contraction phase, credit tightens, leading to reduced borrowing, decreased investment, and a slowdown in economic growth. The state of the credit cycle can therefore shape the trajectory of the broader economy.

2. Business Investment: Credit cycles influence business investment decisions. During the expansion phase, businesses have easier access to credit, which enables them to invest in new projects, expand operations, and pursue growth opportunities. As the credit cycle turns into the contraction phase, businesses may face difficulties in obtaining financing for investment, leading to a decline in capital expenditure, delayed expansion plans, and potential job cuts.

3. Consumer Spending: Credit cycles also impact consumer spending patterns. During the expansion phase, easy access to credit encourages consumers to borrow and spend on discretionary goods and services. As credit tightens in the contraction phase, consumer borrowing becomes more challenging, leading to reduced spending on non-essential items and a potential decrease in consumer confidence.

4. Housing Market: The housing market is particularly sensitive to credit cycles. During the expansion phase, low interest rates and relaxed lending standards fuel demand for housing, leading to increasing property prices and higher levels of mortgage debt. However, as credit conditions tighten in the contraction phase, it becomes more difficult for potential homebuyers to secure mortgages, potentially leading to a decline in property prices and a slowdown in the construction industry.

5. Employment: Credit cycles can impact employment levels within the economy. During the expansion phase, businesses invest in growth and expansion, leading to job creation and lower unemployment rates. Conversely, during the contraction phase, businesses may cut back on hiring, or in severe cases, lay off workers as credit conditions tighten and economic activity slows down. The employment market is closely intertwined with the state of the credit cycle.

6. Financial Stability: Credit cycles have implications for financial stability. As credit expands during the expansion phase, there is an increased potential for excessive risk-taking, higher levels of indebtedness, and the formation of asset price bubbles. If these imbalances are not properly managed, they can lead to financial instability, as seen in the global financial crisis of 2008 when the bursting of the housing bubble resulted in widespread banking system failures and a severe economic downturn.

7. Government Finances: Credit cycles can impact government finances. During the expansion phase, increased economic activity boosts tax revenues, allowing governments to run fiscal surpluses or reduce deficits. However, during the contraction phase, reduced economic activity leads to lower tax revenues and increased demand for social welfare programs, potentially straining government budgets and increasing public debt levels.

It is crucial for policymakers and individuals to be aware of these impacts and adjust their strategies and decision-making accordingly. During the expansion phase, it is prudent to manage credit risks and avoid excessive debt accumulation. During the contraction phase, focus should be on managing existing debt, preserving liquidity, and identifying potential financial opportunities amidst the challenging economic conditions.

By understanding the impacts of credit cycles, stakeholders can better navigate the economic landscape, mitigate risks, and position themselves for long-term stability and growth.

Conclusion

The credit cycle is a fundamental concept in finance that describes the periodic expansion and contraction of credit within an economy. Understanding the credit cycle is crucial for policymakers, lenders, investors, and individuals, as it provides insights into the availability of credit, economic conditions, and potential risks within the financial system.

Throughout its various phases – expansion, peak, contraction, and trough – the credit cycle influences economic growth, investment patterns, consumer spending, and financial stability. During the expansion phase, credit is plentiful, interest rates are low, and economic activity booms. The peak phase marks a turning point, with credit conditions tightening and potential risks emerging. The contraction phase is characterized by reduced credit availability, rising interest rates, and slower economic growth. Finally, the trough phase represents a period of stabilization and a foundation for the next expansion.

Several factors influence the credit cycle, including monetary policy decisions, economic conditions, investor confidence, financial regulations, and government interventions. By closely monitoring these factors and analyzing key indicators such as credit growth, debt-to-income ratios, and nonperforming loan ratios, stakeholders can anticipate shifts in the credit cycle and make informed decisions.

The impacts of the credit cycle on the economy are far-reaching. It affects economic growth, business investment, consumer spending, the housing market, employment levels, financial stability, and government finances. Understanding these impacts allows individuals, businesses, and policymakers to adjust their strategies and decision-making to mitigate risks and seize opportunities.

In conclusion, the credit cycle is a dynamic and recurring phenomenon that drives the availability of credit and shapes the overall economic landscape. It is essential for stakeholders to monitor the credit cycle, navigate its various phases, and adapt to the changing economic conditions in order to foster stability, manage risks, and promote sustainable growth.