Home>Finance>Cross Default: Definition, How It Works, And Consequences

Finance

Cross Default: Definition, How It Works, And Consequences

Published: November 5, 2023

Learn the definition, working principles, and consequences of cross default in finance. Understand how this concept can impact your financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Cross Default: Definition, How It Works, and Consequences

When it comes to finances, it’s essential to have a solid understanding of the various concepts and terms that come into play. One concept that is often encountered and holds significant importance in the world of finance is cross default. But what exactly is cross default, how does it work, and what are the consequences if it occurs? In this blog post, we aim to dive deep into this topic and provide you with the necessary information to understand this concept thoroughly.

Key Takeaways:

- Cross default is a provision in financial agreements that allows the lender to declare a default if the borrower fails to meet their obligations in a separate agreement.

- It poses potential risks for borrowers as it can lead to numerous negative consequences, including accelerated payment obligations, increased interest rates, and a damaged credit rating.

Understanding Cross Default

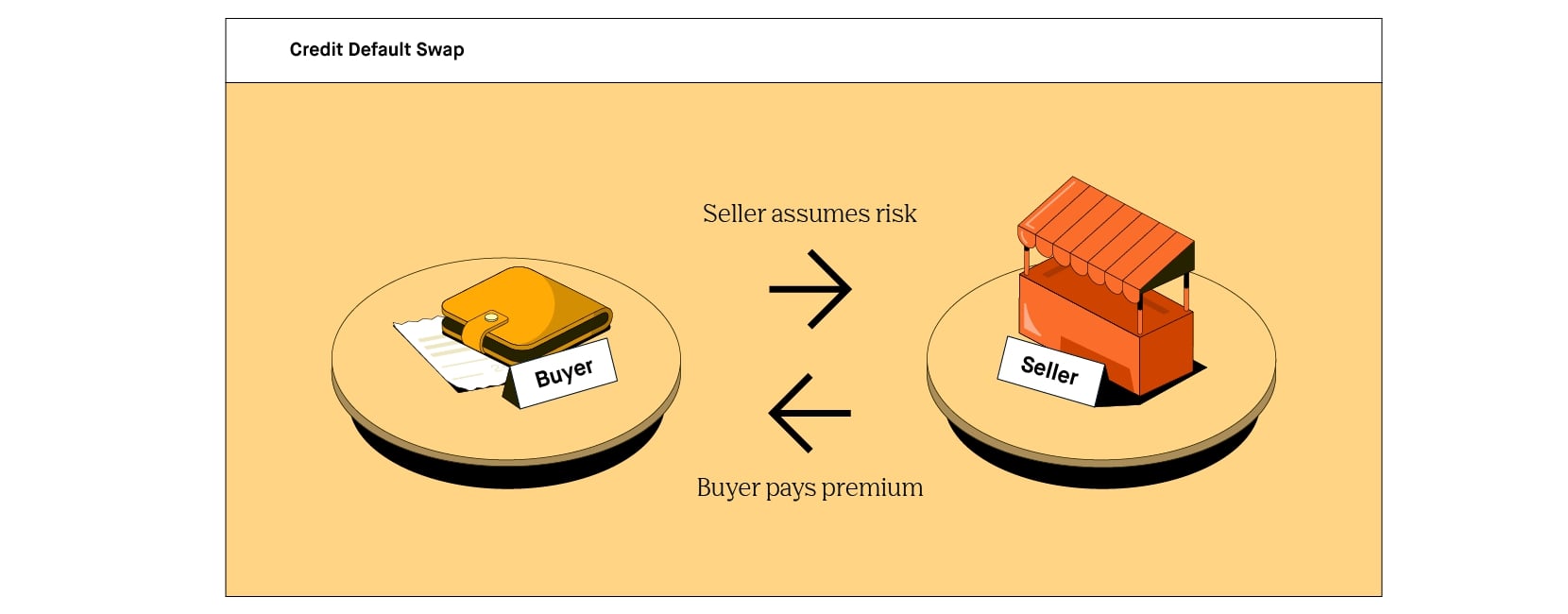

In simple terms, cross default is a safeguard that lenders include in financial agreements, such as loans or bonds, to protect their interests. This provision allows the lender to declare a default if the borrower fails to meet their obligations in a separate agreement. In other words, if a borrower defaults on an entirely unrelated financial commitment, it can trigger a default under the specific loan or bond agreement. This ensures that the lender has some control and protection if the borrower is facing financial difficulties elsewhere.

Now that we have a basic understanding of what cross default is, let’s take a closer look at how it works and its potential consequences:

How Cross Default Works

When cross default is included in a financial agreement, it typically outlines specific triggers that can lead to a default. These triggers can vary depending on the terms negotiated between the lender and borrower. Here’s a simplified example to illustrate how it works:

- A company, ABC Inc., has a loan agreement with Bank XYZ.

- ABC Inc. also has another financial agreement with Company DEF.

- If ABC Inc. defaults on its obligations under the agreement with Company DEF, the cross-default provision will enable Bank XYZ to declare a default on the loan agreement.

By incorporating cross default into the agreement, lenders protect themselves from potential risks associated with the borrower’s financial instability outside of the specific transaction.

Consequences of Cross Default

When a cross default is triggered, it can have significant consequences for the borrower. Some of the potential consequences include:

- Accelerated payment obligations: The lender may demand immediate repayment of the full outstanding principal amount, including any accrued interest.

- Increased interest rates: The default can result in an increase in the interest rate charged on the loan, making it more expensive for the borrower.

- Impaired credit rating: A cross default can negatively impact the borrower’s credit rating, making it more challenging to obtain favorable financing terms in the future.

- Risk of losing collateral: If collateral has been provided to secure the loan, the lender may exercise their right to seize and sell the collateral to recover their losses.

It is crucial for borrowers to be aware of the potential consequences of cross default and assess the risks involved before entering into financial agreements that include this provision.

In conclusion, cross default acts as a safety net for lenders, allowing them to declare a default if the borrower fails to meet their obligations in a separate agreement. This provision poses potential risks for borrowers, such as accelerated payment obligations, higher interest rates, and a damaged credit rating. Therefore, it is essential for individuals and businesses to thoroughly understand the concept of cross default and carefully evaluate the implications before entering into financial agreements that include this provision.