Finance

Definitive Securities Definition

Modified: February 21, 2024

Learn the definitive definition of securities in the world of finance, covering stocks, bonds, and other investment instruments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Definitive Securities Definition: A Comprehensive Guide

Welcome to the FINANCE category of our blog! In this article, we will dive deep into the world of securities and provide you with a definitive definition. Whether you are a seasoned investor or just starting out, understanding securities is essential to making informed financial decisions. So, let’s get started!

Key Takeaways:

- Securities are tradable financial assets that represent ownership or a debt obligation of an entity.

- They include stocks, bonds, mutual funds, and derivatives, among others.

What Are Securities?

Securities are financial instruments that are bought and sold in financial markets. They represent ownership or a debt obligation of an entity, such as a corporation or a government. Securities provide individuals and institutions with a way to invest their money and generate returns over time.

There are various types of securities that investors can choose from, including:

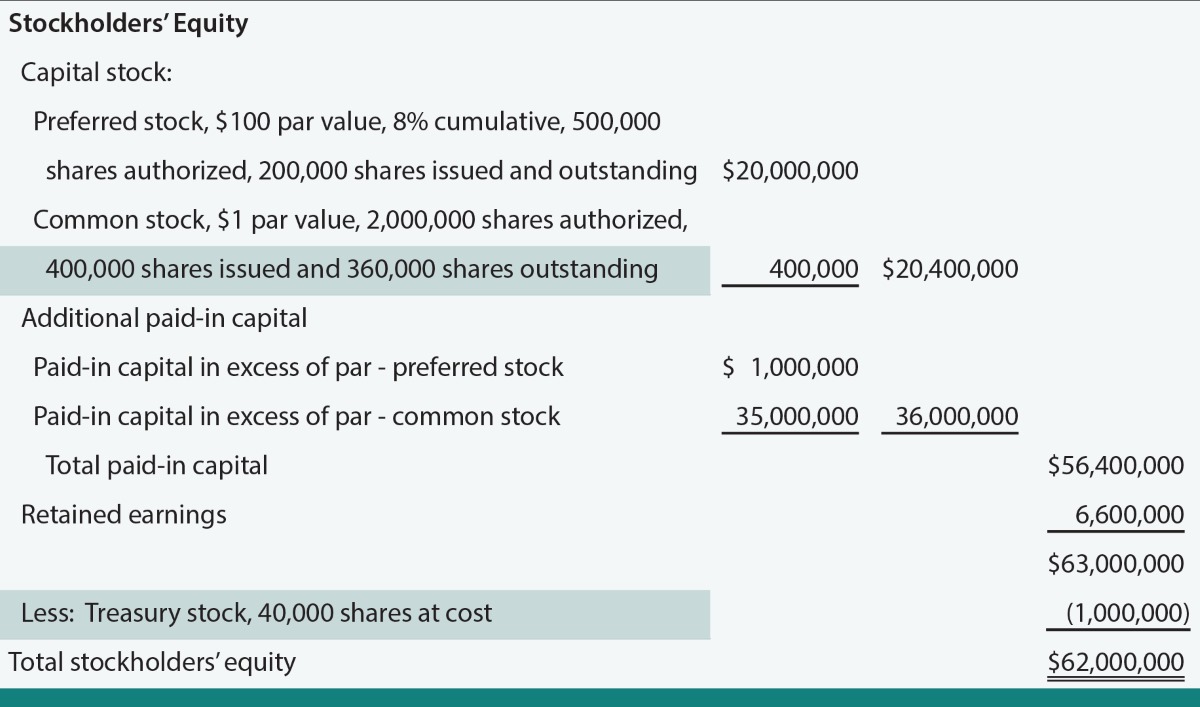

- Stocks: Also known as equity securities, stocks represent ownership in a company. When you buy stocks, you become a shareholder and have the potential to benefit from the company’s profits through dividends or capital appreciation. However, stocks also carry the risk of losing value if the company performs poorly.

- Bonds: Bonds are debt securities that represent a loan made by an investor to an entity, typically a company, municipality, or government. When you invest in bonds, you become a creditor and receive regular interest payments and the principal amount upon maturity. Bonds are generally considered less risky than stocks as they offer fixed income and have a defined maturity date.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer a convenient way to gain exposure to a wide range of securities, making them a popular choice for individual investors.

- Derivatives: Derivatives are financial contracts whose value depends on the performance of an underlying asset. They include options, futures, and swaps, among others. Derivatives are often used to hedge against risks or speculate on price movements. However, they can be complex and carry higher levels of risk compared to other securities.

Why Are Securities Important?

Securities play a crucial role in the global financial system. Here are a few reasons why they are important:

- Capital Formation: By issuing securities, companies and governments can raise capital to fund their operations, investments, and infrastructure projects. This helps stimulate economic growth and innovation.

- Investment Opportunities: Securities provide individuals and institutions with opportunities to invest their money and earn returns. They offer a range of options for investors with different risk appetites and investment goals.

- Market Liquidity: Financial markets rely on securities to provide liquidity, allowing investors to buy and sell assets easily. The ability to trade securities quickly and efficiently is essential for the functioning of financial markets.

Understanding securities is vital for anyone looking to navigate the complex world of finance. By familiarizing yourself with different types of securities and their characteristics, you can make more informed investment decisions and optimize your portfolio.

Now that you have a clear understanding of the definitive securities definition, you are better equipped to explore and delve deeper into this fascinating topic. Stay tuned for more insightful articles on finance in our blog!