Finance

Marketable Security Definition

Published: December 23, 2023

Learn the definition of marketable security in finance and how it impacts investments, with insights from industry experts. Enhance your financial knowledge today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Marketable Securities: Definition and Importance

Welcome to our Finance category! In this blog post, we will dive into the world of marketable securities, what they are, and why they are important for investors. If you’ve ever wondered about investing in financial instruments, such as stocks, bonds, or derivatives, then this post is for you. So, let’s jump right in!

Key Takeaways:

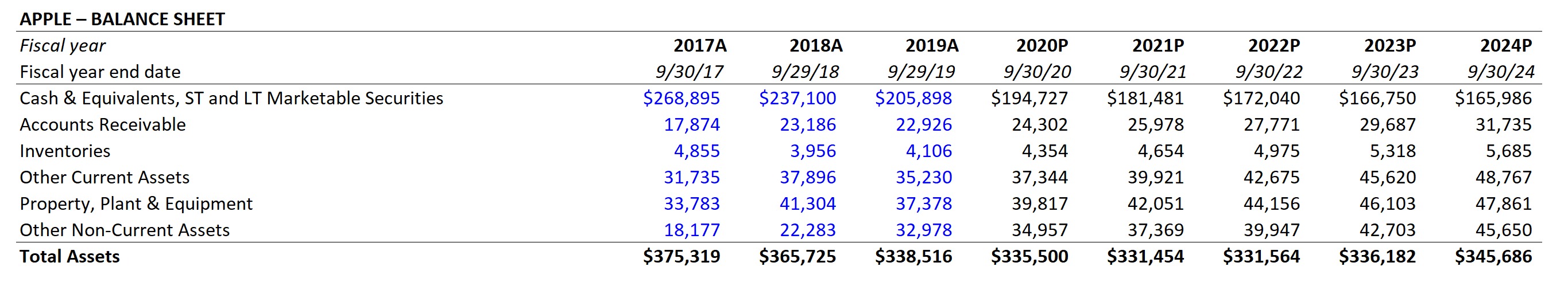

- Marketable securities are readily tradable financial instruments that can be easily converted into cash, such as stocks, bonds, and treasury bills.

- Investors utilize marketable securities for various purposes, such as short-term investments, liquidity management, and diversification of their portfolios.

What are Marketable Securities?

Marketable securities, also known as marketable debt or marketable equity securities, are financial assets that can be easily bought or sold in the market. These securities are traded on organized exchanges or over-the-counter (OTC) markets, making them highly liquid and accessible for investors.

There are different types of marketable securities:

- Stocks: Marketable equity securities refer to shares of publicly traded companies. Investors purchase stocks to become partial owners of the company and benefit from capital appreciation and dividends.

- Bonds: Marketable debt securities represent loans made to corporations or governments. Investors purchase bonds to earn periodic interest payments and receive the principal amount upon maturity.

- Treasury Bills: These are short-term marketable securities issued by the government to raise funds. Investors purchase treasury bills as a low-risk investment with guaranteed returns.

Why are Marketable Securities Important?

Now that we understand what marketable securities are, let’s explore why they are important for investors:

- Liquidity: Marketable securities can be easily converted into cash, providing investors with the ability to access their funds quickly when needed.

- Short-term Investments: These securities offer opportunities for investors looking to park their funds for short durations with the potential for higher returns compared to traditional savings accounts.

- Diversification: By investing in different types of marketable securities, investors can spread their risk and reduce the impact of unfavorable market conditions on their portfolios.

- Income Generation: Marketable securities, such as bonds, provide regular interest payments, allowing investors to generate a steady income stream.

In conclusion, marketable securities play a vital role in the world of finance. Whether you’re a seasoned investor or just starting out, understanding these instruments can help you make informed decisions and optimize your investment strategy. By leveraging their liquidity, potential return, and ability to diversify your portfolio, marketable securities can serve as valuable tools for achieving your financial goals.

Thank you for reading! Stay tuned for more insightful blog posts in our Finance category.