Home>Finance>Delta Neutral: Definition, Use With A Portfolio, And Example

Finance

Delta Neutral: Definition, Use With A Portfolio, And Example

Published: November 10, 2023

Learn the definition and application of delta neutral strategy in finance. Discover how it can be used alongside your portfolio with a practical example.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Delta Neutral: Definition, Use With a Portfolio, and Example

Finance is a complex field with various strategies and concepts that can help investors and traders make informed decisions. One such concept is delta neutral, which is an options trading strategy used to hedge against market volatility. In this blog post, we will explore the definition of delta neutral, its use with a portfolio, and provide an example to help you understand how it works.

Key Takeaways:

- Delta neutral is an options trading strategy used to hedge against market volatility.

- It involves creating a portfolio with offsetting positions to ensure that the overall delta of the portfolio remains close to zero.

What is Delta Neutral?

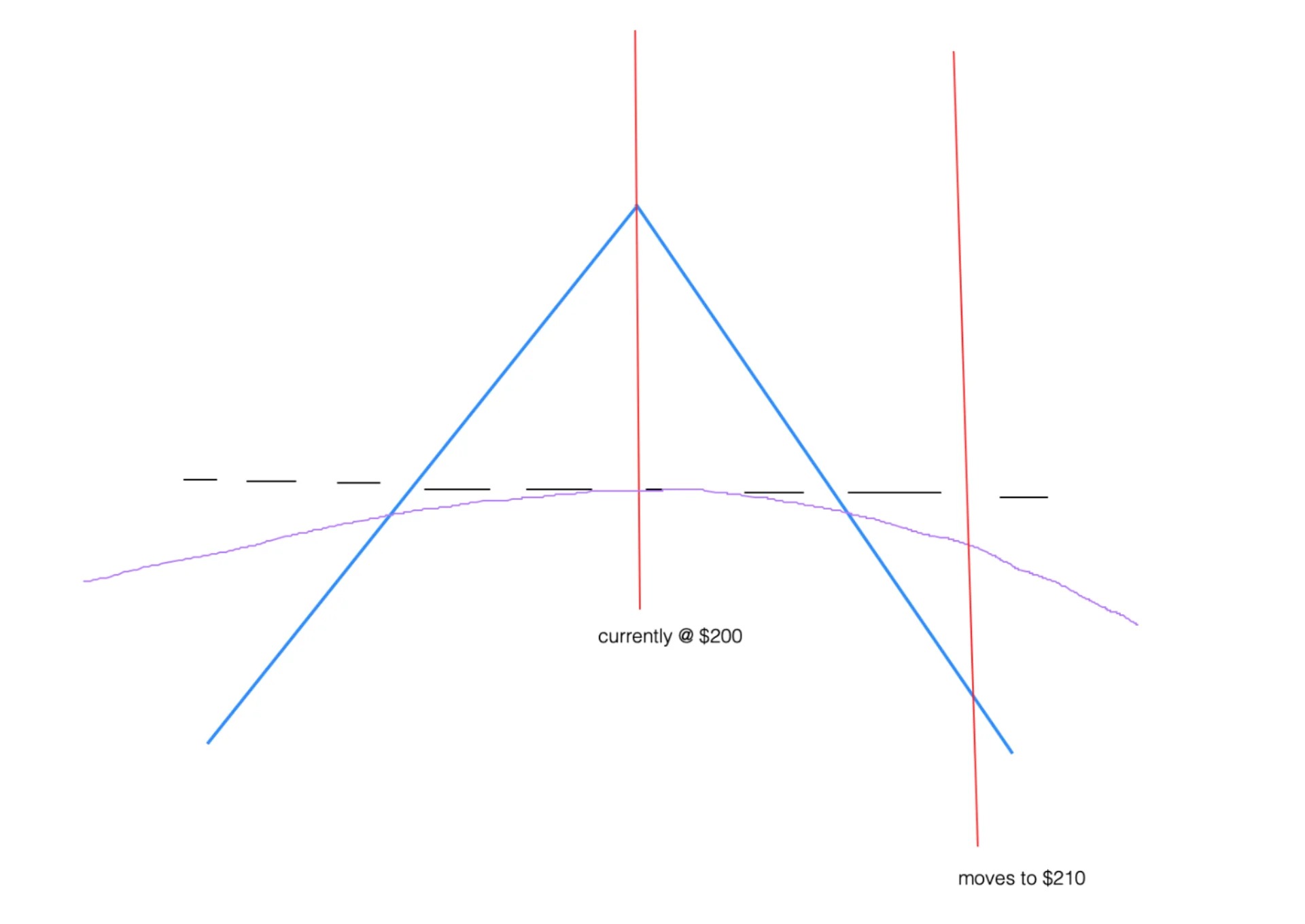

Delta neutral is a term used in options trading to describe a strategy where an investor or trader aims to hedge against market price movements. Delta, in options trading, represents the sensitivity of an option’s price to changes in the price of the underlying asset.

The delta value ranges from -1 to +1. A delta of -1 means that the option price will move in the opposite direction of the underlying asset’s price, while a delta of +1 means that the option price will move in the same direction as the underlying asset’s price. A delta value close to zero indicates that the option price is relatively insensitive to changes in the underlying asset’s price.

The goal of a delta neutral strategy is to create a portfolio with offsetting positions that will ensure the overall delta of the portfolio remains close to zero. By doing so, the strategy aims to protect the portfolio from significant losses resulting from market volatility.

Use of Delta Neutral with a Portfolio

Delta neutral strategies are commonly used by options traders and portfolio managers to hedge against price movements and reduce risk. By implementing a delta neutral strategy, investors can protect their portfolios from adverse market conditions while still maintaining exposure to potential gains.

Some key benefits of using a delta neutral strategy with a portfolio include:

- Protection against market volatility: By maintaining a portfolio with offsetting positions, investors can limit the impact of market movements on their overall investment value.

- Flexibility in trading: Delta neutral strategies allow investors to adjust their positions to align with their market expectations and risk tolerance.

- Risk management: By understanding and managing the delta of their portfolio, investors can control and minimize the overall risk exposure.

- Enhanced profit potential: Delta neutral strategies can enhance the profit potential of a portfolio by minimizing losses during market downturns and maximizing gains during market upswings.

Example of Delta Neutral Strategy

Let’s consider an example to illustrate how a delta neutral strategy works:

Suppose an investor holds a portfolio of stocks and wants to protect against potential losses resulting from market volatility. To create a delta neutral position, the investor could purchase put options on the stocks in their portfolio.

A put option gives the holder the right, but not the obligation, to sell the underlying asset at a specified price within a specified period. By purchasing put options, the investor can hedge against potential downside movements in the stock prices.

To ensure the position remains delta neutral, the investor would need to calculate the total delta of the stock holdings and the total delta of the put options purchased. If the stock holdings have a positive delta value, the investor would need to purchase put options with a negative delta value that offsets the positive delta of the stocks.

By doing so, the investor can effectively protect the portfolio from significant losses if the stock prices decline, thereby achieving a delta neutral position.

Conclusion

Delta neutral is a powerful options trading strategy that aims to hedge against market volatility and reduce risk. By creating a portfolio with offsetting positions, investors can maintain a close-to-zero delta and protect themselves from adverse market conditions. Utilizing a delta neutral strategy can provide both protection against downside risk and enhanced profit potential. It is an important concept for investors and traders to understand and implement in their portfolios to manage risk effectively.