Finance

Distinct Business Entity Definition

Modified: January 17, 2024

Learn about the distinct business entity definition in the world of finance, and understand its significance in various financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Distinct Business Entity Definition: A Key Aspect of Finance

In the world of finance, there are numerous important terms and concepts to comprehend in order to make informed decisions. One such crucial concept is the distinct business entity definition. But what exactly does this term mean? In this blog post, we will dive into what a distinct business entity is, why it matters, and how it impacts the financial landscape.

Key Takeaways:

- A distinct business entity is a legal entity that is separate from its owners, providing liability protection and tax benefits.

- Understanding the concept of distinct business entities is essential for individuals planning to start a business or investors evaluating potential investments.

What is a Distinct Business Entity?

A distinct business entity, also known as a separate legal entity, refers to a business structure that is recognized as an independent entity under the law. This means that the business is treated as a separate legal person, distinct from its owners or shareholders. Common examples of distinct business entities include corporations, limited liability companies (LLCs), and partnerships.

One of the primary advantages of establishing a distinct business entity is the limited liability protection it offers. In the event of legal issues or financial liabilities, the owners’ personal assets are generally protected. This means that creditors cannot pursue the personal assets of the owners to settle the business’s debts. Limited liability is particularly appealing to entrepreneurs and investors who want to protect their personal wealth and minimize risks.

Why Does Distinct Business Entity Definition Matter?

Now, you might wonder why understanding the concept of distinct business entities matters in the realm of finance. Here are a few reasons:

- Legal Protection: By establishing a distinct business entity, individuals can shield their personal assets from business-related liabilities.

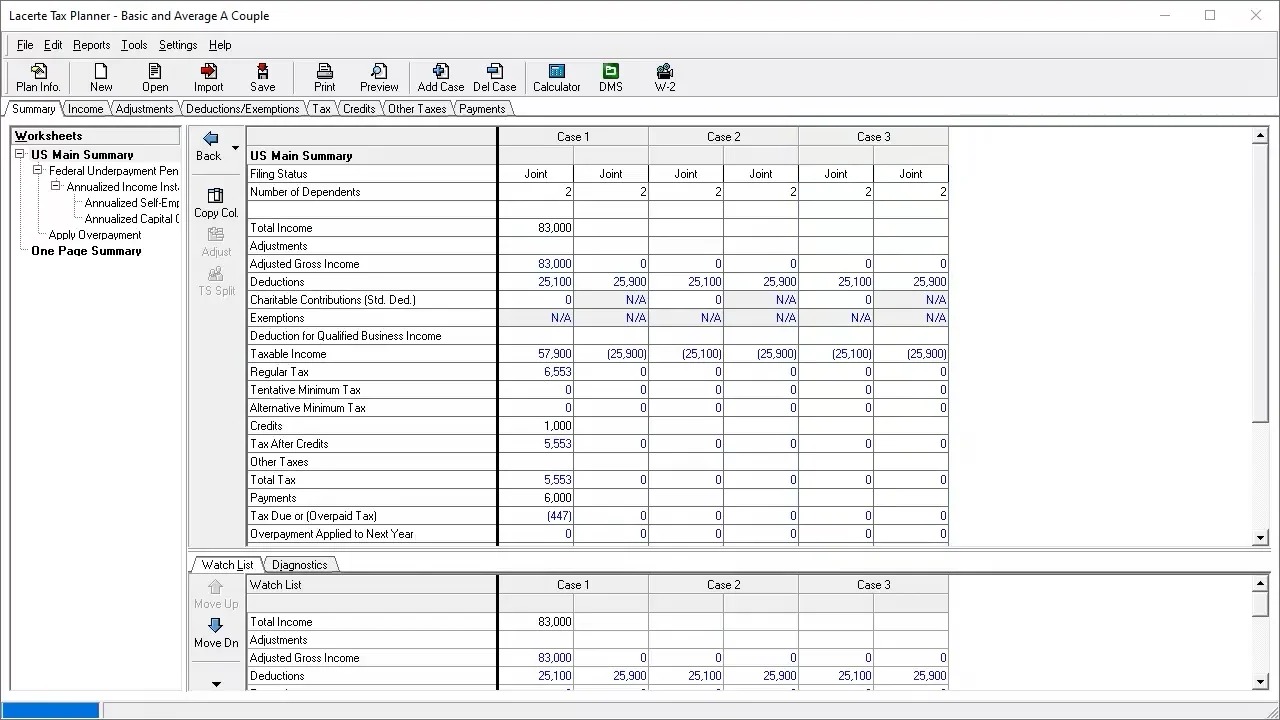

- Tax Benefits: Different business entities have specific tax implications, and understanding these can help entrepreneurs optimize their tax strategies and enhance profitability.

- Investment Opportunities: Investors often evaluate a company’s business structure before making investment decisions. Understanding the distinct business entity definition enables investors to assess the risks and benefits associated with a particular entity.

Conclusion

In conclusion, comprehending the distinct business entity definition is vital for anyone operating in the world of finance. Whether you are an entrepreneur planning to start a business or an investor assessing potential investment opportunities, understanding the concept can help you make sound financial decisions. The distinct business entity offers liability protection, tax benefits, and investment opportunities, making it a significant aspect of the finance landscape.