Home>Finance>How To Hide A Tax Planning Year In Lacerte Tax Planner

Finance

How To Hide A Tax Planning Year In Lacerte Tax Planner

Published: January 20, 2024

Learn how to hide a tax planning year using the Lacerte Tax Planner with our step-by-step guide. Enhance your finance management skills for optimal financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of tax planning! As the saying goes, the only certainties in life are death and taxes. However, with careful tax planning, you can minimize the amount of taxes you owe and maximize your savings. One tool that can greatly assist in this process is the Lacerte Tax Planner.

Lacerte Tax Planner is a comprehensive software solution designed to help individuals and businesses effectively plan and manage their taxes. It provides a wide range of features and functionalities that allow users to analyze their financial data, identify tax-saving opportunities, and create customized tax strategies.

In this article, we will take a closer look at how to hide a tax planning year using Lacerte Tax Planner. But first, let’s understand what a tax planning year is and why it is important.

A tax planning year refers to a specific period during which individuals or businesses analyze their financial situation, evaluate tax implications, and strategically plan their taxes. The goal is to minimize taxable income, maximize deductions, and ultimately reduce the overall tax liability. By strategically timing income and expenses, utilizing tax credits and deductions, and adopting tax-efficient investment strategies, individuals and businesses can potentially save a significant amount of money.

Now that we have a better understanding of tax planning years, let’s dive into the world of Lacerte Tax Planner and explore how it can help you achieve your tax goals.

Understanding Tax Planning Year

In order to effectively use Lacerte Tax Planner to hide a tax planning year, it’s important to have a clear understanding of what a tax planning year entails.

A tax planning year is a specific period of time during which individuals or businesses evaluate their financial situation, analyze their income and deductions, and strategically plan their taxes. This period typically coincides with the calendar year, but it can vary based on the specific tax regulations of a country or jurisdiction.

During the tax planning year, individuals and businesses assess their income sources and identify potential opportunities to reduce their taxable income. This can include deferring income to a future year, accelerating deductions, maximizing tax credits, and utilizing tax-advantaged investment strategies.

Tax planning involves careful analysis of the tax code, understanding different tax brackets, and taking advantage of available deductions and credits. By strategically timing financial activities and making informed decisions, individuals and businesses can minimize their tax liability and keep more of their hard-earned money.

It’s important to note that tax planning is a legal and ethical practice aimed at optimizing tax outcomes within the confines of the tax laws. Engaging in illegal tax evasion or fraudulent activities can have serious legal consequences.

Now that we have a better understanding of the tax planning year and its significance, let’s explore how Lacerte Tax Planner can be utilized to streamline the tax planning process and maximize tax savings.

Overview of Lacerte Tax Planner

Lacerte Tax Planner is a powerful software tool specifically designed to assist individuals and businesses in effectively managing and planning their taxes. It offers a wide range of features and functionalities that streamline the tax planning process and help users maximize their tax savings.

One of the key benefits of Lacerte Tax Planner is its ability to integrate with financial data from various sources. Users can import data from accounting software, spreadsheets, or manually enter the information into the system. This ensures that all relevant financial data is accounted for and provides a comprehensive view of the user’s tax situation.

Once the data is imported or entered, Lacerte Tax Planner enables users to analyze and evaluate their income, deductions, exemptions, and other financial aspects. The software has a user-friendly interface that allows for easy navigation and efficient data input.

Lacerte Tax Planner provides a variety of tools to help users create tax planning strategies tailored to their unique circumstances. Users can experiment with different scenarios by adjusting income, expenses, and other variables to see the potential impact on their tax liability. This allows users to identify the most advantageous tax strategies for their specific situation.

Another notable feature of Lacerte Tax Planner is its ability to generate tax planning reports. These reports provide a comprehensive overview of the user’s tax situation, highlighting areas of potential tax savings and offering recommendations on how to optimize tax outcomes.

Moreover, Lacerte Tax Planner allows users to collaborate with tax professionals or financial advisors. This feature facilitates effective communication and collaboration, ensuring that the tax planning process is carried out in a collaborative manner.

Overall, Lacerte Tax Planner is a comprehensive tool that simplifies the tax planning process and empowers users to make informed decisions that can lead to significant tax savings.

Now that we have an overview of Lacerte Tax Planner, let’s dive into the steps of hiding a tax planning year using this powerful software.

Step 1: Setting up Lacerte Tax Planner

Before you can start using Lacerte Tax Planner to hide a tax planning year, you need to ensure that the software is properly set up and configured. This step is crucial for accurate and efficient tax planning. Follow these steps to set up Lacerte Tax Planner:

- Install the software: Begin by installing the Lacerte Tax Planner software on your computer. Ensure that you have the necessary system requirements and follow the installation instructions provided by the software provider.

- Set up user accounts: Create user accounts for all individuals who will be using the software. Assign appropriate permissions and access levels to ensure data security and privacy.

- Configure company information: Enter the necessary details about your company or organization, such as name, address, and contact information. This information will be used for generating reports and other documents.

- Customize settings: Configure the software settings according to your preferences. This includes setting default tax rates, tax forms, and other options that align with your specific tax requirements.

- Integrate financial data: Connect Lacerte Tax Planner with your accounting software, if applicable. This allows for seamless import of financial data, saving time and reducing manual data entry.

- Update tax laws and regulations: Regularly update the software with the latest tax laws and regulations. This ensures that your tax calculations are accurate and up to date.

By following these steps, you can properly set up Lacerte Tax Planner and ensure that it is ready for use. Proper configuration and customization of the software will enable you to efficiently navigate through tax planning and maximize your tax savings.

Now that Lacerte Tax Planner is set up, let’s move on to the next step: entering client data.

Step 2: Entering Client Data

Once you have set up Lacerte Tax Planner, the next step is to enter the client data into the system. This information is crucial for accurately analyzing the client’s tax situation and creating effective tax planning strategies. Follow these steps to enter client data:

- Create a new client profile: Start by creating a new client profile within Lacerte Tax Planner. Enter the client’s personal information, such as their name, contact details, and tax identification number.

- Collect financial documents: Gather all relevant financial documents from the client, such as W-2 forms, 1099 forms, investment statements, and receipts for deductible expenses. These documents will provide the necessary information for accurate tax planning.

- Enter income details: Input the client’s income details into Lacerte Tax Planner. This includes wages, salary, self-employment income, rental income, and any other sources of income. Ensure that all income sources are accurately captured.

- Record deductions and credits: Enter the client’s deductions and credits into the system. This includes expenses such as mortgage interest, property taxes, medical expenses, educational expenses, and any eligible tax credits. Ensure that all relevant deductions and credits are properly accounted for.

- Update investment information: If the client has investments, input the relevant details into Lacerte Tax Planner. This includes information about stocks, bonds, mutual funds, and other investment vehicles. Properly updating investment information allows for accurate tax planning calculations.

- Review and verify: Double-check all the entered client data to ensure accuracy. Any discrepancies or missing information should be addressed and corrected before moving forward.

- Save and store the client profile: Once all the necessary client data has been entered and verified, save the client profile within Lacerte Tax Planner. This will allow you to access and update the information as needed during the tax planning process.

By following these steps, you can effectively enter client data into Lacerte Tax Planner and lay the foundation for comprehensive tax planning. Accurate and complete client data is essential for analyzing their tax situation and creating customized tax strategies.

Now that the client data is entered, let’s move on to the next step: analyzing the client’s tax situation.

Step 3: Analyzing Client’s Tax Situation

Once the client data is entered into Lacerte Tax Planner, the next step is to analyze their tax situation. This involves reviewing their income, deductions, credits, and other relevant financial factors to gain a comprehensive understanding of their tax liabilities and potential opportunities for tax planning. Follow these steps to analyze the client’s tax situation:

- Review income sources: Start by examining the client’s income sources, such as wages, salary, self-employment income, rental income, and investment income. Identify any income that can be deferred to a future year or accelerated to the current year for tax planning purposes.

- Assess deductions: Evaluate the client’s deductions, including mortgage interest, property taxes, medical expenses, charitable contributions, and other eligible expenses. Determine if there are any additional deductible expenses that can be claimed to reduce the client’s taxable income.

- Evaluate tax credits: Examine the client’s eligible tax credits, such as the Child Tax Credit, Earned Income Tax Credit, or education credits. Identify any credits that can be utilized to offset the client’s tax liability and potentially result in tax savings.

- Analyze investment holdings: Review the client’s investment portfolio and assess the tax consequences of buying, selling, or holding various assets. Consider strategies to minimize the client’s tax liability, such as tax-loss harvesting or utilizing tax-advantaged retirement accounts.

- Consider life events: Take into account any significant life events that may impact the client’s tax situation, such as marriage, divorce, birth of a child, or retirement. These events can have implications for tax planning and may require adjustments to the client’s tax strategies.

- Utilize tax planning software tools: Leverage the features and functionalities of Lacerte Tax Planner to perform in-depth analyses and calculations. The software can generate comprehensive reports that provide a clear picture of the client’s tax situation and highlight potential tax-saving opportunities.

- Collaborate with tax professionals: Consult with tax professionals or financial advisors to gain additional insights and ensure that all tax planning strategies are in compliance with the tax laws and regulations. Their expertise can supplement the analysis and help identify effective tax planning strategies.

By following these steps, you can thoroughly analyze the client’s tax situation and gather the necessary information for creating a customized tax plan. Understanding their income, deductions, credits, and other financial factors allows you to identify areas where tax planning can be beneficial.

Now that the client’s tax situation is analyzed, it’s time to move on to the next step: creating tax planning strategies.

Step 4: Creating Tax Planning Strategies

With a clear understanding of the client’s tax situation, it’s time to develop effective tax planning strategies using Lacerte Tax Planner. This step involves utilizing the software’s features and functionalities to identify opportunities for minimizing tax liabilities and maximizing tax savings. Follow these steps to create tax planning strategies:

- Utilize scenario planning: Use Lacerte Tax Planner to create different tax scenarios based on various income, expense, and deduction assumptions. This helps evaluate different strategies and their potential impact on the client’s tax liability.

- Identify income deferral opportunities: Analyze the client’s income sources and consider deferring income to a future tax year to potentially reduce the current year’s tax liability. This can be done by delaying invoices, deferring bonuses, or utilizing retirement savings accounts.

- Maximize deductions: Explore ways to maximize the client’s deductions. This may involve accelerating deductible expenses into the current year or considering strategies such as bunching itemized deductions every other year.

- Consider tax-efficient investments: Evaluate the client’s investment portfolio and identify opportunities for tax-efficient investing. This can include utilizing tax-advantaged retirement accounts, considering tax-efficient asset allocation strategies, or incorporating tax-loss harvesting techniques.

- Review tax credits: Examine the client’s eligibility for tax credits and identify ways to optimize their utilization. This can involve maximizing credits for education, energy-efficient home upgrades, or adopting certain eligible business practices.

- Explore retirement planning strategies: Assess the client’s retirement goals and explore tax planning strategies related to retirement savings. This may include contributing to tax-advantaged retirement accounts, such as a 401(k) or an Individual Retirement Account (IRA).

- Consider charitable contributions: Explore opportunities for strategic charitable giving. This may involve donating appreciated securities, establishing a donor-advised fund, or utilizing qualified charitable distributions from retirement accounts.

- Stay updated on tax law changes: Regularly monitor and stay informed about any tax law changes or updates that may impact the client’s tax planning strategies. Being aware of current tax regulations ensures that the strategies are in compliance and optimized for the latest tax landscape.

By following these steps and employing the tools and functionalities offered by Lacerte Tax Planner, you can create customized tax planning strategies that align with the client’s financial goals and objectives. These strategies aim to minimize tax liabilities and maximize tax savings, allowing the client to keep more of their hard-earned money.

Now that the tax planning strategies are created, let’s move on to the next step: testing different scenarios.

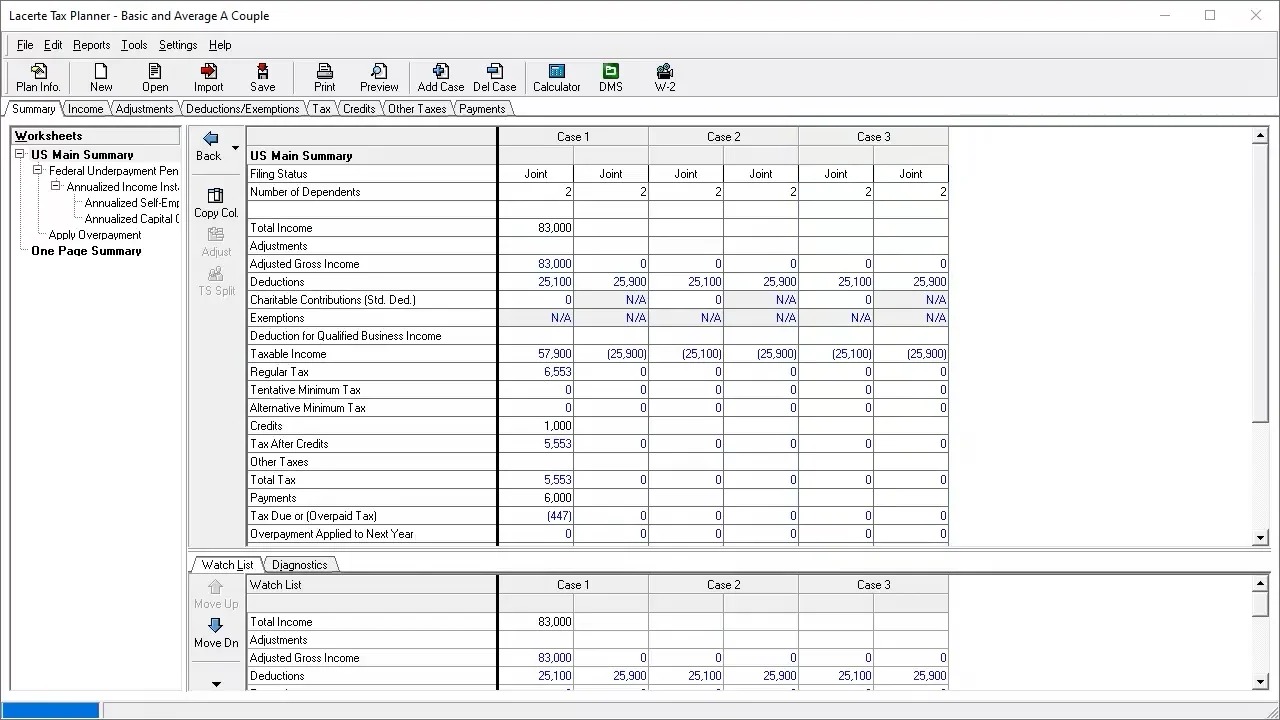

Step 5: Testing Different Scenarios

Testing different scenarios is a crucial step in the tax planning process using Lacerte Tax Planner. This step involves simulating and comparing various tax planning strategies and scenarios to determine the most effective approach for minimizing tax liabilities and maximizing savings. Follow these steps to test different scenarios:

- Select key variables: Identify the key variables that impact the client’s tax liability, such as income, deductions, credits, and investments. These variables will serve as the basis for creating different scenarios.

- Create scenario templates: Utilize the scenario planning features of Lacerte Tax Planner to create templates for different tax planning scenarios. These templates allow you to adjust variables and simulate the impact on the client’s tax liability.

- Run calculations: Use Lacerte Tax Planner to run calculations for each scenario, taking into account the client’s specific financial data and the variables selected in the previous step. This allows for a comprehensive analysis of the potential tax outcomes.

- Compare results: Review and compare the results of each scenario. Analyze the differences in tax liabilities and assess the impact of each strategy on the client’s overall financial situation.

- Evaluate risks and benefits: Consider the risks and benefits associated with each scenario. Assess the potential impact on the client’s cash flow, investment portfolio, and long-term financial goals. Take into account the current tax laws and regulations as well.

- Refine strategies: Based on the analysis and comparison of scenarios, refine the tax planning strategies. Determine which strategies are most effective in achieving the desired tax outcomes while considering the client’s individual circumstances.

- Document and save scenarios: Document the details of each scenario and save them within Lacerte Tax Planner. This allows for easy reference and future comparison when analyzing the client’s tax situation in subsequent years.

By testing different scenarios using Lacerte Tax Planner, you can gain valuable insights into the potential tax outcomes of various strategies. This step helps you identify the most effective tax planning approach for the client and make informed decisions based on the analysis of different scenarios.

Now that different scenarios have been tested, let’s move on to the final step: finalizing the tax plan.

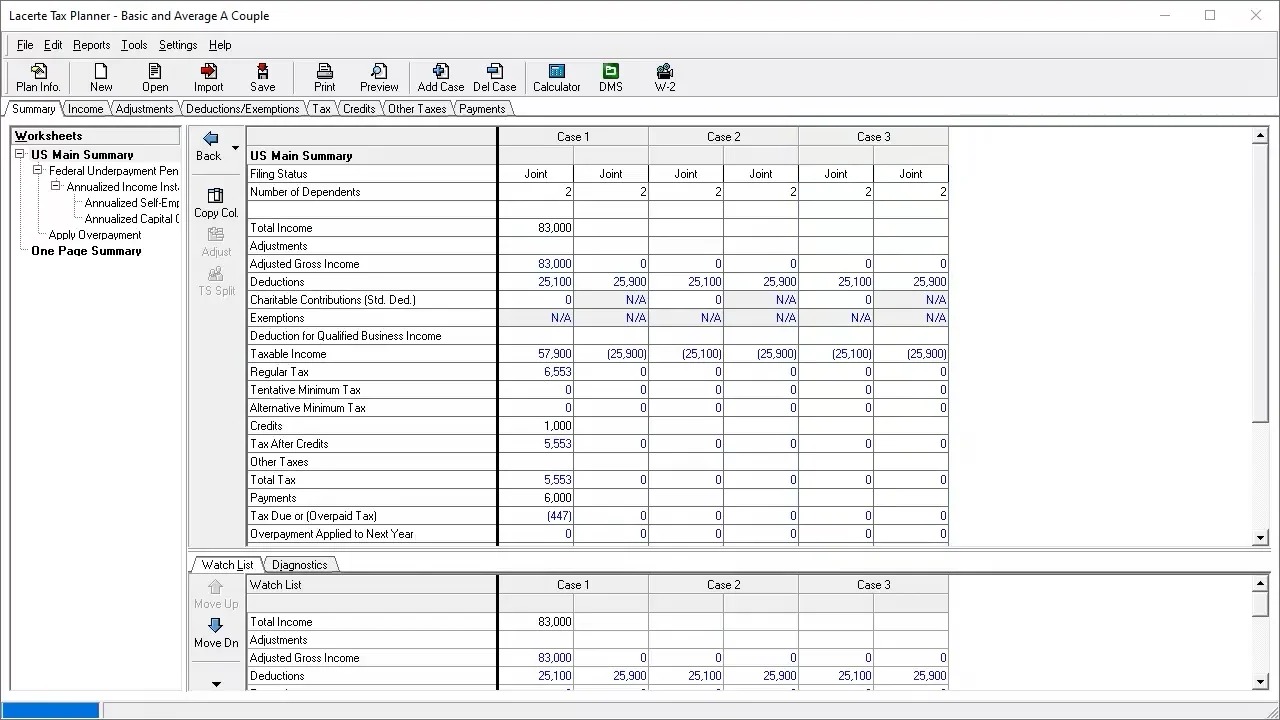

Step 6: Finalizing the Tax Plan

Once you have tested different tax planning scenarios using Lacerte Tax Planner, it’s time to finalize the tax plan. This step involves reviewing the results, making any necessary adjustments, and ensuring that the plan is optimized for the client’s specific situation. Follow these steps to finalize the tax plan:

- Review scenario outcomes: Analyze the outcomes of the different scenarios that were tested. Consider the tax liabilities, cash flow implications, and overall financial impact of each scenario. Identify the most advantageous approach for the client.

- Consider tax law changes: Take into account any recent changes in tax laws and regulations that may impact the final tax plan. Ensure that the strategies align with the latest tax guidelines and comply with all applicable tax requirements.

- Consult with tax professionals: Seek guidance from tax professionals or financial advisors to validate the proposed tax plan. Their expertise can provide valuable insights and ensure that the plan is sound, compliant, and tailored to the client’s specific goals.

- Document the tax plan: Document the final tax plan, including all the strategies, assumptions, and calculations. This documentation serves as a reference for future tax planning and helps ensure consistency in the implementation of the plan.

- Communicate the plan to the client: Present the finalized tax plan to the client in a clear and understandable manner. Clearly explain the strategies, the expected tax savings, and any action items the client needs to undertake to implement the plan effectively.

- Monitor and adjust as needed: Regularly monitor the client’s tax situation throughout the year and make any necessary adjustments to the tax plan. This ensures that the plan remains aligned with the client’s evolving financial circumstances and changing tax regulations.

- Implement and track progress: Work with the client to implement the tax plan, ensuring that all necessary actions are taken. Continuously track the progress of the plan and review its effectiveness during the tax year.

By following these steps and finalizing the tax plan with the help of Lacerte Tax Planner, you can feel confident that the strategies are well-designed and tailored to the client’s specific needs. Regular monitoring and adjustments will help ensure the ongoing effectiveness and relevance of the tax plan.

Congratulations! You have successfully completed all the steps required to hide a tax planning year using Lacerte Tax Planner. By leveraging the software’s powerful features and functionalities, you have optimized the client’s tax outcomes and prepared them for financial success.

Best of luck in your tax planning endeavors!

Conclusion

Effective tax planning is a crucial aspect of managing personal and business finances. With the help of Lacerte Tax Planner, individuals and businesses can streamline the tax planning process and maximize tax savings. By following the steps outlined in this article, you can successfully hide a tax planning year using this powerful software.

We started by understanding the concept of a tax planning year and its significance in minimizing tax liabilities. Then, we provided an overview of Lacerte Tax Planner, highlighting its features and functionalities that make it an ideal tool for tax planning. We walked through setting up the software, entering client data, analyzing tax situations, creating tax planning strategies, testing different scenarios, and finalizing the tax plan.

By utilizing Lacerte Tax Planner, you can effectively analyze income, deductions, credits, and investments to identify opportunities for optimizing tax outcomes. The software’s scenario planning capabilities allow you to compare different tax strategies and select the one that best meets the client’s objectives.

Remember to consult with tax professionals or financial advisors throughout the process to ensure compliance with tax laws and regulations and to gain additional insights into the client’s specific situation.

Tax planning is an ongoing process. Regularly monitor the effectiveness of the tax plan and make adjustments as needed. Stay informed about changes in tax laws and regulations to ensure that the plan remains up to date and aligned with the client’s evolving financial circumstances.

Lacerte Tax Planner serves as a powerful tool in your tax planning arsenal. By following the step-by-step approach outlined in this article, you can effectively navigate the software and create tailored tax plans that minimize tax liabilities and maximize savings.

With diligence, attention to detail, and the use of Lacerte Tax Planner, you can confidently navigate the intricacies of tax planning and secure a brighter financial future for yourself or your business.