Home>Finance>Earnings Before Interest, Taxes, Depreciation, Amortization, Special Losses (EBITDAL) Definition

Finance

Earnings Before Interest, Taxes, Depreciation, Amortization, Special Losses (EBITDAL) Definition

Published: November 15, 2023

Learn the definition of Earnings Before Interest, Taxes, Depreciation, Amortization, Special Losses (EBITDAL) in finance. Gain insight into financial analysis with EBITDAL.

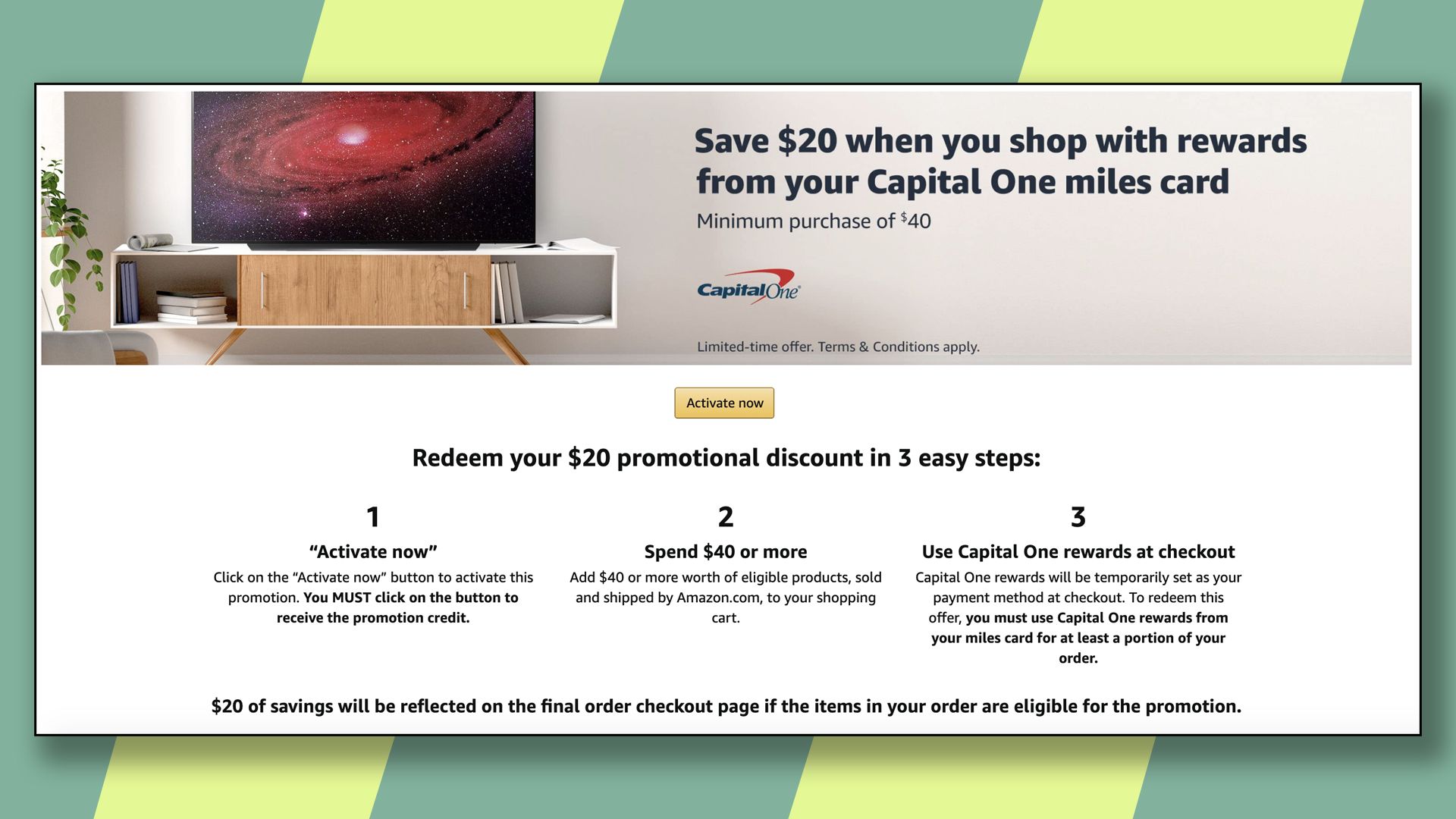

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Earnings Before Interest, Taxes, Depreciation, Amortization, Special Losses (EBITDAL)

When it comes to analyzing a company’s financial performance, there are several key metrics that investors and analysts turn to. One such metric is Earnings Before Interest, Taxes, Depreciation, Amortization, Special Losses (EBITDAL). In this blog post, we will delve into the definition and importance of EBITDAL, as well as its relevance in the field of finance.

Key Takeaways:

- EBITDAL is a financial metric used to assess a company’s operating performance before accounting for interest, taxes, depreciation, amortization, and special losses.

- It provides a clearer picture of a company’s core operations, as it eliminates factors that are unrelated to its day-to-day business activities.

Now let’s dive deeper into what EBITDAL entails and how it can provide valuable insights into a company’s financial health.

Breaking Down EBITDAL

EBITDAL is calculated by starting with a company’s net income and adding back interest, taxes, depreciation, amortization, and any special losses incurred during a specific period. By excluding these factors, the metric allows investors and analysts to evaluate a company’s operational profitability without the influence of external variables.

Here’s a breakdown of the components included in EBITDAL:

- Earnings Before Interest (EBI): This represents a company’s operating income before factoring in interest expenses paid on debt obligations.

- Taxes: Taxes refer to the income taxes a company pays based on its net income.

- Depreciation: Depreciation accounts for the decrease in the value of a company’s tangible assets over time.

- Amortization: Amortization involves the gradual reduction of an intangible asset’s value, such as patents or copyrights, over its useful life.

- Special Losses: Special losses include one-time charges or extraordinary expenses that are not considered part of a company’s regular operations.

By excluding these factors, EBITDAL provides a clearer view of a company’s underlying profitability from its core operations. This metric can be particularly useful when comparing companies in the same industry or assessing a company’s performance over time.

The Importance of EBITDAL in Finance

EBITDAL is an important metric in finance for several reasons:

- Comparability: By eliminating the effects of interest, taxes, depreciation, amortization, and special losses, EBITDAL allows for more accurate comparisons between companies. This is especially valuable when evaluating companies with different capital structures or tax obligations.

- Operational Efficiency: EBITDAL provides insight into a company’s operational profitability, allowing investors and analysts to assess how efficiently it generates income from its core activities. This can help identify areas where operational improvements can be made.

Overall, EBITDAL serves as a useful tool in assessing a company’s financial performance by focusing on its operational profitability. By understanding the components involved in EBITDAL and how it is calculated, investors and analysts can gain valuable insights into a company’s financial health and make more informed decisions.

Remember, when it comes to finance, EBITDAL is just one of many metrics available for evaluation. It is essential to consider other factors and metrics in conjunction with EBITDAL to obtain a comprehensive understanding of a company’s financial standing.