Home>Finance>Fair Debt Collection Practices Act (FDCPA): Definition And Rules

Finance

Fair Debt Collection Practices Act (FDCPA): Definition And Rules

Published: November 22, 2023

Learn the definition and rules of the Fair Debt Collection Practices Act (FDCPA) under the FINANCE category. Understand your rights and protections as a consumer in debt collection.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

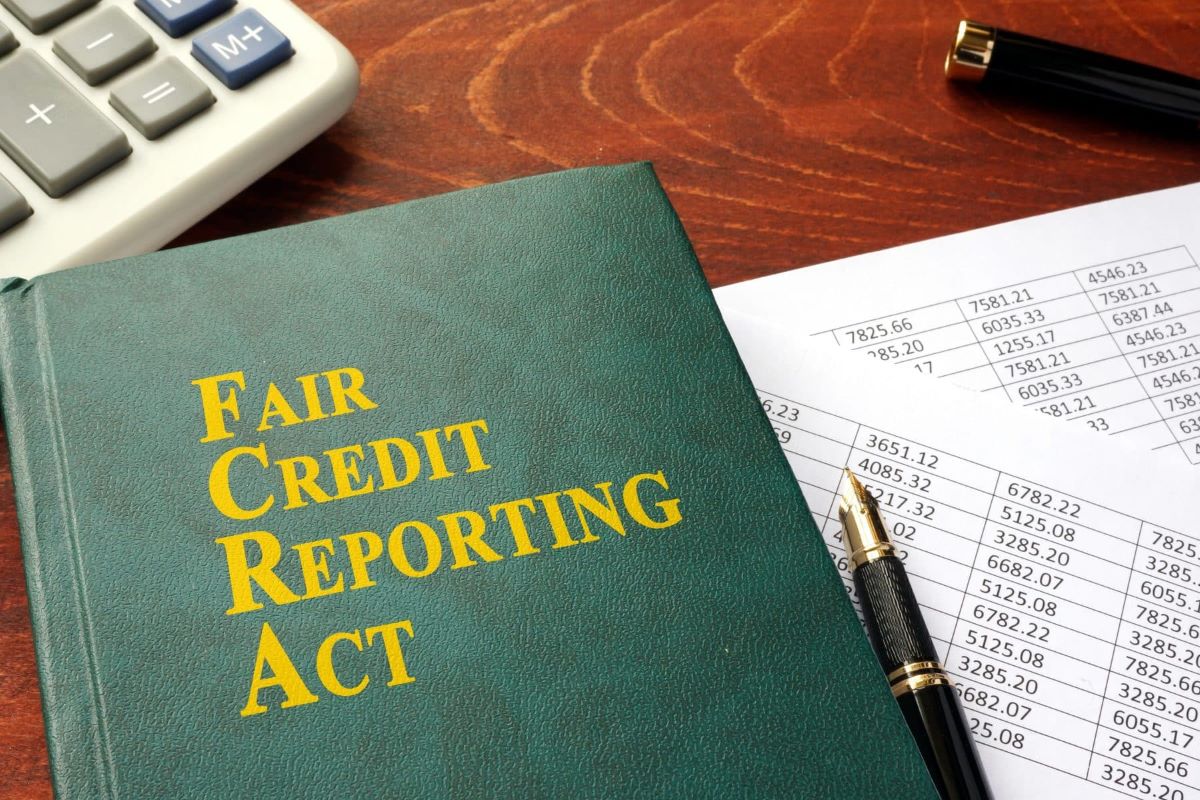

Understanding the Fair Debt Collection Practices Act (FDCPA): Definition and Rules

When it comes to managing personal finances, staying informed about the regulations and laws that protect consumers is crucial. The Fair Debt Collection Practices Act (FDCPA) is one such law that plays a significant role in safeguarding individuals from unfair practices employed by debt collectors. In this blog post, we will delve into the definition and rules of the FDCPA, providing insights into how it can help you navigate debt collection proceedings.

Key Takeaways:

- The Fair Debt Collection Practices Act (FDCPA) is a federal law that regulates debt collection practices in the United States.

- It establishes guidelines for how debt collectors can communicate with consumers, sets limitations on their actions, and outlines the legal remedies available to consumers in case of violations.

So, what exactly is the FDCPA? In simple terms, it is a federal law enacted to protect consumers against unfair and abusive practices employed by debt collectors. It sets guidelines and restrictions on how debt collectors can conduct their business, ensuring that individuals are treated fairly during the collection process.

Under the FDCPA, debt collectors are prohibited from engaging in practices that may harass, oppress, or abuse consumers. This includes using threats, obscene language, or repeated phone calls with the intention to annoy or intimidate individuals into paying their debts. Additionally, debt collectors must provide accurate and transparent information about the debt owed, including the amount, the original creditor, and the options available to resolve the debt.

It’s important to note that the FDCPA only applies to third-party debt collectors and not to the original creditors themselves. If a debt collector violates the regulations outlined in the FDCPA, consumers have the right to take legal action. They can file complaints with the Federal Trade Commission (FTC), seek damages in court, or even request the debt collector to stop contacting them entirely.

By familiarizing yourself with the FDCPA, you can protect your rights as a consumer and ensure that debt collectors treat you fairly. Here are a few key rules established by the FDCPA:

- Debt collectors cannot contact you at inconvenient times, such as before 8 am or after 9 pm, unless you agree otherwise.

- They are not allowed to contact you directly if you have hired an attorney to represent you in regards to the debt.

- Debt collectors must provide written validation of the debt within five days of the initial contact.

- You have the right to dispute a debt and request that the debt collector provide proof of its validity.

The FDCPA serves as a vital tool in protecting consumers from predatory debt collection practices. By understanding your rights and the regulations outlined under the FDCPA, you can effectively navigate the debt collection process and take appropriate action if necessary.

Remember, if you believe your rights have been violated under the FDCPA, it’s advisable to consult with legal professionals who specialize in debt collection laws. They can guide you through the process of filing complaints and seeking necessary remedies to address any violations.

Stay educated, stay empowered!