Home>Finance>How Do I Figure Out The Minimum Payment On College Loans

Finance

How Do I Figure Out The Minimum Payment On College Loans

Published: February 25, 2024

Learn how to calculate the minimum payment on college loans and manage your finances effectively with our expert tips and advice. Take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding the Minimum Payment on College Loans

Introduction

Navigating the complexities of college loans can be overwhelming, especially when it comes to understanding the minimum payment requirements. For many individuals, student loans are a necessary means to access higher education, but comprehending the repayment process is often challenging. The minimum payment on college loans is a crucial aspect of managing one’s finances post-graduation. In this article, we will delve into the intricacies of college loan minimum payments, exploring the factors that influence these payments and providing insights into how to calculate and manage them effectively.

Understanding the dynamics of minimum payments on college loans is essential for borrowers, as it directly impacts their financial planning and budgeting. By gaining a comprehensive understanding of the minimum payment requirements, borrowers can make informed decisions and develop strategies to manage their college loan repayments more efficiently.

Throughout this article, we will unravel the complexities of college loan minimum payments, shedding light on the various factors that influence these payments and offering practical guidance on how to navigate this aspect of student loan management. Whether you are a recent graduate or a seasoned professional looking to gain a deeper understanding of college loan repayments, this article aims to equip you with the knowledge and insights needed to make informed financial decisions and effectively manage your college loan payments.

Understanding College Loans

College loans serve as a crucial financial resource for numerous students pursuing higher education. These loans provide the means to cover tuition fees, living expenses, and other educational costs, enabling individuals to access valuable learning opportunities. However, it’s imperative to comprehend the intricacies of college loans, including the types of loans available, interest rates, and repayment structures.

When considering college loans, it’s essential to differentiate between federal and private loans. Federal loans, offered by the government, typically come with fixed interest rates and various repayment options. On the other hand, private loans are provided by financial institutions and often entail variable interest rates and different terms and conditions. Understanding the distinctions between these loan types is pivotal in making informed borrowing decisions.

Interest rates play a significant role in college loans, impacting the total amount repaid over the loan’s lifespan. It’s crucial for borrowers to comprehend the implications of interest rates and how they affect the overall cost of borrowing. Additionally, the repayment structure of college loans, including the minimum payment requirements, deferment options, and loan forgiveness programs, warrants thorough understanding to effectively manage the repayment process.

Furthermore, borrowers should familiarize themselves with the concept of loan servicers, the entities responsible for managing loan accounts and processing payments. Understanding the role of loan servicers and effectively communicating with them can streamline the loan management process and alleviate potential challenges.

By gaining a comprehensive understanding of college loans, borrowers can make informed decisions when selecting loan options, assessing repayment structures, and planning for their financial obligations post-graduation. This knowledge empowers individuals to navigate the complexities of college loans with confidence, ensuring that they can effectively manage their loan obligations while pursuing their educational aspirations.

Factors Affecting Minimum Payments

Several key factors influence the minimum payments required for college loans. Understanding these factors is essential for borrowers seeking to manage their loan repayments effectively. By comprehending the elements that contribute to minimum payment calculations, individuals can develop informed strategies to navigate their financial obligations and ensure timely repayments.

Loan Balance: The outstanding balance of the loan directly impacts the minimum payment amount. Generally, a higher loan balance results in a higher minimum monthly payment. Borrowers with substantial loan balances may face more significant financial obligations, necessitating careful budgeting and financial planning.

Interest Rate: The interest rate attached to the loan significantly influences the minimum payment. Higher interest rates lead to increased minimum payments, as a larger portion of each payment is allocated to interest rather than the principal balance. Understanding the implications of interest rates is crucial for borrowers, as it directly affects the overall cost of borrowing and the duration of the repayment period.

Repayment Plan: The chosen repayment plan, whether standard, graduated, income-driven, or extended, plays a pivotal role in determining the minimum payment amount. Each plan has distinct features and structures, impacting the monthly payment obligations. Borrowers should carefully evaluate the available repayment options to select a plan that aligns with their financial circumstances and long-term repayment goals.

Loan Term: The duration of the loan, commonly referred to as the loan term, influences the minimum payment requirements. Shorter loan terms typically result in higher monthly payments, while longer terms may offer more manageable minimum payment amounts. Understanding the implications of the loan term is essential for borrowers, as it directly impacts the overall cost of the loan and the duration of the repayment period.

Income and Financial Status: For income-driven repayment plans, the borrower’s income and financial status play a significant role in determining the minimum payment amount. These plans calculate the monthly payment based on the borrower’s discretionary income, ensuring that the repayment amount remains proportionate to the individual’s financial capacity.

By considering these factors, borrowers can gain a comprehensive understanding of the elements that influence minimum payments on college loans. This knowledge empowers individuals to make informed decisions regarding their loan repayment strategies, enabling them to effectively manage their financial obligations while pursuing their educational and career aspirations.

Calculating Minimum Payment

Understanding how the minimum payment on college loans is calculated is essential for borrowers seeking to manage their financial obligations effectively. The calculation of the minimum payment involves several key elements, each contributing to the determination of the monthly repayment amount.

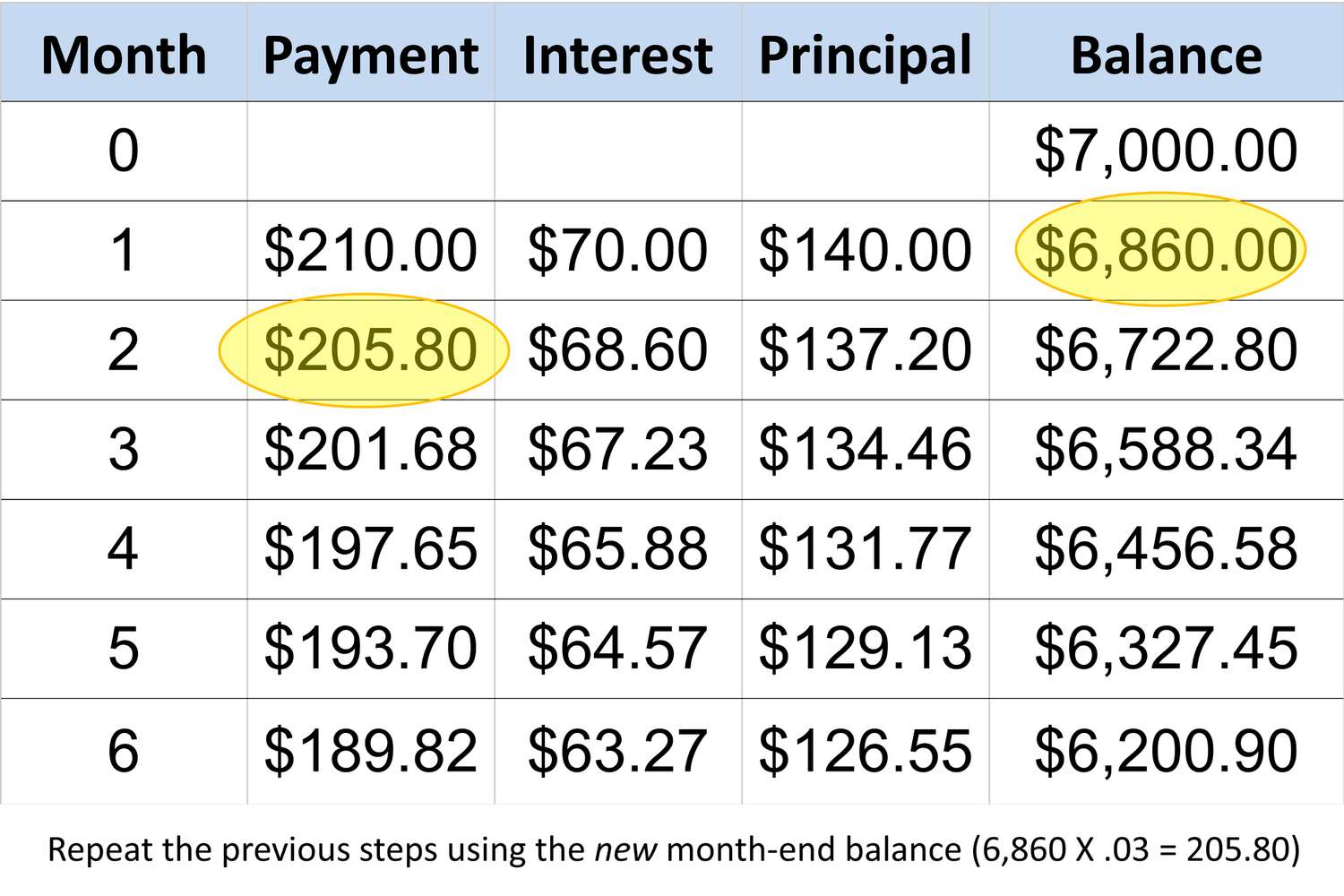

Standard Repayment Formula: The standard method for calculating the minimum payment on college loans involves considering the loan balance, interest rate, and loan term. The minimum payment is structured to ensure that the loan is fully repaid within the specified term while accounting for the accruing interest over the repayment period.

Interest Calculation: The interest accrued on the loan directly impacts the minimum payment amount. Understanding how interest is calculated, whether through simple or compound interest, is crucial for borrowers. The interest calculation method influences the total cost of borrowing and the distribution of payments between interest and the principal balance.

Amortization Schedule: An amortization schedule outlines the repayment timeline, detailing the allocation of each payment between interest and principal. By reviewing the amortization schedule, borrowers can gain insights into how their minimum payments contribute to reducing the outstanding balance over time.

Impact of Additional Payments: Making additional payments towards the principal balance can impact the minimum payment amount in subsequent periods. By reducing the principal balance, borrowers may potentially lower their minimum monthly payments or shorten the overall repayment period, ultimately saving on interest costs.

Income-Driven Repayment Calculations: For income-driven repayment plans, the calculation of the minimum payment involves assessing the borrower’s discretionary income and adjusting the repayment amount accordingly. These calculations aim to ensure that the minimum payment remains proportionate to the borrower’s financial capacity, accommodating fluctuations in income over time.

By understanding the intricacies of minimum payment calculations, borrowers can gain clarity on the factors influencing their monthly repayment obligations. This knowledge empowers individuals to make informed decisions regarding their loan management strategies, enabling them to navigate their financial responsibilities effectively while pursuing their educational and career goals.

Strategies for Managing College Loan Payments

Effectively managing college loan payments is essential for borrowers aiming to navigate their financial obligations with confidence and diligence. By implementing strategic approaches to loan management, individuals can optimize their repayment process and ensure financial stability while pursuing their educational and career aspirations.

1. Budgeting and Financial Planning: Developing a comprehensive budget that accounts for loan repayments is crucial. By allocating a specific portion of income towards loan payments, borrowers can ensure that their financial resources are managed efficiently, minimizing the risk of missed or late payments.

2. Exploring Repayment Options: Understanding the various repayment plans available for college loans is critical. Borrowers should explore options such as standard, graduated, income-driven, and extended repayment plans to identify the most suitable approach based on their financial circumstances and long-term repayment goals.

3. Leveraging Auto-Pay and Payment Scheduling: Setting up automatic payments or scheduling payments in advance can streamline the repayment process. This approach reduces the likelihood of missed payments and may even lead to potential interest rate reductions offered by some lenders for enrolling in auto-pay programs.

4. Prioritizing High-Interest Loans: If managing multiple college loans, prioritizing the repayment of high-interest loans can lead to long-term interest savings. By allocating additional funds towards high-interest loans while making minimum payments on others, borrowers can expedite the repayment process and reduce overall interest costs.

5. Seeking Loan Forgiveness and Assistance Programs: Researching and applying for loan forgiveness programs, particularly for federal loans, can provide relief for borrowers working in public service or specific industries. Additionally, exploring assistance programs offered by employers or professional organizations can alleviate the financial burden of college loan repayments.

6. Communicating with Loan Servicers: Establishing open communication with loan servicers is essential. In cases of financial hardship or unforeseen circumstances, borrowers should proactively engage with their loan servicers to explore available options, such as deferment, forbearance, or loan modification.

7. Investing in Financial Literacy: Continuously educating oneself about personal finance and loan management can yield long-term benefits. By enhancing financial literacy, borrowers can make informed decisions, optimize their loan repayment strategies, and effectively plan for their financial future.

By implementing these strategies, borrowers can proactively manage their college loan payments, mitigate financial stress, and work towards achieving long-term financial wellness. These approaches empower individuals to navigate their loan obligations effectively, ensuring that they can pursue their educational and career endeavors with financial confidence and stability.

Conclusion

Managing college loan payments is a significant aspect of post-graduation financial planning, and understanding the intricacies of minimum payments is essential for borrowers. By gaining insights into the factors influencing minimum payments, the calculation process, and strategic approaches to loan management, individuals can navigate their loan obligations with confidence and diligence.

Throughout this article, we’ve explored the multifaceted nature of college loans, delving into the various factors that impact minimum payments. From loan balance and interest rates to repayment plans and income-driven calculations, each element plays a pivotal role in determining the minimum monthly payment amount. By comprehending these factors, borrowers can make informed decisions and develop effective strategies to manage their loan repayments.

Furthermore, understanding how minimum payments are calculated provides borrowers with clarity on the dynamics of the repayment process. Whether through standard repayment formulas, interest calculations, or income-driven repayment assessments, the calculation methods offer valuable insights into the allocation of payments and the long-term impact on the loan balance.

Implementing strategic approaches to managing college loan payments empowers borrowers to optimize their financial resources and achieve long-term stability. By budgeting effectively, exploring repayment options, leveraging payment automation, and prioritizing high-interest loans, individuals can proactively navigate their loan obligations while working towards their broader financial goals.

Ultimately, effective loan management requires continuous engagement with financial literacy, open communication with loan servicers, and a proactive approach to seeking assistance and forgiveness programs. By investing in financial education and maintaining transparent communication, borrowers can navigate their loan obligations with confidence and resilience.

In conclusion, comprehending the minimum payment requirements and adopting strategic approaches to loan management enables borrowers to achieve financial wellness and pursue their educational and career aspirations with confidence. By leveraging the insights and strategies outlined in this article, individuals can navigate the complexities of college loan payments and work towards long-term financial stability.