Finance

How Do I Notify Credit Bureaus Of A Death

Published: January 6, 2024

Losing a loved one is difficult. Find out how to notify credit bureaus of a death and ensure financial matters are properly managed. Trust our expertise in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dealing with the loss of a loved one is an incredibly difficult and emotional time. In addition to the emotional toll, there are also practical matters that need to be addressed, such as notifying credit bureaus of the person’s passing. This is an important step to prevent potential identity theft and fraud using the deceased person’s information.

Credit bureaus, also known as credit reporting agencies, play a vital role in the financial system. They collect and maintain credit information of individuals, which is used by lenders, creditors, and other financial institutions to evaluate creditworthiness and make lending decisions. It is crucial to inform credit bureaus about a death to ensure that the deceased person’s credit file is appropriately marked and updated.

By notifying credit bureaus of a death, you can protect the deceased person’s identity and help prevent fraudulent activity. This includes unauthorized access to existing accounts or the opening of new accounts in the deceased person’s name. Taking the necessary steps to inform credit bureaus can save the deceased person’s family or estate potential headaches and financial losses down the road.

In this article, we will outline the steps to notify the three major credit bureaus in the United States – Equifax, Experian, and TransUnion – of a death. These steps will help ensure that the credit files of the deceased person are handled appropriately and protect against potential identity theft or fraud.

Understanding Credit Bureaus

Before we dive into the process of notifying credit bureaus of a death, let’s first understand what credit bureaus are and their role in the financial system.

Credit bureaus are agencies that collect, maintain, and distribute credit information about individuals. They gather data from various sources, including financial institutions, lenders, and creditors, and compile it into a credit report. This report contains information such as credit accounts, payment history, outstanding debts, and public records related to creditworthiness.

In the United States, there are three main credit bureaus: Equifax, Experian, and TransUnion. These bureaus are private companies that operate independently and compete with one another. They gather and process vast amounts of data to generate credit reports and credit scores that financial institutions use to assess an individual’s creditworthiness when applying for loans, credit cards, or other forms of credit.

Each credit bureau may have slightly different data collection methods and sources. Therefore, it is essential to notify all three major credit bureaus of a death to ensure that the deceased person’s credit file is marked appropriately. This helps protect the deceased individual’s identity and prevents fraudulent activity from occurring using their personal information.

It’s important to note that credit bureaus operate under the Fair Credit Reporting Act (FCRA), a federal law that governs how consumer credit information is collected, reported, and used. The FCRA sets guidelines on how credit bureaus should handle consumer information, including the removal of inaccurate or outdated information from credit reports and establishing procedures for responding to consumer disputes.

Understanding the role and function of credit bureaus is essential when it comes to notifying them of a death. By informing these bureaus, you can ensure that the deceased person’s credit information is appropriately handled, which helps protect their identity and prevent any potential misuse or fraud.

Importance of Notifying Credit Bureaus

Notifying credit bureaus of a death is a crucial step to protect the deceased person’s identity and prevent potential identity theft or fraud. Let’s explore the importance of informing credit bureaus about a death and the potential consequences of neglecting this essential task.

1. Identity Protection: When someone passes away, their personal information can still be at risk. Identity thieves may attempt to exploit the deceased person’s information to open new accounts, incur debts, or commit fraudulent activities. By notifying credit bureaus of the death, the deceased person’s credit file can be flagged or frozen to prevent unauthorized access and potential misuse of their identity.

2. Financial Security: Neglecting to inform credit bureaus about a death can have considerable financial implications for the deceased person’s estate or family. If fraudulent activities occur, such as unauthorized charges or new accounts opened in the deceased individual’s name, it can be challenging to address and resolve these issues without proper documentation and notification to the credit bureaus.

3. Legal Obligations: In some cases, there may be legal obligations to notify credit bureaus of a death. For example, if the deceased person had joint accounts or cosigners, it is essential to inform the credit bureaus to prevent any liability on the part of the surviving individual or cosigner. Failure to fulfill these obligations can lead to legal complications and financial repercussions.

4. Estate Administration: Properly notifying credit bureaus of a death is essential for the administration of the deceased person’s estate. It ensures that accurate information is reflected in their credit file, which may be necessary for estate settlement, debt repayment, or other financial matters. It can also help streamline the process of closing accounts, transferring assets, and resolving outstanding debts.

5. Peace of Mind: By taking the necessary steps to inform credit bureaus about a death, the deceased person’s family and loved ones can have peace of mind. They can rest assured that the deceased individual’s credit information is being handled appropriately, minimizing the risk of identity theft, and avoiding potential financial burdens in the future.

Overall, notifying credit bureaus of a death is not only a responsible action but also a crucial one. It protects the deceased person’s identity, safeguards the finances of their estate or family, and ensures compliance with legal obligations. By taking this step, you can provide a solid foundation for resolving financial matters and preserving the deceased individual’s legacy.

Steps to Notify Credit Bureaus of a Death

When it comes to notifying credit bureaus of a death, there are specific steps to follow to ensure that the process is completed accurately and efficiently. Here are the steps you should take:

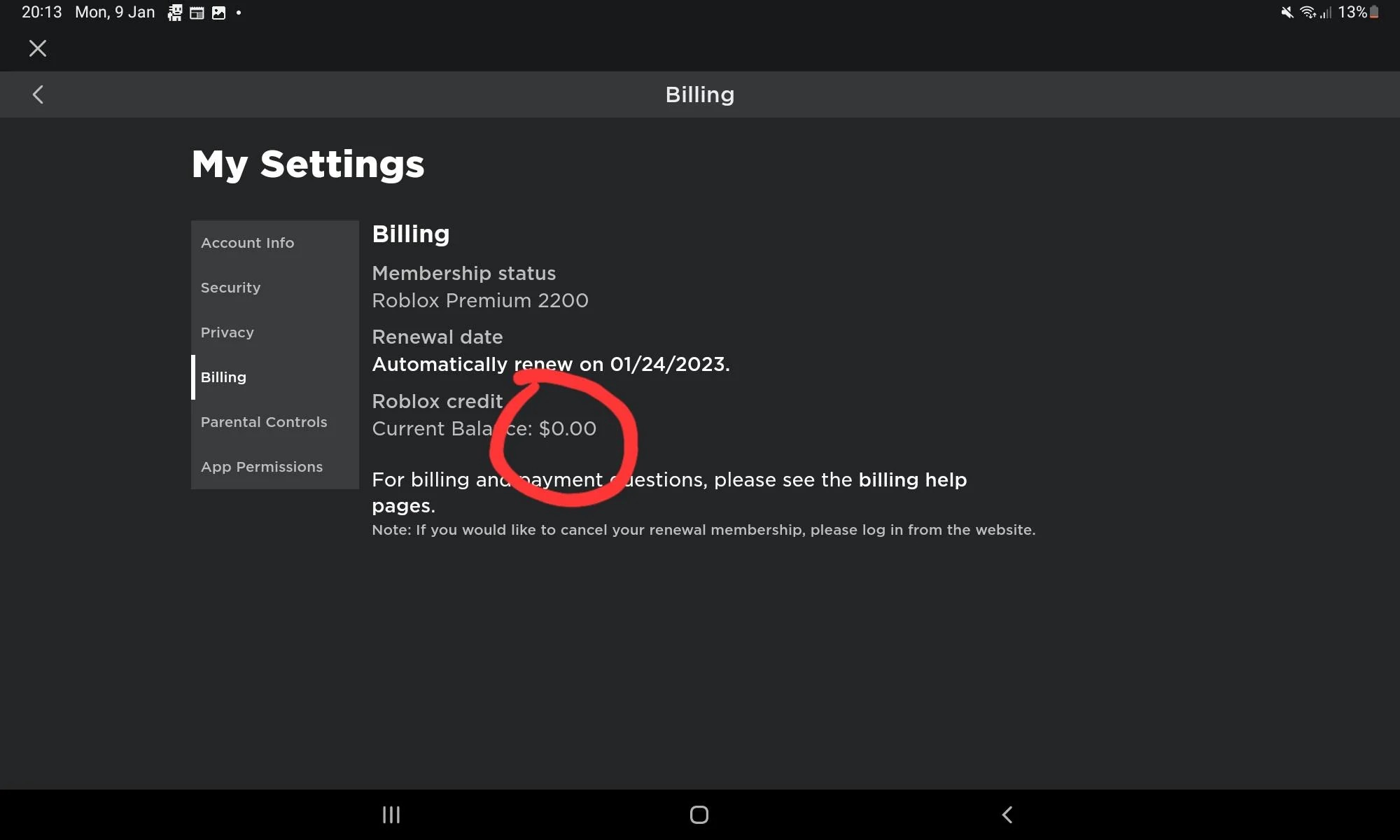

- Contact the Social Security Administration (SSA): The first step is to notify the SSA of the individual’s passing. This can be done by calling their toll-free number or visiting their local office. The SSA will update their records and notify credit bureaus of the death.

- Gather necessary documentation: Collect essential documents, including the death certificate, your identification, and any supporting documents that may be required. These documents will be needed when submitting notifications to the credit bureaus.

- Notify Equifax: Visit the Equifax website and navigate to their dedicated “Deceased Notification” page. Follow the instructions provided and complete the notification form, providing accurate information about the deceased person, including their name, Social Security number, date of birth, and date of death. Attach any necessary documentation as specified by Equifax.

- Notify Experian: Visit the Experian website and access their “Deceased Status” page. Follow the prompts and provide the requested information about the deceased individual. This includes their name, Social Security number, date of birth, date of death, and other relevant details. Make sure to attach any required documentation to support the notification.

- Notify TransUnion: Access the TransUnion website and locate their “Deceased Alert” page. Fill out the necessary fields with accurate information about the deceased person, including their name, Social Security number, date of birth, and date of death. Attach any required documentation to support the notification.

- Keep records of communication: As you notify each credit bureau, keep a record of the date and time of contact, the name of the representative you spoke with, and any reference numbers provided. These records can be essential in case any issues arise later.

It is important to note that the specific process and requirements may vary slightly among the credit bureaus. Therefore, it is crucial to visit each bureau’s website or contact their customer support for detailed instructions on how to notify them of a death and what documents they require.

By following these steps and notifying all three major credit bureaus, you can ensure that the deceased person’s credit file is appropriately updated and marked to prevent potential identity theft or fraudulent activity.

Contacting Equifax

Equifax is one of the three major credit bureaus in the United States. To notify Equifax of a death and update the deceased person’s credit file, follow these steps:

- Visit the Equifax website: Access Equifax’s official website by typing “Equifax” into your web browser’s search bar.

- Locate the dedicated “Deceased Notification” page: Once you are on the Equifax website, navigate to the section specifically designated for notifying them of a death. This page is typically found under the section about consumer assistance or contact information.

- Complete the notification form: On the “Deceased Notification” page, you will find a form that needs to be completed. Fill in the required fields with accurate information about the deceased person, including their full name, Social Security number, date of birth, and date of death. Ensure that all information is entered correctly to avoid any delays or complications in the process.

- Provide necessary documentation: Equifax may require supporting documents to verify the validity of the death notification. This typically includes a copy of the death certificate or other official documentation. Follow the instructions provided and attach the required documentation to the notification form.

- Submit the notification: After completing the form and attaching any necessary documentation, review the information for accuracy and click the “Submit” button to send the notification to Equifax. Take note of any confirmation numbers or reference numbers provided for future reference.

- Keep records: As you complete the notification process, make sure to keep a record of the date and time of submission, as well as any confirmation or reference numbers. These records can be useful in case any issues arise or if you need to follow up with Equifax in the future.

Keep in mind that the exact process and requirements for notifying Equifax may be subject to change. It is always a good idea to visit their website and review the most up-to-date information and instructions regarding deceased notifications. Additionally, if you encounter any difficulties or have specific questions, contact Equifax’s customer support for further assistance.

By promptly notifying Equifax of a death and providing accurate information and documentation, you can help ensure that the deceased person’s credit file is properly updated in their records, minimizing the risk of identity theft or fraudulent activities.

Contacting Experian

Experian is one of the major credit bureaus in the United States. To notify Experian of a death and update the deceased person’s credit file, follow these steps:

- Visit the Experian website: Open your web browser and search for the official Experian website.

- Access the “Deceased Status” page: Once you are on the Experian website, look for the section specifically dedicated to notifying them of a death. This page is typically labeled as “Deceased Status” or “Notify Us of a Death.”

- Provide required information: On the “Deceased Status” page, you will find a form that needs to be completed. Fill in the necessary fields with accurate information about the deceased individual, including their full name, Social Security number, date of birth, and date of death. Ensure accuracy to avoid any complications in the process.

- Attach supporting documents: Experian may require additional documentation to verify the validity of the death notification. This usually includes a copy of the death certificate or other official documentation. Follow the instructions provided and attach any necessary supporting documents to the notification form.

- Submit the notification: Review the information and attached documents for accuracy, then submit the notification form to Experian. Take note of any confirmation numbers or reference numbers provided to track the progress of the notification.

- Record keeping: Keep a record of the date and time of your submission, as well as any confirmation or reference numbers. These records can be helpful if you need to follow up with Experian or provide proof of notification in the future.

It’s worth noting that the process and requirements for notifying Experian may be subject to change. Therefore, it’s always a good idea to visit their website to review the most up-to-date instructions and information regarding deceased notifications. If you have any difficulties or specific questions, contacting Experian’s customer support can provide further assistance.

By promptly notifying Experian of a death and providing accurate information and documentation, you ensure that the deceased person’s credit file is properly updated in their records. This is an essential step in protecting their identity and preventing potential identity theft or fraudulent activities.

Contacting TransUnion

TransUnion is one of the major credit bureaus in the United States. To notify TransUnion of a death and update the deceased person’s credit file, follow these steps:

- Access the TransUnion website: Open your web browser and search for the official TransUnion website.

- Locate the “Deceased Alert” page: Once you are on the TransUnion website, navigate to the section specifically designated for deceased notifications. This page is typically titled as “Deceased Alert” or “Notify Us of a Death.”

- Fill out the required fields: On the “Deceased Alert” page, you will find a form that needs to be completed. Provide accurate information about the deceased person, including their full name, Social Security number, date of birth, and date of death.

- Attach supporting documents: TransUnion may require supporting documents to verify the death notification. These documents usually include a copy of the death certificate or other official documentation. Follow the instructions provided and attach the required supporting documents to the notification form.

- Submit the notification: Review the information and attached documents for accuracy, and then submit the notification form to TransUnion. Make note of any confirmation numbers or reference numbers provided as a reference for future inquiries.

- Maintain records: Keep a record of the date and time of submission, as well as any confirmation or reference numbers. These records will be valuable if you need to follow up with TransUnion or provide evidence of notification in the future.

Remember that the process and requirements for notifying TransUnion may be subject to change. It is essential to visit their website and review the most up-to-date instructions and information regarding deceased notifications. If you encounter any difficulties or have specific questions, contacting TransUnion’s customer support can provide further assistance.

By promptly notifying TransUnion of a death and providing accurate information and documentation, you can ensure that the deceased person’s credit file is properly updated in their records. This is a crucial step in protecting their identity and preventing potential identity theft or fraudulent activities.

Additional Considerations

While notifying the major credit bureaus of a death is an important step, there are a few additional considerations to keep in mind during this process:

1. Freezing the deceased person’s credit: In addition to notifying the credit bureaus of the death, consider placing a credit freeze on the deceased person’s credit file. This adds an extra layer of protection by preventing any new credit accounts from being opened in their name. You may need to contact each credit bureau individually to request a credit freeze.

2. Notifying other financial institutions: Informing the credit bureaus is a crucial step, but it’s also important to notify the financial institutions the deceased person had accounts with. This includes banks, credit card issuers, and loan providers. By doing so, you can ensure that their accounts are closed or properly managed to avoid any unauthorized access or potential identity theft.

3. Informing other relevant parties: In addition to credit bureaus and financial institutions, there may be other parties that need to be notified of the death. This can include insurance companies, employers, government agencies, and other service providers. Be sure to consult with the appropriate entities to understand their notification requirements and ensure that the necessary action is taken.

4. Seeking legal and professional assistance: If you find the process of notifying credit bureaus and managing the deceased person’s financial affairs overwhelming, consider seeking legal or professional assistance. An estate attorney or financial advisor can provide guidance and support in handling the necessary tasks and paperwork involved in settling the deceased person’s estate and managing their financial matters.

5. Monitoring credit reports and accounts: Even after notifying the credit bureaus and taking precautions, it’s important to monitor the deceased person’s credit reports and accounts regularly. This allows you to detect any suspicious activity or signs of potential identity theft. You can request free annual credit reports from each credit bureau or consider using credit monitoring services for added protection.

Remember, the process of notifying credit bureaus and managing the financial affairs of a deceased loved one may take time and coordination. It is crucial to stay organized, keep records of all communications, and remain diligent in ensuring that all necessary steps are taken to protect the deceased person’s identity and financial standing.

Conclusion

Notifying credit bureaus of a death is an essential step to protect the deceased person’s identity and prevent potential identity theft or fraud. By following the proper procedures and contacting the three major credit bureaus – Equifax, Experian, and TransUnion – you can ensure that the deceased individual’s credit file is appropriately handled and marked.

When notifying credit bureaus, it is crucial to provide accurate information, including the deceased person’s full name, Social Security number, date of birth, and date of death. It is also important to attach any required documentation, such as a death certificate, to support the notification.

In addition to notifying credit bureaus, consider taking further steps to protect the deceased person’s credit, such as placing a credit freeze on their file and notifying other financial institutions they had accounts with.

Throughout the process, it is essential to keep records of all communications, including dates, times, confirmation numbers, and the names of representatives you speak with. These records can be valuable for future reference or in case any issues arise.

Remember that notifying credit bureaus is just one part of managing the financial affairs of a deceased loved one. It is important to also notify other relevant parties, seek professional assistance if needed, and regularly monitor credit reports and accounts to ensure the continued protection of the deceased person’s identity.

By taking these necessary steps and staying vigilant, you can provide peace of mind for the deceased person’s family and help safeguard their financial legacy.