Finance

When Capital One Reports To The Credit Bureaus

Modified: March 6, 2024

Discover how and when Capital One reports to the credit bureaus, and how it can impact your overall credit health. Stay on top of your finances with Capital One.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your credit, understanding how your actions can affect your credit score is crucial. One major factor that plays a significant role in determining your creditworthiness is how your lenders report your payment information to the credit bureaus. In this article, we will explore when Capital One, a prominent financial institution, reports to the credit bureaus and the impact it can have on your credit score.

As one of the leading credit card issuers in the United States, Capital One has millions of customers who rely on their credit products to make everyday purchases, build credit history, and manage their financial lives. It is important to know how Capital One reports your payment history because it can greatly influence your credit score and overall creditworthiness.

Understanding when Capital One reports to the credit bureaus can help you make informed decisions about your finances and take the necessary steps to improve your credit standing. Let’s delve into the details of Capital One’s reporting policy and the implications it has for your credit score.

Capital One’s Reporting Policy

Capital One follows a consistent reporting policy when it comes to providing information about your credit card account to the major credit bureaus, including Experian, Equifax, and TransUnion. This reporting policy is in line with industry standards and helps ensure that your payment history and credit utilization are accurately reflected in your credit report.

When you open a credit card account with Capital One, they will typically report your account information to the credit bureaus within 30 days of account activation. This includes your credit limit, account balance, and payment history. Subsequently, Capital One will update the credit bureaus with any changes to your account, such as credit limit increases or missed payments.

It is important to note that if you have multiple credit cards or accounts with Capital One, each account will be reported separately to the credit bureaus. This means that your payment history and credit utilization for each account will be evaluated individually when calculating your credit score.

Capital One’s reporting policy applies to all types of credit card accounts, including their popular rewards cards, secured cards, and student cards. By reporting your account information to the credit bureaus, Capital One enables you to establish credit history and demonstrate responsible credit management.

The accurate and consistent reporting of your credit card information by Capital One is crucial, as it allows potential lenders and creditors to assess your creditworthiness when you apply for new credit. Your credit report serves as a snapshot of your financial behavior, and Capital One’s commitment to reporting your account information helps lenders make informed decisions about extending credit to you.

When Capital One Reports Payment History

Capital One typically reports your payment history to the credit bureaus on a monthly basis. This includes information about whether you made your payments on time, any missed or late payments, and the length of time each payment was overdue.

The specific date that Capital One reports your payment history can vary depending on your individual account. However, it is important to note that they usually report this information shortly after your statement closing date. This means that your payment activity from the previous billing cycle will be reflected in your credit report once it is reported to the credit bureaus.

For example, if your statement closing date is on the 15th of each month, Capital One will typically report your payment history to the credit bureaus within a few days after that. This will capture any payments you made before or on the statement due date, as well as any missed or late payments.

It’s worth mentioning that Capital One reports both positive and negative payment history. If you consistently make your payments on time, it will contribute to building a positive credit history and may improve your credit score over time. On the other hand, late or missed payments can have a negative impact on your credit score and make it more challenging to obtain credit in the future.

It’s crucial to prioritize making your credit card payments by the due date to maintain a good payment history. Late payments can not only lower your credit score but also lead to the imposition of fees and higher interest rates on your credit card balances. Making your payments on time is an important aspect of responsible credit management.

Impact on Credit Scores

The way Capital One reports your payment history to the credit bureaus can have a significant impact on your credit scores. Your credit score is a numerical representation of your creditworthiness, and it plays a crucial role in determining your eligibility for loans, credit cards, and other forms of credit.

Consistently making your credit card payments on time and in full can have a positive impact on your credit score. It demonstrates to lenders that you are reliable and responsible when it comes to managing credit. This can lead to a higher credit score over time, making it easier to obtain credit and secure favorable terms.

However, late or missed payments can have a detrimental effect on your credit scores. Each late payment reported by Capital One can result in a drop in your credit score, and the more recent and frequent the late payments, the more severe the impact may be. This can make it more difficult for you to qualify for credit in the future and may result in higher interest rates or unfavorable loan terms.

In addition to your payment history, the utilization of your available credit also affects your credit scores. Capital One reports your credit limit and account balance, and this information is used to calculate your credit utilization ratio. A high credit utilization ratio (the amount of credit you are using compared to your total credit limit) can negatively impact your credit scores.

For example, if you have a credit limit of $5,000 on your Capital One credit card and your balance is consistently near or at the limit, it can suggest to creditors that you are relying heavily on credit and may be at risk of overextending yourself financially. Keeping your credit utilization ratio low, ideally below 30%, can help improve your credit scores.

It’s important to note that your payment history and credit utilization are just two factors that contribute to your credit scores. Other factors, such as the length of your credit history, types of credit used, and the number of recent credit inquiries, also play a role. Capital One’s reporting policy ensures that these important credit factors are accurately represented in your credit reports.

By understanding the impact of Capital One’s reporting policy, you can take proactive steps to maintain a good credit history, make timely payments, and keep your credit utilization in check. Doing so will not only help you maintain a healthy credit score but also put you in a stronger position to achieve your financial goals.

Timelines for Reporting to Credit Bureaus

Capital One follows specific timelines when reporting your account information to the major credit bureaus. While the exact timing can vary, there are some general guidelines to keep in mind to understand when your information will be updated on your credit report.

Typically, Capital One reports your credit card account information to the credit bureaus on a monthly basis. This means that your payment history, credit limit, and account balance will be updated once a month. This is usually done shortly after your statement closing date.

For example, if your statement closing date is on the 15th of each month, Capital One will typically report your account information to the credit bureaus within a few days after that. This ensures that the most recent activity on your account is reflected accurately in your credit report.

It’s important to note that while Capital One reports your account activity monthly, the credit bureaus may not update your credit information immediately. It can take some time for the credit bureaus to receive and process the information from Capital One and update your credit report.

In general, you can expect your credit report to be updated within 30 days after Capital One reports your account information to the credit bureaus. This allows the credit bureaus enough time to review and incorporate the updated information into your credit history.

It’s also worth mentioning that changes to your account, such as credit limit increases or decreases, may not be reflected in your credit report immediately. These updates will typically occur within the same monthly reporting cycle, but the exact timing can vary.

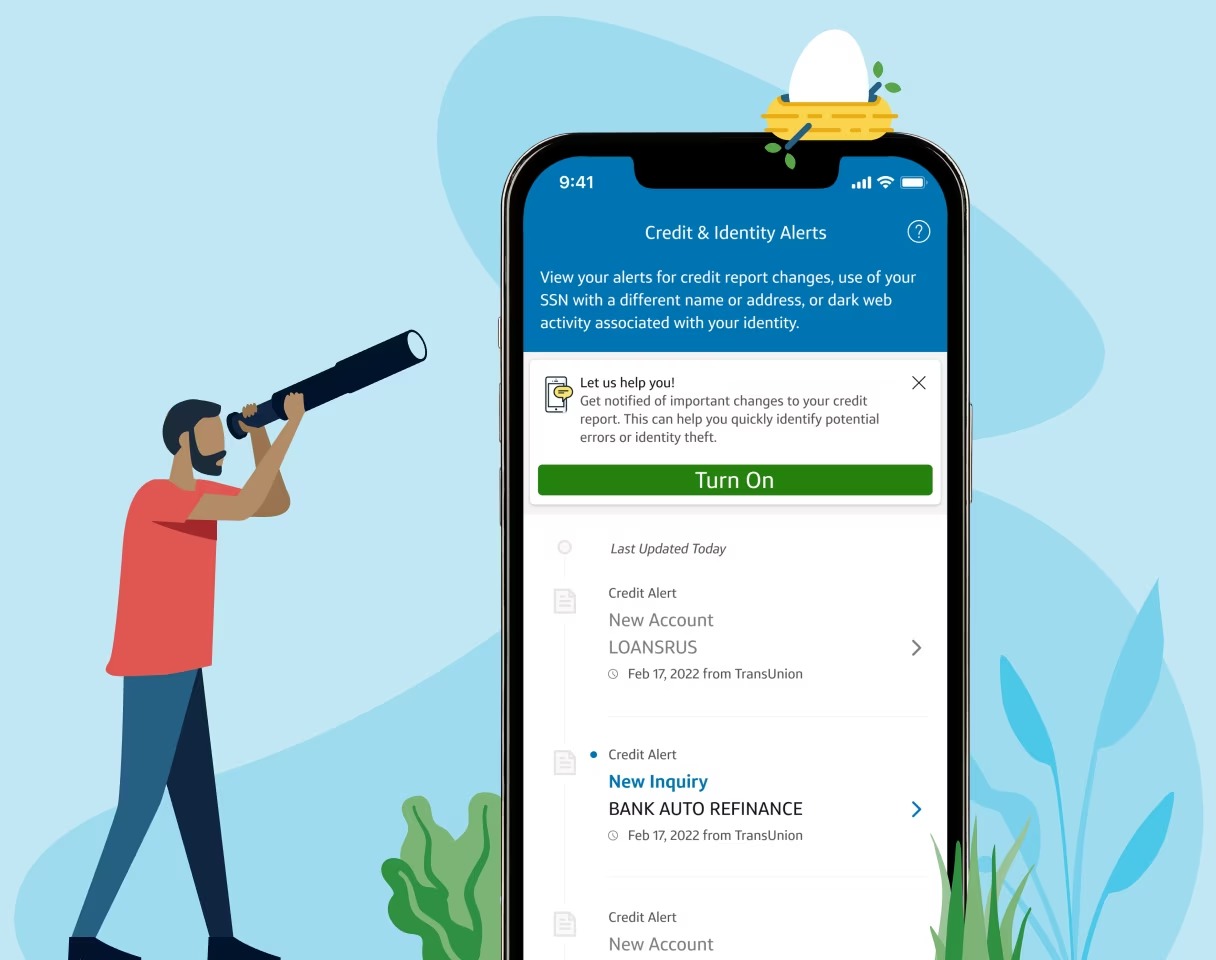

Monitoring your credit report regularly is essential to ensure that the information reported by Capital One and other lenders is accurate. By checking your credit report, you can identify any errors or discrepancies and take the necessary steps to correct them.

Remember, your credit report is a snapshot of your credit history, and it plays a crucial role in determining your creditworthiness. By understanding the timelines for reporting to credit bureaus, you can stay informed about when your credit information will be updated and take control of your financial health.

How Delinquencies are Reported

Delinquencies occur when you fail to make your credit card payments by the due date or within the grace period provided by Capital One. These missed or late payments can have a negative impact on your credit score and overall creditworthiness.

When it comes to reporting delinquencies, Capital One follows industry standards and guidelines set by the credit bureaus. If you miss a payment on your Capital One credit card, the delinquency will typically be reported to the credit bureaus after 30 days of non-payment.

Once a delinquency is reported, it will appear on your credit report, and it can have a significant impact on your credit score. The severity of the impact will depend on various factors, such as the length of delinquency, the number of missed payments, and the overall history of your credit behavior.

For example, a recent delinquency or multiple missed payments within a short period can result in a more significant drop in your credit score. Conversely, if you have a long history of on-time payments and only one occasional late payment, the impact may be less severe.

It’s important to note that the reporting of a delinquency does not automatically mean it will remain on your credit report forever. The Fair Credit Reporting Act (FCRA) imposes time limits on how long negative information, such as delinquencies, can be reported on your credit file. Generally, delinquencies can remain on your credit report for up to seven years from the date of the first missed payment.

To minimize the impact of delinquencies on your credit score, it is crucial to address them as soon as possible. If you find yourself unable to make your credit card payments on time, it is recommended that you contact Capital One to discuss your situation. They may be able to offer solutions such as payment arrangements or other options to help you avoid further delinquencies.

It’s also important to remember that the reporting of delinquencies is not limited to just credit cards. If you have other types of loans or lines of credit with Capital One, such as a personal loan or a car loan, delinquencies on those accounts can also be reported to the credit bureaus, further impacting your credit score.

Being proactive in managing your credit and making consistent, on-time payments is key to maintaining a positive credit history and protecting your credit score from the negative impact of delinquencies.

Disputing Credit Report Errors

It is not uncommon for credit report errors to occur, and Capital One understands the importance of ensuring the accuracy of the information reported to the credit bureaus. If you believe there is an error on your credit report related to your Capital One account, it’s crucial to take the necessary steps to dispute and correct the inaccuracies.

The first step in disputing a credit report error is to review your credit report from all three major credit bureaus – Experian, Equifax, and TransUnion. You can obtain a free copy of your credit report once a year from each bureau through AnnualCreditReport.com. Carefully review the information on your report, focusing on your Capital One account details, payment history, and any other relevant information.

If you identify an error or discrepancy, gather any supporting documents or evidence that can help support your claim. This can include payment receipts, account statements, or any correspondence with Capital One regarding the account in question.

Once you have gathered the necessary documentation, you can proceed with filing a dispute with the credit bureau(s) that are reporting the error. Each credit bureau has an online dispute portal where you can submit your dispute. Provide a clear and detailed explanation of the error and include any supporting documents you have.

Upon receiving your dispute, the credit bureau will typically conduct an investigation to verify the accuracy of the information being reported. This investigation may involve contacting Capital One to gather more details about the account in question. The credit bureau is required to provide you with a response within 30 days of receiving your dispute.

If the investigation reveals that there is indeed an error, the credit bureau will update your credit report and remove or correct the inaccurate information. They will also notify the other credit bureaus to ensure consistency across all your credit reports. Once the correction is made, it’s a good practice to check your credit reports periodically to ensure that the error has been resolved appropriately.

If the credit bureau’s investigation does not resolve the dispute to your satisfaction, you have the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) or seek legal advice to further address the issue.

Capital One recognizes the importance of accurate reporting and cooperates with credit bureaus during the investigation process. They are committed to resolving any discrepancies and ensuring that your credit reports reflect the correct information related to your Capital One account.

Remember, monitoring your credit reports regularly and taking action to correct any errors can help maintain the accuracy of your credit information and support your overall financial well-being.

Conclusion

Understanding when and how Capital One reports to the credit bureaus is essential for managing your credit effectively and maintaining a healthy credit score. By adhering to their reporting policy and making timely payments, you can build a positive credit history and improve your creditworthiness.

Capital One’s commitment to accurate reporting ensures that your payment history, credit utilization, and other key account details are properly reflected in your credit reports. This information is used by lenders and creditors to assess your creditworthiness when you apply for new credit or loans.

Late or missed payments can have a detrimental impact on your credit scores, making it more difficult to obtain credit in the future. Therefore, it is crucial to prioritize making your credit card payments on time and in full to maintain a positive payment history.

If you believe there is an error on your credit report related to your Capital One account, it is important to take the necessary steps to dispute and correct the inaccuracies. By reviewing your credit report regularly and filing disputes as needed, you can ensure that your credit information remains accurate and up-to-date.

Capital One recognizes the importance of accurate reporting and works with credit bureaus to investigate and resolve any reported errors. They strive to provide accurate and reliable information, allowing you to make informed financial decisions and achieve your financial goals.

Remember, effectively managing your credit includes not only monitoring your credit reports but also practicing good financial habits, such as keeping your credit utilization low and managing your debts responsibly. By doing so, you can build a strong credit foundation and enjoy the benefits of a positive credit history.

In conclusion, staying informed about Capital One’s reporting policy, understanding the impact it has on your credit scores, and taking the necessary steps to address any errors will empower you to maintain a healthy credit profile and achieve your financial aspirations.