Finance

How Do I Use My Citizens Pay Line Of Credit

Modified: February 21, 2024

Learn how to effectively utilize your Citizens Pay Line of Credit for all your financial needs. Finance your dreams and achieve your goals with ease.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Citizens Pay Line of Credit

- Applying for a Citizens Pay Line of Credit

- Activating Your Citizens Pay Line of Credit

- Making Purchases with Your Citizens Pay Line of Credit

- Repaying Your Citizens Pay Line of Credit

- Managing Your Citizens Pay Line of Credit

- Accessing Account Information Online

- Contacting Customer Support

- Conclusion

Introduction

Welcome to the world of Citizens Pay Line of Credit, where financial flexibility and convenience meet your everyday needs. In this article, we will explore the various aspects of the Citizens Pay Line of Credit and how you can make the most out of this powerful financial tool.

Whether you’re looking to make a large purchase, cover unexpected expenses, or simply need some extra cash flow, a line of credit can provide you with the necessary funds without the hassle of traditional loans or credit cards.

The Citizens Pay Line of Credit is designed to give you the freedom to access funds when you need them, without the restrictions of a fixed loan amount or a predetermined repayment schedule. It offers a flexible and convenient way to manage your finances, allowing you to borrow funds and make payments on your own terms.

With a Citizens Pay Line of Credit, you have the flexibility to use the funds for a wide range of purposes. Whether you need to make home improvements, cover medical expenses, or even take a well-deserved vacation, the line of credit is at your disposal.

Now, let’s dive into the details of how you can apply for, activate, and make the most of your Citizens Pay Line of Credit. Discover the benefits and rewards that come with financial flexibility and take control of your financial future.

Understanding the Citizens Pay Line of Credit

The Citizens Pay Line of Credit is a versatile financial product that provides you with a revolving line of credit that you can use as needed. Unlike a traditional loan with a fixed amount, the line of credit gives you the flexibility to borrow funds up to a certain limit, based on your creditworthiness and financial situation.

One of the key advantages of a Citizens Pay Line of Credit is that you only pay interest on the amount you borrow, not on the entire credit limit. This means that you can access funds whenever you need them, without accruing unnecessary interest charges on unused portions of your line of credit.

Another benefit of the Citizens Pay Line of Credit is the ability to make minimum payments, rather than paying off the entire balance at once. This provides you with financial flexibility and allows you to manage your monthly cash flow more effectively.

It’s important to note that a line of credit is different from a credit card. While both provide you with a source of credit, a line of credit typically has lower interest rates and may offer higher credit limits. Additionally, a line of credit may require collateral or a higher credit score compared to a credit card.

To qualify for a Citizens Pay Line of Credit, you will need to meet certain eligibility criteria, including a good credit history and income stability. The application process typically involves a credit check and verification of your financial information. Once approved, you will receive a line of credit with a specific credit limit, which you can then access as needed.

Keep in mind that responsible usage of your line of credit is crucial. While it provides financial flexibility, it’s important to borrow only what you need and to make regular payments to keep your account in good standing.

Now that you have a basic understanding of how the Citizens Pay Line of Credit works, let’s explore the process of applying for and activating your line of credit in the next section.

Applying for a Citizens Pay Line of Credit

Applying for a Citizens Pay Line of Credit is a simple and straightforward process that can be done online or in person at a Citizens Bank branch. To get started, you’ll need to gather some basic documentation and information.

The first step is to ensure you meet the eligibility requirements. These may include being at least 18 years old, having a good credit history, and meeting income criteria. It’s also important to have an idea of how much credit you may need and for what purpose.

Once you have gathered the necessary information, you can start the application process. If you prefer to apply online, visit the Citizens Bank website and navigate to the line of credit application page. Fill in the required personal and financial information, including your name, address, employment details, income, and any outstanding debts or liabilities.

If you prefer to apply in person, locate the nearest Citizens Bank branch and schedule an appointment with a representative. During the meeting, you will be guided through the application process, and the representative will assist you in completing all necessary paperwork.

When completing the application, it’s important to be accurate and provide all the required information. Any discrepancies or incomplete information may delay the approval process.

After submitting your application, it will be reviewed by the bank’s underwriting team. They will assess your creditworthiness and may request additional documentation or information if needed.

Once your application is approved, you will receive notification from Citizens Bank. They will provide you with information on the approved credit limit, interest rate, and any other terms and conditions. At this point, you can decide whether to accept the offer or decline.

If you choose to accept the offer, you will need to complete the necessary paperwork, which may include signing loan agreements and providing any required collateral. The line of credit will then be activated, and you can start using it to access funds as needed.

It’s important to read and understand the terms and conditions of the line of credit before accepting. Be aware of the interest rates, repayment options, late payment fees, and any other charges associated with the account.

Now that you know how to apply for a Citizens Pay Line of Credit, let’s move on to the next section, where we will explore how to activate your line of credit.

Activating Your Citizens Pay Line of Credit

Once you have been approved for a Citizens Pay Line of Credit, it’s time to activate your account and start using your available credit. The activation process is simple and can be completed online or through customer support.

If you prefer to activate your line of credit online, visit the Citizens Bank website and log in to your account. Navigate to the “Account Services” or “Manage Accounts” section, where you will find the option to activate your line of credit. Follow the prompts and provide any additional information or documentation required.

If you are unable to activate your line of credit online or have any questions or concerns, you can contact Citizens Bank customer support. They will guide you through the activation process and address any issues you may encounter.

Once your Citizens Pay Line of Credit is activated, you can start using it to make purchases, pay bills, or access cash as needed. Keep in mind that there may be a certain timeframe within which you need to use the line of credit to keep it active. Be sure to review the terms and conditions for more details.

When using your line of credit, it’s essential to keep track of your spending and stay within your approved credit limit. Exceeding the credit limit may result in additional fees or restrictions on your account.

It’s also important to understand the repayment terms associated with your Citizens Pay Line of Credit. Make note of the minimum monthly payment required and any fees or penalties for late payments. Responsible and timely repayment will help you maintain a good credit history and avoid unnecessary charges.

Now that you know how to activate your Citizens Pay Line of Credit, let’s move on to the next section, where we will discuss making purchases with your line of credit.

Making Purchases with Your Citizens Pay Line of Credit

With your Citizens Pay Line of Credit activated, you have the freedom to make purchases and access funds whenever you need them. Whether you’re making everyday purchases or larger investments, using your line of credit is simple and convenient.

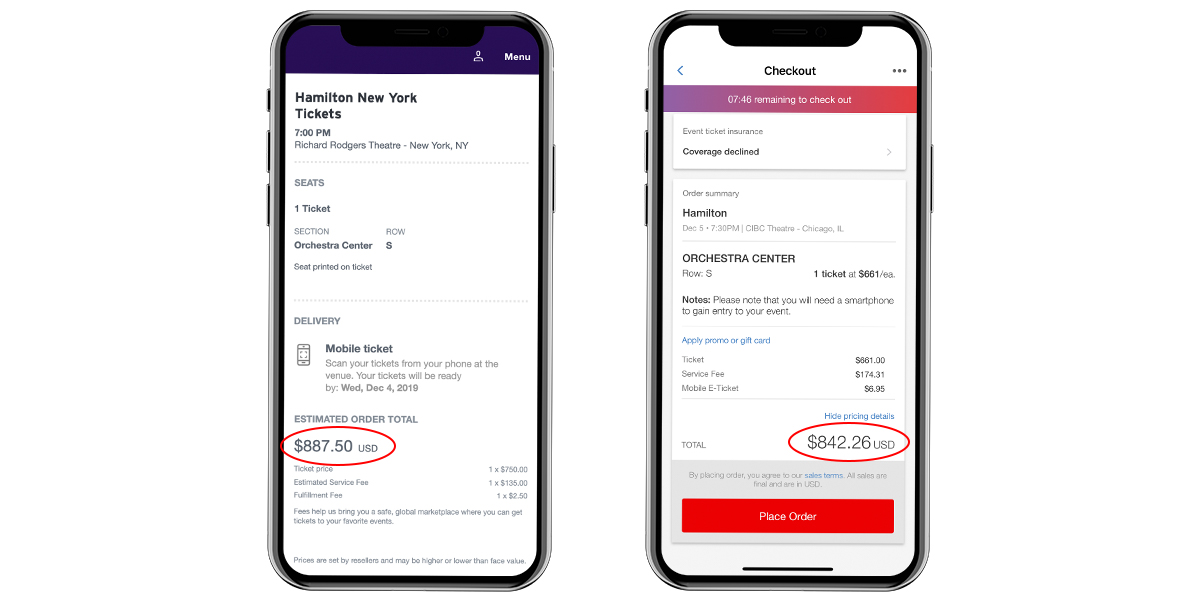

To make purchases with your line of credit, you can use the Citizens Pay Line of Credit Card provided by the bank. This card works just like a regular credit card, allowing you to swipe, tap, or enter the card details for online purchases. The transactions made using the line of credit will be charged to your account and will count towards your credit limit.

Another way to access funds is through online transfers. Citizens Pay provides you with the convenience of transferring funds from your line of credit directly to your bank account. This allows you to use the funds for various purposes, such as paying bills, making online payments, or even transferring the money to another account.

When using your Citizens Pay Line of Credit, it’s crucial to keep track of your spending and maintain a good understanding of your available credit limit. Regularly reviewing your account statements and monitoring your transactions will help you stay on top of your finances and avoid any surprises.

When making payments with your Citizens Pay Line of Credit, it’s important to consider your repayment plan. While you have the option to make minimum monthly payments, paying off your balance in full or making larger payments can help you minimize interest charges and pay off your debt faster.

Remember to keep your spending in line with your financial goals and avoid unnecessary debt. Use your line of credit responsibly and make purchases that align with your budget and needs.

In case you have any questions or concerns about using your Citizens Pay Line of Credit or making purchases, the bank’s customer support is available to assist you. They can provide guidance on transaction limits, payment options, and any account-related inquiries you may have.

Now that you understand how to make purchases with your Citizens Pay Line of Credit, let’s move on to the next section, where we will discuss repaying your line of credit.

Repaying Your Citizens Pay Line of Credit

Repaying your Citizens Pay Line of Credit is an important aspect of managing your financial obligations and maintaining a healthy credit standing. Being responsible with your repayments ensures that you can continue to access your line of credit and avoid unnecessary fees or penalties.

When it comes to repaying your line of credit, you have a few options available to you. The first step is to review your monthly statement, which will outline your outstanding balance, minimum payment due, and any accrued interest or fees.

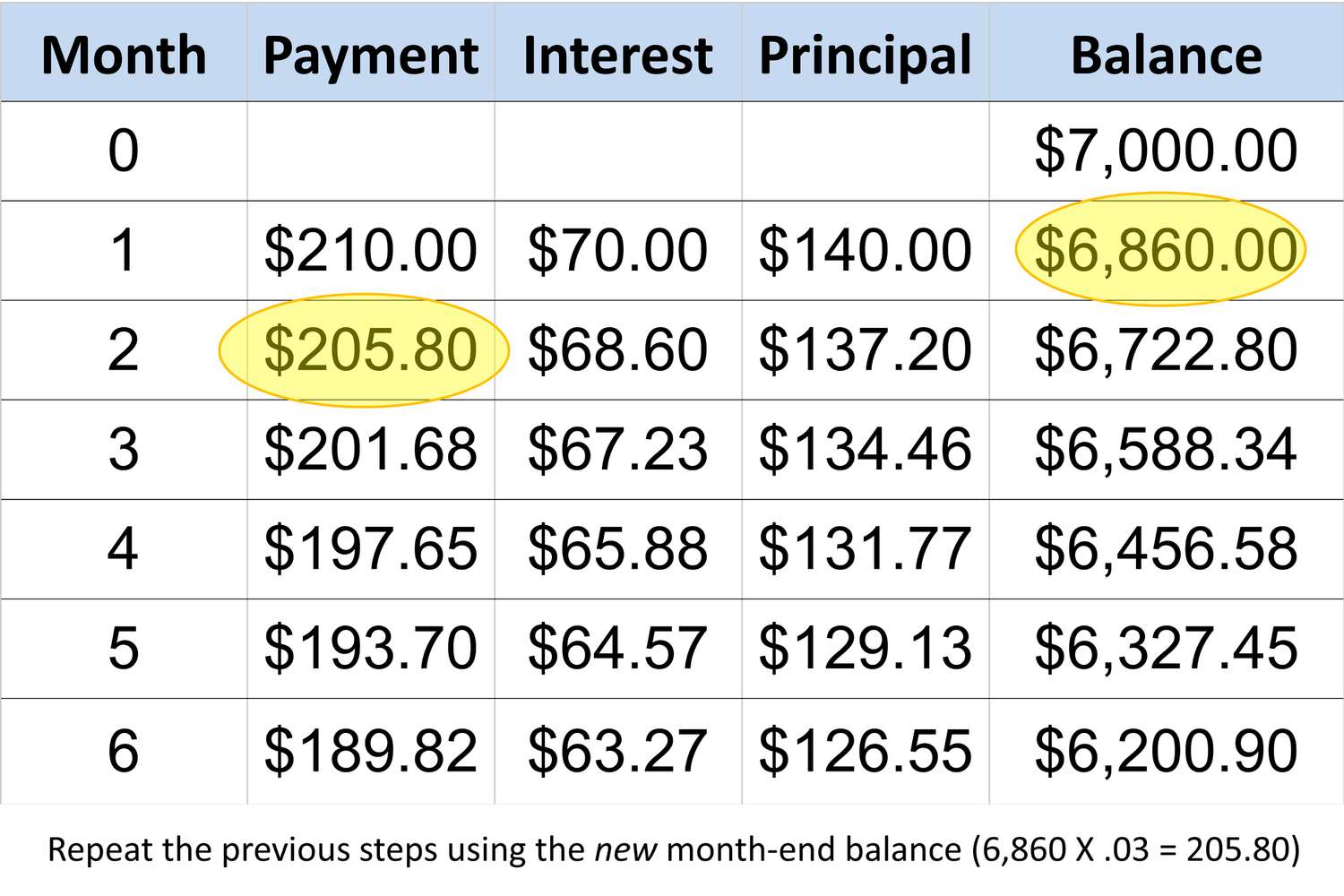

One option for repayment is to make the minimum monthly payment. The minimum payment is typically a small percentage of your outstanding balance, although it’s important to note that paying only the minimum amount may result in higher interest charges over time. It’s advisable to pay more than the minimum if possible to reduce your overall debt and pay off your line of credit sooner.

If you have the means to pay off your full balance, that is always a wise choice. Clearing the entire balance not only saves you on interest charges but also frees up your credit limit for future use.

Another option is to make additional payments beyond the minimum amount due. By paying more than the minimum, you can reduce the overall interest you’ll pay and accelerate the repayment process. This can help you manage your debt more effectively and potentially save money in the long run.

It’s important to make your payments on time to avoid late payment fees and negative impacts on your credit score. Setting up automatic payments or reminders can help you stay on track and ensure that you never miss a payment.

If you encounter any difficulties in making your payments or foresee financial challenges, it’s crucial to reach out to Citizens Bank’s customer support as soon as possible. They may be able to offer guidance or alternative repayment options to help you manage your line of credit responsibly.

By consistently meeting your repayment obligations, you will not only maintain a positive credit history, but you may also be eligible for credit limit increases or better interest rates in the future.

Now that you understand how to repay your Citizens Pay Line of Credit, let’s move on to the next section, where we will discuss how to manage your line of credit effectively.

Managing Your Citizens Pay Line of Credit

Successfully managing your Citizens Pay Line of Credit is crucial for maintaining your financial well-being. By implementing effective strategies and staying organized, you can make the most out of your line of credit while minimizing unnecessary costs and potential pitfalls.

One key aspect of effective management is monitoring your account activity regularly. By reviewing your statements and transactions, you can track your spending, identify any discrepancies, and ensure that all charges are legitimate. This also helps you stay within your credit limit and avoid overspending.

Creating a budget is another essential management tool. By setting financial goals and allocating funds to specific categories, you can prioritize your spending and make informed decisions about using your line of credit. Keep in mind that a line of credit should be used responsibly and for necessary expenses rather than frivolous purchases.

If you find that you are consistently relying on your line of credit for day-to-day expenses, it may be time to reassess your financial situation. Consider exploring other strategies, such as cutting unnecessary expenses or increasing your income through additional sources, to reduce reliance on credit.

Regularly reviewing the interest rates and terms of your Citizens Pay Line of Credit is also essential. Interest rates may change over time, so staying informed about any modifications can help you assess whether your line of credit is still the best option for your financial needs. You may discover other credit products or loan options that offer more favorable terms.

Utilize the tools provided by Citizens Bank to manage your line of credit effectively. Online banking platforms often offer features such as payment reminders, account alerts, and spending categorization, which can help you stay organized and make better financial decisions. Taking advantage of these tools can streamline your account management and ensure a smooth experience.

Lastly, make an effort to pay your line of credit on time and in full whenever possible. Timely and responsible payments not only keep your credit in good standing but also save you money on interest payments. Consider setting up automatic payments or reminders to avoid missing any payment deadlines.

By following these management strategies, you can navigate your Citizens Pay Line of Credit successfully and utilize it as a valuable financial tool. Remember, proper management will help you maintain control over your finances and use your line of credit to your advantage.

In the next section, we will explore how to access your Citizens Pay Line of Credit account information online and the importance of contacting customer support when needed.

Accessing Account Information Online

Accessing your Citizens Pay Line of Credit account information online is a convenient and efficient way to stay informed about your finances. With online access, you can easily monitor your account activity, check your balance, make payments, and review your transaction history from the comfort of your own home or on the go.

To access your account information online, start by visiting the Citizens Bank website and logging into your online banking portal. If you haven’t already registered for online banking, you will need to create an account by providing your personal and account information.

Once you’re logged in, navigate to the section that specifically relates to your line of credit. This may be labeled as “Line of Credit,” “My Credit Account,” or something similar. From there, you will have access to a range of features and options to manage your line of credit.

Key features of accessing your account information online include:

- Viewing your current balance and available credit

- Checking your transaction history, including recent purchases and payments

- Making payments towards your line of credit

- Scheduling automatic payments to ensure timely repayments

- Setting up alerts and notifications to stay updated on important account activity

- Reviewing interest rates, fees, and any other account-related details

It’s important to regularly review your account information online to stay on top of your financial obligations and to ensure the accuracy of your transactions. Promptly reporting any discrepancies or unauthorized charges to customer support will help protect your account and resolve any issues that may arise.

Furthermore, accessing your account information online provides a platform for you to track your progress towards paying off your line of credit, set financial goals, and make more informed financial decisions. By having a clear understanding of your account status, you can effectively manage your line of credit and optimize your overall financial health.

In case you have any questions or encounter any difficulties when accessing your account information online, reach out to Citizens Bank customer support for assistance. They can provide guidance, answer your inquiries, and help resolve any technical issues you may be experiencing.

With online access to your account information, you can have greater control over your Citizens Pay Line of Credit and make informed financial decisions with ease.

In the concluding section, we will provide a brief overview and wrap up the key points discussed throughout the article.

Contacting Customer Support

Customer support is there to assist you with any questions, concerns, or issues you may have regarding your Citizens Pay Line of Credit. Whether you need clarification on account details, assistance with technical difficulties, or general guidance, reaching out to customer support can provide you with the necessary help and peace of mind.

There are several ways to contact Citizens Bank’s customer support:

- Phone Support: The most direct and immediate way to get in touch with customer support is by calling the designated phone number for line of credit inquiries. This allows you to speak directly with a representative who can assist you with your specific questions or concerns.

- Online Chat: Many banks offer online chat support as an alternative to phone calls. With this option, you can have a real-time conversation with a customer support representative through the bank’s website or mobile app. This offers convenience and flexibility while still receiving personalized assistance.

- Email Support: If your inquiry is not time-sensitive, you can send an email to the designated customer support email address. Be sure to include your account information and provide a clear and detailed explanation of your question or issue. While the response may take longer compared to other methods, this option allows you to provide all the necessary information in one go.

- In-person Support: If you prefer face-to-face interaction, you can visit your local Citizens Bank branch and speak with a representative in person. This can be especially useful if your inquiry requires documents or additional information that is easier to provide in person.

When contacting customer support, remember to have your account information handy for verification purposes. This will help expedite the process and ensure that the representative can access your account details to address your specific needs correctly.

Customer support is not only there to assist you in times of confusion or difficulty but also to provide guidance on how to make the most of your Citizens Pay Line of Credit. They can offer insights on managing your account, understanding terms and conditions, and even suggest personalized financial strategies based on your unique circumstances.

Don’t hesitate to reach out to customer support whenever you have questions or concerns. They are trained professionals who are dedicated to assisting you in managing your line of credit effectively and ensuring that your banking experience is smooth and satisfactory.

In the concluding section, we will provide a brief overview and wrap up the key points discussed throughout the article.

Conclusion

Congratulations! You now have a comprehensive understanding of how to navigate and maximize the benefits of your Citizens Pay Line of Credit. This versatile financial tool provides you with the flexibility and convenience to access funds when you need them, repay on your terms, and manage your finances effectively.

Throughout this article, we explored the various aspects of the Citizens Pay Line of Credit, from understanding its purpose and benefits to applying, activating, and managing your account. We discussed how to make purchases, repay your line of credit, access online account information, and the importance of contacting customer support.

Remember, responsible usage of your line of credit is key. Use it wisely and purposefully, keeping within your credit limit and making timely repayments to maintain a positive credit history. Regularly reviewing your account statements and online account information will help you stay on top of your finances and make informed financial decisions.

Should you encounter any questions or concerns along the way, don’t hesitate to contact Citizens Bank’s customer support. They are there to assist you and provide the necessary guidance to ensure your experience with your Citizens Pay Line of Credit is smooth and beneficial.

By leveraging the features and benefits of your Citizens Pay Line of Credit, you can gain greater control over your finances, handle unexpected expenses, and achieve your financial goals with ease. Remember to use this tool responsibly, always keeping your long-term financial well-being in mind.

We hope this guide has equipped you with the knowledge and confidence to use your Citizens Pay Line of Credit to its fullest potential. Make the most out of your financial flexibility and take charge of your financial future.

Now, go out there and embrace the power of your Citizens Pay Line of Credit!