Finance

Where Can I Use Citizens Pay Line Of Credit

Modified: February 21, 2024

Looking for flexible financing options? Find out where you can use Citizens Pay Line of Credit to manage your finances and achieve your financial goals. Explore our finance solutions today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Citizens Pay Line of Credit

- Using Citizens Pay Line of Credit for Online Shopping

- Using Citizens Pay Line of Credit for In-Store Purchases

- Using Citizens Pay Line of Credit for Bill Payments

- Using Citizens Pay Line of Credit for Travel Expenses

- Using Citizens Pay Line of Credit for Home Improvement

- Using Citizens Pay Line of Credit for Medical Expenses

- Using Citizens Pay Line of Credit for Education Expenses

- Using Citizens Pay Line of Credit for Personal Expenses

- Conclusion

Introduction

Citizens Pay Line of Credit is a versatile financial tool that provides individuals with the flexibility and convenience to manage their expenses. Whether it’s for online shopping, in-store purchases, bill payments, travel expenses, or even home improvement projects, Citizens Pay Line of Credit offers a convenient and secure way to access funds.

With the increasing emphasis on digital transactions and contactless payments, Citizens Pay Line of Credit has become an essential tool for individuals looking to streamline their financial transactions. It allows users to make purchases or cover expenses without the need for cash or traditional credit cards.

Furthermore, Citizens Pay Line of Credit offers competitive interest rates and flexible repayment terms, making it an attractive choice for those seeking financial flexibility. Whether you need to cover unexpected medical expenses, tuition fees, or simply want to indulge in a luxury purchase, the Citizens Pay Line of Credit has you covered.

In this article, we will explore the various ways you can use the Citizens Pay Line of Credit to manage your expenses. From online shopping to home improvement projects, we will delve into the versatility of this financial tool, making it an essential companion for individuals looking for convenient and flexible payment options.

Understanding Citizens Pay Line of Credit

Citizens Pay Line of Credit is a flexible financial product that allows individuals to access a pre-approved credit limit. It functions similar to a credit card but without the physical card. Instead, it provides users with a virtual line of credit that can be accessed through various platforms, such as online banking or a mobile app.

One of the major advantages of Citizens Pay Line of Credit is that it offers a revolving credit facility. This means that as you pay off your outstanding balance, your available credit limit increases, providing you with ongoing access to funds. It offers greater financial flexibility compared to traditional loans, where you receive a lump sum amount and repay it over a fixed period.

Interest is charged only on the amount of credit utilized, rather than the entire credit limit. This allows individuals to save on interest costs, as they have the option to repay the borrowed amount in full or make minimum monthly payments. However, it is important to note that carrying balances for an extended period can lead to higher interest charges.

When applying for a Citizens Pay Line of Credit, individuals undergo a credit assessment to determine their creditworthiness. Factors such as credit score, income, and financial history are taken into consideration during the approval process. The approved credit limit is based on these factors, ensuring responsible borrowing practices.

Citizens Pay Line of Credit offers convenience in terms of accessing funds. Users can transfer funds from their line of credit to their checking account to make purchases or pay bills. Additionally, they can make use of online banking or mobile apps to monitor their account, track expenses, and make payments.

By understanding how Citizens Pay Line of Credit works, individuals can make better financial decisions and leverage this versatile tool to manage their expenses effectively.

Using Citizens Pay Line of Credit for Online Shopping

Citizens Pay Line of Credit is an excellent option for online shopping enthusiasts. With the rise of e-commerce, more and more people are turning to online platforms to purchase goods and services. Citizens Pay Line of Credit provides a convenient and secure way to make online purchases without the need for a physical credit card.

When using Citizens Pay Line of Credit for online shopping, you can add your line of credit as a payment option during the checkout process. Simply select the Citizens Pay Line of Credit option and provide the necessary details. Once the transaction is complete, the amount will be deducted from your available credit limit.

One of the benefits of using Citizens Pay Line of Credit for online shopping is the ability to monitor and manage your expenses easily. You can access your account online or through a mobile app to keep track of your purchases, set spending limits, and receive notifications about your available credit.

Another advantage is the added protection against fraudulent transactions. Citizens Pay Line of Credit offers advanced security features, such as secure encryption and multi-factor authentication, to ensure the safety of your transactions. If you encounter any unauthorized charges, you can quickly report them and initiate a dispute process to protect your funds.

Citizens Pay Line of Credit also provides various online shopping benefits such as cashback rewards or promotional offers. Some retailers may offer exclusive discounts or rewards when you use the Citizens Pay Line of Credit as the payment method. It’s always a good idea to check for any ongoing offers or promotions to maximize your savings.

Using Citizens Pay Line of Credit for online shopping not only offers convenience and security but also provides the flexibility to manage your finances effectively. You can choose to pay off your online shopping purchases in full every month or make minimum monthly payments, depending on your financial situation. Just remember to be mindful of your spending habits and avoid unnecessary debt.

Overall, Citizens Pay Line of Credit is a great option for those who enjoy the convenience and variety of online shopping. By utilizing this financial tool, you can make purchases with ease and have a seamless online shopping experience.

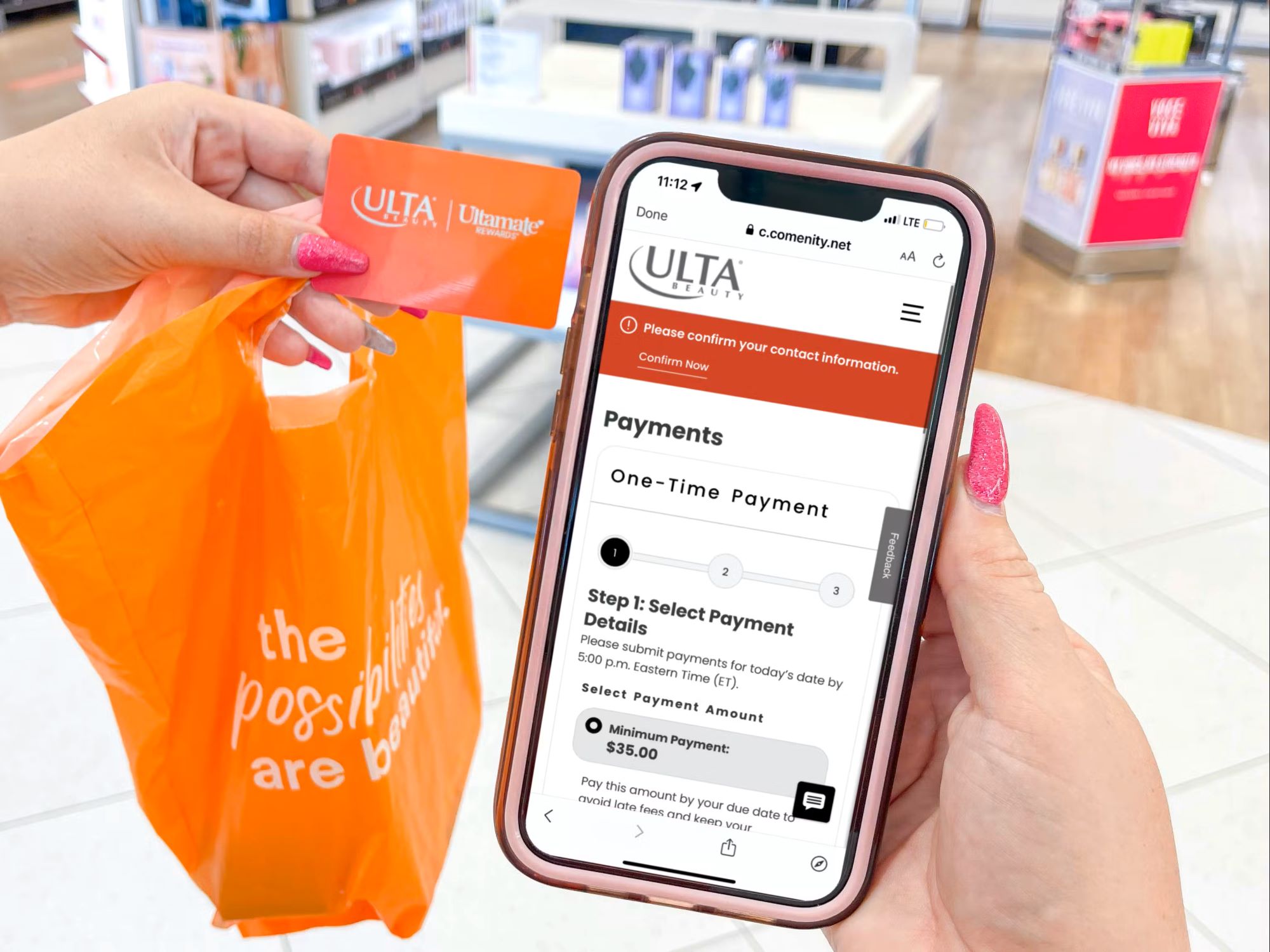

Using Citizens Pay Line of Credit for In-Store Purchases

In addition to online shopping, Citizens Pay Line of Credit can also be used for in-store purchases, providing a versatile payment option for a wide range of retail transactions. Whether you’re buying groceries, clothes, electronics, or other items, Citizens Pay Line of Credit offers a convenient and secure way to make purchases without the need for cash or a physical credit card.

When using Citizens Pay Line of Credit for in-store purchases, you have multiple options to access your funds. Many merchants now offer contactless payment methods, such as mobile wallets or NFC-enabled cards. By linking your Citizens Pay Line of Credit to a mobile wallet, like Apple Pay or Google Pay, you can simply tap your phone or card at the payment terminal to complete the transaction.

Alternatively, if a merchant doesn’t support contactless payments, you can provide your Citizens Pay Line of Credit details manually. Simply present your virtual line of credit information to the cashier, either through the mobile banking app or by providing the necessary card details. The transaction amount will be deducted from your available credit limit.

Using Citizens Pay Line of Credit for in-store purchases offers several advantages. First, it eliminates the need to carry cash or multiple credit cards, simplifying your wallet or purse. Whether you’re making a small purchase or a larger one, you can use your virtual line of credit with ease.

Another benefit is the ability to track and monitor your expenses in real-time. With access to online banking or mobile apps, you can review your transaction history, set up spending alerts, and stay in control of your budget. This added visibility can help you make informed financial decisions and avoid overspending.

Citizens Pay Line of Credit also provides the flexibility to repay your in-store purchases. You have the option to pay off the entire balance within the billing cycle or make minimum monthly payments. Just be mindful of the interest charges that may apply if you carry a balance from month to month.

Overall, Citizens Pay Line of Credit offers a convenient and secure payment method for in-store purchases. Whether you prefer to tap your phone or provide your virtual line of credit details, this financial tool ensures a seamless shopping experience while providing the flexibility to manage your expenses effectively.

Using Citizens Pay Line of Credit for Bill Payments

Citizens Pay Line of Credit is not only useful for shopping but also offers a convenient way to manage your bill payments. Whether it’s your monthly utilities, credit card bills, or other recurring expenses, you can use Citizens Pay Line of Credit to make timely payments and stay on top of your financial obligations.

One of the advantages of using Citizens Pay Line of Credit for bill payments is the flexibility it provides. You can link your virtual line of credit to your bill payment accounts, either through online banking or by providing the necessary details to the billing companies. This allows you to automate the payment process, ensuring that your bills are paid on time without the need for manual intervention.

By setting up automatic payments through Citizens Pay Line of Credit, you can avoid late fees and penalties. You can choose to make minimum monthly payments or pay off the entire balance, depending on your financial situation and preferences.

In addition to utility and credit card bills, Citizens Pay Line of Credit can also be used for other recurring payments, such as insurance premiums, subscription services, and memberships. By consolidating all your bills into one payment method, you can simplify your financial management and reduce the risk of missing any payments.

Using Citizens Pay Line of Credit for bill payments also offers the convenience of tracking and managing your expenses. With online banking or mobile apps, you can easily monitor your payment history, set up reminders for upcoming bills, and view your available credit. This level of visibility helps you stay organized and in control of your financial obligations.

Furthermore, Citizens Pay Line of Credit provides an added layer of security for bill payments. Through secure encryption and advanced authentication measures, you can have peace of mind knowing that your payment information is protected. In case of any unauthorized transactions, you can report them promptly and initiate a dispute process to safeguard your funds.

Overall, Citizens Pay Line of Credit offers a convenient and flexible way to manage your bill payments. By streamlining the process, automating payments, and monitoring your expenses, you can ensure that your bills are paid on time while maintaining control over your financial commitments.

Using Citizens Pay Line of Credit for Travel Expenses

Citizens Pay Line of Credit is a versatile financial tool that can be a great option for managing travel expenses. Whether you’re planning a vacation, a business trip, or even a weekend getaway, using Citizens Pay Line of Credit can offer convenience, flexibility, and security throughout your travel journey.

One of the main benefits of using Citizens Pay Line of Credit for travel expenses is the ability to make online bookings and reservations. From flights and hotels to rental cars and activities, you can use your virtual line of credit to secure your travel arrangements within minutes. This eliminates the need to carry large sums of cash or rely on multiple credit cards.

Furthermore, Citizens Pay Line of Credit offers competitive foreign exchange rates and can be used internationally. This makes it an ideal payment method when traveling abroad, as you can make purchases in local currency without having to worry about exchanging cash or carrying multiple currencies. Just be sure to check if there are any foreign transaction fees associated with your line of credit.

Using Citizens Pay Line of Credit for travel expenses also provides the advantage of having a dedicated credit limit for your trip. Whether you’re on a tight budget or looking to splurge on experiences, you can set your spending limit accordingly and track your expenses in real-time. This helps you stay within your budget and avoid any post-trip financial surprises.

In addition, Citizens Pay Line of Credit often provides travel-related benefits such as travel insurance coverage, trip cancellation protection, and even access to airport lounges. These added perks can enhance your travel experience and provide peace of mind during your journey.

Another advantage is the ability to manage and track your travel expenses easily. By accessing your account through online banking or mobile apps, you can view your transaction history, monitor your spending, and receive notifications about your available credit. This level of control helps you stay organized and on top of your financial situation while traveling.

If you’re planning an extended trip or have ongoing travel expenses, Citizens Pay Line of Credit also offers the flexibility of making minimum monthly payments or paying off the entire balance. Just be mindful of the interest charges that may apply if you choose to carry a balance from month to month.

Overall, using Citizens Pay Line of Credit for travel expenses provides convenience, flexibility, and security. From making online bookings to managing your expenses and enjoying travel-related perks, this financial tool can make your travel experience smoother and more enjoyable.

Using Citizens Pay Line of Credit for Home Improvement

Citizens Pay Line of Credit can be an excellent financing option for your home improvement projects. Whether you’re planning to renovate your kitchen, upgrade your bathroom, or make any other enhancements to your home, using Citizens Pay Line of Credit can offer flexibility, convenience, and competitive interest rates.

One of the advantages of using Citizens Pay Line of Credit for home improvement is the ability to access funds as you need them. Unlike a traditional home equity loan or a personal loan, where you receive a lump sum upfront, Citizens Pay Line of Credit allows you to borrow as much or as little as you require, up to your approved credit limit. This allows you to manage your cash flow effectively and only pay interest on the amount you utilize.

Using Citizens Pay Line of Credit for home improvement projects also offers the advantage of flexibility in repayment. You have the option to make minimum monthly payments or pay off the entire balance within the billing cycle, depending on your financial situation and preferences. This gives you the freedom to choose a repayment plan that works best for your budget.

Furthermore, Citizens Pay Line of Credit eliminates the need for a home appraisal or collateral, making it a hassle-free option for financing your home improvement projects. You can apply for the line of credit online or through your local Citizens bank branch and receive a quick approval decision based on your creditworthiness.

Using Citizens Pay Line of Credit can also help you keep track of your home improvement expenses. By accessing your account through online banking or mobile apps, you can easily monitor your transaction history, set spending limits, and stay organized with your budget. This visibility allows you to make informed financial decisions throughout the project.

In addition, Citizens Pay Line of Credit may come with special benefits or promotional offers for home improvement purchases. Some retailers or home improvement stores may offer exclusive discounts or incentives when you use Citizens Pay Line of Credit as your payment method. Be sure to check for any ongoing promotions to maximize your savings on your home improvement expenses.

Overall, using Citizens Pay Line of Credit for home improvement provides a flexible and convenient financing option. Whether you’re tackling small repairs or embarking on a major renovation, this financial tool can help you fund your projects while maintaining control over your budget and expenses.

Using Citizens Pay Line of Credit for Medical Expenses

Citizens Pay Line of Credit can be a helpful option for managing unexpected or planned medical expenses. Whether you need to cover medical bills, prescription medications, or even elective procedures, using Citizens Pay Line of Credit offers a flexible and convenient way to finance your medical needs.

One of the advantages of using Citizens Pay Line of Credit for medical expenses is the ability to access funds quickly. In times of medical emergencies, having immediate access to funds can be crucial. With Citizens Pay Line of Credit, you can have the peace of mind knowing that you have a pre-approved credit limit available to cover unexpected medical costs.

Using Citizens Pay Line of Credit for medical expenses also provides flexibility in repayment options. Depending on your financial situation, you can choose to repay the entire balance within the billing cycle or make minimum monthly payments. This allows you to manage your medical expenses in a way that fits your budget.

Additionally, Citizens Pay Line of Credit offers competitive interest rates, making it a cost-effective financing option for medical expenses. By utilizing the line of credit, you can avoid high-interest rates associated with credit cards or personal loans, potentially saving you money in the long run.

Another advantage of using Citizens Pay Line of Credit for medical expenses is the convenience it offers. You can easily link your line of credit to your medical provider’s online payment system or handle medical bills through online banking or mobile apps. This streamlines the payment process and allows for easy tracking and management of your medical expenses.

Furthermore, Citizens Pay Line of Credit provides an added layer of security for your medical transactions. With advanced security measures in place, such as encryption and multi-factor authentication, you can have peace of mind knowing that your financial information is protected.

In cases where insurance coverage may not fully cover the medical expenses, or if you have a high deductible, using Citizens Pay Line of Credit can bridge the gap and ensure that you receive the necessary medical treatments without delay. It offers a convenient and reliable source of funding when you need it most.

Overall, using Citizens Pay Line of Credit for medical expenses provides a flexible and convenient financing option. From managing unexpected medical bills to covering elective procedures, this financial tool allows you to access funds quickly and efficiently, giving you peace of mind and the ability to prioritize your health and well-being.

Using Citizens Pay Line of Credit for Education Expenses

Citizens Pay Line of Credit can be a valuable tool for financing education expenses, whether it’s tuition fees, textbooks, or other educational needs. With the rising costs of education, using Citizens Pay Line of Credit offers a flexible and convenient way to manage the financial aspects of obtaining knowledge and skills.

One of the advantages of using Citizens Pay Line of Credit for education expenses is the availability of funds when you need them. From paying tuition fees to purchasing course materials, having access to a pre-approved credit limit allows you to cover educational expenses without delay, ensuring a smooth and uninterrupted learning experience.

Using Citizens Pay Line of Credit for education expenses also offers flexibility in repayment. Depending on your financial situation and preferences, you can choose to make minimum monthly payments or pay off the entire balance within the billing cycle. This flexibility allows you to manage your educational expenses according to your budget.

Furthermore, Citizens Pay Line of Credit often offers competitive interest rates, making it a cost-effective financing option compared to other forms of borrowing, such as personal loans or credit cards. By utilizing the line of credit, you can potentially save money on interest charges over the long term.

Another advantage is the convenience and ease of using Citizens Pay Line of Credit for educational expenses. You can link your line of credit to the online payment systems of educational institutions, allowing for seamless and secure transactions. Additionally, by accessing your account through online banking or mobile apps, you can easily track and manage your educational expenses in real-time.

Citizens Pay Line of Credit can also be used for various education-related expenses, including study abroad programs, certification courses, or professional development workshops. The versatility of the line of credit allows you to invest in your education beyond traditional academic pursuits.

In addition, Citizens Pay Line of Credit may offer additional benefits or rewards specifically geared toward educational expenses. Some programs may provide cashback rewards or promotional offers when you use the line of credit for educational transactions. Be sure to explore and take advantage of any available offers to maximize your savings.

Overall, using Citizens Pay Line of Credit for education expenses provides a convenient and flexible financing option. By utilizing this tool, you can focus on your educational pursuits without worrying about the financial aspects, ensuring that you have the necessary resources to invest in your future.

Using Citizens Pay Line of Credit for Personal Expenses

Citizens Pay Line of Credit is a versatile financial tool that can be utilized for various personal expenses. Whether it’s for unexpected financial emergencies, special occasions, or simply to have some extra funds for discretionary spending, using Citizens Pay Line of Credit offers flexibility and convenience to manage your personal expenses.

One of the advantages of using Citizens Pay Line of Credit for personal expenses is the ability to access funds quickly and easily. Whether you need to cover medical bills, home repairs, or any other personal expense, having a pre-approved credit limit allows you to address these financial needs promptly.

Using Citizens Pay Line of Credit also offers the flexibility of repayment. Depending on your financial situation and preferences, you can make minimum monthly payments or pay off the entire balance within the billing cycle. This flexibility allows you to manage your personal expenses within your budget and financial capabilities.

Furthermore, Citizens Pay Line of Credit often offers competitive interest rates compared to other forms of borrowing, such as credit cards or personal loans. By utilizing the line of credit for personal expenses, you can potentially save money on interest charges and manage your debt more effectively.

Another advantage is the convenience and ease of using Citizens Pay Line of Credit for personal expenses. Whether you need to make online purchases, cover unexpected bills, or indulge in personal luxuries, you can easily access your line of credit through online banking or mobile apps. This allows for seamless transactions and real-time tracking of your expenses.

In addition, Citizens Pay Line of Credit may offer benefits or rewards specific to personal spending. Some programs may provide cashback rewards or promotional offers when you use the line of credit for personal transactions. Be sure to explore these offers and take advantage of any available savings or incentives.

Using Citizens Pay Line of Credit for personal expenses also provides the advantage of security and protection. With advanced security measures in place, such as encryption and fraud monitoring, you can have peace of mind knowing that your personal information and transactions are safeguarded.

Overall, using Citizens Pay Line of Credit for personal expenses offers flexibility, convenience, and competitive interest rates. Whether it’s for unexpected emergencies or discretionary spending, this financial tool allows you to manage your personal expenses effectively while maintaining control over your budget and financial well-being.

Conclusion

Citizens Pay Line of Credit provides individuals with a versatile and convenient financial tool to manage their expenses effectively. Whether it’s for online shopping, in-store purchases, bill payments, travel expenses, home improvement projects, medical needs, education expenses, or personal spending, Citizens Pay Line of Credit offers a flexible and secure solution.

By utilizing Citizens Pay Line of Credit, individuals can enjoy the convenience of making online purchases without the need for physical credit cards. They can also experience seamless in-store transactions, eliminating the hassle of carrying cash or multiple credit cards. With the ability to use Citizens Pay Line of Credit for bill payments, individuals can streamline their financial obligations and avoid late fees. When it comes to travel expenses, Citizens Pay Line of Credit offers a convenient payment option with competitive exchange rates, helping individuals manage their budget effectively while on the go.

For home improvement projects, Citizens Pay Line of Credit allows individuals to access funds as needed, offering flexibility in repayment options. When it comes to medical expenses, Citizens Pay Line of Credit can provide necessary funds during emergencies or planned treatments, ensuring peace of mind and timely access to healthcare. Additionally, Citizens Pay Line of Credit serves as a valuable tool to finance education expenses, allowing individuals to invest in their future without the financial burdens that traditional loans may impose. Finally, for personal expenses, Citizens Pay Line of Credit offers flexibility, convenience, and competitive interest rates, putting individuals in control of their finances.

In conclusion, Citizens Pay Line of Credit is a powerful financial tool that caters to individuals’ diverse needs. Whether it’s for day-to-day spending or managing significant expenses, Citizens Pay Line of Credit provides the flexibility, convenience, and security required to stay in control of one’s financial well-being. By leveraging this versatile tool, individuals can better manage their expenses, plan for the future, and achieve their financial goals.