Home>Finance>How Does UIA In Michigan Determine A Minimum Payment For Repayment Of Overpayment For Unemployment

Finance

How Does UIA In Michigan Determine A Minimum Payment For Repayment Of Overpayment For Unemployment

Published: February 27, 2024

Learn how the UIA in Michigan calculates the minimum repayment for overpayment of unemployment benefits. Understand the finance aspect of repayment requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Unemployment Insurance Agency (UIA) in Michigan plays a pivotal role in providing financial assistance to eligible individuals who are unemployed through no fault of their own. The agency ensures that qualified claimants receive monetary support, thereby helping them navigate the challenges of unemployment. However, there are instances where overpayments occur, leading to the need for repayment. Understanding how UIA determines the minimum payment for the repayment of overpayment is crucial for individuals navigating this process.

The calculation of overpayments and the subsequent determination of the minimum payment for repayment are multifaceted processes that involve various considerations. By delving into the intricacies of these procedures, individuals can gain insight into the factors that influence the minimum payment determination. This knowledge empowers them to make informed decisions and take the necessary steps to fulfill their repayment obligations.

In the subsequent sections, we will explore the UIA in Michigan, delve into the calculation of overpayments, and elucidate the factors involved in determining the minimum payment for repayment. By shedding light on these essential aspects, this article aims to provide clarity and guidance to individuals seeking to understand the intricacies of overpayment repayment within the purview of UIA in Michigan.

**

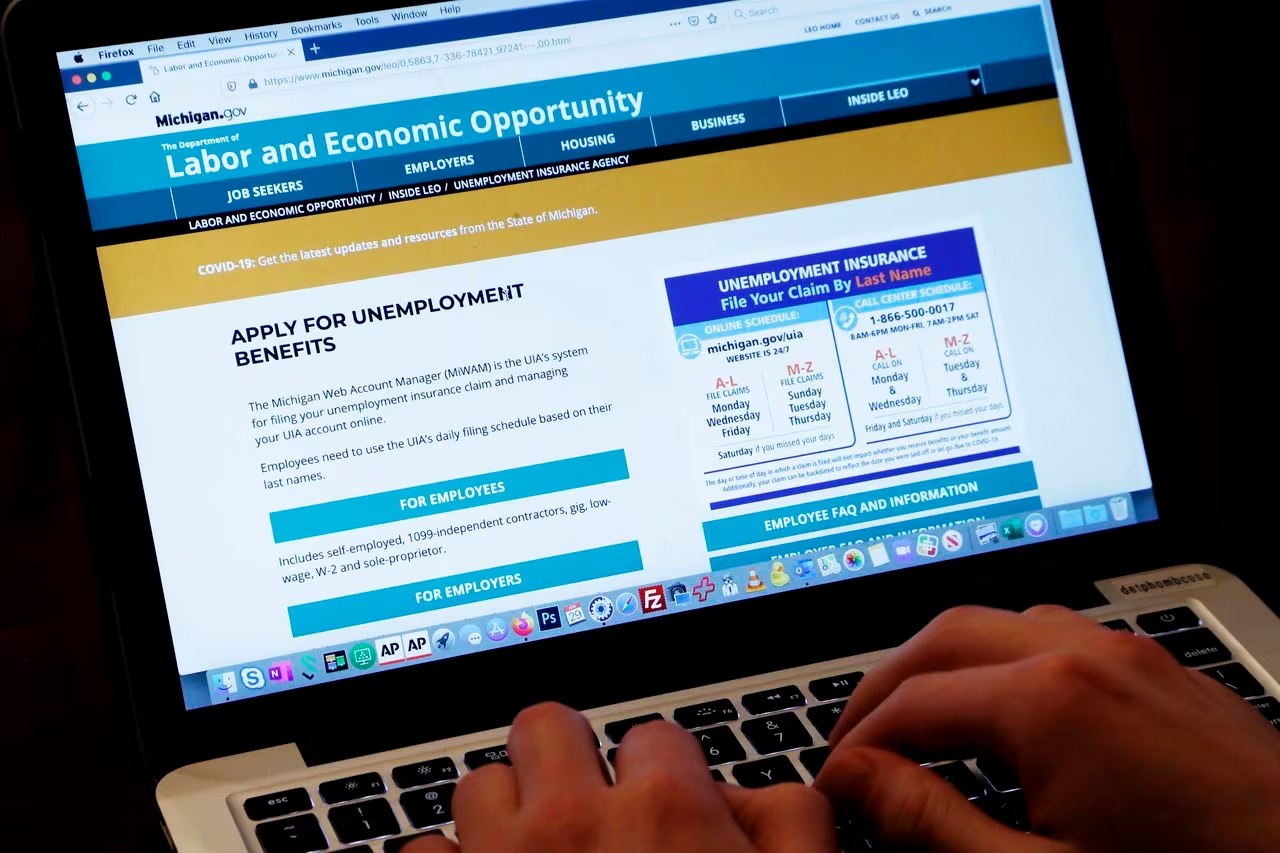

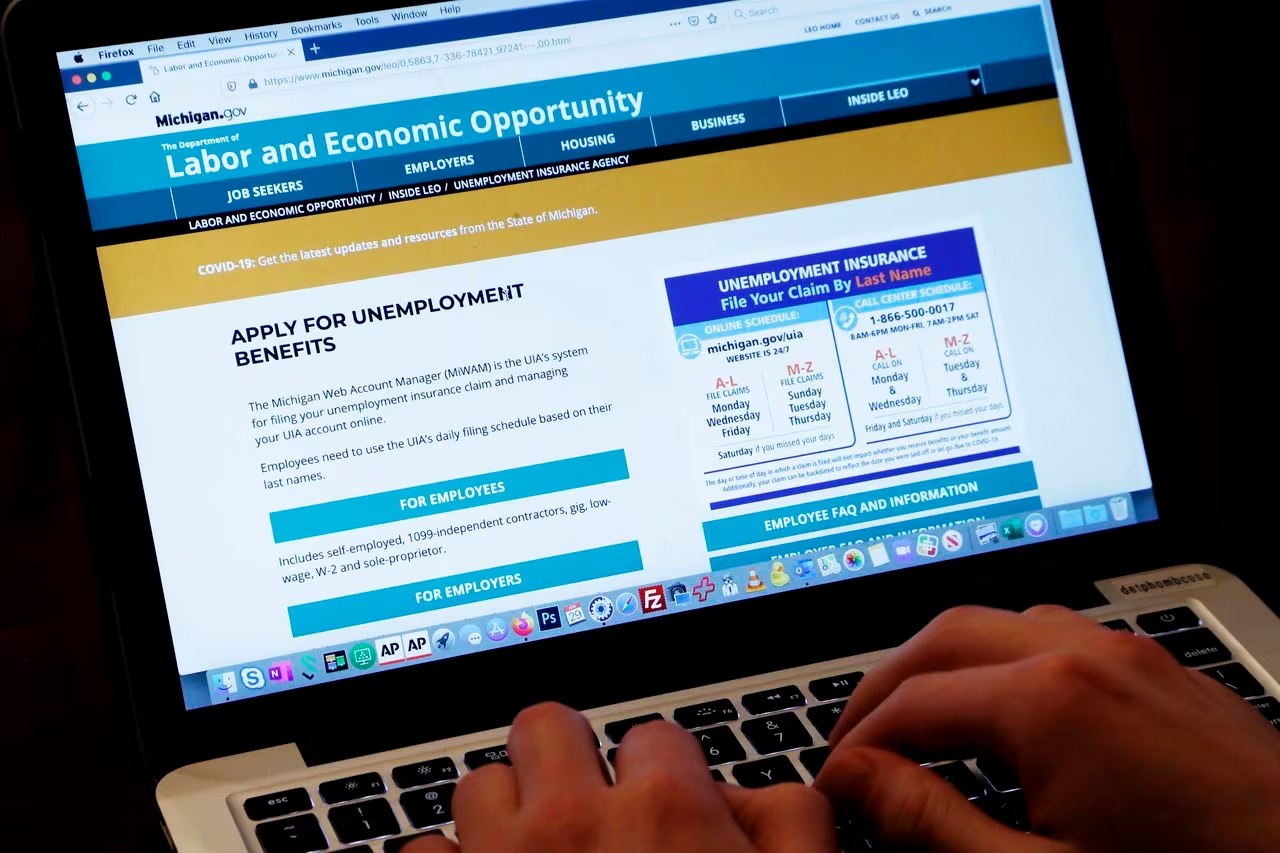

Overview of Unemployment Insurance Agency (UIA) in Michigan

The Unemployment Insurance Agency (UIA) in Michigan is tasked with the responsibility of administering unemployment benefits to eligible individuals in the state. Its primary objective is to provide temporary financial assistance to workers who have lost their jobs through no fault of their own. This vital support serves as a crucial safety net, helping individuals meet their basic needs while they actively seek new employment opportunities.

UIA oversees the Unemployment Insurance (UI) program, which is designed to offer partial wage replacement to qualified individuals who meet the stipulated eligibility criteria. The agency processes unemployment claims, assesses eligibility, and disburses benefit payments to eligible claimants. Additionally, UIA plays a pivotal role in safeguarding the integrity of the UI program by conducting investigations to prevent and address instances of fraud or improper payments.

Amid the overarching goal of providing essential financial assistance, the agency also addresses overpayments that may occur within the UI program. Overpayments can stem from various reasons, such as administrative errors, claimant mistakes, or failure to report earnings accurately. When overpayments occur, UIA takes measures to recover the excess funds, ensuring the proper utilization of resources and the maintenance of program integrity.

Understanding the role and functions of UIA is fundamental for individuals navigating the unemployment benefits system in Michigan. By familiarizing themselves with the agency’s operations, claimants can better comprehend the processes involved in overpayment calculation and repayment. This knowledge equips individuals with the necessary insights to fulfill their obligations and effectively engage with UIA to address overpayment issues.

**

Calculation of Overpayment

Overpayments within the context of unemployment benefits occur when claimants receive funds in excess of what they are entitled to under the program’s guidelines. The calculation of overpayments involves a meticulous assessment of various factors to determine the extent of the excess funds disbursed to claimants.

One of the primary considerations in the calculation of overpayment is the accurate reporting of earnings. Claimants are required to report their earnings truthfully and promptly to ensure that their benefit amounts are calculated correctly. Failure to report earnings, underreporting of income, or inaccuracies in reporting can lead to overpayments. Additionally, administrative errors, such as processing mistakes or miscalculations, can contribute to overpayment situations.

When overpayments occur, UIA conducts thorough reviews to ascertain the specific reasons behind the excess disbursement of funds. This involves examining claimant records, earnings reports, and other pertinent documentation to identify the factors that led to the overpayment. By conducting comprehensive assessments, UIA endeavors to ensure the accuracy of overpayment determinations and uphold the integrity of the UI program.

Once the overpayment amount is determined, claimants are informed of the excess funds they have received and the corresponding repayment obligations. Understanding the intricacies of overpayment calculation is essential for individuals navigating the process of addressing overpayment issues. By comprehending the factors that contribute to overpayments and the methodologies employed in their calculation, claimants can actively participate in resolving overpayment matters in collaboration with UIA.

**

Determining Minimum Payment for Repayment

When addressing overpayment of unemployment benefits, the Unemployment Insurance Agency (UIA) in Michigan employs a structured approach to determine the minimum payment required for repayment. This process involves assessing various factors to establish a reasonable and feasible minimum payment amount that claimants are obligated to repay.

UIA considers the financial circumstances of individuals when determining the minimum payment for repayment. This entails evaluating the claimant’s ability to repay the overpayment while ensuring that their essential financial needs are met. By taking into account the claimant’s financial capacity, UIA aims to establish a minimum payment amount that is reasonable and manageable, considering the individual’s current economic standing.

Another crucial factor in determining the minimum payment for repayment is the magnitude of the overpayment. UIA evaluates the extent of the overpayment to ascertain the appropriate minimum payment that facilitates the gradual reimbursement of the excess funds. By aligning the minimum payment with the overpayment amount, UIA seeks to establish a structured repayment plan that enables claimants to fulfill their obligations without undue financial strain.

Furthermore, UIA considers the duration of the repayment period when determining the minimum payment. The agency aims to establish a balanced repayment timeline that accommodates the claimant’s financial circumstances while ensuring the timely resolution of the overpayment. By delineating a reasonable repayment period, UIA endeavors to facilitate the gradual reimbursement of overpaid funds without imposing undue hardship on claimants.

Understanding the methodology behind the determination of the minimum payment for repayment is essential for individuals navigating the overpayment repayment process. By comprehending the considerations involved in this determination, claimants can actively engage with UIA to address their repayment obligations effectively. Additionally, gaining insights into the factors influencing the minimum payment determination empowers individuals to participate in constructive discussions with UIA to establish feasible and equitable repayment arrangements.

**

Factors Considered in Minimum Payment Determination

When determining the minimum payment for the repayment of overpayment for unemployment benefits, the Unemployment Insurance Agency (UIA) in Michigan takes into account several key factors to establish a fair and feasible repayment arrangement. Understanding these factors is paramount for individuals navigating the process, as it provides insights into the considerations that shape the minimum payment determination.

1. Financial Capacity: UIA assesses the claimant’s financial capacity to ascertain their ability to repay the overpayment. This involves evaluating the individual’s income, expenses, and overall financial standing. By understanding the claimant’s financial circumstances, UIA aims to establish a minimum payment amount that aligns with the individual’s ability to make payments without experiencing undue hardship.

2. Overpayment Magnitude: The extent of the overpayment is a pivotal factor in determining the minimum payment. UIA considers the total amount of the overpayment when establishing the minimum payment, aiming to devise a repayment plan that gradually recoups the excess funds without imposing excessive financial strain on the claimant.

3. Repayment Period: The duration of the repayment period is carefully evaluated by UIA. The agency seeks to establish a reasonable timeline for repayment that balances the claimant’s financial circumstances with the need for timely reimbursement of the overpaid funds. By delineating a structured repayment period, UIA aims to facilitate the gradual resolution of overpayment while accommodating the claimant’s financial situation.

4. Communication and Collaboration: UIA encourages open communication and collaboration with claimants during the repayment determination process. Claimants are afforded the opportunity to provide relevant information about their financial situation, which can inform the minimum payment determination. This collaborative approach allows for constructive dialogue and the establishment of equitable repayment arrangements.

5. Compliance with Guidelines: UIA adheres to established guidelines and regulations governing overpayment repayment. The agency ensures that the minimum payment determination aligns with statutory requirements and program guidelines, fostering transparency and fairness in the repayment process.

By considering these factors, UIA endeavors to establish minimum payment amounts that are reasonable, equitable, and tailored to the claimant’s financial circumstances. Understanding the intricacies of these considerations empowers individuals to engage proactively with UIA, fostering constructive dialogue and facilitating the establishment of feasible repayment arrangements.

**

Conclusion

The process of addressing overpayment for unemployment benefits and determining the minimum payment for repayment within the purview of the Unemployment Insurance Agency (UIA) in Michigan encompasses a multifaceted approach. By delving into the intricacies of overpayment calculation and repayment determination, individuals gain valuable insights into the considerations that shape the repayment process.

Understanding the role of UIA and the factors influencing the minimum payment determination equips individuals with the knowledge necessary to navigate overpayment issues effectively. By comprehending the agency’s emphasis on assessing financial capacity, considering the magnitude of overpayments, and delineating reasonable repayment periods, claimants can actively engage with UIA to establish equitable and feasible repayment arrangements.

Furthermore, fostering open communication and collaboration with UIA facilitates constructive dialogue, enabling individuals to provide relevant information about their financial circumstances and work towards mutually beneficial repayment solutions. By aligning with established guidelines and regulations, UIA ensures transparency and fairness in the repayment process, fostering trust and accountability.

In essence, the determination of the minimum payment for overpayment repayment reflects UIA’s commitment to addressing overpayment issues in a manner that considers the claimant’s financial capacity while ensuring the gradual reimbursement of excess funds. This balanced approach aims to facilitate the resolution of overpayment matters without imposing undue financial strain on individuals.

By shedding light on the intricacies of overpayment repayment and the factors influencing the minimum payment determination, this article aims to provide clarity and guidance to individuals navigating the UIA system in Michigan. Empowered with knowledge and insights, individuals can actively participate in the resolution of overpayment issues, fostering a cooperative and constructive engagement with UIA to address repayment obligations effectively.

**