Finance

How Hard Is Accounting Degree

Modified: December 30, 2023

Earn a finance degree and break into the world of accounting. Discover the challenges and rewards of pursuing an accounting degree.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an Accounting Degree?

- Overview of Accounting Degree Programs

- Curriculum and Course Load

- Difficulty of Accounting Coursework

- Analyzing and Interpreting Financial Statements

- Taxation and Auditing Challenges

- Advanced Accounting Topics

- Professional Certification Exams

- Workload and Time Commitment

- Study Strategies and Resources

- Conclusion

Introduction

Embarking on a journey to pursue higher education is an exciting and sometimes daunting endeavor. For those interested in the world of finance and numbers, an accounting degree can be an excellent choice. However, it is important to understand the challenges that lie ahead when choosing this path.

An accounting degree goes beyond simple mathematics and number crunching. It delves into the intricate world of financial analysis, taxation, auditing, and advanced accounting principles. This comprehensive field requires a deep understanding of complex concepts, attention to detail, and an analytical mindset.

In this article, we will explore the various aspects of an accounting degree and shed light on the level of difficulty that students may face along the way. From the curriculum and coursework to the demands of professional certification exams, we will provide insights into what it takes to earn an accounting degree and the challenges that students may encounter.

Whether you are a high school student contemplating your future field of study or a working professional considering a career change, understanding the nuances of an accounting degree can help you make an informed decision and better prepare yourself for the academic journey ahead.

So, let us dive into the world of numbers, analyses, and financial expertise, and discover just how hard an accounting degree can be.

What is an Accounting Degree?

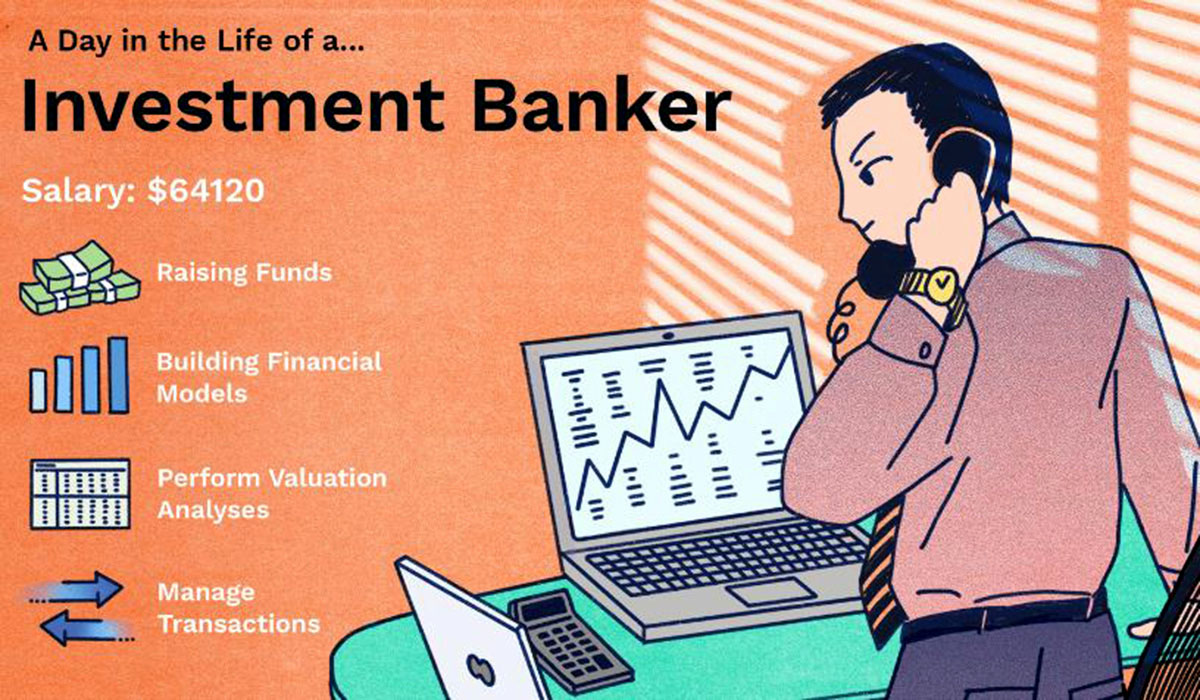

An accounting degree is an academic qualification earned by individuals who seek to build a career in the field of accounting and finance. It provides students with a strong foundation in accounting principles, financial analysis, taxation, auditing, and other related areas.

Accountants play a critical role in organizations by ensuring accurate financial recordkeeping, analyzing financial data, preparing financial statements, and providing insights to aid in decision-making. They are knowledgeable about tax regulations, financial laws, and best practices in financial management.

An accounting degree program typically includes a mix of core business courses and specialized accounting courses. Core business courses may cover topics such as economics, business communication, management, and marketing, while specialized accounting courses delve into areas like financial accounting, managerial accounting, auditing, taxation, and accounting information systems.

Throughout their studies, accounting students gain practical skills and knowledge related to financial reporting, analyzing financial statements, interpreting financial data, tax planning, and auditing procedures. They also develop proficiency in utilizing accounting software and technology to facilitate efficient financial management.

Accounting degrees are offered at various levels of education, including associate’s, bachelor’s, and master’s degrees. An associate’s degree typically provides a basic understanding of foundational accounting principles, while a bachelor’s degree offers a more comprehensive education with a broader scope of accounting topics covered. A master’s degree in accounting provides advanced knowledge and specialization in areas like forensic accounting, international accounting, or financial analysis.

Overall, an accounting degree equips students with the necessary skills and knowledge to pursue various career paths in accounting, finance, and business. It offers a strong foundation for those interested in becoming certified public accountants (CPAs), financial analysts, auditors, tax professionals, or financial consultants.

Overview of Accounting Degree Programs

Accounting degree programs are designed to provide students with a comprehensive understanding of various accounting principles and practices. These programs typically cover a wide range of topics, including financial accounting, managerial accounting, taxation, auditing, accounting systems, and more.

Accounting degree programs can be pursued at various educational institutions, including universities, colleges, and online learning platforms. They are typically offered at the associate’s, bachelor’s, and master’s degree levels, allowing students to choose the level that aligns with their career goals and educational aspirations.

An associate’s degree in accounting is an entry-level program that usually takes around two years to complete. This program provides students with a solid foundation in basic accounting principles, financial analysis, and bookkeeping. It also introduces them to business and general education courses to provide a well-rounded education.

A bachelor’s degree in accounting is a more comprehensive program that typically takes four years to complete. In addition to core accounting courses, students also take a variety of business courses, such as economics, finance, statistics, and management. This broader curriculum provides students with a well-rounded education and prepares them for various roles in the accounting and finance field.

A master’s degree in accounting is an advanced program that allows students to delve deeper into specialized areas of accounting. It typically takes one to two years to complete and is often pursued by individuals who want to enhance their career prospects or specialize in a specific area of accounting, such as forensic accounting or taxation.

Online accounting degree programs are also available, offering flexibility for students who may have work or other commitments. These programs provide the same quality education as traditional programs but allow students to study at their own pace from anywhere with internet access.

When considering an accounting degree program, it is essential to research and evaluate the curriculum, faculty, accreditation, and career outcomes. Look for programs that are accredited by recognized accrediting bodies to ensure the program meets certain quality standards. Additionally, consider the reputation of the institution and its faculty members in the accounting field.

Overall, accounting degree programs provide students with a comprehensive education in accounting principles and practices. They equip students with the necessary skills and knowledge to pursue a variety of accounting careers in both the public and private sectors.

Curriculum and Course Load

The curriculum and course load of an accounting degree program are carefully designed to provide students with a well-rounded education that covers the essential knowledge and skills required in the field of accounting.

The specific courses and credit requirements may vary depending on the level of the degree program (associate’s, bachelor’s, or master’s) and the institution offering the program. However, there are certain core courses that are typically included in accounting degree programs across the board.

Some of the common core courses you can expect to encounter in an accounting degree program include:

- Financial Accounting: This course focuses on the principles and practices of recording and reporting financial transactions. Students learn how to prepare financial statements, analyze financial data, and gain an understanding of generally accepted accounting principles (GAAP).

- Managerial Accounting: This course explores how accounting information is used for decision-making within organizations. Students learn how to analyze costs, budget and plan, and make strategic business decisions based on financial data.

- Taxation: Taxation courses provide an overview of the tax laws and regulations that individuals and businesses must adhere to. Students learn how to calculate taxes, prepare tax returns, and develop tax-saving strategies.

- Auditing: Auditing courses focus on the examination and evaluation of financial records and systems to ensure their accuracy and compliance with regulations. Students learn about auditing procedures, internal controls, and ethical considerations in auditing practices.

- Accounting Information Systems: This course introduces students to the use of technology in accounting and how information systems are utilized to process and manage financial data. Students learn about accounting software, databases, and data security.

In addition to core courses, accounting degree programs may also include electives or concentration areas where students can specialize in a specific aspect of accounting, such as forensic accounting, international accounting, or financial analysis.

The course load can vary depending on the institution and degree level. Typically, full-time students in a bachelor’s degree program are expected to take around 15-18 credit hours per semester, which equates to 4-5 courses. This can vary based on the complexity and workload of each course.

It is important to note that accounting courses can be challenging and require a significant amount of time and effort to succeed. Students should be prepared for a rigorous workload that includes reading textbooks, completing assignments, participating in group projects, and studying for exams.

Many accounting degree programs also incorporate experiential learning opportunities, such as internships or co-op placements, where students can gain hands-on experience in real-world accounting settings. These practical experiences are valuable in applying learned concepts and building professional networks.

Overall, the curriculum and course load of an accounting degree program are designed to equip students with the knowledge, skills, and practical experience necessary to thrive in the accounting profession.

Difficulty of Accounting Coursework

Accounting coursework can be challenging, requiring students to develop a strong foundation in accounting principles and develop analytical and problem-solving skills. The difficulty of the coursework depends on various factors, including the complexity of the subject matter, the level of the degree program, and the individual’s aptitude for accounting.

One of the reasons accounting coursework can be challenging is the need for precise attention to detail. Accounting involves working with large amounts of financial data, ensuring accuracy in calculations, and adhering to regulatory standards. Even a small error can have significant implications for financial reporting and decision-making.

Accounting coursework also requires students to develop critical thinking and analytical skills. They must be able to analyze financial statements, interpret data, identify trends, and make informed recommendations. This can involve complex calculations, understanding accounting principles and regulations, and applying critical judgment to solve accounting problems.

The difficulty of accounting coursework increases as students progress through the degree program. In introductory courses, students learn the basic principles and concepts of accounting. As they advance, they encounter more complex topics such as advanced financial accounting, taxation, and auditing.

Furthermore, accounting coursework often requires students to work independently and manage their time effectively. They may need to complete assignments, study for exams, and meet project deadlines. This can be challenging for some students, particularly those who are not accustomed to the rigorous demands of academic coursework.

Successful completion of accounting coursework often requires a strong work ethic, discipline, and perseverance. It is important for students to stay organized, keep up with readings and assignments, seek clarification when needed, and actively participate in class discussions and activities.

While accounting coursework can be challenging, there are resources available to support students in their studies. Professors and teaching assistants are often available for consultation and guidance. Additionally, tutoring services, study groups, and online resources can provide additional support and clarification for difficult concepts.

Overall, the difficulty of accounting coursework is subjective and can vary from individual to individual. It requires a solid understanding of accounting principles, attention to detail, analytical skills, and effective time management. With dedication and perseverance, students can navigate the challenges and succeed in their accounting studies.

Analyzing and Interpreting Financial Statements

One of the fundamental skills that accounting students develop is the ability to analyze and interpret financial statements. Financial statements are crucial documents that provide a snapshot of a company’s financial performance and position.

Analyzing financial statements involves a thorough examination of the various components, such as the balance sheet, income statement, and cash flow statement. This process allows accountants and financial analysts to gain insights into a company’s profitability, liquidity, solvency, and overall financial health.

Interpreting financial statements requires a deep understanding of accounting principles, financial ratios, and industry benchmarks. Accountants must possess strong analytical skills and the ability to identify trends and patterns from the numbers presented in the financial statements.

Some of the key elements involved in analyzing and interpreting financial statements include:

- Ratio Analysis: Accountants use financial ratios to assess a company’s performance and compare it to industry standards. Common ratios include liquidity ratios, profitability ratios, debt ratios, and efficiency ratios. By examining these ratios, accountants can evaluate the financial health and operational efficiency of a company.

- Trend Analysis: Accountants analyze financial statements over multiple periods to identify trends in financial performance. This can help identify patterns, such as revenue growth, cost trends, or fluctuations in profitability. Trend analysis provides valuable insights and can help anticipate future financial outcomes.

- Comparative Analysis: Accountants compare financial statements of different companies within the same industry to assess their relative performance. Comparing key financial indicators such as revenue, profitability, and liquidity ratios can help gauge a company’s competitive position.

- Cash Flow Assessment: A crucial aspect of financial statement analysis is evaluating a company’s cash flow. Cash flow statements provide information about a company’s ability to generate cash, its financing activities, and investing activities. Accountants assess the company’s ability to generate positive cash flow for operational and investment needs.

By analyzing and interpreting financial statements, accountants can provide valuable insights and recommendations to businesses and decision-makers. They can identify areas of strength and weakness, assess the impact of financial decisions, and contribute to strategic planning and resource allocation.

It is important for accounting students to develop strong analytical skills and attention to detail to effectively analyze and interpret financial statements. They must also have a solid understanding of accounting principles, financial reporting standards, and industry-specific knowledge to accurately interpret the information presented in the financial statements.

Overall, analyzing and interpreting financial statements is a critical skill set for accountants, financial analysts, and professionals in the finance industry. It requires a combination of technical knowledge, analytical abilities, and an understanding of the broader business context to provide meaningful insights and drive informed decision-making.

Taxation and Auditing Challenges

When it comes to accounting, two specialized areas that present unique challenges are taxation and auditing. Taxation and auditing are critical functions in ensuring legal compliance, financial transparency, and accurate reporting for individuals and businesses.

Taxation poses challenges due to the complex and constantly changing nature of tax laws and regulations. Accountants specializing in taxation must stay updated with the latest tax codes, deductions, credits, and reporting requirements. They are responsible for providing tax planning and advisory services, ensuring accurate preparation of tax returns, and assisting with tax audits or investigations.

Some of the challenges that professionals face in the field of taxation include:

- Interpretation of Tax Laws: Tax laws can be intricate, and interpreting them accurately requires expertise and attention to detail. Changes in tax regulations and new rulings can impact the way businesses and individuals calculate their tax liabilities. Accountants specialized in taxation must navigate through these laws and apply them appropriately to ensure compliance.

- Tax Planning and Strategy: Effective tax planning involves understanding the financial goals of individuals or businesses and exploring strategies to minimize tax liabilities within the boundaries of the law. Developing tax-efficient structures and taking advantage of available deductions and credits require careful analysis and strategic thinking.

- Auditing Challenges: Auditing involves examining financial records, procedures, and internal controls to ensure accuracy, compliance, and transparency. Auditors face challenges related to identifying and mitigating fraud risks, assessing the adequacy of internal controls, and maintaining professional skepticism. They must exercise professional judgment and adhere to professional standards to conduct unbiased and thorough audits.

- Complexity of Financial Transactions: Businesses engage in various complex financial transactions, such as mergers and acquisitions, stock options, and international transactions. These transactions often have tax implications that require careful analysis and expertise to determine the appropriate tax treatment. Accountants specializing in taxation need to navigate through these complexities to ensure proper tax reporting.

Apart from the technical challenges, tax professionals and auditors must also possess strong communication and interpersonal skills. They interact with clients, tax authorities, and other stakeholders, and are often required to explain complex tax concepts in simple terms and provide guidance and recommendations.

Continuing education and professional development are crucial for tax professionals and auditors to stay updated with changes in tax laws and regulations. They must dedicate themselves to ongoing learning and obtaining relevant certifications to enhance their expertise and maintain their professional competence.

Overall, taxation and auditing present unique challenges that require specialized knowledge, attention to detail, critical thinking, and effective communication skills. Professionals in these fields play a pivotal role in ensuring accurate financial reporting, adherence to tax laws, and maintaining the integrity of financial information.

Advanced Accounting Topics

As students progress in their accounting studies, they encounter advanced accounting topics that delve deeper into complex financial reporting, specialized industries, and advanced accounting principles. These topics require a solid foundation in basic accounting concepts and build upon that knowledge to explore more intricate aspects of the field.

Some of the advanced accounting topics that students may encounter in their academic journey or professional careers include:

- Consolidation and Business Combinations: This topic focuses on the accounting treatment of consolidating financial statements for companies involved in mergers, acquisitions, and joint ventures. Students learn how to consolidate the financial statements of parent companies and subsidiaries, allocate goodwill, and handle intercompany transactions.

- Derivatives and Hedging: Derivatives are financial instruments whose value is derived from an underlying asset, index, or benchmark. Advanced accounting courses explore the accounting principles and reporting requirements for derivatives and hedging activities, such as futures contracts, options, and swaps.

- International Accounting Standards: As businesses operate in a globalized world, understanding international accounting standards is crucial. Topics such as International Financial Reporting Standards (IFRS) and the convergence of accounting standards provide insights into handling international transactions and preparing financial statements that comply with global practices.

- Forensic Accounting: Forensic accounting combines accounting, auditing, and investigative skills to detect financial fraud and analyze financial data for legal purposes. Students learn about fraud examination techniques, legal considerations, and the role of accounting in litigation and dispute resolution.

- Sustainability Reporting: With increasing focus on corporate social responsibility and sustainable business practices, accounting professionals are involved in measuring, reporting, and analyzing sustainability metrics. Advanced accounting courses delve into topics related to environmental, social, and governance (ESG) reporting and its integration with financial reporting.

Advanced accounting topics require students to think critically, analyze complex scenarios, and apply accounting principles to real-world situations. They often involve case studies, research projects, and in-depth analysis of financial statements and disclosures.

Professionals specializing in advanced accounting topics may pursue additional certifications or designations to enhance their expertise. For example, Certified Public Accountants (CPAs) can choose to pursue specialized certifications like Chartered Financial Analyst (CFA), Certified Management Accountant (CMA), or Certified Fraud Examiner (CFE) to demonstrate their proficiency in specific areas.

It is important for students and professionals to stay updated with emerging trends and developments in advanced accounting topics. Continuing education, professional development programs, and industry conferences provide opportunities to deepen knowledge and expand skill sets in these specialized areas.

Overall, advanced accounting topics expand on foundational accounting concepts and explore specialized areas of the field. They equip students and professionals with the necessary knowledge and skills to navigate complex financial scenarios, address specific industry challenges, and contribute to the evolving landscape of accounting and financial reporting.

Professional Certification Exams

Professional certification exams play a crucial role in the accounting field, allowing individuals to demonstrate their competence, expertise, and commitment to professional standards. These exams provide validation of knowledge and skills and are highly regarded by employers, clients, and the accounting community.

There are several professional certifications available for accountants, each catering to different areas of specialization and career goals. Some of the most recognized certifications include:

- Certified Public Accountant (CPA): The CPA certification is one of the most prestigious and widely recognized certifications in the accounting field. It is awarded by state boards of accountancy and requires passing a rigorous exam that covers various areas of accounting and related subjects. CPAs are qualified to provide various accounting services, including auditing, consulting, tax planning, and financial analysis.

- Chartered Financial Analyst (CFA): The CFA certification is highly regarded in the field of finance and investment management. The exam covers topics such as economics, financial analysis, portfolio management, and ethics. CFAs are experts in investment analysis, asset valuation, and financial decision-making.

- Certified Management Accountant (CMA): The CMA certification is designed for professionals involved in management accounting and financial management roles. The exam covers topics such as planning, performance, and control. CMAs are skilled in budgeting, cost management, financial analysis, and strategic planning.

- Certified Fraud Examiner (CFE): The CFE certification is focused on fraud prevention, detection, and deterrence. The exam covers topics such as fraud schemes, investigation techniques, and legal considerations. CFEs are experts in identifying and investigating fraudulent activities within organizations.

Preparing for professional certification exams can be challenging due to their comprehensive nature and the level of knowledge required. Candidates must dedicate significant time and effort to study for the exams, often utilizing study materials, practice exams, and review courses.

Many certification exams have multiple parts or levels, requiring candidates to pass each section to earn the certification. Additionally, most certifications have ongoing continuing professional education (CPE) requirements to ensure professionals stay current with industry developments and maintain their certification status.

Successfully earning a professional certification can open doors to new career opportunities, enhance earning potential, and showcase a commitment to professionalism and excellence. Many employers value and prioritize candidates with professional certifications, as they demonstrate a higher level of expertise and dedication to their field.

It is important to research and understand the requirements, eligibility criteria, and exam structure for the chosen certification. By doing so, candidates can adequately prepare and allocate the necessary time and resources to ensure success.

Professional certification exams provide a valuable credential that validates the proficiency and expertise of accounting professionals. They serve as a benchmark for excellence in the field and offer opportunities for career advancement and professional growth.

Workload and Time Commitment

Pursuing an accounting degree requires a significant workload and time commitment. Accounting coursework demands dedication, discipline, and effective time management to ensure academic success while meeting other personal and professional obligations.

The workload and time commitment can vary depending on the level of the degree program and the individual’s study habits and learning style. Here are some factors to consider:

- Credit Hours: The number of credit hours assigned to each course determines the amount of time you will spend in class. Typically, a full-time student in a bachelor’s degree program takes around 15-18 credit hours per semester, which translates to approximately 12-15 hours of classroom time per week.

- Outside Study Time: Accounting coursework requires dedicated study time outside of the classroom. It is recommended to allocate an average of 2-3 hours of study time for every credit hour. This means that a 3-credit hour accounting course may require around 6-9 hours of additional study time per week.

- Assignments and Projects: Accounting courses often involve assignments, projects, and case studies that require additional time to complete. Analyzing financial statements, solving accounting problems, and preparing reports can be time-consuming tasks that may require several hours of focused effort.

- Exam Preparation: Preparing for exams is a crucial aspect of an accounting degree program. Reviewing lecture notes, practicing problems, and conducting comprehensive exam preparation can take a considerable amount of time, especially during midterms and finals.

- Practical Experience: Some accounting programs incorporate internships, co-op placements, or other experiential learning opportunities. While these provide valuable real-world experience, they also require additional time commitments outside of regular coursework.

To effectively manage the workload and time commitments, consider implementing the following strategies:

- Create a Schedule: Develop a schedule that allows for dedicated study time, coursework completion, and other commitments. Prioritize tasks and allocate specific time slots for studying, attending lectures, completing assignments, and exam preparation.

- Stay Organized: Use tools such as calendars, planners, and to-do lists to keep track of important deadlines and tasks. Breaking down larger assignments into smaller manageable tasks can help prevent procrastination and improve productivity.

- Seek Support: Utilize resources and support services offered by your educational institution. This may include tutoring services, study groups, or academic advisors who can provide guidance and assistance when needed.

- Balance Workload: Try to distribute the workload evenly throughout the semester to avoid cramming and excessive stress during exam periods. Develop a consistent study routine and pace yourself with assignments and projects.

- Take Care of Yourself: Prioritize self-care by ensuring you have time for relaxation, exercise, and social activities. Taking breaks and maintaining a healthy work-life balance can help prevent burnout and enhance overall well-being.

It is important to remember that the workload and time commitment may vary depending on factors such as the intensity of the program, individual study habits, and personal circumstances. Being proactive, managing time effectively, and maintaining a disciplined approach will help ensure success throughout your accounting degree journey.

Study Strategies and Resources

Developing effective study strategies and utilizing available resources can significantly enhance your learning experience and academic success in an accounting degree program. Here are some study strategies and resources to consider:

- Active Learning: Actively engage with the course material by taking notes, asking questions, and participating in class discussions. Actively reviewing and summarizing the content helps reinforce your understanding and retention of important concepts.

- Practice Problems: Accounting coursework often involves solving various problems and applying accounting principles to real-world scenarios. Practice solving problems regularly to strengthen your understanding and problem-solving skills. Many textbooks and online resources offer practice problems and solutions for further practice.

- Group Study Sessions: Collaborating with peers can be an effective way to reinforce learning and gain different perspectives on accounting concepts. Form study groups to discuss and explain difficult topics, share insights, and quiz each other.

- Utilize Online Resources: Take advantage of online resources such as academic websites, video tutorials, and online accounting communities. Websites like Khan Academy, Coursera, and Investopedia offer educational resources and video lectures on various accounting topics.

- Seek Professor/Instructor Guidance: If you encounter difficulties or have questions, don’t hesitate to reach out to your professors or instructors. They can provide clarification, guidance, and additional resources to support your learning.

- Textbooks and Reference Materials: Invest in recommended textbooks and reference materials that cover the topics taught in your accounting courses. Use these resources for further study, clarification, and as a reference during assignments and exams.

- Practice Time Management: Effective time management is crucial to balance coursework, assignments, and other responsibilities. Create a study schedule and break down larger tasks into smaller, manageable parts. Set realistic goals and allocate dedicated study time to ensure you stay on track.

- Utilize Technology and Accounting Software: Familiarize yourself with accounting software and technology commonly used in the industry. This hands-on experience will not only enhance your technical skills but also provide practical application of accounting concepts learned in the classroom.

- Review and Reflect Regularly: Regularly revisit previously covered material to reinforce your understanding and retention. Review lecture notes, textbooks, and class discussions to connect concepts and identify any areas that require further attention.

Additionally, take advantage of any academic support services offered by your institution, such as tutoring centers, writing centers, or study skills workshops. These resources can provide guidance on study techniques, time management, and provide additional support for difficult subjects.

Remember that everyone has their own learning style and preferences, so experiment with different strategies to find what works best for you. Stay motivated, maintain a positive mindset, and embrace the learning process as you progress through your accounting degree.

Conclusion

Pursuing an accounting degree can be a challenging yet rewarding endeavor. Throughout this article, we have explored various aspects of an accounting degree, including its definition, curriculum, difficulty level, and the skills required to excel in the field.

We learned that an accounting degree provides students with a comprehensive understanding of accounting principles, financial analysis, taxation, auditing, and other related areas. It equips individuals with the necessary skills and knowledge to pursue diverse career paths in accounting, finance, and business.

The curriculum of an accounting degree program covers a range of core business courses and specialized accounting courses. It requires a significant workload and time commitment, with coursework demanding attention to detail, critical thinking, and problem-solving abilities.

We explored advanced accounting topics and the challenges involved in taxation and auditing. Understanding these specialized areas is essential to navigate complex financial reporting, legal compliance, and fraud prevention.

Professional certification exams were highlighted as important milestones in an accounting career, validating individuals’ competence and expertise. These certifications hold weight in the accounting industry and can open doors to new opportunities and career advancement.

To succeed in an accounting degree program, students are encouraged to implement study strategies such as active learning, problem-solving practice, group study sessions, and utilizing available resources such as textbooks, online materials, and professor guidance.

In conclusion, earning an accounting degree requires dedication, determination, and continuous learning. It equips individuals with the skills and knowledge needed for a successful career in accounting. As the business landscape evolves, the demand for knowledgeable accountants continues to grow, making an accounting degree a valuable investment in one’s future.